Uber Stock Rebound Hinges On Autonomous Vehicle Success

Table of Contents

H2: The Current State of Uber's Autonomous Vehicle Program

Uber's foray into autonomous vehicles represents a significant investment in the future of transportation. Success in this area is paramount for the company's long-term growth and profitability, directly impacting Uber stock performance.

H3: Technological Challenges and Progress

Developing fully autonomous vehicles is an incredibly complex undertaking. The challenges are multifaceted, encompassing sophisticated software development, reliable sensor technology, and navigating stringent safety regulations.

- Milestones Achieved: Uber's AV program has logged millions of autonomous miles in test environments, collaborating with tech giants to refine its self-driving systems. These partnerships, coupled with internal advancements, demonstrate a commitment to pushing the boundaries of autonomous driving technology.

- Challenges Faced: The path to fully autonomous driving has not been without its setbacks. Incidents, though rare, have highlighted the safety concerns inherent in this emerging technology. Regulatory hurdles and the need for extensive testing have also slowed progress.

- Technological Approach: Uber leverages a combination of technologies, including LiDAR, advanced cameras, and high-definition mapping, to enable its autonomous vehicles to perceive and navigate their surroundings. Continuous improvement in these areas is crucial for the program's success.

H3: Competition in the Autonomous Vehicle Market

The autonomous vehicle market is fiercely competitive, with major players like Waymo, Cruise (General Motors), and Tesla vying for dominance.

- Competitive Landscape: Waymo, a subsidiary of Alphabet (Google), has amassed considerable experience and data in autonomous driving. Cruise boasts strong partnerships and significant investment. Tesla, meanwhile, focuses on integrating self-driving capabilities into its consumer vehicles.

- Uber's Position: Uber's strategy focuses on leveraging its existing ride-sharing network and data to integrate autonomous vehicles into its existing operations. This offers a potential advantage in terms of immediate deployment and market penetration. However, it also faces challenges in competing against companies with a longer history in autonomous vehicle development.

- Market Impact: The competitive dynamics of the autonomous vehicle market will undoubtedly influence investor sentiment towards Uber's stock. Success in this arena will solidify Uber's position as a leader in future transportation, boosting its stock price. Conversely, falling behind could significantly impact its valuation.

H2: The Potential Impact of Autonomous Vehicles on Uber's Revenue and Profitability

The successful implementation of autonomous vehicles has the potential to revolutionize Uber's business model, dramatically impacting its revenue and profitability.

H3: Reduced Operational Costs

One of the most significant potential benefits of autonomous vehicles is a drastic reduction in operational costs. Currently, a substantial portion of Uber's expenses goes towards driver compensation.

- Cost Savings: Replacing human drivers with self-driving systems could save billions annually. This cost reduction would significantly improve profit margins.

- Improved Profitability: Lower operational costs translate directly into higher profitability, attracting investors and boosting Uber stock.

H3: New Revenue Streams

Autonomous vehicles open doors to entirely new revenue streams beyond ride-sharing.

- Autonomous Delivery: Self-driving vehicles can be seamlessly integrated into Uber Eats and other delivery services, expanding market reach and efficiency.

- Robotaxi Fleets: The potential to operate large-scale robotaxi fleets presents a lucrative opportunity for generating revenue, creating a new revenue stream with potential for substantial growth.

- Market Size and Revenue: The market for autonomous delivery and robotaxi services is projected to be immense, offering a significant opportunity for Uber to expand its revenue base.

H3: Increased Efficiency and Scalability

Autonomous vehicles can optimize routing, reduce downtime, and improve overall operational efficiency.

- Optimized Routing: Self-driving systems can leverage real-time data to optimize routes, leading to faster travel times and reduced fuel consumption.

- Global Expansion: Autonomous vehicles can enable Uber to expand into new markets more easily, overcoming limitations associated with driver availability and labor costs. This scalability is a key driver of potential stock growth.

H2: Investor Sentiment and Market Reaction to Uber's Autonomous Vehicle Progress

Investor sentiment and market reaction towards Uber's autonomous vehicle program are pivotal in shaping its stock price.

H3: Analyst Opinions and Stock Price Predictions

Financial analysts closely monitor Uber's AV progress, and their opinions directly influence investor decisions.

- Price Targets: Many analysts have incorporated the potential success (or failure) of Uber's autonomous vehicle program into their stock price predictions. Positive developments usually lead to increased price targets, while setbacks have the opposite effect.

- Market Sentiment: The overall market sentiment towards autonomous vehicles plays a crucial role. Positive news and advancements in the broader sector usually benefit Uber's stock.

H3: Risk Factors and Potential Downsides

Despite the potential benefits, several risk factors could hinder the success of Uber's autonomous vehicle program.

