Understanding The Analyst Downgrade: Implications For BigBear.ai (BBAI) Investors

Table of Contents

What Constitutes an Analyst Downgrade?

Analyst ratings are crucial tools in stock market analysis. These ratings, typically categorized as Buy, Hold, or Sell, reflect an analyst's opinion on a company's future performance and investment potential. A "downgrade" simply means a shift in an analyst's rating to a more negative outlook. For example, a downgrade might involve a change from "Buy" to "Hold" or from "Hold" to "Sell".

Several factors contribute to analyst downgrades. These often include:

- Financial Performance: Disappointing earnings reports, missed revenue projections, or declining profitability can all trigger downgrades.

- Competitive Landscape: Increased competition, loss of market share, or the emergence of disruptive technologies can negatively impact a company's outlook.

- Market Conditions: Broader economic factors, such as recessionary fears or changes in interest rates, can also influence analyst assessments.

Bullet Points:

- Examples of negative factors include: decreased revenue, increased debt, lawsuits, regulatory changes.

- Downgrades are usually communicated publicly through press releases, analyst reports, and financial news outlets.

- It's critical to carefully examine the reasoning behind the downgrade; not all downgrades are created equal. Understanding the specific concerns raised by the analyst is key to informed decision-making.

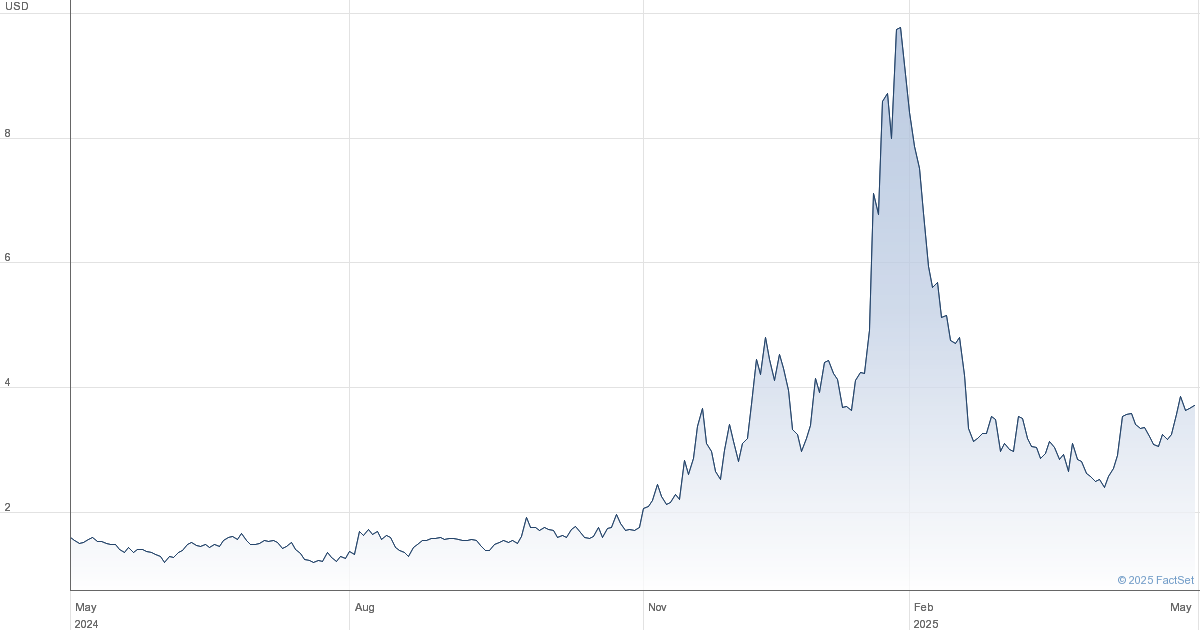

Impact of Analyst Downgrades on BBAI Stock Price

Analyst downgrades typically lead to increased volatility and often result in a decline in a stock's price. This is because investor sentiment is heavily influenced by analyst opinions. When a respected analyst downgrades a stock, it can trigger a sell-off as investors react to the negative news.

Bullet Points:

- Historical data can reveal how BBAI stock reacted to previous downgrades, providing some insight into potential future behavior.

- Expect price fluctuations in the short term following a downgrade announcement, as investors adjust their positions.

