Understanding The Bitcoin Rebound: Market Trends And Predictions

Table of Contents

Analyzing the Recent Bitcoin Price Dip

Key Factors Contributing to the Dip

Several interconnected factors contributed to the recent Bitcoin price dip. Understanding these is crucial to predicting future Bitcoin price movements and assessing the sustainability of any Bitcoin rebound.

- Regulatory Uncertainty: Increased regulatory scrutiny in various jurisdictions created uncertainty among investors, leading to sell-offs. The ambiguity surrounding Bitcoin's legal status and taxation continues to impact investor sentiment and Bitcoin price volatility.

- Macroeconomic Factors: Global macroeconomic conditions, particularly high inflation rates and rising interest rates, significantly influence Bitcoin's price. Investors often shift their assets towards safer investments during periods of economic instability, leading to decreased demand for riskier assets like Bitcoin.

- Major Market Events: Geopolitical events and significant news concerning other asset classes can trigger widespread risk aversion, causing Bitcoin price to drop alongside other riskier investments.

- Whale Activity and Large Sell-offs: The actions of large Bitcoin holders ("whales") can significantly impact market price. Large sell-offs by these whales can create downward pressure, exacerbating existing bearish trends.

- Negative News: Negative news cycles, such as security breaches on cryptocurrency exchanges or high-profile scams, often negatively impact investor confidence and Bitcoin price. Specific examples include the FTX collapse and various regulatory crackdowns.

