Unclaimed Tax Refunds: Thousands Of Savings Account Holders Affected

Table of Contents

How to Check for Unclaimed Tax Refunds

The first step to recovering your money is to check if a refund is even waiting for you. This process varies depending on your country of residence, but generally involves visiting the official government website responsible for tax administration. For example, in the United States, you would use the IRS website; similar resources exist in other countries (e.g., HMRC in the UK, Canada Revenue Agency in Canada).

The process typically involves these steps:

-

Visit the relevant government website: Locate the specific page dedicated to unclaimed property or unclaimed refunds. The website address should be easily accessible through a search engine like Google or Bing.

-

Enter your Social Security number (or equivalent): You'll need to provide your national identification number for verification purposes. This ensures only you can access your financial information.

-

Provide other necessary identifying information: This might include your full name, date of birth, and previous addresses. Be as accurate as possible, as incorrect information will delay or prevent you from accessing your refund.

-

Review the results carefully: Once you submit your information, the system will search for any unclaimed tax refunds associated with your details. Carefully review the results, noting the amount, the tax year, and any additional information provided.

Dealing with Difficulties: If you encounter difficulties, such as an error message or a lack of results despite believing you have an unclaimed refund, review the website's FAQs or contact customer service for assistance. Incorrect information is a common issue, so double-checking your input is crucial.

Common Reasons for Unclaimed Tax Refunds

Many reasons contribute to people leaving money unclaimed. Understanding these reasons can help you avoid this situation in the future. Some of the most frequent causes include:

-

Change of address: Failing to update your address with tax authorities is a major contributor. Refunds are often sent to the address on file, resulting in undeliverable mail and subsequently unclaimed funds.

-

Simple mistakes on tax returns: Errors on tax forms can delay processing or lead to rejection. This can prevent a refund from being issued in the first place or delay its arrival.

-

Lack of awareness: Many people are simply unaware of the existence of unclaimed funds programs or the possibility of overlooked refunds.

-

Overlooked refunds: Small refunds are often overlooked, especially if they are not anticipated.

Leaving these refunds unclaimed means not only missing out on the money itself but also losing out on potential interest that could have accumulated over time.

The Claiming Process: Steps to Recover Your Unclaimed Tax Refund

Once you've located an unclaimed refund, the claiming process usually involves:

-

Gather necessary documents: This typically includes your tax returns (or documentation referencing the tax year in question), government-issued identification, and potentially other supporting documentation as requested by the relevant authority.

-

Complete the claim form accurately: The claim form will likely require detailed information, so ensure all fields are filled in correctly and completely. Any inaccuracies may delay the processing of your claim.

-

Submit the claim via mail or online: Most jurisdictions now offer online claim submission, which is often faster and more convenient. However, some may require mailing physical documents. Follow the instructions carefully.

-

Track the status of your claim: Once submitted, track your claim's progress using the provided tracking number or online portal.

The timeframe for receiving your refund varies depending on the jurisdiction and the processing time. Be patient, but also follow up if you don't receive your refund within a reasonable time frame.

Protecting Yourself from Future Unclaimed Tax Refunds

Taking proactive steps can prevent future instances of unclaimed tax refunds. These include:

-

Keep accurate records of all tax filings: Maintain organized files of all your tax-related documents, including receipts, W-2s, and 1099s. This helps prevent errors and makes locating necessary information easier.

-

Update your address with tax authorities promptly: Notify the tax authorities immediately whenever you change your address to ensure refunds are sent to the correct location.

-

Double-check your tax return for accuracy: Before submitting your tax return, carefully review all information for any potential errors. Errors are a major source of unclaimed refunds.

-

Regularly check for unclaimed funds online: Make checking for unclaimed funds a regular part of your financial routine, perhaps annually, to ensure you're not missing out on any money.

Conclusion: Reclaiming Your Unclaimed Tax Refund

Checking for and claiming unclaimed tax refunds involves several straightforward steps: checking official government websites for your region, gathering necessary documents, completing the claim form accurately, and submitting it through the appropriate channel. The importance of this process cannot be overstated; you could be entitled to money you've unknowingly left unclaimed. Don't miss out on potentially thousands of dollars! Check for your unclaimed tax refund today!

