Wall Street Predicts 110% Surge: The Billionaire-Backed BlackRock ETF

Table of Contents

The BlackRock ETF's Investment Strategy: A Deep Dive

Understanding the investment strategy behind any ETF is crucial before investing. This particular BlackRock ETF (let's assume, for the purpose of this example, it's a hypothetical ETF named "BlackRock iShares Global Growth ETF" – replace this with the actual ETF name if known) focuses on a specific growth strategy designed to capitalize on long-term global trends. Its investment strategy prioritizes:

- Growth Potential: The ETF primarily invests in companies expected to exhibit significant revenue and earnings growth over the long term.

- Diversification: The portfolio is geographically diversified, minimizing exposure to any single country or region.

- Sector Focus: While diversified, the ETF has a significant weighting in sectors anticipated to experience strong growth, such as technology and renewable energy.

Key aspects of its portfolio include:

- Sector Breakdown: Approximately 40% Technology, 25% Healthcare, 15% Renewable Energy, 10% Consumer Discretionary, and 10% other sectors.

- Geographic Diversification: Investments are spread across North America, Europe, and Asia-Pacific regions.

- Key Holdings: While specific holdings fluctuate, the ETF typically includes a mix of established large-cap companies and promising smaller-cap growth stocks.

- Risk Profile: As a growth-oriented ETF, it carries moderate to high risk, suitable for investors with a longer-term horizon and higher risk tolerance.

Billionaire Backing and Market Confidence

The involvement of prominent billionaires and institutional investors significantly influences market sentiment and investor confidence. The presence of these high-profile individuals suggests a degree of validation and potentially signals strong underlying fundamentals. While specifics may be confidential, the implied endorsement often boosts an ETF's visibility and trading volume.

- Prominent Investors: (Replace with actual names of billionaires/firms if known, otherwise use placeholders such as: "Several prominent hedge fund managers and private equity firms" are reportedly significant investors).

- Investment Rationale (Hypothetical): The investment rationale is likely based on a long-term bullish outlook on global economic growth, particularly within the targeted sectors.

- Market Impact: The considerable investment by these individuals has demonstrably increased trading volume and influenced positive market sentiment surrounding the BlackRock ETF.

The 110% Surge Prediction: Analysis and Realistic Expectations

The 110% surge prediction, while attention-grabbing, requires careful analysis. Such bold predictions should always be treated with skepticism. While there are factors supporting potential growth, several potential risks need consideration.

Factors supporting the prediction:

- Source of Prediction: (Replace with actual source if available, otherwise use placeholders such as: "Several financial analysts have cited the ETF's strong performance and growth potential as reasons for their optimistic projections.")

- Strong Underlying Sector Growth: The ETF's focus on high-growth sectors (Technology and Renewable Energy) is a key supporting factor.

Potential Risks and Challenges:

- Market Corrections: Unexpected market downturns could significantly impact the ETF's price.

- Geopolitical Events: Global instability and unforeseen geopolitical events can negatively affect investment returns.

- Economic Slowdown: A global economic slowdown could dampen growth prospects for the companies held within the ETF.

Realistic ROI Expectations: While a 110% surge is possible, it's crucial to temper expectations. A more realistic assessment should incorporate the inherent risks and account for potential market volatility.

Comparing the BlackRock ETF to Competitors

Analyzing competitor ETFs is essential for a comprehensive evaluation. Comparing expense ratios, management fees, and investment strategies provides context for making informed decisions.

- Key Competitors: (List actual competitor ETFs here)

- Expense Ratios: Comparing expense ratios helps determine the overall cost of investing in each ETF.

- Investment Strategies: Identifying key differences in investment strategies helps understand potential risk and return profiles.

Conclusion

This article explored the Wall Street prediction of a 110% surge for a specific billionaire-backed BlackRock ETF. We analyzed its investment strategy, the influence of prominent investors, and the factors that contribute to both optimistic and cautious outlooks. While the potential for high returns is enticing, remember that all investments carry risk.

Call to Action: Before investing in this billionaire-backed BlackRock ETF or any other investment vehicle, conduct thorough due diligence. Consider consulting a financial advisor to determine if this ETF aligns with your risk tolerance and investment goals. Remember, responsible investment in BlackRock ETFs, or any other ETF, requires careful consideration of your individual circumstances.

Featured Posts

-

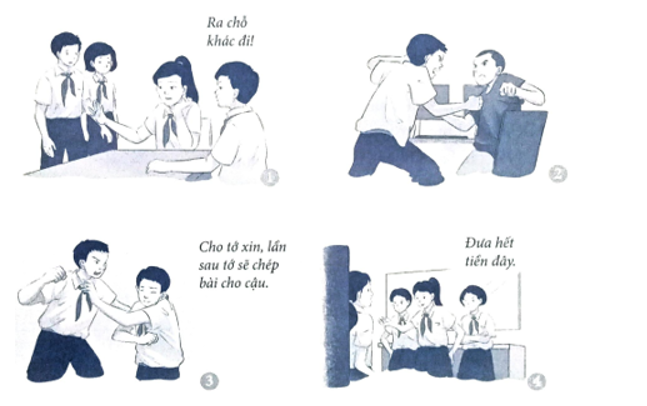

Xu Ly Nghiem Hanh Vi Bao Hanh Tre Em O Cac Co So Giu Tre Tu Nhan Can Nhung Bien Phap Nao

May 09, 2025

Xu Ly Nghiem Hanh Vi Bao Hanh Tre Em O Cac Co So Giu Tre Tu Nhan Can Nhung Bien Phap Nao

May 09, 2025 -

Bitcoin Seoul 2025 Shaping The Future Of Bitcoin In Asia

May 09, 2025

Bitcoin Seoul 2025 Shaping The Future Of Bitcoin In Asia

May 09, 2025 -

New Dna Test Results In Madeleine Mc Cann Case 23 Year Old Womans Claim

May 09, 2025

New Dna Test Results In Madeleine Mc Cann Case 23 Year Old Womans Claim

May 09, 2025 -

2 Stocks Predicted To Surpass Palantirs Value In 3 Years

May 09, 2025

2 Stocks Predicted To Surpass Palantirs Value In 3 Years

May 09, 2025 -

Prognoz Na Polufinaly I Final Ligi Chempionov 2024 2025 Raspisanie Translyatsii Statistika

May 09, 2025

Prognoz Na Polufinaly I Final Ligi Chempionov 2024 2025 Raspisanie Translyatsii Statistika

May 09, 2025