U.S. Fed Holds Rates Amid Inflation And Unemployment Concerns

Table of Contents

Inflation Remains a Key Concern

Inflation continues to be a major headache for the Federal Reserve. While showing signs of cooling, the rate remains significantly above the Fed's 2% target. Understanding the current inflation landscape is crucial to comprehending the "U.S. Fed Holds Rates" decision.

- CPI and PPI Data: The Consumer Price Index (CPI) and Producer Price Index (PPI) offer crucial insights into price changes. While recent data shows a slight deceleration in CPI increases, it's still elevated, indicating persistent inflationary pressures. For example, a recent CPI report might show a 3% year-over-year increase, down from 4% the previous month, but still far from the Fed's goal.

- Contributing Factors: Several factors fuel persistent inflation. Elevated energy prices, lingering supply chain disruptions, and robust consumer demand all contribute to upward pressure on prices. The war in Ukraine, for instance, has significantly impacted global energy markets, driving up gasoline prices and impacting the cost of goods and services across the board.

- Impact of Inflation: High inflation erodes purchasing power, impacting consumer spending and business investment. Consumers may delay large purchases, and businesses may hesitate to invest in expansion if they anticipate further price increases.

Unemployment Rate and Labor Market Dynamics

The strength of the U.S. labor market adds another layer of complexity to the Fed's decision-making process. While inflation is a concern, a significant rise in unemployment is equally undesirable.

- Unemployment Rate and Job Growth: The unemployment rate remains historically low, indicating a robust job market. However, recent job growth figures, while positive, have shown some signs of slowing. This data point suggests that the labor market might be beginning to cool, potentially reducing upward pressure on wages and, consequently, inflation.

- Wage Growth and Labor Shortages: Despite some slowing, wage growth remains relatively strong. This reflects persistent labor shortages in certain sectors, pushing up labor costs and contributing to inflationary pressures. The impact of increased automation on employment rates will also need to be considered in further rate decisions.

- The Phillips Curve: The relationship between inflation and unemployment, often depicted by the Phillips Curve, suggests a trade-off between the two. The Fed needs to carefully navigate this trade-off, aiming to reduce inflation without triggering a significant rise in unemployment.

The Fed's Rationale for Holding Rates

The Fed's decision to hold rates reflects a cautious approach, acknowledging the ongoing challenges of inflation while also monitoring the labor market's health.

- Fed's Statement: The official statement accompanying the rate decision emphasized the need to assess incoming data and the evolving economic outlook. The Fed is clearly adopting a "wait-and-see" approach, giving themselves time to fully evaluate the impact of previous rate hikes and assess the latest economic indicators.

- Risks of Rate Changes: Raising rates further could potentially trigger a recession by dampening economic activity. Conversely, lowering rates too soon could exacerbate inflation. The current strategy aims to strike a balance, allowing the current policy to fully work its way through the system.

- Forward Guidance: The Fed's forward guidance, or its communication about future policy, is crucial for market expectations. Any hints of future rate hikes or cuts significantly influence investor behavior and overall economic sentiment. Maintaining a degree of uncertainty is a calculated risk the Fed appears to be taking.

Market Reaction and Economic Outlook

The market's response to the Fed's announcement was mixed, reflecting the uncertainty surrounding the economic outlook.

