Regulatory Reform In Focus: Indian Insurers And Bond Forwards

Table of Contents

The Role of Bond Forwards in Indian Insurers' Investment Portfolios

Bond forwards provide Indian insurers with a powerful tool to manage interest rate risk and enhance investment returns. By entering into forward contracts, insurers can lock in future interest rates, protecting their portfolios from adverse movements. This is particularly crucial in managing liabilities, as many insurance products involve long-term obligations. Effectively managing asset-liability mismatches is key to the financial health of any insurer.

- Increased flexibility in managing asset-liability mismatches: Bond forwards allow insurers to fine-tune their investment portfolios to better match their liabilities, reducing exposure to interest rate fluctuations.

- Opportunities for yield enhancement and capital optimization: Strategic use of bond forwards can lead to improved yield and more efficient capital allocation.

- Efficient management of duration risk: Insurers can use bond forwards to adjust the duration of their portfolios, mitigating the impact of interest rate changes on their net asset value.

- Diversification of investment portfolios: Incorporating bond forwards offers a new avenue for diversification, reducing overall portfolio risk. This contributes to a more robust Indian Insurance Investment strategy. The use of Bond Forwards Investment strategies is becoming increasingly sophisticated in India.

Impact of Recent Regulatory Changes on Bond Forward Usage

Recent regulatory changes by the IRDAI (Insurance Regulatory and Development Authority of India) have significantly impacted the use of bond forwards by Indian insurers. These changes aim to enhance transparency, strengthen risk management practices, and maintain the stability of the financial system. However, these changes also present challenges.

- Increased capital requirements for certain derivative exposures: New regulations may necessitate higher capital reserves for insurers holding significant positions in bond forwards, impacting their capital allocation strategies.

- Changes in reporting and disclosure requirements: More stringent reporting standards demand greater transparency and detail in the disclosure of bond forward transactions.

- Impact of stricter guidelines on valuation methodologies: The adoption of new valuation methodologies can affect the reported value of bond forward positions, impacting financial statements and regulatory reporting.

- The role of IRDAI (Insurance Regulatory and Development Authority of India) in shaping the regulatory landscape: The IRDAI plays a pivotal role in defining Bond Forward Regulations India, constantly reviewing and updating these regulations to maintain stability and promote responsible use of derivatives within the Indian insurance sector. Navigating IRDAI Regulations is crucial for compliance.

Strategies for Indian Insurers to Effectively Utilize Bond Forwards

Successfully incorporating bond forwards into investment strategies requires careful planning and execution. Insurers must develop robust frameworks that address risk appetite, internal controls, and compliance.

- Developing robust risk management frameworks: A well-defined risk management framework is essential to identify, measure, and mitigate risks associated with bond forward positions.

- Implementing effective internal controls and oversight: Strong internal controls are crucial to ensure compliance with regulations and prevent unauthorized trading activity. Investing in robust Insurance Technology can greatly aid in this aspect.

- Selecting appropriate hedging strategies based on risk tolerance and investment objectives: The choice of hedging strategy should align with the specific risk profile and investment goals of the insurer.

- Importance of skilled personnel and technology: Insurers need adequately trained personnel and advanced technology to effectively manage bond forward transactions and related risks. Effective Bond Forward Trading requires expertise in both financial markets and regulatory compliance.

Future Outlook for Bond Forwards in the Indian Insurance Sector

The future of bond forwards in the Indian insurance sector is promising. Continued regulatory harmonization with international standards, technological advancements, and the evolving market conditions will shape their usage.

- Potential for increased sophistication in derivative usage: We can anticipate more complex derivative strategies employed by insurers to manage risks and enhance returns.

- Impact of technological advancements on trading and risk management: The adoption of advanced technologies like AI and machine learning will improve trading efficiency and risk management capabilities. Fintech in Insurance is expected to play a significant role here.

