Understanding Principal Financial Group (PFG): An Analyst Perspective

Table of Contents

Navigating the complex world of financial services requires a keen understanding of key players. For investors and analysts alike, Principal Financial Group (PFG) represents a significant entity demanding careful consideration. Principal Financial Group (PFG) is a global financial services leader offering a diverse range of retirement, insurance, and asset management solutions. This article provides an in-depth analyst perspective on Principal Financial Group (PFG), examining its core business segments, financial performance, investment strategies, competitive landscape, and future outlook, including a look at its ESG initiatives.

H2: PFG's Core Business Segments and Revenue Streams

Principal Financial Group (PFG) operates across several key business segments, each contributing significantly to its overall revenue streams. Understanding these segments is crucial for a comprehensive assessment of PFG's financial health and growth potential.

-

Retirement and Income Solutions: This segment is a cornerstone of PFG's business, focusing on providing retirement planning services and products, including annuities and various retirement savings vehicles. Key revenue drivers include:

- Sales of individual and group retirement plans.

- Management fees from retirement accounts.

- Growth in assets under management (AUM) within retirement portfolios. This segment relies heavily on effective retirement planning strategies and strong client relationships.

-

Insurance Solutions: PFG offers a comprehensive suite of insurance products, catering to individual and corporate clients. Revenue is generated through:

- Premiums from life insurance policies.

- Sales of disability and other supplemental insurance products.

- Investment income earned on insurance reserves. The performance of this segment is closely tied to claims experience and the effectiveness of risk management.

-

Asset Management: This segment manages a substantial portfolio of assets for both institutional and individual investors. Key revenue generators include:

- Management fees based on assets under management (AUM).

- Performance-based fees on successful investment strategies.

- The overall success hinges on investment management expertise, market trends, and competitive asset allocation strategies.

Recent developments in the industry, such as increased regulatory scrutiny and evolving customer preferences for digital platforms, have prompted PFG to adapt and invest in technological upgrades and new product offerings.

H2: Financial Performance Analysis of PFG

Analyzing PFG's financial performance involves scrutinizing key metrics to understand its profitability, growth trajectory, and overall financial health. We look at several key indicators:

-

Revenue Growth: Consistent revenue growth indicates a strong market position and effective business strategies. Examining year-over-year and quarterly revenue trends reveals PFG's performance in relation to market conditions and internal performance.

-

Profitability: Key profitability ratios like return on equity (ROE) and return on assets (ROA) demonstrate how efficiently PFG utilizes its capital and assets to generate profits. Analyzing these metrics over time provides valuable insights into PFG's operational efficiency and overall profitability.

-

Earnings per Share (EPS): Tracking EPS helps assess PFG's profitability from a shareholder perspective. Consistent growth in EPS often indicates a healthy and growing business.

-

Debt Levels: A careful examination of PFG's debt levels and its ability to manage debt is important in assessing its long-term financial stability. High levels of debt can pose risks, while effective management of debt indicates financial prudence.

PFG's dividend policy and shareholder returns are also important considerations for investors. A consistent and growing dividend payout often signals confidence in the company’s future prospects. Comparing PFG’s financial statements and performance to its competitors in the financial services industry provides further context and highlights relative strengths and weaknesses.

H2: Investment Strategies and Portfolio Management at PFG

PFG employs diverse investment strategies across its business units, reflecting its commitment to generating strong returns for its clients and shareholders.

-

Portfolio Diversification: PFG actively utilizes portfolio diversification to manage risk and enhance returns. Diversification across asset classes, geographies, and sectors reduces reliance on single investments and improves the overall resilience of portfolios.

-

Risk Management: Robust risk management strategies are critical in the financial services industry. PFG employs sophisticated models and controls to mitigate potential risks and protect client assets. This involves various risk assessment methods and proactive strategies to manage market volatilities and unforeseen events.

-

Investment Philosophy: A clear investment philosophy guides PFG's investment decisions across all its segments. This philosophy emphasizes long-term value creation, responsible investing, and aligning investment decisions with client objectives. Specific investment approaches might include active management, passive management, or a combination, depending on the strategy and client needs. The performance of these strategies is subject to constant monitoring and adaptation as needed.

H2: Competitive Landscape and Future Outlook for PFG

PFG operates in a competitive financial services landscape, facing established players and emerging fintech companies. Key competitors include MetLife, Prudential Financial, and other large financial institutions. Understanding the competitive dynamics is critical in assessing PFG's future outlook.

-

Competitive Advantage: PFG's competitive advantages lie in its diversified business model, strong brand reputation, and extensive distribution network. Its long history, strong client relationships, and ongoing commitment to innovation provide further competitive edge.

-

Market Share: Analyzing PFG's market share in each business segment provides insights into its relative position within the market and its growth potential.