- Regulatory Hurdles: Navigating complex and evolving regulations related to autonomous vehicles presents a significant challenge.

- Technological Setbacks: Unforeseen technological challenges and delays in development could impact investor confidence.

- Safety Concerns: Public perception and concerns regarding the safety of autonomous vehicles remain a major factor. Any significant safety incidents could negatively impact Uber's stock.

3. Conclusion

The success of Uber's autonomous vehicle program is inextricably linked to the future performance of its stock. While significant challenges exist, the potential for reduced operational costs, new revenue streams, and increased efficiency presents a compelling case for substantial growth. Investors should closely monitor the progress of Uber's autonomous vehicle development, paying attention to both the technological advancements and the regulatory landscape. Understanding the intricacies of this sector is crucial for making informed investment decisions regarding Uber stock. Stay informed on the latest developments in Uber's autonomous vehicle program to make smart investment choices.

Featured Posts

-

Saving Private Ryans Unscripted Scenes A Deeper Look

May 08, 2025

Saving Private Ryans Unscripted Scenes A Deeper Look

May 08, 2025 -

Okc Thunder Kenrich Williams Highlights A Standout Leader

May 08, 2025

Okc Thunder Kenrich Williams Highlights A Standout Leader

May 08, 2025 -

Gewinnzahlen Lotto 6aus49 19 April 2025

May 08, 2025

Gewinnzahlen Lotto 6aus49 19 April 2025

May 08, 2025 -

Saturday Lotto Results April 12th Winning Numbers

May 08, 2025

Saturday Lotto Results April 12th Winning Numbers

May 08, 2025 -

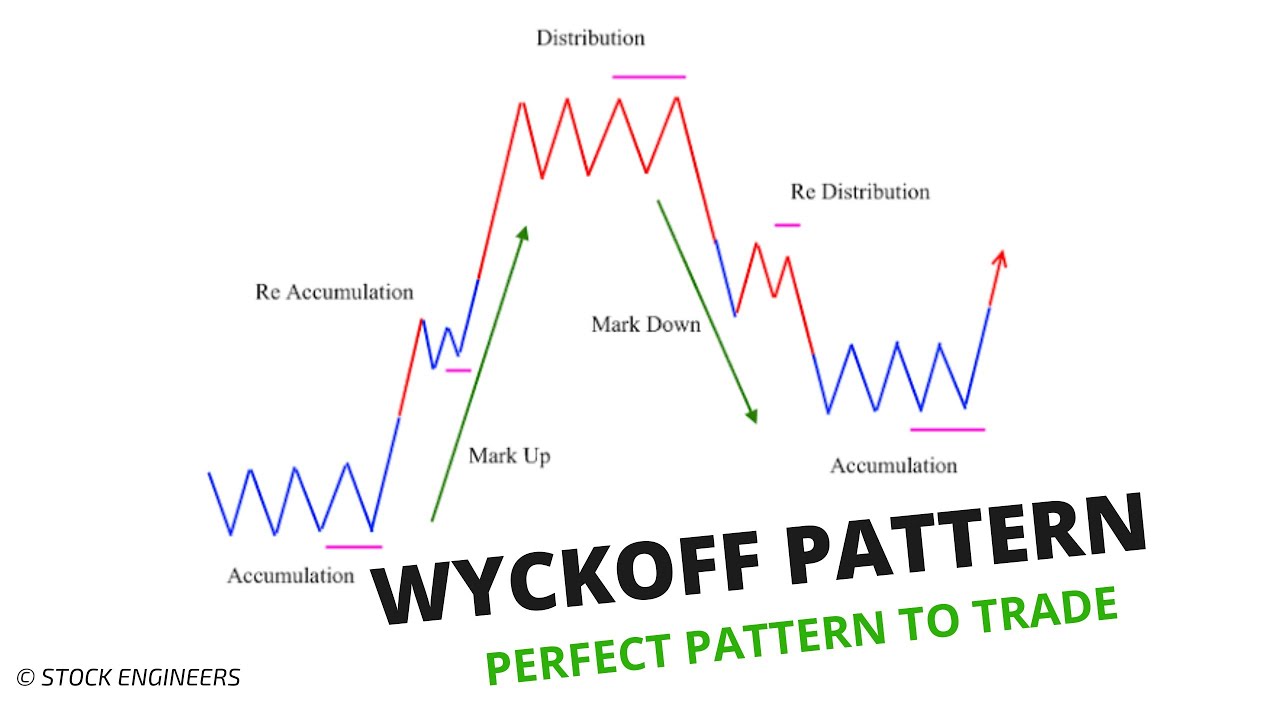

Ethereums Path To 2 700 A Wyckoff Accumulation Perspective

May 08, 2025

Ethereums Path To 2 700 A Wyckoff Accumulation Perspective

May 08, 2025