Understanding Fortune Coins: Marching Towards Financial Success

Table of Contents

What are Fortune Coins?

Defining "Fortune Coins":

"Fortune coins" is a broad term encompassing a range of digital assets perceived as having significant future value. This includes cryptocurrencies with high growth potential, Non-Fungible Tokens (NFTs) linked to potential financial gains, and other digital assets positioned for future appreciation. It's important to distinguish this from established cryptocurrencies like Bitcoin, which have already seen significant price appreciation and are considered more stable (relatively speaking). Fortune coins, on the other hand, often represent newer projects or assets with higher risk and potentially higher reward. Keywords like cryptocurrency investment, digital assets, and high-growth potential accurately describe this volatile but potentially lucrative market segment.

- Examples of "fortune coins": While we cannot endorse specific coins, examples might include tokens associated with emerging blockchain projects, metaverse platforms, or innovative decentralized finance (DeFi) applications. It is crucial to perform thorough due diligence before investing in any of these.

- Distinction from traditional investments: Fortune coins differ significantly from traditional investments like stocks and bonds. Their value is highly influenced by market sentiment, technological developments, and regulatory changes. Unlike traditional assets, there is no inherent "value" tied to underlying physical assets or company performance.

- Importance of due diligence: Before considering any fortune coin investment, rigorous research is paramount. Understanding the project's whitepaper, team expertise, and market competition is essential to assess its potential and risks.

Potential Benefits of Fortune Coin Investments

High Growth Potential:

Fortune coin investments offer the potential for high returns on investment (ROI). The cryptocurrency market has historically demonstrated periods of rapid price appreciation, creating opportunities for significant gains. However, it is crucial to understand that this high growth potential is accompanied by substantial volatility and risk. Keywords like high ROI, cryptocurrency gains, and investment opportunities are relevant here.

- Illustrative examples of past successful cryptocurrency investments: While past performance is not indicative of future results, analyzing the growth trajectories of some successful cryptocurrencies can provide context. For example, early investors in Bitcoin and Ethereum reaped substantial rewards.

- Discuss diversification as a risk mitigation strategy: Diversifying your portfolio across multiple fortune coins can help reduce the impact of losses from any single investment.

- Explain the concept of early adoption: Investing in promising fortune coins early on, before widespread adoption, could potentially yield higher returns, but it also carries significantly higher risk.

Risks Associated with Fortune Coin Investments

Volatility and Market Fluctuations:

The cryptocurrency market is notoriously volatile. Prices can fluctuate dramatically in short periods, leading to substantial gains or losses. This volatility is influenced by various factors, including news events, technological advancements, regulatory changes, and market sentiment. Keywords like cryptocurrency risk, market volatility, and investment risks are crucial here.

- Examples of past market crashes and their impact on investors: History is replete with instances of significant cryptocurrency market crashes. Understanding these events and their impact is essential for realistic risk assessment.

- Explain the impact of regulatory uncertainty: The regulatory landscape for cryptocurrencies is still evolving globally, and changes in regulations can significantly impact market prices.

- Highlight the importance of risk management: Implementing risk management strategies, such as stop-loss orders and diversification, is crucial to mitigate potential losses.

Scams and Fraud:

The cryptocurrency market is unfortunately susceptible to scams and fraudulent activities. Many projects are created with malicious intent, aiming to defraud unsuspecting investors. Keywords like crypto scams, investment fraud, and safe cryptocurrency investments highlight this significant risk.

- Red flags to watch out for: Be wary of unrealistic promises of high returns, anonymous development teams, and pressure to invest quickly.

- Importance of verifying project legitimacy: Thoroughly research the project's whitepaper, team, and community before investing. Look for verifiable information and independent audits.

- Recommended resources for identifying scams: Utilize reputable websites and communities to check the legitimacy of projects and avoid known scams.