-

Industry Trends: The financial services industry is constantly evolving, with ongoing technological advancements, changing regulations, and shifting customer expectations. PFG's ability to adapt to these trends will be crucial to its long-term success. Factors such as low interest rates, increased competition, and regulatory changes can greatly influence PFG's future performance and profitability.

-

Future Growth Prospects: PFG’s future growth hinges on its ability to innovate, expand into new markets, and effectively manage risks. The global expansion plans, technological advancements, and adaptation to regulatory changes can greatly affect the future growth prospects.

H2: ESG Considerations and Sustainability at PFG

Environmental, Social, and Governance (ESG) factors are increasingly important for investors and stakeholders. PFG is actively involved in various ESG initiatives, reflecting a commitment to sustainability and responsible business practices.

-

ESG Investing: PFG integrates ESG considerations into its investment strategies, aligning investment decisions with environmental and social values. This approach recognizes the long-term impacts of climate change and social issues on investments.

-

Corporate Social Responsibility: PFG demonstrates corporate social responsibility through its philanthropic activities, commitment to diversity and inclusion, and employee engagement in sustainability programs.

-

Environmental Impact: Assessing PFG's environmental impact and the strategies it has in place to minimize its carbon footprint is a key aspect of ESG analysis.

Conclusion:

This analysis of Principal Financial Group (PFG) reveals a company with a diversified business model, strong financial performance, and a commitment to responsible investing. While the competitive landscape presents challenges, PFG's established market position, strategic initiatives, and robust risk management strategies suggest a positive outlook. However, potential challenges remain, including adapting to evolving market conditions and regulatory changes. Gain a deeper understanding of Principal Financial Group (PFG) by exploring their investor relations website, or contact us to discuss your investment strategy related to PFG and its various investment products.

