Understanding Elevated Stock Market Valuations: BofA's Insight For Investors

Table of Contents

Factors Contributing to Elevated Stock Market Valuations

Several interconnected factors contribute to periods of elevated stock market valuations. Understanding these drivers is paramount for investors seeking to make sound judgments.

Low Interest Rates and Monetary Policy

Historically low interest rates significantly influence investor behavior and drive up stock prices. This is because:

- Lower borrowing costs stimulate investment: Cheap loans encourage businesses to expand and individuals to invest, increasing demand for equities.

- Quantitative easing (QE) programs inject liquidity: Central banks like the Federal Reserve implement QE to increase the money supply, boosting asset prices, including stocks. This surplus liquidity seeks returns, often flowing into the stock market.

- Federal Reserve actions impact valuations: The Fed's decisions on interest rates and QE directly influence the cost of capital and overall market liquidity, consequently impacting stock valuations. A period of prolonged low interest rates can inflate asset bubbles.

Strong Corporate Earnings and Profitability

Robust corporate performance is another key driver of higher stock valuations. This is fueled by:

- Technological innovation and increased productivity: Technological advancements often lead to higher efficiency and profits, boosting investor confidence and driving up stock prices.

- Mergers and acquisitions (M&A): Strategic M&A activity can lead to increased market share and synergies, resulting in stronger earnings and higher stock valuations.

- Strong consumer spending: Robust consumer spending fuels corporate revenue growth, leading to higher profitability and attractive stock valuations. This positive feedback loop can contribute to elevated market valuations.

Investor Sentiment and Market Psychology

Market psychology and investor sentiment play a powerful role in driving stock prices, even beyond fundamental factors.

- Fear of missing out (FOMO): FOMO can create a self-fulfilling prophecy, with investors piling into the market for fear of lagging behind, pushing prices even higher.

- Media coverage and analyst predictions: Positive media coverage and optimistic analyst forecasts can amplify investor enthusiasm and drive up stock valuations. Conversely, negative sentiment can trigger sell-offs.

- Geopolitical events and global economic uncertainty: Global events and economic uncertainty can impact investor sentiment, either boosting demand for safe haven assets or fueling speculation in riskier assets, leading to volatility in market valuations.

BofA's Perspective on Elevated Stock Market Valuations

Bank of America (BofA) provides valuable insights into the current market conditions and the implications of elevated stock market valuations.

Identifying Potential Risks

BofA's analysis highlights potential risks associated with high valuations, including:

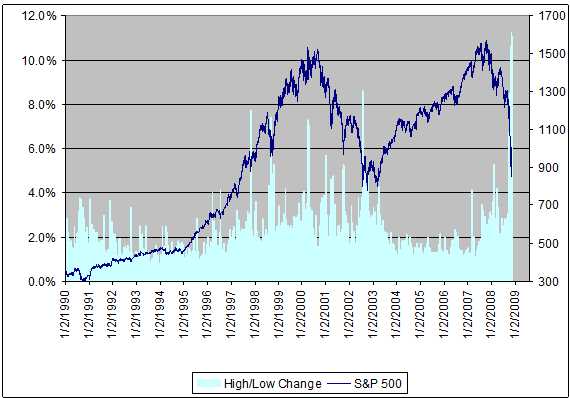

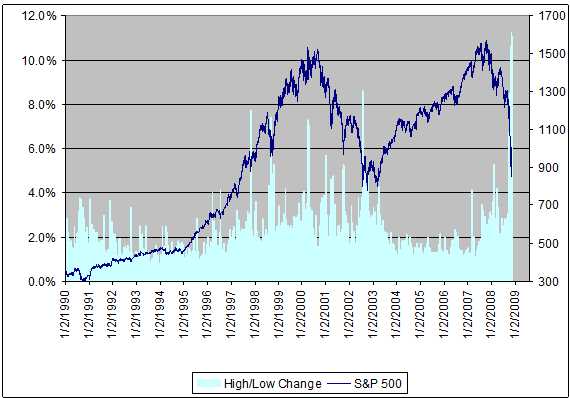

- Market corrections and bubbles: BofA likely employs various valuation metrics, such as Price-to-Earnings (P/E) ratios, to identify potentially overvalued sectors or the market as a whole. Elevated P/E ratios, for instance, can signal a potential market correction.

