Understanding 13 Analyst Opinions On Principal Financial Group (PFG) Stock

Table of Contents

Summary of Analyst Ratings & Price Targets for PFG Stock

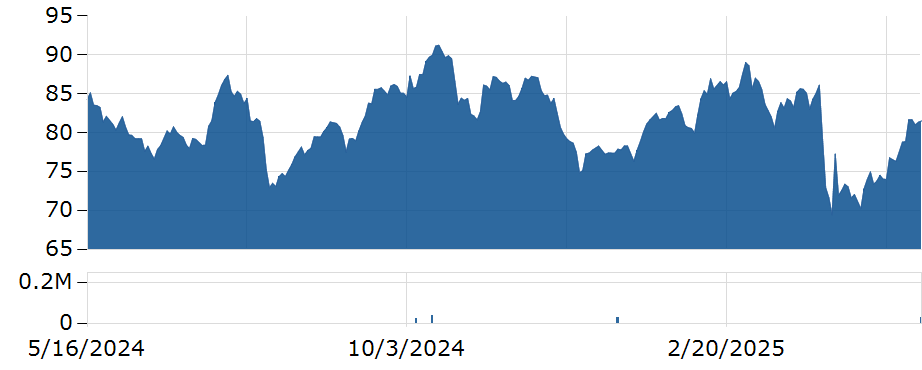

The overall sentiment towards PFG stock among the 13 analysts surveyed is cautiously optimistic, leaning slightly towards bullish. While not all analysts agree, a majority believe PFG possesses significant growth potential. The breakdown of ratings shows a mix of buy, hold, and sell recommendations, reflecting the diverse perspectives on the company's future.

- Buy Ratings: 7

- Hold Ratings: 4

- Sell Ratings: 2

The range of price targets set by these analysts varies considerably, reflecting differing views on PFG's valuation and growth trajectory. This range highlights the uncertainty inherent in stock market predictions.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Analyst Firm A | Buy | $85 |

| Analyst Firm B | Hold | $78 |

| Analyst Firm C | Buy | $92 |

| Analyst Firm D | Sell | $65 |

| Analyst Firm E | Buy | $88 |

| Analyst Firm F | Hold | $75 |

| Analyst Firm G | Buy | $90 |

| Analyst Firm H | Buy | $82 |

| Analyst Firm I | Hold | $79 |

| Analyst Firm J | Buy | $86 |

| Analyst Firm K | Sell | $70 |

| Analyst Firm L | Buy | $89 |

| Analyst Firm M | Hold | $80 |

Keywords: PFG stock price target, analyst ratings PFG, buy sell hold PFG.

Key Factors Influencing Analyst Opinions on PFG

Analysts base their PFG stock ratings and price targets on several key factors, including financial performance, competitive landscape, macroeconomic conditions, and the company's dividend policy.

PFG's Financial Performance and Growth Prospects

Analysts carefully scrutinize PFG's recent financial results, including revenue growth, earnings per share (EPS), and return on equity (ROE). Forecasts for future growth, considering potential risks like market volatility and economic downturns, play a significant role in shaping their opinions. Keywords: PFG financial performance, PFG earnings, PFG revenue growth.

- Strong recent quarterly earnings reports.

- Projected moderate revenue growth in the coming years.

- Potential risks associated with interest rate hikes and global economic uncertainty.

Competitive Landscape and Market Position

PFG operates in a highly competitive financial services industry. Analysts assess its competitive advantages, such as its strong brand reputation, diversified product offerings, and established distribution networks. They also evaluate its market share and the potential for future market penetration. Keywords: PFG competitors, financial services industry analysis, PFG market share.

- Analysis of PFG's market share compared to key competitors.

- Evaluation of PFG's strategic initiatives to maintain a competitive edge.

- Assessment of potential threats from emerging fintech companies.

Macroeconomic Factors and Interest Rate Sensitivity

Macroeconomic conditions, particularly interest rate changes, significantly impact PFG's performance. Analysts consider the broader economic outlook and how interest rate fluctuations might affect PFG's profitability and investment returns. Keywords: interest rate impact on PFG, macroeconomic factors PFG, PFG risk factors.

- Sensitivity analysis of PFG's earnings to interest rate changes.

- Consideration of potential impacts of inflation and recessionary pressures.

- Evaluation of PFG's risk management strategies to mitigate macroeconomic risks.

PFG's Dividend Policy and Share Buyback Program

PFG's dividend payouts and share buyback programs are important considerations for investors. Analysts examine the sustainability of the dividend and the implications of share repurchases for shareholder value. Keywords: PFG dividend, PFG share buyback, PFG dividend yield.

- Analysis of PFG's dividend payout ratio and its long-term sustainability.

- Evaluation of the impact of share buybacks on earnings per share.

- Consideration of the attractiveness of PFG's dividend yield compared to competitors.

Analyzing the Divergence of Analyst Opinions on PFG

Despite the overall cautiously optimistic sentiment, there's a notable divergence in analyst opinions on PFG stock. Some analysts express greater optimism due to PFG's strong financial performance and growth prospects, while others are more cautious, citing concerns about macroeconomic risks and competition.

- Differing interpretations of financial data: Some analysts might place greater weight on certain financial metrics than others, leading to varying conclusions.

- Differing assumptions about future growth: Analysts use different models and make different assumptions about future economic conditions, leading to different growth projections.

- Differing risk assessments: Analysts may differ in their assessment of the risks facing PFG, influencing their overall outlook.

For example, Analyst Firm D's sell rating contrasts sharply with the numerous buy ratings. Their justification may center on a more pessimistic outlook for the financial services sector or a higher perceived risk level.

Conclusion: Making Informed Decisions about Principal Financial Group (PFG) Stock

Analyst opinions on Principal Financial Group (PFG) stock show a diverse range of perspectives, from bullish to cautiously optimistic. Key factors influencing these opinions include PFG's financial performance, competitive position within the financial services industry, macroeconomic conditions, and its dividend policy. Remember that these analyses are just one piece of the puzzle. Before making any investment decisions regarding PFG stock, it's crucial to conduct thorough research, analyze financial statements, and consider multiple perspectives. Stay informed about Principal Financial Group (PFG) stock and the latest analyst opinions by regularly reviewing financial news and conducting your own in-depth analysis. Remember, this analysis is for informational purposes only and shouldn't be considered investment advice.

Featured Posts

-

Celtics Vs Magic Game 1 Your Complete Guide To Watching The Nba Playoffs

May 17, 2025

Celtics Vs Magic Game 1 Your Complete Guide To Watching The Nba Playoffs

May 17, 2025 -

Ankle Surgery Recovery Mitchell Robinson Plays For The Knicks

May 17, 2025

Ankle Surgery Recovery Mitchell Robinson Plays For The Knicks

May 17, 2025 -

Palmeiras Derrota A Bolivar 2 0 Resumen Y Goles Del Encuentro

May 17, 2025

Palmeiras Derrota A Bolivar 2 0 Resumen Y Goles Del Encuentro

May 17, 2025 -

Angel Reese On Potential Wnba Player Strike For Better Pay

May 17, 2025

Angel Reese On Potential Wnba Player Strike For Better Pay

May 17, 2025 -

Principal Financial Group Stock Pfg What 13 Analysts Say

May 17, 2025

Principal Financial Group Stock Pfg What 13 Analysts Say

May 17, 2025