- Further regulatory harmonization with international standards: Alignment with global best practices in derivative regulation will enhance transparency and investor confidence. This development will continue to shape the Derivative Market in India.

Conclusion: Embracing the Potential of Regulatory Reform in Indian Insurers and Bond Forwards

Regulatory reform is reshaping the Indian insurance landscape, creating both opportunities and challenges for insurers. Bond forwards, when used strategically and responsibly, offer significant potential for risk mitigation and investment returns. Understanding and adapting to regulatory changes, implementing robust risk management frameworks, and investing in the right expertise and technology are crucial for success. Stay informed on Regulatory Updates and continue to research the evolving landscape of Indian Insurance Industry and Bond Forward Usage to leverage the full potential of this dynamic market. Don't hesitate to explore the opportunities presented by Bond Forward Usage and its impact on Risk Mitigation and Investment Opportunities in the Indian insurance sector.

Featured Posts

-

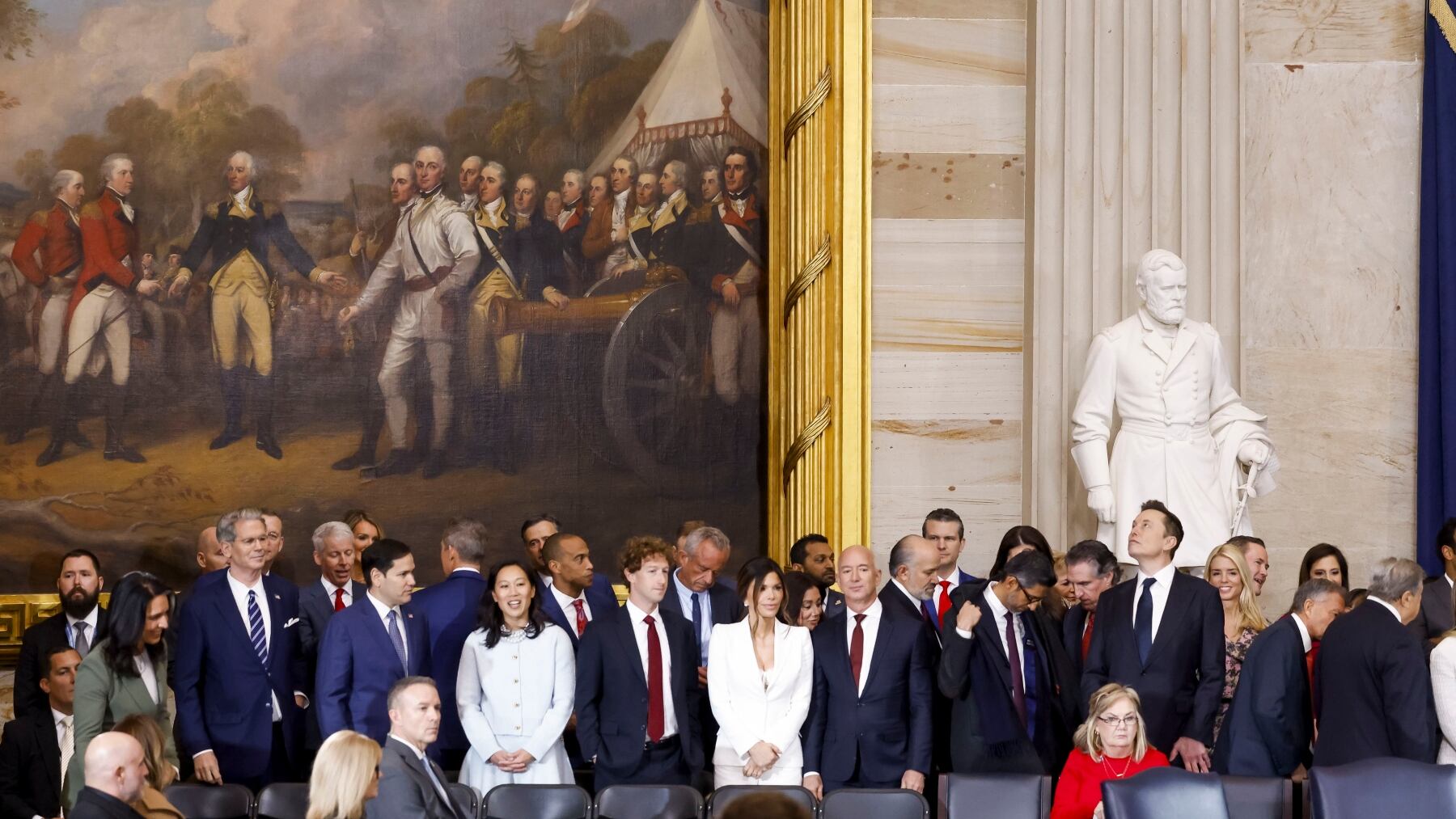

Analyzing The Net Worth Losses Of Elon Musk Jeff Bezos And Mark Zuckerberg After Trumps Inauguration

May 10, 2025

Analyzing The Net Worth Losses Of Elon Musk Jeff Bezos And Mark Zuckerberg After Trumps Inauguration

