Understanding The Bitcoin Rebound And Its Implications

Table of Contents

Factors Contributing to Bitcoin Rebounds

Several interconnected elements contribute to the phenomenon of a Bitcoin rebound. These factors often interact, creating a complex interplay that drives price fluctuations.

Regulatory Developments

Positive regulatory developments significantly influence investor confidence and market sentiment. Clearer regulatory frameworks, reduced uncertainty, and positive statements from governmental bodies can trigger a Bitcoin rebound.

-

Examples of Positive Regulatory Developments:

- A country legalizing Bitcoin as a form of payment.

- A regulatory body issuing guidelines clarifying the tax treatment of cryptocurrencies.

- Positive statements from central bank officials regarding the potential benefits of blockchain technology.

-

Impact on Investor Confidence: Positive regulatory news reduces the perceived risk associated with Bitcoin investment, attracting new investors and encouraging existing ones to increase their holdings. This increased demand often leads to a price surge, resulting in a Bitcoin rebound.

Market Sentiment and Investor Psychology

The cryptocurrency market is heavily influenced by market sentiment and investor psychology. Fear, uncertainty, and doubt (FUD) can drive prices down, while fear of missing out (FOMO) can fuel rapid price increases.

-

Impact of News Cycles, Social Media, and Influencers: News cycles, social media trends, and opinions from prominent figures in the cryptocurrency space can significantly sway market sentiment, creating waves of buying and selling pressure. A positive news story or a bullish prediction from an influencer can quickly spark a Bitcoin rebound.

-

Interaction with Technical Analysis: Investor psychology often interacts with technical analysis, creating self-fulfilling prophecies. For example, if technical indicators suggest a price reversal, investors might anticipate a Bitcoin rebound, leading to increased buying pressure and fulfilling the prediction.

Technological Advancements

Technological advancements within the Bitcoin ecosystem play a vital role in driving long-term growth and, consequently, short-term rebounds. Upgrades, scaling solutions, and new developments often increase efficiency, security, and adoption.

-

Examples of Technological Advancements:

- Successful implementation of the Lightning Network for faster and cheaper transactions.

- Upgrades to the Bitcoin protocol enhancing security and scalability.

- Development of new applications and services built on the Bitcoin blockchain.

-

Attracting New Investors: These advancements showcase Bitcoin's ongoing development and potential, attracting new investors and further fueling demand, ultimately leading to a Bitcoin price rebound.

Macroeconomic Factors

Global macroeconomic conditions significantly impact Bitcoin's price, potentially triggering rebounds. Periods of high inflation, economic uncertainty, or geopolitical instability can drive investors towards Bitcoin as a safe haven asset or a hedge against inflation.

-

Inflation and Economic Uncertainty: During times of high inflation or economic uncertainty, investors may seek alternative assets to preserve their wealth. Bitcoin, with its limited supply, can be seen as a hedge against inflation, resulting in increased demand and potential price rebounds.

-

Correlation with Traditional Markets: While not always perfectly correlated, Bitcoin's price can sometimes react to events in traditional markets. A downturn in traditional markets might lead investors to seek refuge in Bitcoin, triggering a rebound.

Implications of Bitcoin Rebounds

Bitcoin rebounds have significant implications for investors, the broader cryptocurrency market, and the long-term adoption of Bitcoin.

Impact on Investors

Bitcoin rebounds offer opportunities for profit but also carry considerable risk.

-

Strategies for Capitalizing on Rebounds: Investors can utilize strategies like dollar-cost averaging or employ technical analysis to identify potential entry and exit points during a Bitcoin rebound.

-

Importance of Risk Management: It is crucial to implement effective risk management strategies, such as diversification and setting stop-loss orders, to protect against potential losses. Bitcoin's volatility demands caution.

Implications for the Broader Cryptocurrency Market

Bitcoin rebounds often influence the performance of altcoins (alternative cryptocurrencies) and the overall health of the cryptocurrency ecosystem.

-

Bitcoin Dominance: Bitcoin's market dominance (its share of the total cryptocurrency market capitalization) plays a significant role. A strong Bitcoin rebound can positively influence altcoin prices, while a weak rebound or a price correction could negatively impact the entire market.

-

Market Recovery Signal: A sustained Bitcoin rebound can be seen as a positive signal for the broader cryptocurrency market, suggesting a potential overall market recovery.

Long-Term Implications for Bitcoin Adoption

Sustained Bitcoin rebounds can contribute to greater mainstream adoption and integration into the global financial system.