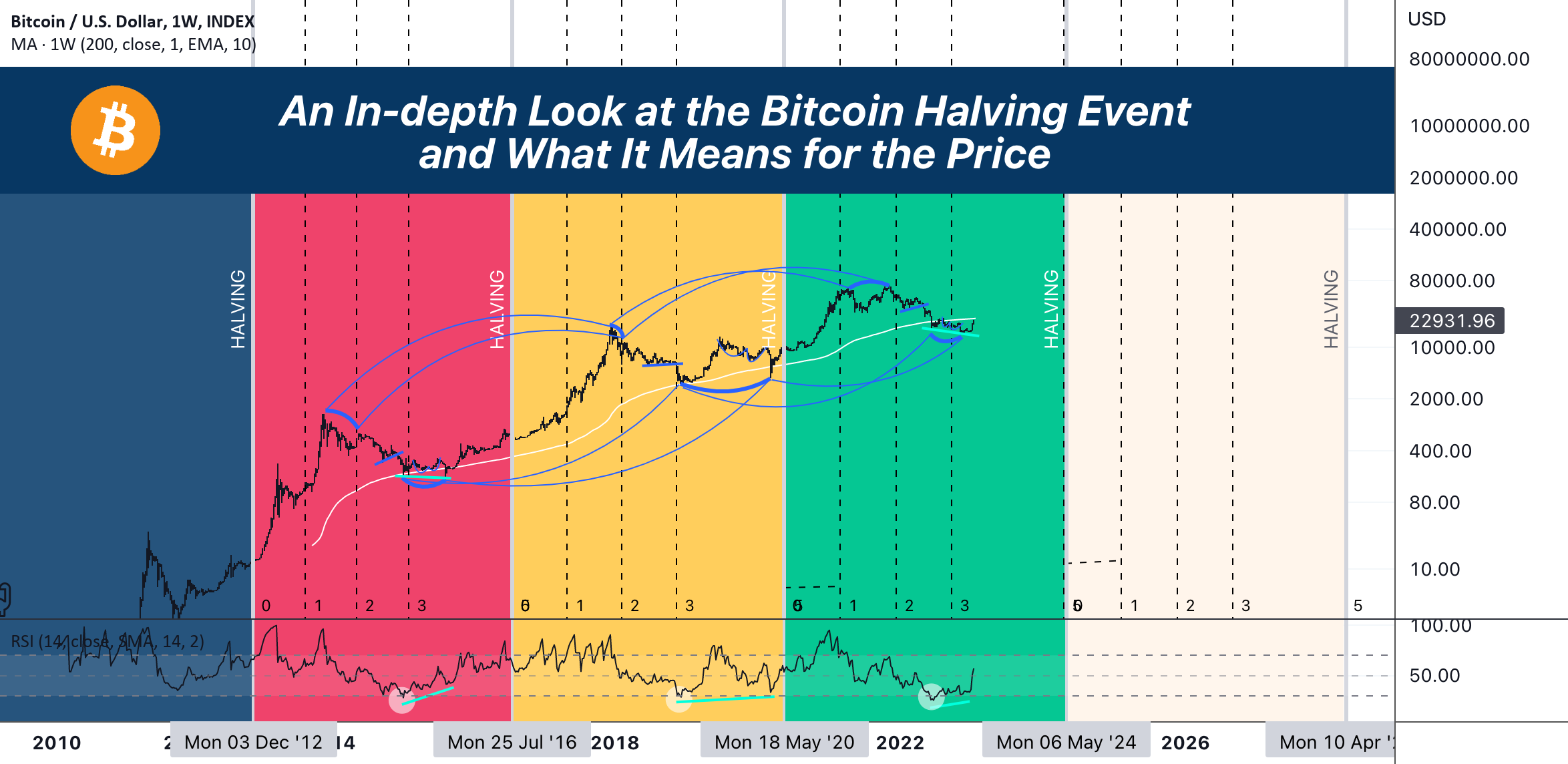

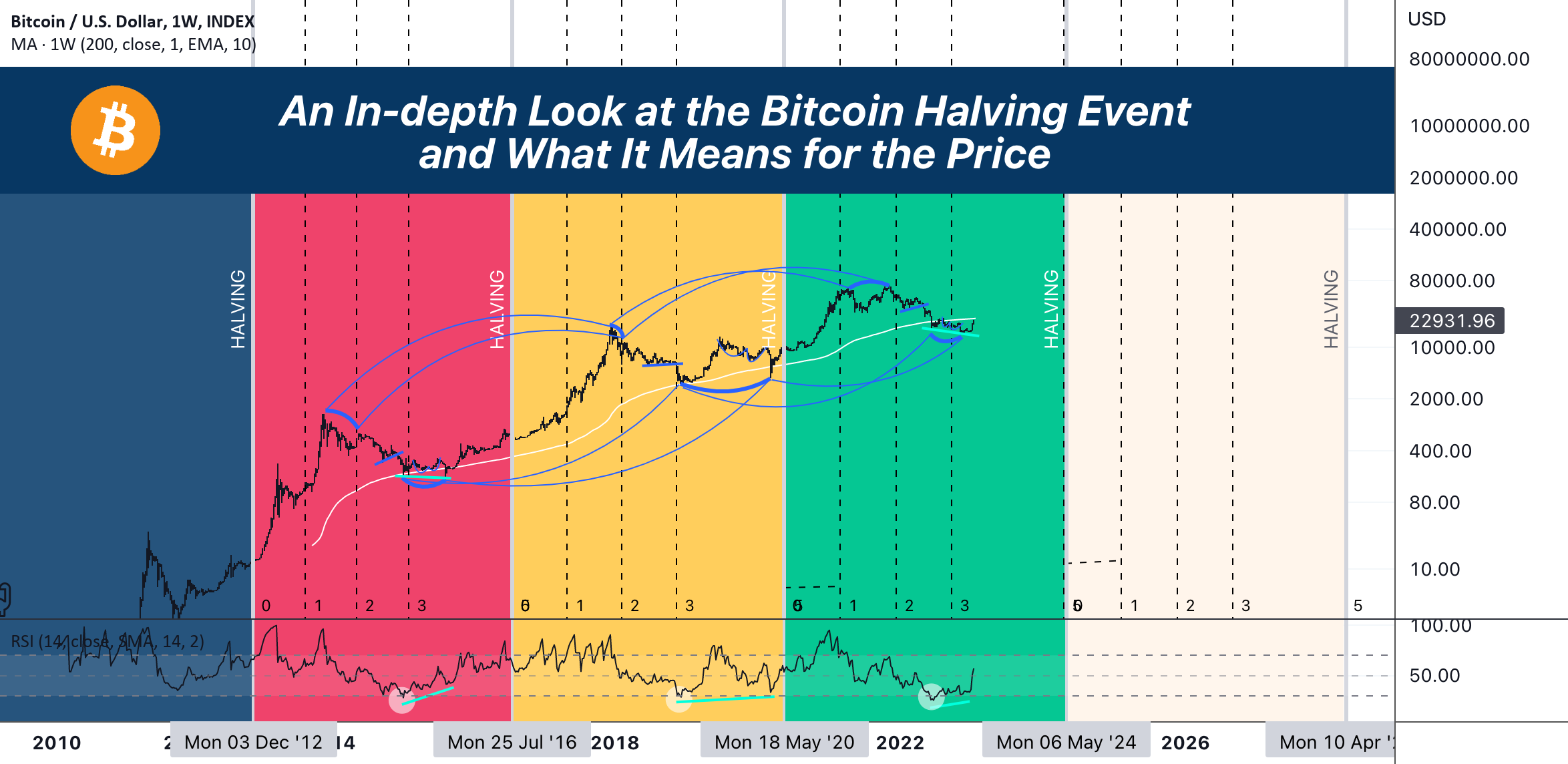

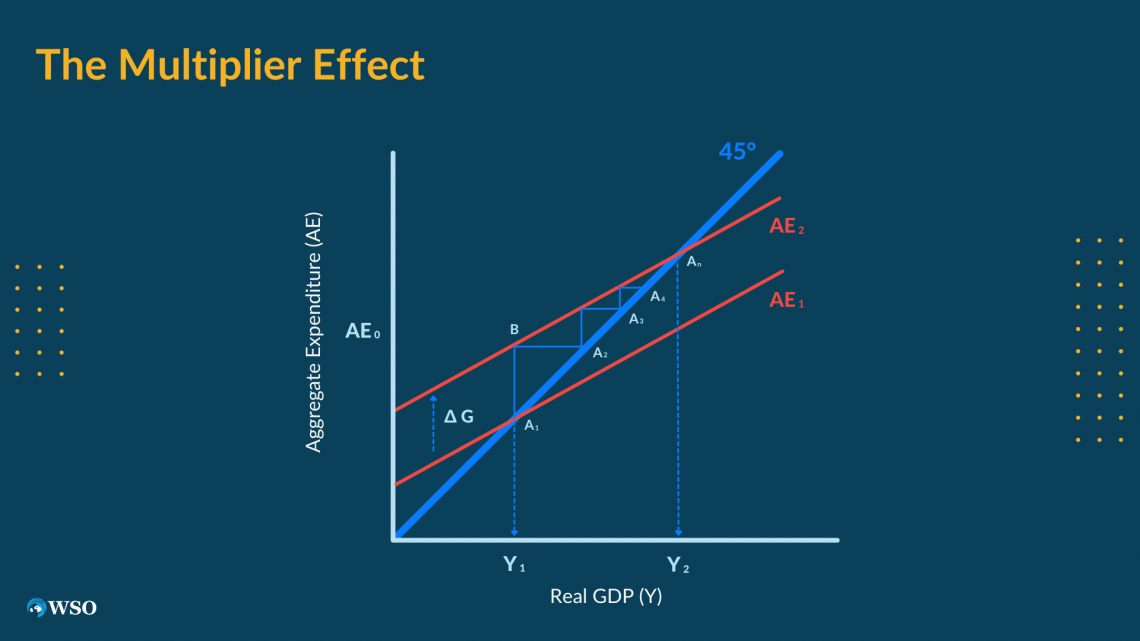

Technical Analysis of the Dip

Technical analysis provides valuable insights into price trends and potential reversal points. Analyzing charts helps understand the dynamics of the Bitcoin price dip and identify potential Bitcoin rebound signals.

- Bearish Chart Patterns: The charts displayed clear bearish trends, including the breaking of key support levels and the formation of resistance levels that prevented price recovery.

- Volume Analysis: Low trading volume during the price decline confirmed the lack of strong buying pressure, contributing to the sustained downward trend.

- Technical Indicators: Indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) showed oversold conditions, suggesting a potential reversal.

- Key Chart Patterns: Some analysts observed chart patterns like a "double bottom," which often precedes a price increase, hinting at a possible Bitcoin rebound.

Factors Driving the Bitcoin Rebound

Renewed Investor Confidence

Several factors contribute to the renewed investor confidence fueling the Bitcoin rebound.

- Positive News and Adoption: Positive news concerning institutional investment in Bitcoin, the approval of Bitcoin ETFs in certain jurisdictions, and growing adoption by businesses and payment processors signal increased confidence in the long-term value of Bitcoin.

- Shifting Narrative: A shift in the narrative surrounding Bitcoin's long-term potential as a store of value and hedge against inflation is influencing investor sentiment.

