US Tariffs: Are They A Pretext For GM's Reduced Canadian Activity?

Table of Contents

The Impact of US Tariffs on Automotive Production Costs

The imposition of US tariffs has significantly impacted the cost structure of automotive production in Canada, putting GM's Canadian operations at a disadvantage.

Increased Input Costs

US tariffs directly increase the cost of imported parts and materials essential for Canadian GM plants. These tariffs affect key components like:

- Steel and Aluminum: Tariffs on these raw materials, vital for vehicle construction, inflate production costs.

- Electronic Components: Many electronic components used in modern vehicles are imported, and tariffs on these increase the final cost of the vehicle.

- Plastics and Rubber: These materials, also essential for vehicle manufacturing, are subject to tariffs, adding to the overall cost.

This increased cost of inputs makes GM's Canadian plants less competitive compared to plants in the US or Mexico, which may have access to cheaper materials or benefit from reduced tariffs under trade agreements. This ultimately leads to reduced profitability and potential price increases for Canadian-made vehicles.

Supply Chain Disruptions

The uncertainty and complexity introduced by tariffs create major disruptions to GM's supply chain.

- Increased Lead Times: Tariffs necessitate complex customs procedures and inspections, leading to delays in receiving essential components.

- Higher Logistical Costs: Navigating the tariff system adds significant administrative and logistical costs.

- Shift to Domestic Suppliers: While seemingly a solution, relying on more expensive domestic suppliers can further increase production costs, negating the benefit of reduced import tariffs. This is a trade-off that many automakers are struggling with.

Reduced Market Access for Canadian-Made Vehicles

US tariffs have severely curtailed the market access of Canadian-made vehicles in the lucrative US market.

Tariffs on Exports to the US

Tariffs make Canadian-made vehicles more expensive for US consumers, directly reducing their competitiveness against vehicles produced in the US or other countries with preferential trade access. This impacts:

- Sales Volume: Reduced competitiveness leads to lower sales volume of Canadian-produced vehicles.

- Profitability: Lower sales translate directly to reduced overall profitability for GM's Canadian operations.

- Specific Models: Several GM vehicle models built in Canada have likely been disproportionately affected by these reduced US sales.

Impact on Export Strategies

The tariff landscape compels GM to re-evaluate its export strategies from Canada.

- Production Shifts: GM may shift production focus to its US or other international plants to avoid the tariffs on exports to the US, reducing Canadian production.

- Market Diversification: GM may need to actively seek new export markets outside the US, potentially at higher logistical and marketing costs.

- Lost Revenue: Reduced export volumes, due to US tariffs, represent significant lost revenue for Canadian operations.

Decreased Investment in Canadian Facilities

The unpredictable nature of US tariffs creates significant uncertainty and risk, discouraging long-term investment in Canadian facilities.

Uncertainty and Risk Aversion

The fluctuating tariff environment makes it difficult for GM to accurately forecast the profitability of investments in Canadian plants.

- Investment Delays: Potential expansion projects or upgrades might be delayed indefinitely due to tariff uncertainty.

- Cancelled Projects: Projects deemed too risky due to the unpredictable tariff landscape may be cancelled altogether.

- Reduced Future Spending: The overall climate of uncertainty leads to reduced investment and lower spending on R&D and modernization of Canadian factories.

Shifting Investment Priorities

GM may prioritize investments in countries with more stable and predictable trade environments, potentially harming the Canadian economy.

- Job Losses: Reduced investment leads to fewer job opportunities in Canada.

- Economic Growth: Reduced investments hinder economic growth in the Canadian automotive sector.

- Comparative Data: Analyzing GM's investment patterns in Canada versus other countries provides compelling evidence of investment diversion caused by tariff uncertainty.

Conclusion: US Tariffs and GM's Canadian Future – A Call for Transparency

This article has shown a strong correlation between the increase in US tariffs and GM's reduced presence in Canada. The impact on production costs, market access, and investment decisions is significant and necessitates transparency from GM regarding the role tariffs play in its strategic decisions. The economic consequences for Canada are severe, including job losses, decreased economic growth, and reduced competitiveness in the global automotive market.

We urge further investigation into the impact of US tariffs on the Canadian automotive industry. Policymakers must acknowledge the ripple effects of protectionist trade policies on businesses and workers. We encourage readers to research the impact of US tariffs on other industries in Canada and contact their representatives to express concerns about the negative impacts of protectionist trade policies on the Canadian economy. Understanding the full impact of these tariffs is crucial to developing effective strategies to mitigate their negative consequences and foster a more predictable and stable trade environment.