-

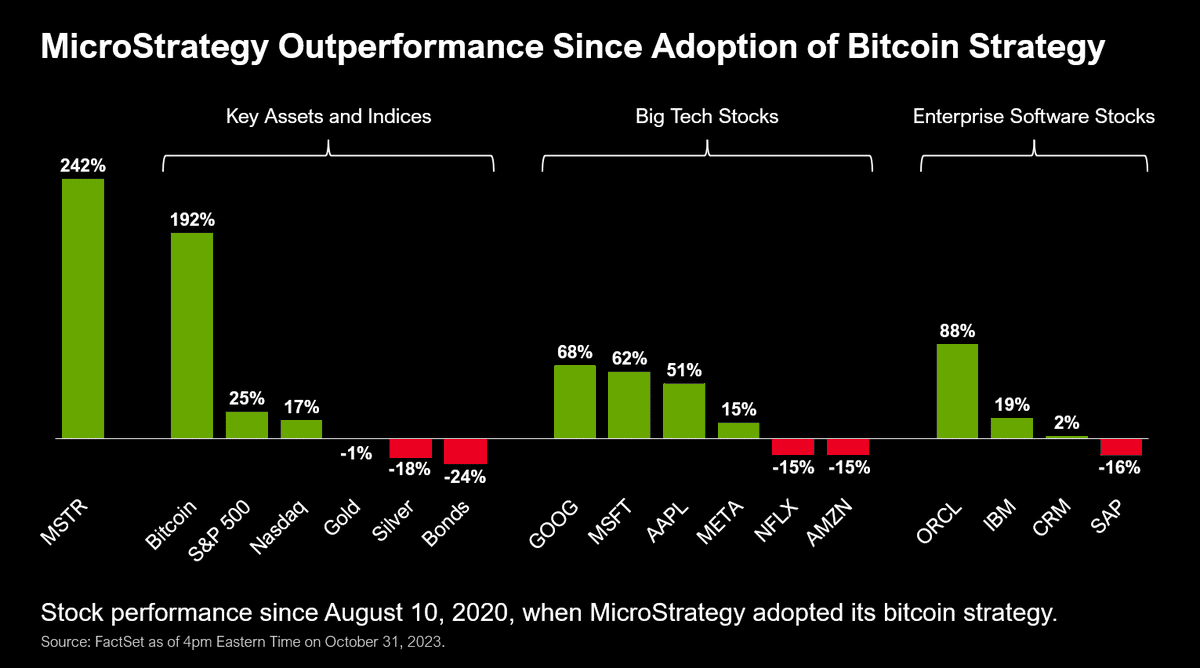

Institutional Investors and Corporations: Significant institutional investment and corporate adoption can be spurred by rising Bitcoin prices and positive market sentiment.

-

Impact on Price and Market Capitalization: Continued rebounds and increased adoption can lead to a higher Bitcoin price and a larger market capitalization, strengthening its position as a leading digital asset.

Conclusion

Understanding the intricacies of a Bitcoin rebound is crucial for navigating the volatile cryptocurrency market. Several key factors contribute to these price surges, including regulatory developments, market sentiment, technological advancements, and macroeconomic conditions. These rebounds have significant implications for investors, influencing their potential gains and losses. Moreover, they impact the broader cryptocurrency market and the long-term adoption of Bitcoin. Staying updated on the latest news and analysis, and understanding the interplay of these factors, is vital to making informed decisions regarding your Bitcoin investments. Continue learning about the dynamics of the Bitcoin rebound and its various facets to become a more savvy investor in the ever-evolving cryptocurrency landscape.

Featured Posts

-

Nuggets Westbrook Leads Jokics Birthday Celebration With Special Rendition

May 08, 2025

Nuggets Westbrook Leads Jokics Birthday Celebration With Special Rendition

May 08, 2025 -

Lotto And Lotto Plus Draw Results Wednesday 2nd April 2025

May 08, 2025

Lotto And Lotto Plus Draw Results Wednesday 2nd April 2025

May 08, 2025 -

Sharp Decline In Toronto Home Sales 23 Year Over Year Decrease 4 Price Drop

May 08, 2025

Sharp Decline In Toronto Home Sales 23 Year Over Year Decrease 4 Price Drop

May 08, 2025 -

Micro Strategy Vs Bitcoin Which Is The Better Investment In 2025

May 08, 2025

Micro Strategy Vs Bitcoin Which Is The Better Investment In 2025

May 08, 2025 -

Analysis Trump Medias Crypto Com Etf Partnership And Its Market Implications

May 08, 2025

Analysis Trump Medias Crypto Com Etf Partnership And Its Market Implications

May 08, 2025