West Ham's Financial Challenges: Addressing A £25m Deficit

Table of Contents

The Sources of West Ham's £25m Deficit

The £25 million deficit facing West Ham is a multifaceted problem stemming from a confluence of factors. Let's break down the key contributors:

High Player Wages and Transfer Fees

West Ham, like many Premier League clubs, has invested heavily in player acquisitions in recent years. This has led to a significant burden on the wage bill.

- High-earning players: Several players command substantial salaries, placing a strain on the club's resources. The exact figures are often confidential, but reports suggest several key players are amongst the highest earners at the club.

- Expensive transfers: Recent transfer fees for incoming players have added substantially to the club's expenditure. While some transfers have proven successful, others haven't yielded the expected return on investment.

- Premier League finances: The competitive nature of the Premier League means clubs often engage in bidding wars, driving up player prices and wages, putting smaller clubs at a disadvantage compared to those with larger budgets. West Ham's spending is not unusual in the context of Premier League finances, but it needs careful management.

Reduced Matchday Revenue

Matchday revenue is a crucial income stream for football clubs, and West Ham has experienced a downturn in this area.

- Decreased attendance: A number of factors contribute to lower stadium attendance, including the impact of the COVID-19 pandemic, inconsistent on-field performance, and potentially ticket pricing strategies.

- Comparison to previous seasons: Comparing attendance figures from recent seasons to previous years reveals a significant drop, directly impacting the club's income.

- Potential revenue streams: Exploring alternative revenue streams, such as improved hospitality packages or more engaging fan experiences, could help mitigate the impact of reduced attendance.

Lack of Significant Commercial Revenue

While matchday and player sales contribute significantly, commercial revenue is another key element for financial stability. West Ham needs to strengthen this area.

- Sponsorship deals: Securing lucrative sponsorship deals with major brands is vital. A review of current sponsorship agreements and an exploration of new partnerships could be beneficial.

- Merchandise sales: Boosting merchandise sales requires effective marketing and appealing product offerings. This involves understanding the fan base and providing merchandise they desire.

- Broadcast revenue: While largely fixed by league position, West Ham can optimize its share by performing well consistently and improving its global brand visibility.

Strategies for Addressing the Financial Deficit

To overcome the £25 million deficit and achieve long-term financial stability, West Ham needs a multi-pronged approach:

Cost-Cutting Measures

Controlling expenditure is crucial. Several options could be explored:

- Wage reductions: Negotiating wage reductions with higher-earning players, or allowing higher-earners to leave on mutually agreeable terms, could significantly reduce the wage bill.

- Player sales: Selling players who are not essential to the first team, or who have a high market value, can generate much-needed funds. Careful consideration needs to be given to squad balance when selling players, though.

- Renegotiating contracts: Re-negotiating existing contracts with players, staff, or sponsors, can help reduce long-term financial commitments.

- Reducing operational costs: Implementing efficiency measures across all club departments can lead to cost savings.

Revenue Generation Strategies

Simultaneously, West Ham must increase its income streams:

- Improved marketing and branding: A strong marketing campaign and improved brand image can attract sponsors and fans alike.

- Securing lucrative sponsorship deals: Actively pursuing new and high-value sponsorship deals is paramount for financial growth.

- Increasing matchday revenue: Improving fan engagement, introducing attractive ticket pricing strategies and enhancing the matchday experience are essential for attracting larger crowds.

- Developing the youth academy: Investing in the youth academy provides a cost-effective pipeline for future talent, reducing reliance on expensive transfers.

Financial Restructuring

If necessary, West Ham may consider restructuring its finances:

- Potential investors: Attracting external investment could provide the capital needed to overcome the deficit and support future growth.

- Loan options: Securing loans could provide short-term financial relief, but careful consideration should be given to the terms and long-term implications of such an approach.

- Implications for club ownership: Any restructuring could have implications for the club's ownership and governance structure.

Conclusion: Overcoming West Ham's Financial Challenges

West Ham's £25 million deficit is a serious issue stemming from high wages, reduced matchday revenue, and a need for stronger commercial income. Addressing this requires a combination of cost-cutting measures, aggressive revenue generation strategies, and possibly financial restructuring. The urgency of the situation cannot be overstated; decisive action is required to ensure the club's long-term financial stability and competitive future. What strategies do you think West Ham should prioritize to address its £25m deficit? Share your thoughts on the West Ham United fan forums or other relevant news sources [link to West Ham news source/fan forum].

