UK Taxpayers Facing HMRC Scrutiny: Income Over £23,000

Table of Contents

Are you a UK taxpayer earning over £23,000? Recent HMRC data reveals a significant increase in investigations targeting individuals in this income bracket. This heightened scrutiny means it's more crucial than ever for higher earners to understand their tax obligations and take proactive steps to minimize their risk of an HMRC investigation. This article will inform you about HMRC scrutiny, common reasons for investigations, and how to protect yourself. We'll cover HMRC scrutiny, UK taxpayers, and income over £23,000 in detail.

<h2>Understanding HMRC's Focus on Higher Earners</h2>

HMRC targets individuals earning over £23,000 for several key reasons. The higher your income, the greater your tax liability, and consequently, the higher the potential for tax avoidance or evasion. HMRC utilizes sophisticated data analytics to identify potential discrepancies, making it more challenging to overlook inaccuracies.

Different types of income fall under this scrutiny, including:

- Salaries

- Dividends

- Rental income

- Self-employment income

- Capital gains

HMRC investigations often focus on:

- Complex tax schemes: These often involve offshore accounts or intricate structures designed to minimize tax liabilities.

- Undeclared income: This is a major focus, whether it's rental income, freelance work, or unreported earnings from investments.

- Inconsistent reporting: HMRC uses sophisticated data matching techniques to identify inconsistencies between declared income and information obtained from third parties (banks, employers, etc.).

<h2>Common Reasons for HMRC Investigations</h2>

Several factors can trigger an HMRC investigation for taxpayers earning over £23,000. These include:

- Inconsistent income declaration: Significant variations in declared income across multiple tax years raise red flags.

- Missing or inaccurate tax returns: Failure to file returns or submitting incomplete/inaccurate information is a major cause for investigation.

- Suspicious transactions: Large, unexplained cash deposits or unusually high spending patterns may trigger scrutiny.

- Lifestyle discrepancies: If your lifestyle seems inconsistent with your declared income, HMRC may investigate further. This can include owning expensive assets like properties or vehicles.

- Failure to declare rental income or capital gains: These are common areas of non-compliance, often leading to HMRC investigations.

<h2>How to Minimize Your Risk of HMRC Scrutiny</h2>

Proactive measures significantly reduce the likelihood of an HMRC investigation. These include:

- Meticulous record-keeping: Maintaining comprehensive and accurate financial records is paramount. This includes receipts, invoices, bank statements, and any other relevant documentation.

- Professional tax advice: A qualified accountant can offer invaluable guidance on your tax obligations, ensuring compliance and helping to navigate complex tax regulations.

- Accurate and timely declarations: Ensure all income sources are declared accurately and submitted by the relevant deadlines.

- Understanding your tax obligations: Familiarize yourself with the relevant tax laws and regulations.

- Legitimate tax planning: Employ legitimate tax planning strategies, avoiding aggressive or risky approaches that could raise suspicion.

<h2>What to Do if You're Under HMRC Investigation</h2>

If you're facing an HMRC investigation, act swiftly and strategically:

- Respond promptly: Respond to all HMRC correspondence promptly and professionally.

- Gather documentation: Compile all relevant financial documentation to support your tax declarations.

- Seek professional advice: Contact a tax specialist or solicitor immediately for expert guidance.

- Transparency is key: Do not attempt to withhold or conceal information from HMRC. This will only worsen the situation.

- Understand your rights: Familiarize yourself with your rights throughout the investigation process.

<h2>Conclusion: Protecting Yourself from HMRC Scrutiny – Income Over £23,000</h2>

Facing HMRC scrutiny can be daunting, particularly for UK taxpayers with an income over £23,000. Accurate record-keeping, professional advice, and timely declarations are essential for minimizing your risk. Understanding your tax obligations and employing legitimate tax planning strategies are crucial. Don't wait until you're facing an HMRC investigation. Take control of your tax affairs today. Contact a qualified tax advisor to ensure your income over £23,000 is declared accurately and legally. Proactive management of your tax affairs is the best defence against HMRC scrutiny.

