US Bond ETF Investments: A Taiwanese Retreat

Table of Contents

Why Taiwanese Investors are Turning to US Bond ETFs

Taiwanese investors are increasingly drawn to US Bond ETFs for several key reasons:

Diversification and Risk Mitigation

Investing in US Bond ETFs offers significant diversification benefits. By allocating a portion of your portfolio to US government bonds and corporate bonds, you reduce your dependence on the Taiwanese market. This is particularly crucial given the interconnectedness of global markets and the potential for regional economic downturns. The US represents a large, developed economy, offering relative stability compared to smaller, more volatile markets. Furthermore, investing in a different currency (USD) provides currency diversification, potentially mitigating losses if the Taiwanese dollar (TWD) weakens against the US dollar.

- Lower Volatility: US Bond ETFs generally exhibit lower volatility than Taiwanese equities.

- Reduced Exposure to Taiwan's Economic Cycles: Diversification reduces the impact of domestic economic fluctuations on your overall portfolio.

- Potential for Stable Income Streams: Many US Bond ETFs generate regular income through interest payments.

Attractive Yields and Relatively Stable Returns

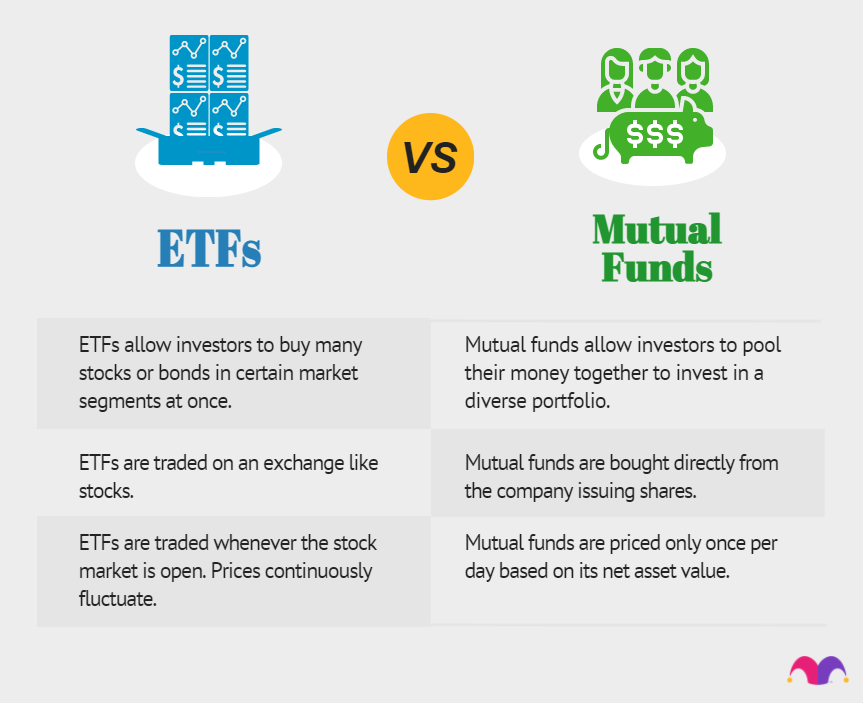

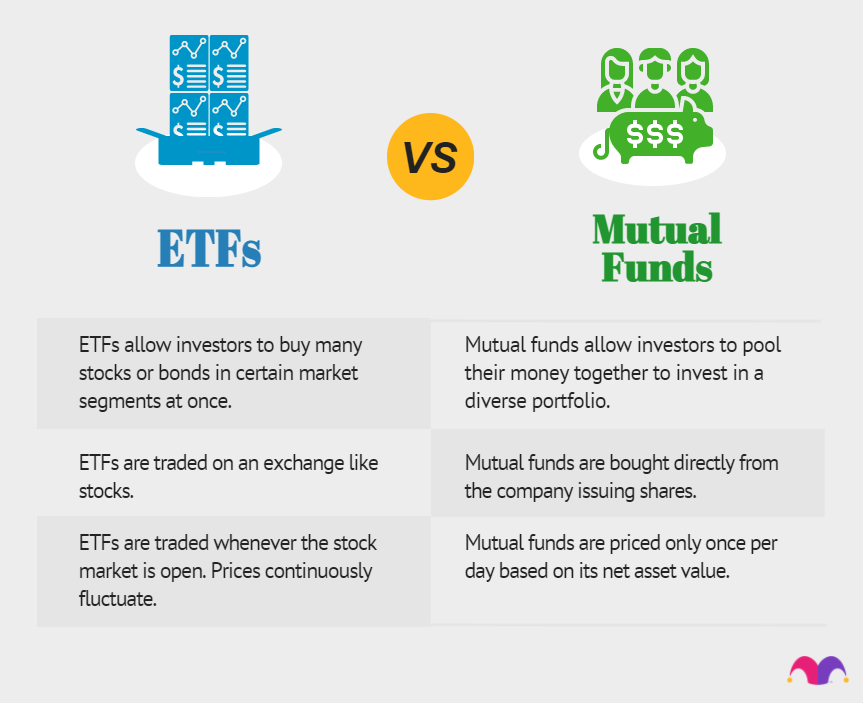

Compared to other investment options available to Taiwanese investors, US Bond ETFs can offer attractive yields and relatively stable returns. While returns aren't guaranteed, the potential for stable income streams and capital appreciation makes them an appealing choice for investors seeking lower risk. Understanding bond yields is key; these represent the return an investor receives from holding a bond until maturity. ETFs aggregate numerous bonds, offering diversified exposure and potentially smoother returns than individual bond purchases.