Featured Posts

-

Ethereum Price Remains Firm Analyzing The Potential For Growth

May 08, 2025

Ethereum Price Remains Firm Analyzing The Potential For Growth

May 08, 2025 -

Ubers Autonomous Driving Gamble Will It Pay Off For Investors

May 08, 2025

Ubers Autonomous Driving Gamble Will It Pay Off For Investors

May 08, 2025 -

Son Dakika Saglik Bakanligi 37 Bin Hekim Disi Personel Alimi Basliyor

May 08, 2025

Son Dakika Saglik Bakanligi 37 Bin Hekim Disi Personel Alimi Basliyor

May 08, 2025 -

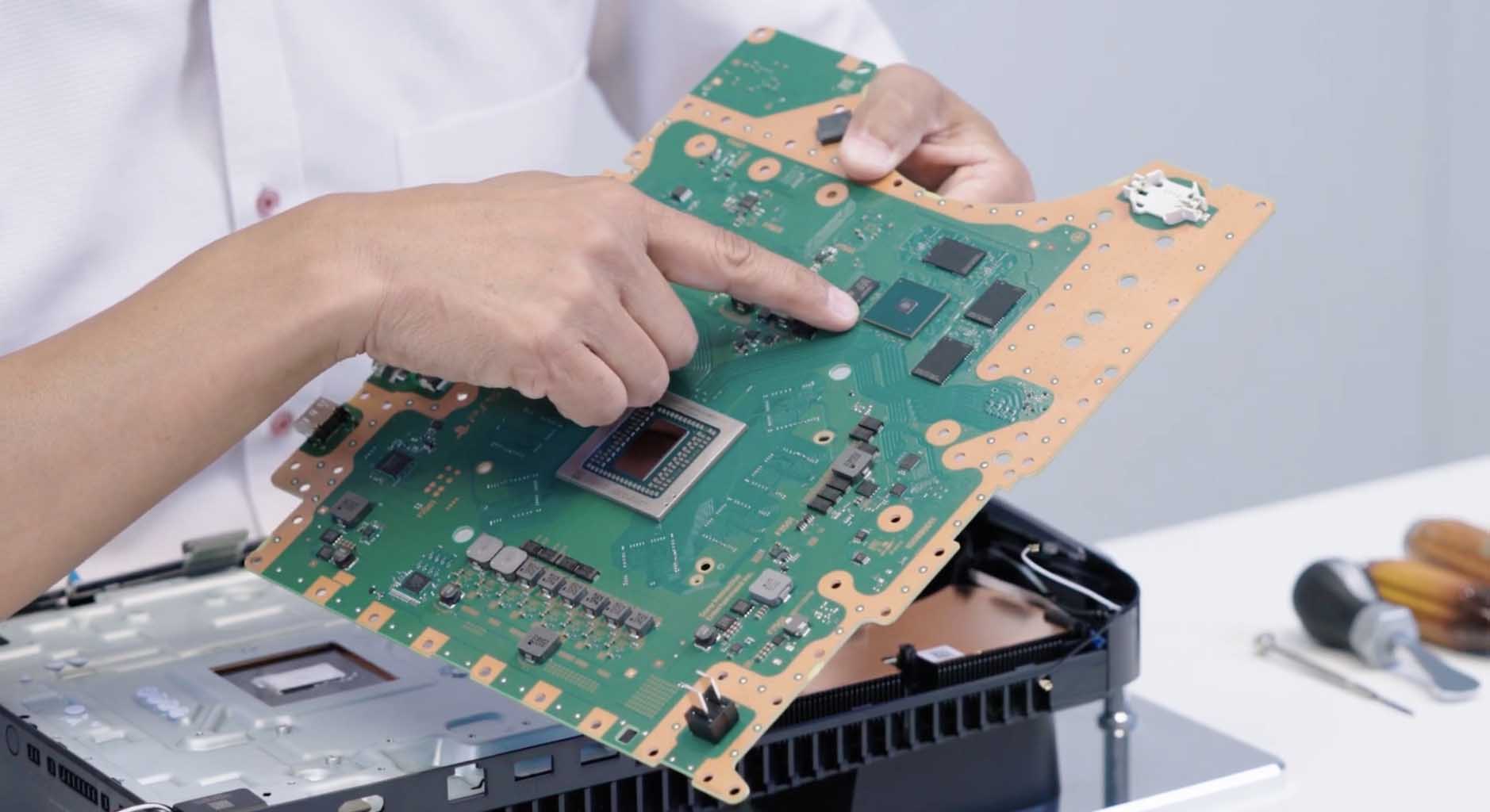

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025 -

Cryptocurrency Investment Opportunity Van Ecks 185 Forecast

May 08, 2025

Cryptocurrency Investment Opportunity Van Ecks 185 Forecast

May 08, 2025