May 10, 2025 -

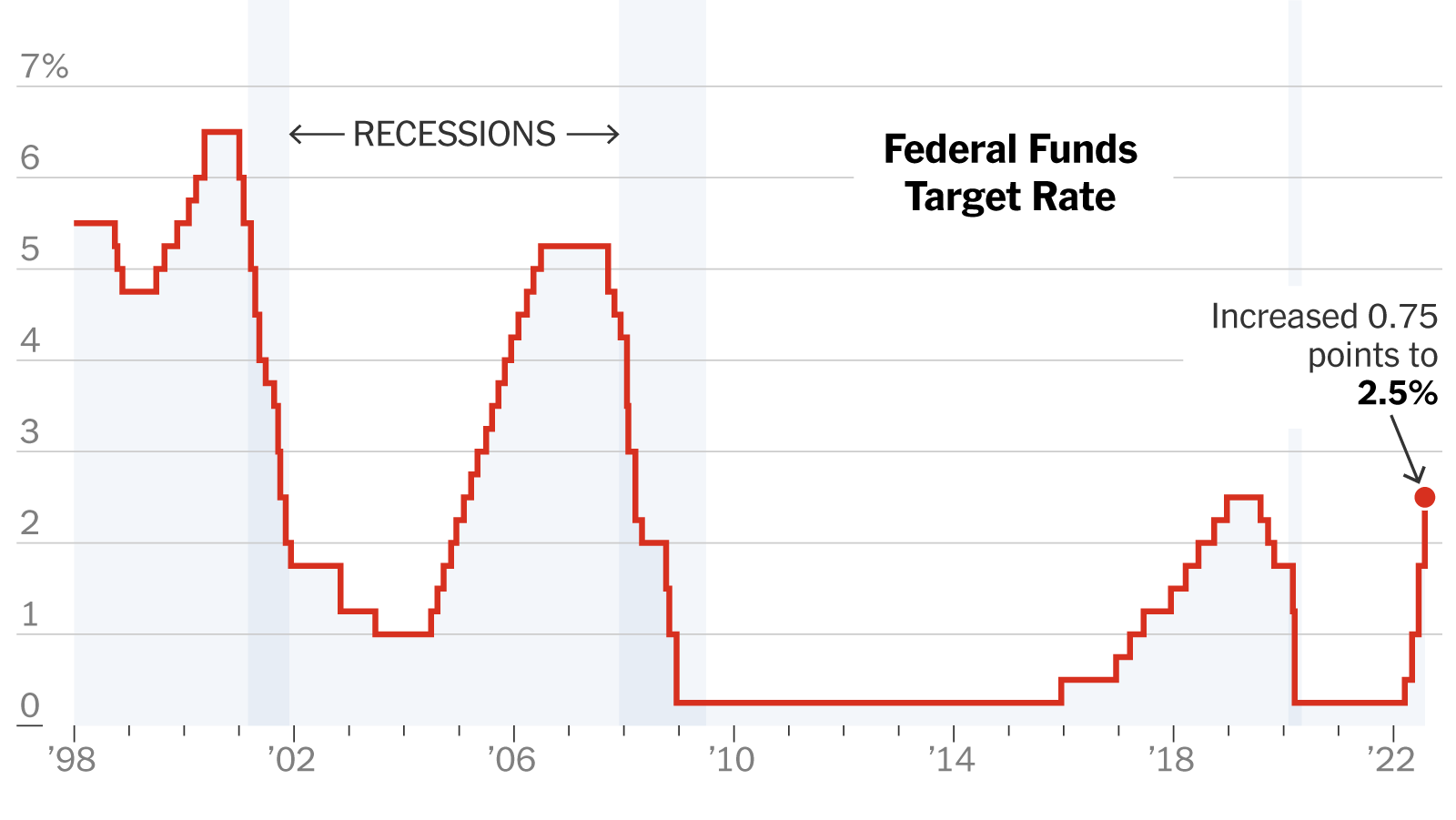

U S Federal Reserve Rate Decision And The Mounting Economic Challenges

May 10, 2025

U S Federal Reserve Rate Decision And The Mounting Economic Challenges

May 10, 2025 -

Apples Ai Current Status And Future Predictions

May 10, 2025

Apples Ai Current Status And Future Predictions