Featured Posts

-

Aeroport Permi Otmena I Zaderzhka Reysov V Svyazi So Snegopadom

May 09, 2025

Aeroport Permi Otmena I Zaderzhka Reysov V Svyazi So Snegopadom

May 09, 2025 -

Examining The Correlation Between Us Economic Power And Elon Musks Fortune

May 09, 2025

Examining The Correlation Between Us Economic Power And Elon Musks Fortune

May 09, 2025 -

Bert Kreischer And His Wife Navigating The Netflix Comedy Specials And Their Sex Jokes

May 09, 2025

Bert Kreischer And His Wife Navigating The Netflix Comedy Specials And Their Sex Jokes

May 09, 2025 -

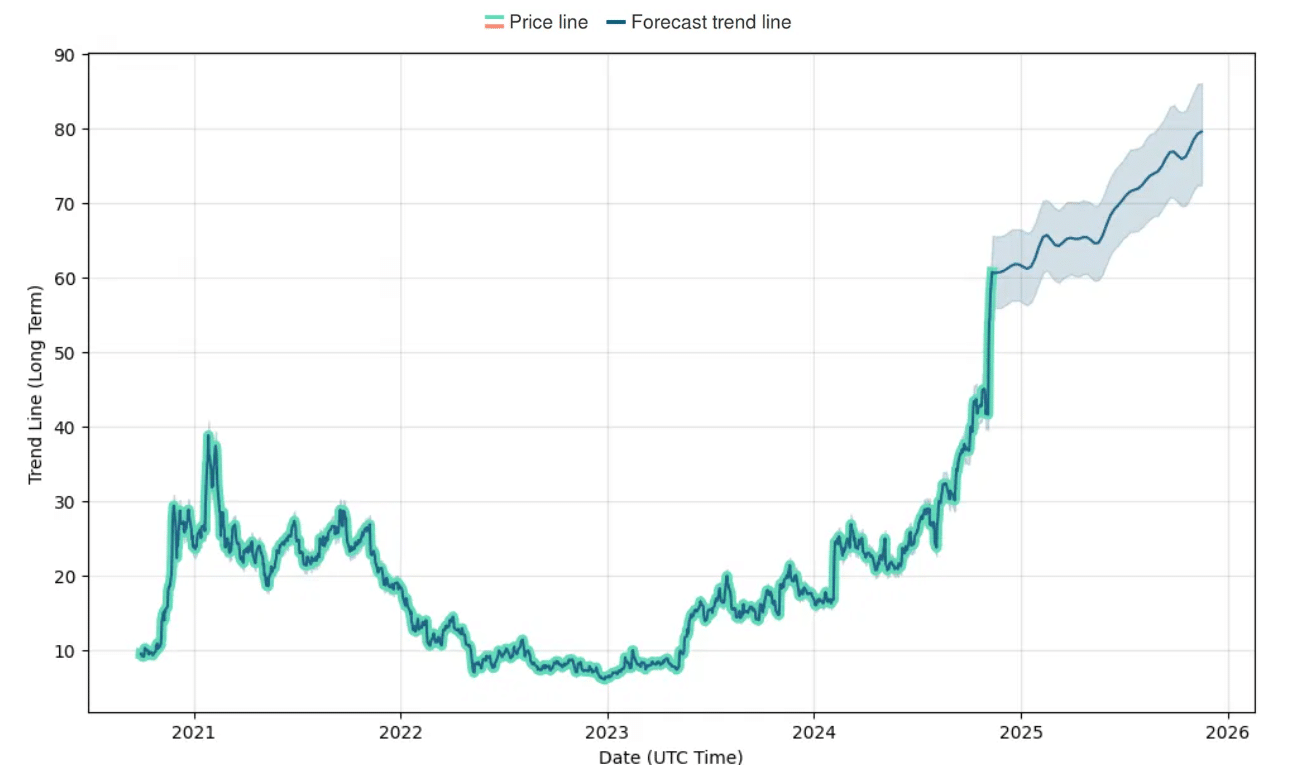

Late To The Palantir Party Evaluating The Stock Before Its Predicted 2025 Growth

May 09, 2025

Late To The Palantir Party Evaluating The Stock Before Its Predicted 2025 Growth

May 09, 2025 -

Colapinto Replacing Doohan At Imola Just Rumours

May 09, 2025

Colapinto Replacing Doohan At Imola Just Rumours

May 09, 2025