- Media coverage and overall investor sentiment amplify the impact of an analyst downgrade, further influencing price movements.

Analyzing the Specific Downgrades for BigBear.ai (BBAI)

Recent downgrades of BigBear.ai (BBAI) have highlighted specific concerns. [Insert summary of recent downgrades here, including specific analyst firms, their ratings, and the key reasons cited for the downgrades]. It's important to analyze these concerns carefully and consider counterarguments or supporting evidence. For example, [mention any positive news, future contracts, or technological advancements that could counteract the negative sentiment].

Bullet Points:

- List specific analyst firms and their revised ratings for BBAI.

- Detail the reasons provided by analysts for their downgrades, providing specific examples.

- Offer alternative perspectives, if available, that might offer a more optimistic view of BBAI's future.

Strategies for BBAI Investors Following a Downgrade

Facing an analyst downgrade, BBAI investors face several options: holding their shares, selling, or averaging down (buying more shares at a lower price to lower the average cost basis). The optimal strategy depends entirely on your individual risk tolerance and investment goals.

Bullet Points:

- Holding: Pros – potential for future price recovery; Cons – risk of further losses.

- Selling: Pros – limiting potential losses; Cons – missing out on potential future gains.

- Averaging Down: Pros – lowering average cost per share; Cons – increasing the total investment at risk.

Consider the following:

- Your personal risk tolerance: Are you comfortable with the possibility of further price declines?

- Your investment timeline: Are you investing for the long term or short term?

- Your overall portfolio diversification: Is BBAI a significant portion of your portfolio?

Long-Term Outlook for BigBear.ai (BBAI)

Despite recent downgrades, BigBear.ai possesses certain strengths, including [mention key competitive advantages, technological advancements, or potential market opportunities]. However, risks remain, including [mention potential challenges, competitive threats, or financial risks].

Bullet Points:

- Identify potential catalysts for future growth, such as new contracts, technological breakthroughs, or expansion into new markets.

- Clearly outline the inherent risks associated with investing in BBAI, considering both market and company-specific factors.

- Discuss the long-term potential for BBAI, weighing the risks and rewards to provide a balanced outlook.

Conclusion: Understanding Analyst Downgrades and Their Impact on Your BBAI Investment

Analyst downgrades, while impactful, don't necessarily signal the end of a company's success. Understanding the reasons behind the downgrade and assessing your personal risk tolerance are crucial when making investment decisions regarding BigBear.ai (BBAI). Thorough research, considering both the positive and negative aspects, is vital for developing a well-informed investment strategy. Continue researching BigBear.ai (BBAI), stay informed about market analysis and upcoming news, and make informed decisions based on your risk profile and long-term financial goals. For further insights into BBAI investment strategies, please contact us or visit [link to relevant resources].

Featured Posts

-

Choosing The Best Wireless Headphones Improvements And Advancements

May 20, 2025

Choosing The Best Wireless Headphones Improvements And Advancements

May 20, 2025 -

Nyt Mini Crossword Answers March 31

May 20, 2025

Nyt Mini Crossword Answers March 31

May 20, 2025 -

Big Bear Ai Holdings Inc Sued Implications For Investors

May 20, 2025

Big Bear Ai Holdings Inc Sued Implications For Investors

May 20, 2025 -

Clean Energy Under Siege Threats To A Booming Industry

May 20, 2025

Clean Energy Under Siege Threats To A Booming Industry

May 20, 2025 -

Thousands With Savings Accounts Unknowingly Owe Hmrc Tax

May 20, 2025

Thousands With Savings Accounts Unknowingly Owe Hmrc Tax

May 20, 2025

Latest Posts

-

Billionaire Boy Inheritance Influence And Impact

May 20, 2025

Billionaire Boy Inheritance Influence And Impact

May 20, 2025 -

The Billionaire Boys Guide To Success Or How Not To Be One

May 20, 2025

The Billionaire Boys Guide To Success Or How Not To Be One

May 20, 2025 -

Raising A Billionaire Boy Challenges And Opportunities

May 20, 2025

Raising A Billionaire Boy Challenges And Opportunities

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon

May 20, 2025

Understanding The Billionaire Boy Phenomenon

May 20, 2025 -

Billionaire Boy A Study In Wealth And Privilege

May 20, 2025

Billionaire Boy A Study In Wealth And Privilege

May 20, 2025