Featured Posts

-

Phoi Canh Nhu Mo Kham Pha Cong Vien Dien Anh Thu Thiem Ven Song Sai Gon

May 17, 2025

Phoi Canh Nhu Mo Kham Pha Cong Vien Dien Anh Thu Thiem Ven Song Sai Gon

May 17, 2025 -

Bmw And Porsches China Challenges A Growing Industry Trend

May 17, 2025

Bmw And Porsches China Challenges A Growing Industry Trend

May 17, 2025 -

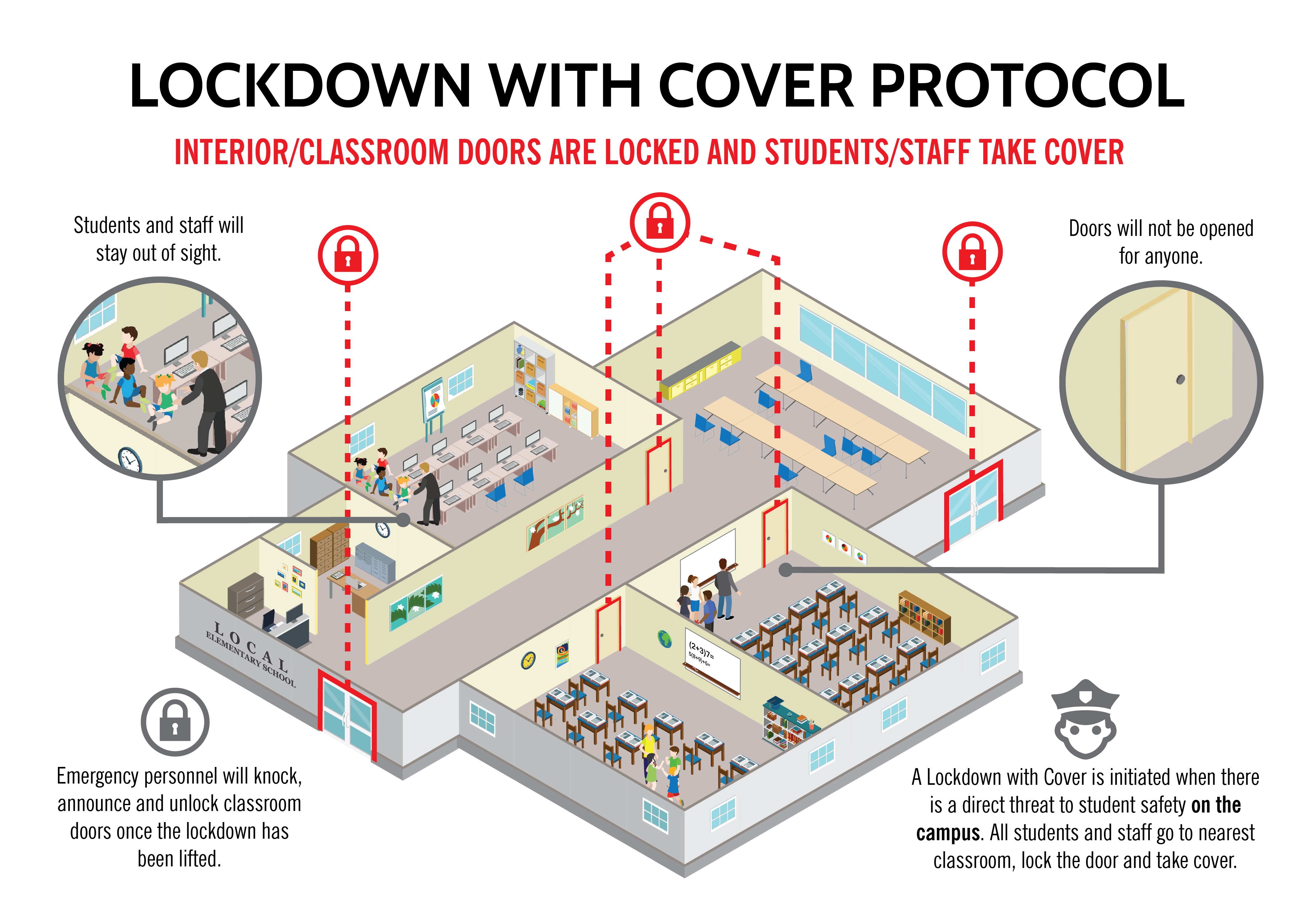

Understanding Florida School Shootings And Lockdown Procedures A Generations Perspective

May 17, 2025

Understanding Florida School Shootings And Lockdown Procedures A Generations Perspective

May 17, 2025 -

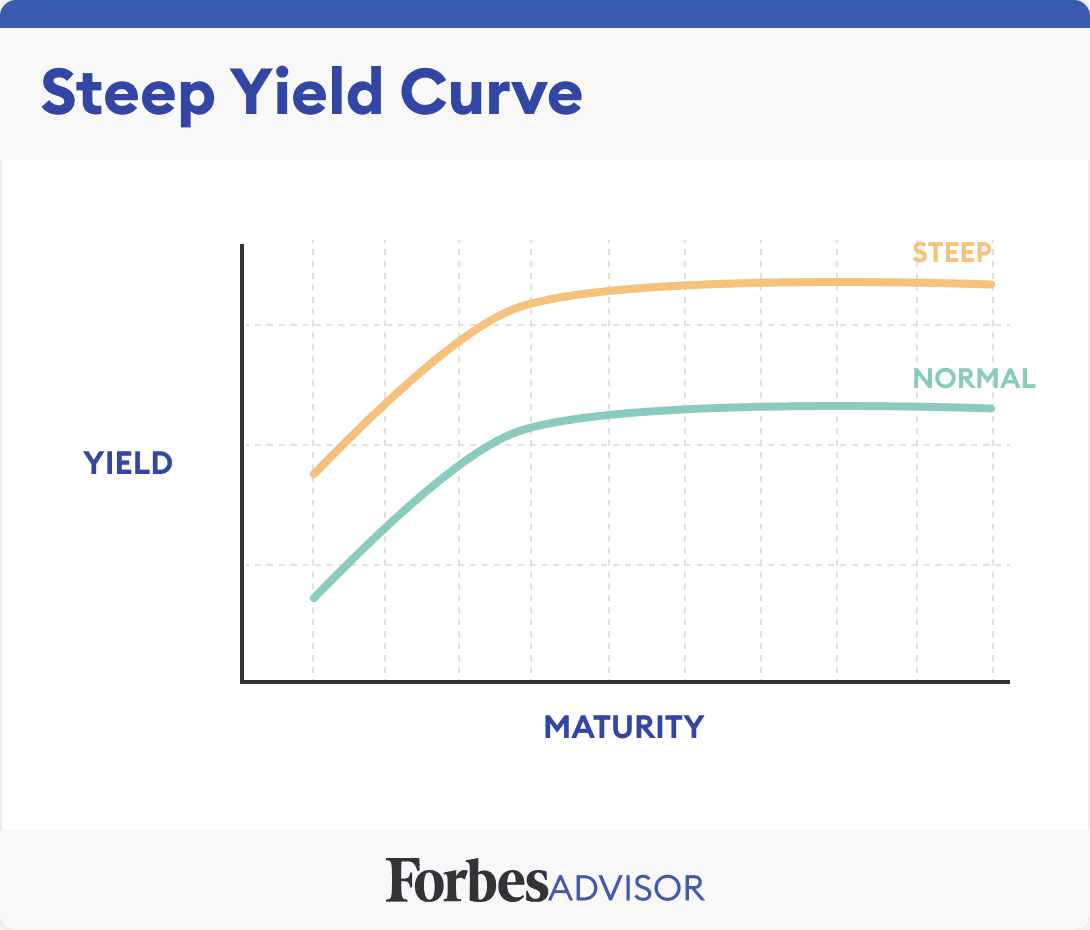

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025 -

Bet365 Bonus Code Nypbet Expert Picks And Odds For Knicks Vs Pistons Series

May 17, 2025

Bet365 Bonus Code Nypbet Expert Picks And Odds For Knicks Vs Pistons Series

May 17, 2025