May 10, 2025 -

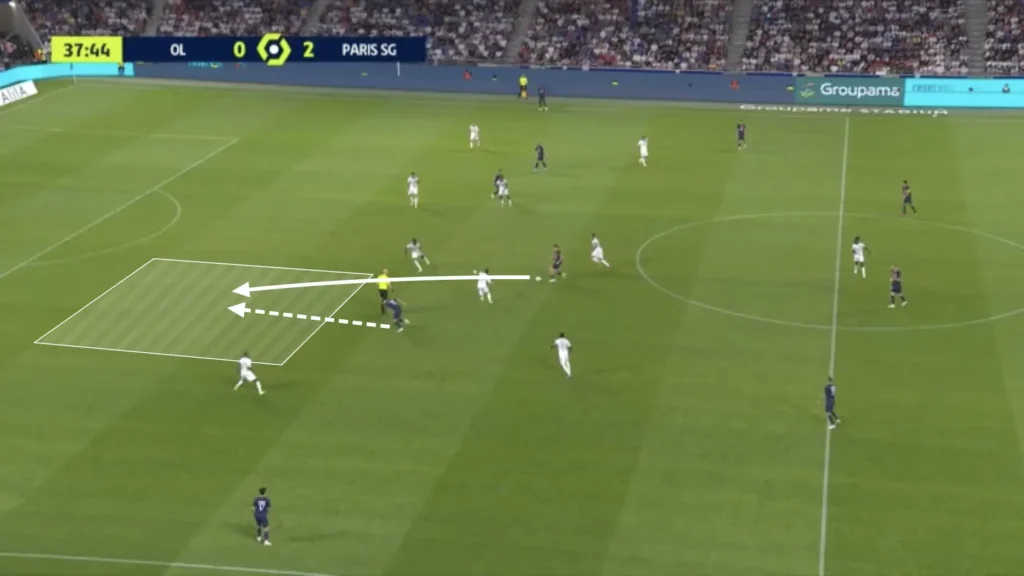

Psgs Winning Formula Luis Enriques Tactical Masterclass

May 10, 2025

Psgs Winning Formula Luis Enriques Tactical Masterclass

May 10, 2025 -

Young Thugs Uy Scuti Release Date Hints And Fan Speculation

May 10, 2025

Young Thugs Uy Scuti Release Date Hints And Fan Speculation

May 10, 2025