Featured Posts

-

2032 Au Cameroun Macron Face Au Defi D Un Troisieme Mandat Et D Un Referendum

May 20, 2025

2032 Au Cameroun Macron Face Au Defi D Un Troisieme Mandat Et D Un Referendum

May 20, 2025 -

Miami Gp Tea Break Triggers Hamilton And Ferrari Dispute

May 20, 2025

Miami Gp Tea Break Triggers Hamilton And Ferrari Dispute

May 20, 2025 -

Druhe Dieta Jennifer Lawrence Herecka Potvrdila Radostnu Novinu

May 20, 2025

Druhe Dieta Jennifer Lawrence Herecka Potvrdila Radostnu Novinu

May 20, 2025 -

Hegseth Confirms Another Us Missile System Arrives In The Philippines

May 20, 2025

Hegseth Confirms Another Us Missile System Arrives In The Philippines

May 20, 2025 -

Todays Nyt Mini Crossword Answers February 25th

May 20, 2025

Todays Nyt Mini Crossword Answers February 25th

May 20, 2025

Latest Posts

-

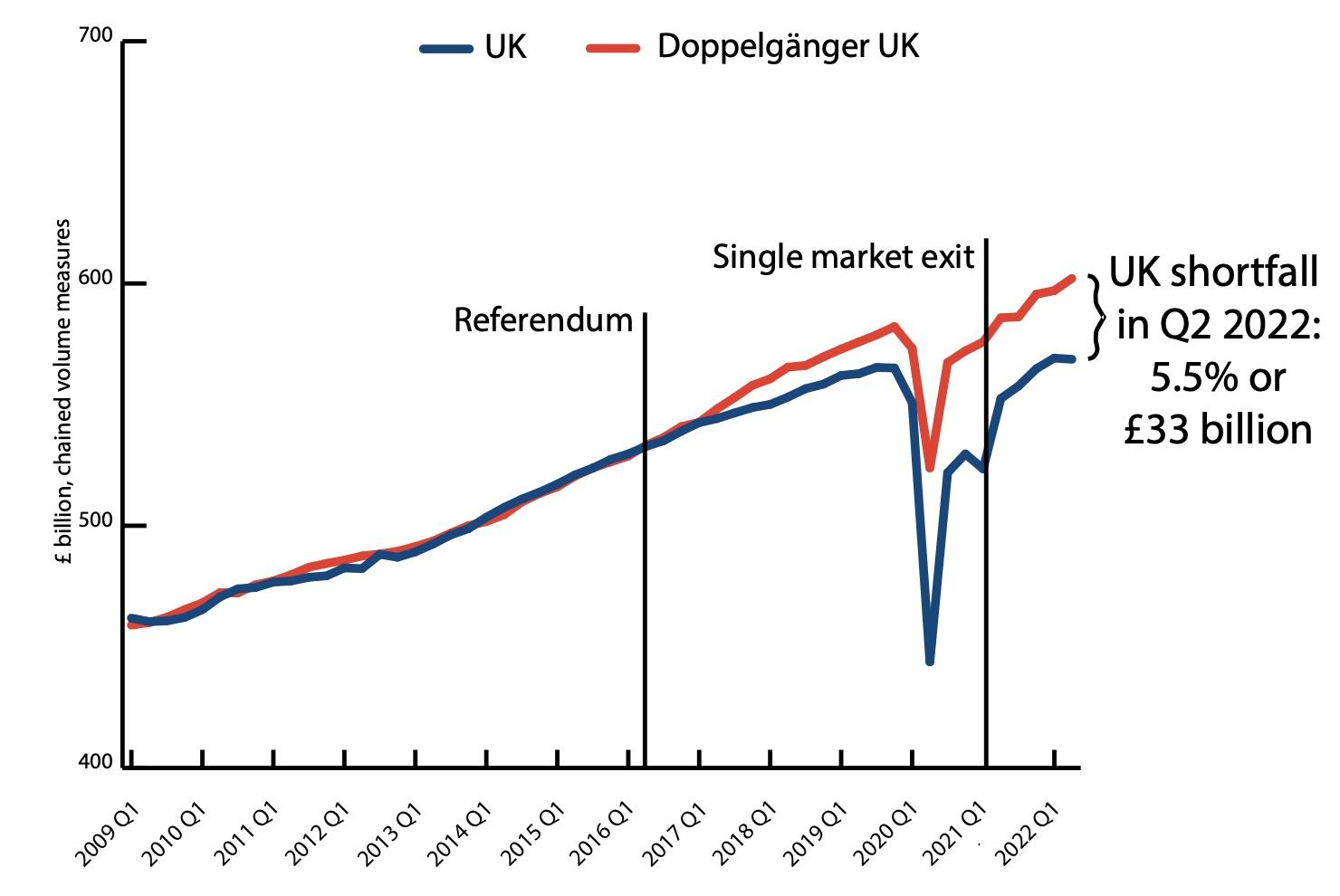

Brexits Toll The Struggle Of Uk Luxury Exports To The Eu

May 20, 2025

Brexits Toll The Struggle Of Uk Luxury Exports To The Eu

May 20, 2025 -

The Bof A Perspective Why High Stock Market Valuations Are Not A Threat

May 20, 2025

The Bof A Perspective Why High Stock Market Valuations Are Not A Threat

May 20, 2025 -

Post Brexit Challenges For Uk Luxury Exports To The Eu

May 20, 2025

Post Brexit Challenges For Uk Luxury Exports To The Eu

May 20, 2025 -

Uk Luxury Sector Brexits Lingering Export Problems

May 20, 2025

Uk Luxury Sector Brexits Lingering Export Problems

May 20, 2025 -

Ignoring High Stock Valuations A Bof A Supported Investment Strategy

May 20, 2025

Ignoring High Stock Valuations A Bof A Supported Investment Strategy

May 20, 2025