Featured Posts

-

Fenerbahce De Sezonun Ilk Ayriligi Tadic Yeni Takiminda

May 20, 2025

Fenerbahce De Sezonun Ilk Ayriligi Tadic Yeni Takiminda

May 20, 2025 -

Biarritz Trois Journees D Echanges Pour Les Femmes Autour Du 8 Mars

May 20, 2025

Biarritz Trois Journees D Echanges Pour Les Femmes Autour Du 8 Mars

May 20, 2025 -

Experimente A Amazonia Festival Da Cunha Em Manaus Com Isabelle Nogueira

May 20, 2025

Experimente A Amazonia Festival Da Cunha Em Manaus Com Isabelle Nogueira

May 20, 2025 -

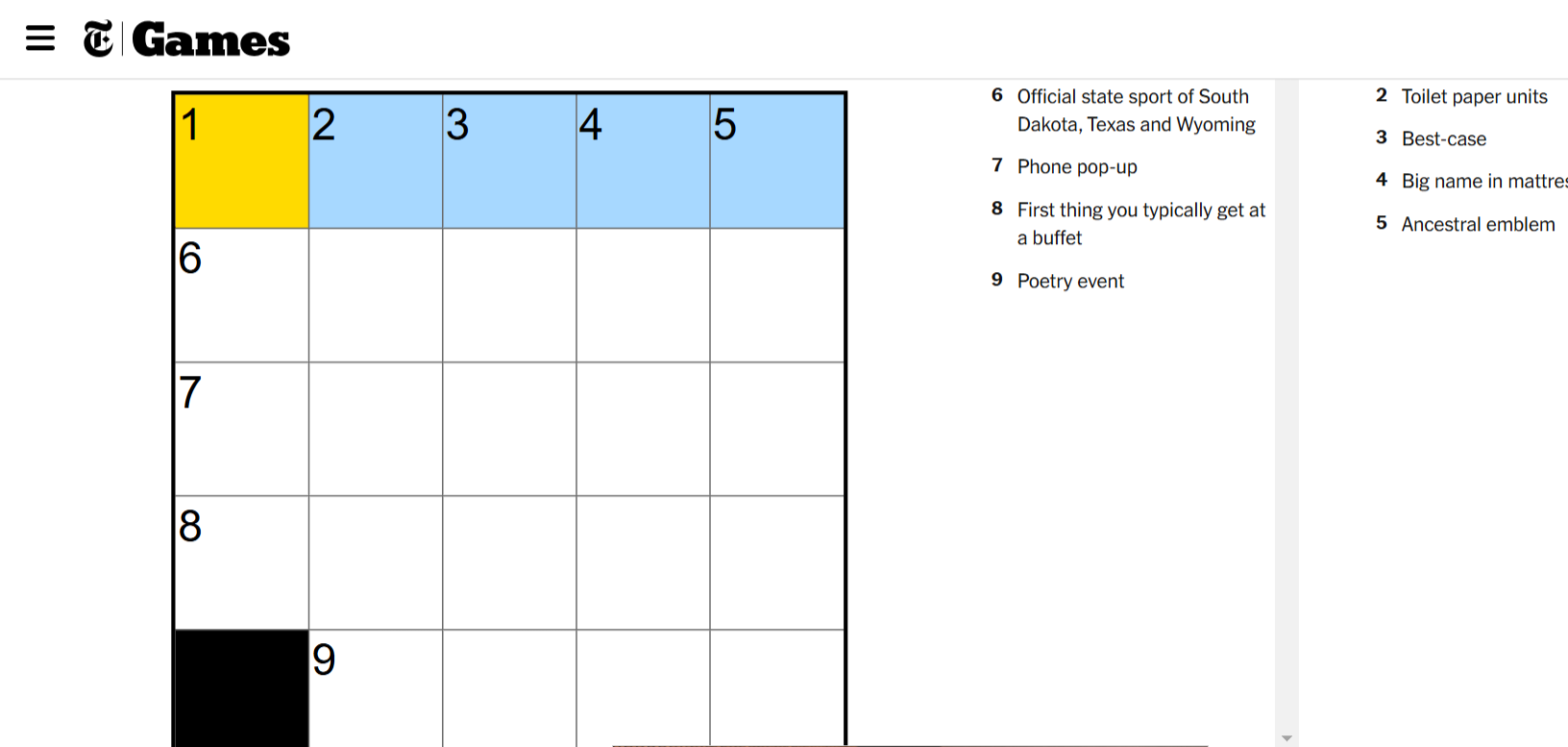

Nyt Mini Crossword Solutions March 22

May 20, 2025

Nyt Mini Crossword Solutions March 22

May 20, 2025 -

Jutarnji List Nova Drama Najboljeg Hrvatskog Dramskog Pisca

May 20, 2025

Jutarnji List Nova Drama Najboljeg Hrvatskog Dramskog Pisca

May 20, 2025

Latest Posts

-

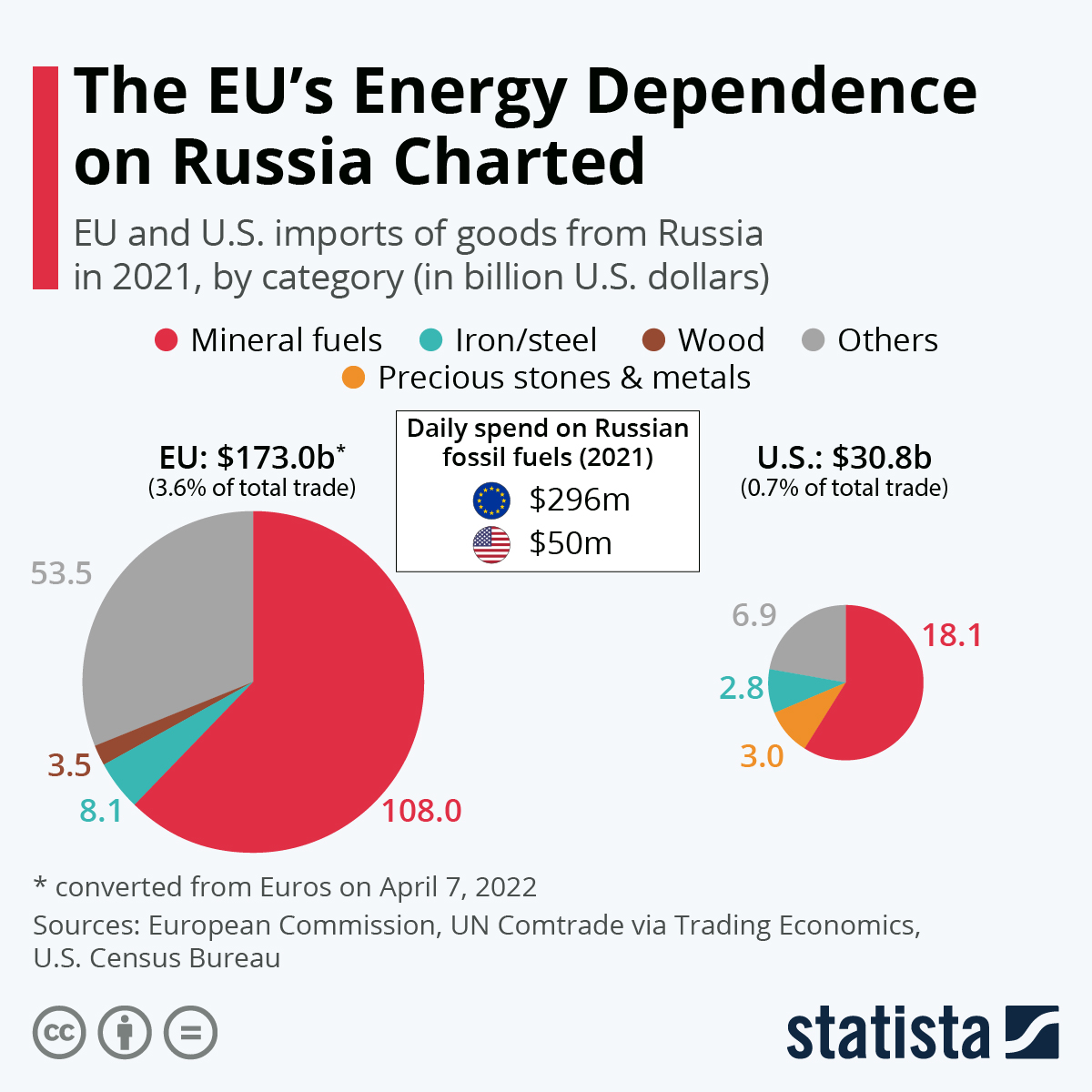

Post Nuclear Taiwan The Growing Importance Of Lng In The Energy Mix

May 20, 2025

Post Nuclear Taiwan The Growing Importance Of Lng In The Energy Mix

May 20, 2025 -

The Paradox Of Clean Energy Growth Amidst Opposition

May 20, 2025

The Paradox Of Clean Energy Growth Amidst Opposition

May 20, 2025 -

Are Bmw And Porsche Losing Ground In China An Industry Perspective

May 20, 2025

Are Bmw And Porsche Losing Ground In China An Industry Perspective

May 20, 2025 -

The Los Angeles Wildfires A Glimmer Of A Disturbing Trend In Disaster Betting

May 20, 2025

The Los Angeles Wildfires A Glimmer Of A Disturbing Trend In Disaster Betting

May 20, 2025 -

Taiwans Energy Transition Increased Reliance On Lng Imports Following Nuclear Closure

May 20, 2025

Taiwans Energy Transition Increased Reliance On Lng Imports Following Nuclear Closure

May 20, 2025