- Market volatility: High valuations often lead to increased market volatility. BofA's analysis likely incorporates predictions regarding the potential for increased swings in stock prices.

- Sector-specific risks: BofA may identify specific sectors that appear particularly vulnerable to a market downturn due to overvaluation or other factors.

Investment Strategies for Navigating High Valuations

BofA's recommendations for navigating elevated valuations likely include:

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk.

- Value investing: Focusing on undervalued companies with strong fundamentals can mitigate some of the risks associated with high market valuations.

- Defensive stocks and bonds: Including defensive stocks (less sensitive to economic cycles) and bonds in a portfolio can provide stability during periods of market uncertainty.

Long-Term Investment Outlook

BofA's long-term outlook on the sustainability of current valuations likely considers:

- Future economic growth: Predictions for future economic growth are crucial in determining the long-term viability of current stock prices.

- Inflation: BofA's outlook on inflation is critical, as high inflation can erode the real value of investments and impact valuations.

- Technological advancements: Technological breakthroughs can reshape industries and influence long-term market trends, impacting valuations.

Conclusion

Understanding elevated stock market valuations is crucial for every investor. BofA's insights provide a valuable framework for navigating this complex environment. By considering the factors driving high valuations, assessing potential risks, and adopting strategic investment approaches, investors can better position themselves for success. Remember to regularly review your investment strategy and stay informed about market developments to effectively manage risk associated with elevated stock market valuations. Continue to learn more about understanding elevated stock market valuations to make informed decisions and build a resilient portfolio.

Featured Posts

-

Escape To The Country Budgeting For Your Rural Lifestyle

May 24, 2025

Escape To The Country Budgeting For Your Rural Lifestyle

May 24, 2025 -

A Realistic Escape To The Country Weighing The Pros And Cons

May 24, 2025

A Realistic Escape To The Country Weighing The Pros And Cons

May 24, 2025 -

Paris Fashion Week Amira Al Zuhairs Zimmermann Debut

May 24, 2025

Paris Fashion Week Amira Al Zuhairs Zimmermann Debut

May 24, 2025 -

Frazier Teases Celtics Fan Dreyer With Championship Rings On Today Show

May 24, 2025

Frazier Teases Celtics Fan Dreyer With Championship Rings On Today Show

May 24, 2025 -

Carmen Joy Crookes New Single

May 24, 2025

Carmen Joy Crookes New Single

May 24, 2025

Latest Posts

-

Podderzhka Eleny Rybakinoy Buduschee Kazakhstanskogo Zhenskogo Tennisa

May 24, 2025

Podderzhka Eleny Rybakinoy Buduschee Kazakhstanskogo Zhenskogo Tennisa

May 24, 2025 -

Rybakinas Victory Propels Kazakhstan To Billie Jean King Cup Finals

May 24, 2025

Rybakinas Victory Propels Kazakhstan To Billie Jean King Cup Finals

May 24, 2025 -

Kazakhstans Billie Jean King Cup Finals Berth Rybakinas Crucial Role

May 24, 2025

Kazakhstans Billie Jean King Cup Finals Berth Rybakinas Crucial Role

May 24, 2025 -

Rybakina Pomogaet Yunym Tennisistkam Kazakhstana

May 24, 2025

Rybakina Pomogaet Yunym Tennisistkam Kazakhstana

May 24, 2025 -

Concerns Addressed Today Show Co Hosts Discuss Missing Anchor

May 24, 2025

Concerns Addressed Today Show Co Hosts Discuss Missing Anchor

May 24, 2025