Understanding And Interpreting The NAV Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

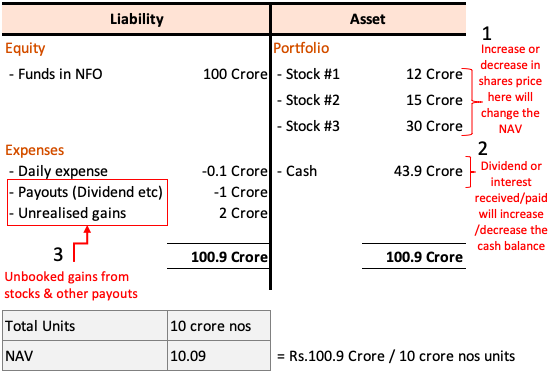

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For the Amundi Dow Jones Industrial Average UCITS ETF, it reflects the total value of the index constituents held in the fund. Understanding NAV is essential for evaluating the ETF's performance and comparing it to its market price.

The NAV calculation is straightforward:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

- Total Assets: This includes the market value of all securities (stocks, bonds, etc.) held by the ETF.

- Total Liabilities: These are the fund's expenses, payable amounts and other obligations.

- Number of Outstanding Shares: The total number of ETF shares currently in circulation.

The ETF provider, Amundi, calculates and publishes the NAV daily, usually at the end of the trading day. This NAV reflects the closing prices of the underlying assets. It's important to remember that the NAV is different from the market price; the market price can fluctuate throughout the trading day, while the NAV is a snapshot at a specific point in time.

Factors Influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF. These factors directly impact the value of the underlying assets within the fund.

-

Performance of the Dow Jones Industrial Average: The primary driver of the ETF's NAV is the performance of the Dow Jones Industrial Average itself. Positive index performance generally leads to a higher NAV, while negative performance results in a lower NAV. This is because the ETF aims to replicate the index's performance.

-

Currency Fluctuations: If the ETF holds assets denominated in currencies other than the base currency of the ETF (e.g., the Euro), currency fluctuations can affect the NAV. A strengthening Euro relative to the US dollar, for instance, could increase the NAV of a Euro-denominated ETF tracking a US index.

-

Dividends and Expense Ratios: Dividends received from the underlying stocks increase the total assets of the ETF and thus the NAV. Conversely, the expense ratio, representing the fund's management and operating costs, reduces the NAV.

-

Management Fees and Other Charges: Any management fees or other charges levied by Amundi will also impact the NAV, albeit slightly. These are typically deducted from the fund's assets.

Interpreting NAV Changes and Their Significance for Investors

Interpreting NAV changes is key to understanding the ETF's performance.

-

Positive NAV Changes: Indicate growth in the value of the underlying assets, reflecting positive performance of the Dow Jones Industrial Average.

-

Negative NAV Changes: Signal a decline in the value of the underlying assets, indicating a negative performance of the index.

Comparing NAV changes over time is crucial for assessing long-term performance. While a single day's NAV change might not be significant, consistent positive changes over a period reflect positive investment growth. However, it's vital to remember that NAV alone isn't sufficient for investment decisions. The market price of the ETF should also be considered, as the two may differ slightly due to supply and demand forces.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Finding the daily NAV is straightforward:

-

Amundi Website: The most reliable source is the official Amundi website. Look for the ETF's fact sheet or pricing information section.

-

Financial News Websites: Many reputable financial news websites, such as those of major financial news outlets, provide real-time or delayed NAV data for ETFs.

-

Brokerage Platforms: If you hold the Amundi Dow Jones Industrial Average UCITS ETF through a brokerage account, your platform will usually provide the NAV alongside other relevant investment information.

Conclusion: Mastering the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for evaluating its performance and making informed investment decisions. By considering factors like the underlying index's performance, currency fluctuations, dividends, and expenses, you can interpret NAV changes effectively. Remember to consider the NAV in conjunction with the market price for a comprehensive view. Regularly track your NAV, understand your Amundi ETF NAV, and monitor your Amundi Dow Jones Industrial Average UCITS ETF NAV to make better investment choices. Take control of your investment journey by consistently monitoring this key performance indicator.

Featured Posts

-

Skolko Let Personazham V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025

Skolko Let Personazham V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025 -

How To Track The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

How To Track The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025 -

Alfred Dreyfus French Lawmakers Seek To Right A Historical Wrong

May 24, 2025

Alfred Dreyfus French Lawmakers Seek To Right A Historical Wrong

May 24, 2025 -

Full Soundtrack List Picture This Movie On Prime Video

May 24, 2025

Full Soundtrack List Picture This Movie On Prime Video

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value

May 24, 2025

Latest Posts

-

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025 -

Relx Sterke Financiele Prestaties Dankzij Ai Ondanks Economische Onzekerheid

May 24, 2025

Relx Sterke Financiele Prestaties Dankzij Ai Ondanks Economische Onzekerheid

May 24, 2025 -

Ai Stuwt Relx Door Economische Recessie Positieve Vooruitzichten Tot 2025

May 24, 2025

Ai Stuwt Relx Door Economische Recessie Positieve Vooruitzichten Tot 2025

May 24, 2025 -

Aex Stijgt Positief Beurzenherstel Na Trumps Aankondiging

May 24, 2025

Aex Stijgt Positief Beurzenherstel Na Trumps Aankondiging

May 24, 2025 -

Stock Market In Amsterdam Down 2 Post Trump Tariff Announcement

May 24, 2025

Stock Market In Amsterdam Down 2 Post Trump Tariff Announcement

May 24, 2025