Strategies for Investing in Fortune Coins

Research and Due Diligence:

Thorough research is paramount before investing in any fortune coin. Understand the project's fundamentals, including its technology, use case, team, and market competition. Keywords like cryptocurrency research, due diligence, and investment strategy are essential considerations.

- Steps to take before investing: Review the project's whitepaper carefully, investigate the team's background and expertise, analyze the community's engagement, and assess the market competition.

- Importance of using secure wallets and exchanges: Utilize reputable and secure cryptocurrency wallets and exchanges to protect your assets.

- Diversification strategies to mitigate risk: Diversify your portfolio across multiple promising projects to reduce the impact of any single investment's failure.

Risk Management and Diversification:

Effective risk management is crucial for success in the volatile world of fortune coins. Diversification is a key strategy, spreading investments across multiple assets to mitigate the impact of losses. Keywords like risk management, portfolio diversification, and investment portfolio are highly relevant.

- Strategies for managing risk: Implement stop-loss orders to limit potential losses, utilize dollar-cost averaging to reduce the impact of market volatility, and avoid investing more than you can afford to lose.

- Benefits of diversifying across different types of fortune coins: Spreading your investments across different projects and sectors reduces your overall risk.

- The importance of having a long-term investment strategy: Fortune coin investments are often long-term ventures. Avoid impulsive decisions and stick to your investment plan.

Conclusion:

Understanding the world of "fortune coins" requires a balanced perspective. While the potential for significant financial gains is undeniable, it’s crucial to acknowledge and mitigate the inherent risks. Through thorough research, diversified investments, and a well-defined risk management strategy, you can navigate this exciting landscape and potentially march towards your financial success with "fortune coins." Remember to always conduct your own thorough research and consult with financial advisors before making any investment decisions related to fortune coins or any other high-risk assets. Start your journey to financial success by learning more about smart "fortune coin" investment strategies today!