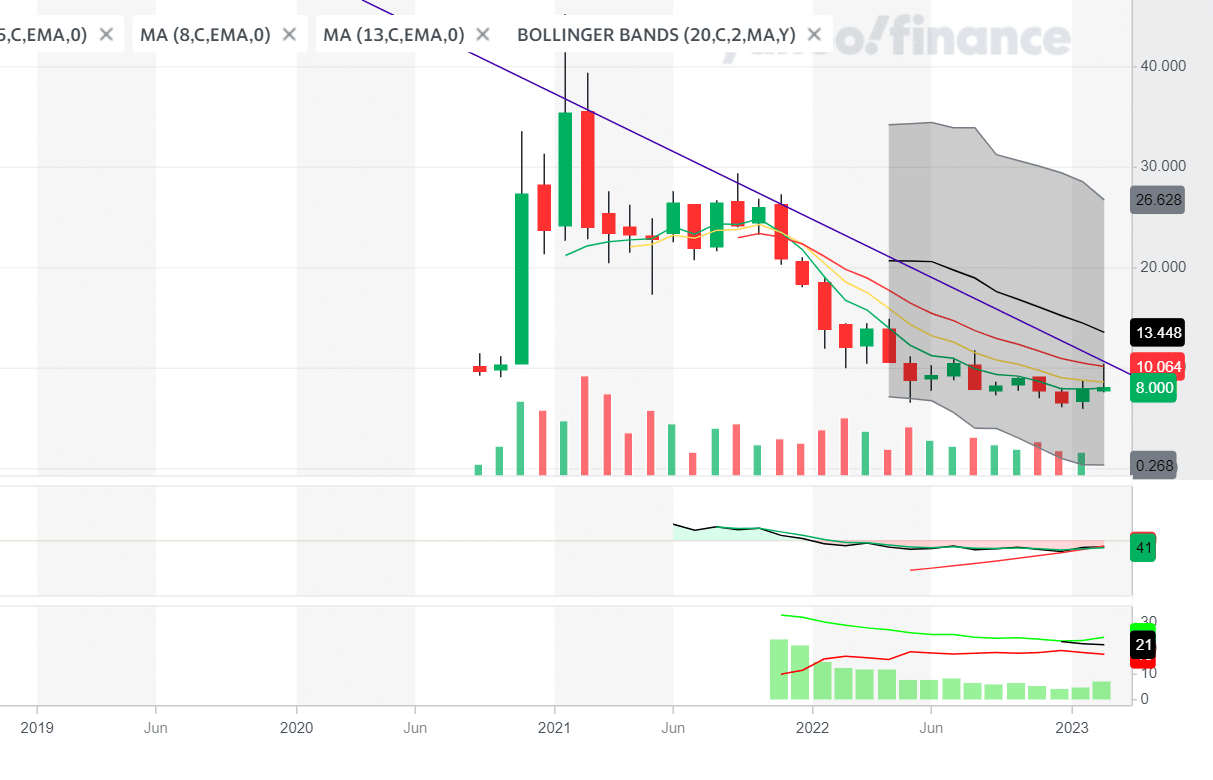

- Market Performance: Stock markets generally reacted positively to the news, suggesting some relief that further rate hikes were not immediately implemented. Bond yields also reacted, with longer-term yields showing a modest increase and shorter-term yields falling slightly.

- Impact on Economic Sectors: Different economic sectors will experience varying impacts. Interest-rate-sensitive sectors like housing and construction may experience some relief, while sectors facing significant inflationary pressures could continue to struggle.

- Short-Term and Long-Term Predictions: Short-term economic forecasts depend heavily on incoming data related to inflation and the labor market. Long-term projections remain uncertain, with various scenarios depending on the evolution of global economic conditions, geopolitical events, and future monetary policy decisions.

Conclusion: Understanding the U.S. Fed's Decision to Hold Rates

The U.S. Fed's decision to hold rates reflects a careful assessment of the current economic landscape. Inflation remains a key concern, but the strong labor market complicates the situation. The Fed is taking a cautious, data-dependent approach, buying time to analyze the impact of previous rate hikes and monitor the evolution of both inflation and unemployment. The market's reaction was mixed, with uncertainties about the short-term and long-term economic outlook remaining. To stay abreast of future "U.S. Fed Holds Rates" announcements and the implications for your financial well-being, follow reputable financial news sources like the Wall Street Journal or Bloomberg, and consider subscribing to a financial newsletter specializing in Federal Reserve interest rate decisions and monitoring U.S. monetary policy.

Featured Posts

-

Post 2025 Nhl Trade Deadline Playoff Predictions And Analysis

May 09, 2025

Post 2025 Nhl Trade Deadline Playoff Predictions And Analysis

May 09, 2025 -

Njwm Krt Alqdm Alsabqyn Walmdkhnyn Qss Whqayq

May 09, 2025

Njwm Krt Alqdm Alsabqyn Walmdkhnyn Qss Whqayq

May 09, 2025 -

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025 -

Is Figmas Ai The Future Of Design A Comparison With Competitors

May 09, 2025

Is Figmas Ai The Future Of Design A Comparison With Competitors

May 09, 2025 -

Young Thug Pledges Faithfulness To Mariah The Scientist In Leaked Snippet

May 09, 2025

Young Thug Pledges Faithfulness To Mariah The Scientist In Leaked Snippet

May 09, 2025