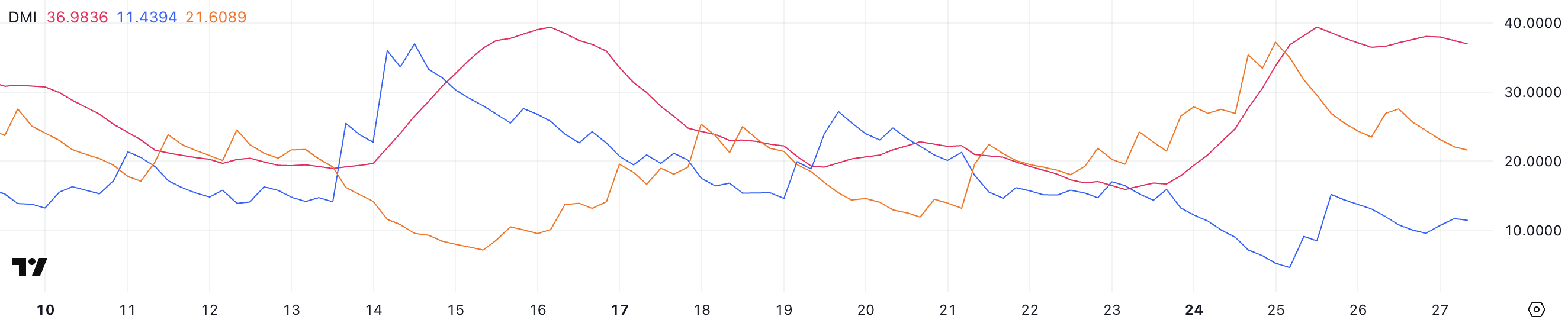

Technical Reversal Signals

Technical analysis played a key role in identifying the Bitcoin rebound.

- Technical Indicators: Indicators like the RSI and MACD moved out of oversold territory, signaling a potential shift in momentum.

- Support Levels: Key support levels were successfully defended, indicating buying pressure from investors.

- Bullish Chart Patterns: The emergence of bullish chart patterns, such as the completion of a double bottom, provided further evidence of a potential upward trend.

Macroeconomic Shifts

While macroeconomic factors initially contributed to the dip, potential shifts in these conditions could favor Bitcoin.

- Inflation Rates: If inflation rates begin to fall, Bitcoin's value proposition as a hedge against inflation might become more attractive to investors, leading to increased demand.

Predicting Future Bitcoin Price Movements

Short-Term Predictions

Predicting short-term Bitcoin price movements is inherently difficult. However, based on current market conditions and technical analysis:

- Short-term gains are possible if positive news continues and technical indicators remain bullish.

- Potential price targets can be extrapolated from technical analysis, but these should be viewed as potential scenarios rather than certainties.

Long-Term Predictions

Long-term predictions are even more speculative. Nevertheless:

- Widespread Bitcoin adoption could drive significant price increases.

- Bitcoin's role as a store of value and its limited supply could support long-term price appreciation.

- Technological advancements, such as the Lightning Network, could enhance Bitcoin's scalability and usability, positively impacting its price.

Conclusion

The recent Bitcoin rebound is a complex phenomenon influenced by a confluence of regulatory changes, shifting investor sentiment, technical indicators, and macroeconomic shifts. While short-term price predictions are uncertain, the long-term potential of Bitcoin remains a topic of considerable debate. Understanding the complexities of a Bitcoin rebound requires continuous learning. Stay informed about market trends and conduct thorough research before making any investment decisions. The volatility inherent in the Bitcoin price necessitates a cautious and informed approach to investing in this exciting but unpredictable asset. Remember to always diversify your portfolio and only invest what you can afford to lose.

Featured Posts

-

The Future Of Xrp Navigating Regulatory Uncertainty After The Sec Ruling

May 08, 2025

The Future Of Xrp Navigating Regulatory Uncertainty After The Sec Ruling

May 08, 2025 -

Superman In Minecraft 5 Minute Thailand Theater Preview

May 08, 2025

Superman In Minecraft 5 Minute Thailand Theater Preview

May 08, 2025 -

Bitcoins 10x Multiplier Could It Storm Wall Street

May 08, 2025

Bitcoins 10x Multiplier Could It Storm Wall Street

May 08, 2025 -

Bitcoin Seoul 2025 Asias Largest Bitcoin Conference

May 08, 2025

Bitcoin Seoul 2025 Asias Largest Bitcoin Conference

May 08, 2025 -

The Taiwan Dollars Surge Implications For Economic Restructuring

May 08, 2025

The Taiwan Dollars Surge Implications For Economic Restructuring

May 08, 2025