Featured Posts

-

Moodys Downgrade Of Us Debt Criticism Mounts From The White House

May 18, 2025

Moodys Downgrade Of Us Debt Criticism Mounts From The White House

May 18, 2025 -

Bowen Yangs Hilarious Reaction To Snls White Lotus Parody With Aimee Lou Wood

May 18, 2025

Bowen Yangs Hilarious Reaction To Snls White Lotus Parody With Aimee Lou Wood

May 18, 2025 -

Kanye West Accuses Kim Kardashian Of Sex Trafficking A Detailed Analysis

May 18, 2025

Kanye West Accuses Kim Kardashian Of Sex Trafficking A Detailed Analysis

May 18, 2025 -

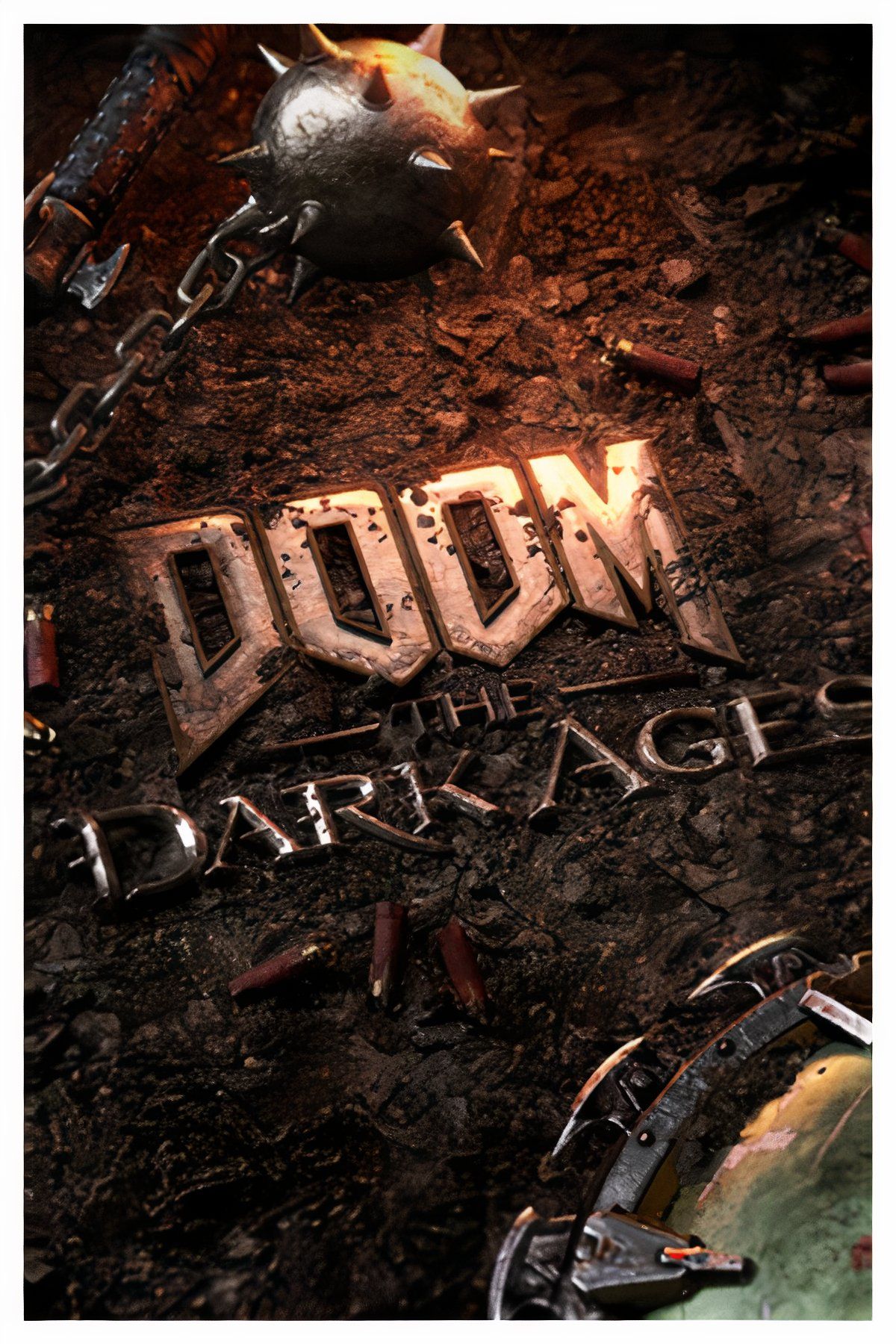

Doom The Dark Ages A Game For Both Lovers And Slayers

May 18, 2025

Doom The Dark Ages A Game For Both Lovers And Slayers

May 18, 2025 -

Amsterdam Hotel Attack Police Investigation Following Knife Incident

May 18, 2025

Amsterdam Hotel Attack Police Investigation Following Knife Incident

May 18, 2025

Latest Posts

-

Povredeni Alkaras Predao Mec Runu U Finalu Barselone

May 18, 2025

Povredeni Alkaras Predao Mec Runu U Finalu Barselone

May 18, 2025 -

Final Barselone Rune Slavi Protiv Povredenog Alkarasa

May 18, 2025

Final Barselone Rune Slavi Protiv Povredenog Alkarasa

May 18, 2025 -

Rune Osvaja Barselonu Alkaras Predao Mec Zbog Povrede

May 18, 2025

Rune Osvaja Barselonu Alkaras Predao Mec Zbog Povrede

May 18, 2025 -

Neocekivana Pobeda Runea Alkaras Povreden U Finalu Barselone

May 18, 2025

Neocekivana Pobeda Runea Alkaras Povreden U Finalu Barselone

May 18, 2025 -

Rune Dominira Protiv Povredenog Alkarasa U Finalu Barselone

May 18, 2025

Rune Dominira Protiv Povredenog Alkarasa U Finalu Barselone

May 18, 2025