- Competitive Interest Rates: US Treasury bonds often offer competitive interest rates.

- Potential for Capital Appreciation: Bond prices can rise, leading to capital gains if interest rates fall.

- Predictable Income Stream: Many bond ETFs distribute regular dividend payments from the underlying bonds.

Accessibility and Ease of Investment

Accessing US Bond ETFs from Taiwan is relatively straightforward. Many Taiwanese brokerage firms provide access to US exchanges, allowing investors to buy and sell these ETFs through online trading platforms. The transparency and regulatory oversight of the US securities market provide a level of comfort and protection for investors.

- Low Transaction Costs: Online brokerage platforms offer competitive transaction fees.

- Online Trading Convenience: Buying and selling US Bond ETFs is easy and convenient.

- Regulated Market: The US securities market is highly regulated, offering investor protection.

Understanding the Risks of US Bond ETF Investments for Taiwanese Investors

While US Bond ETFs offer several advantages, it's crucial to understand the potential risks:

Currency Fluctuations

Fluctuations in the USD/TWD exchange rate can significantly impact returns. If the TWD appreciates against the USD, your returns in TWD will be lower. Conversely, a weakening TWD can boost your returns when converting USD back to TWD.

- Potential for Losses Due to Currency Depreciation: A weakening TWD can offset gains made from the ETF's performance.

- Hedging Strategies to Consider: Currency hedging strategies can mitigate this risk, but come with their own costs and complexities.

Interest Rate Risk

Changes in US interest rates directly affect bond prices. When interest rates rise, bond prices generally fall, and vice-versa. This inverse relationship is crucial to understand.

- Inverse Relationship Between Interest Rates and Bond Prices: Rising interest rates can lead to capital losses.

Inflation Risk

Inflation erodes the purchasing power of your returns. If inflation rises faster than the yield on your US Bond ETF, your real return (after adjusting for inflation) will be lower.

- Inflation Erodes Purchasing Power: It's essential to consider inflation-adjusted returns.

Choosing the Right US Bond ETF for Your Portfolio

Selecting the appropriate US Bond ETF requires careful consideration of your individual circumstances:

Investment Goals and Risk Tolerance

Your investment goals (e.g., retirement, wealth preservation) and risk tolerance should guide your ETF selection. Conservative investors might prefer ETFs focused on government bonds, while those with a higher risk tolerance may consider corporate bond ETFs.

- Consider Short-Term vs. Long-Term Goals: Choose ETFs with maturities aligning with your time horizon.

- Choose ETFs Matching Risk Profile: Select ETFs that align with your risk tolerance, from low to high risk.

Factors to Consider When Selecting a US Bond ETF

Several factors are crucial when comparing different ETFs:

- Expense Ratio: Lower expense ratios mean lower costs.

- Maturity Dates: Consider the average maturity of the bonds within the ETF.

- Credit Quality: Analyze the credit ratings of the underlying bonds. Higher ratings indicate lower default risk.

- Diversification within the ETF: Look for ETFs with broad diversification across sectors and maturities.

Conclusion: Navigating the World of US Bond ETF Investments as a Taiwanese Investor

US Bond ETF investments offer Taiwanese investors a valuable tool for diversification and risk mitigation. However, understanding the potential risks associated with currency fluctuations, interest rate changes, and inflation is crucial. Thorough research, comparing different ETFs, and considering your personal investment goals and risk tolerance are essential. Before investing, consult with a qualified financial advisor to discuss whether US Bond ETF investments align with your individual financial situation. Start exploring the potential benefits of US Bond ETF investments today by researching different ETFs available and seeking professional financial advice. You may find valuable resources and further reading on reputable financial websites and publications.

Featured Posts

-

El Regreso De Neymar Brasil Vs Argentina En El Monumental

May 08, 2025

El Regreso De Neymar Brasil Vs Argentina En El Monumental

May 08, 2025 -

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025 -

Ftc Challenges Court Ruling On Microsoft Activision Merger

May 08, 2025

Ftc Challenges Court Ruling On Microsoft Activision Merger

May 08, 2025 -

Ubers Autonomous Driving Gamble Will It Pay Off For Investors

May 08, 2025

Ubers Autonomous Driving Gamble Will It Pay Off For Investors

May 08, 2025 -

Ethereum Price Remains Firm Analyzing The Potential For Growth

May 08, 2025

Ethereum Price Remains Firm Analyzing The Potential For Growth

May 08, 2025