Why Is D-Wave Quantum (QBTS) Stock Price Falling In 2025?

Table of Contents

Increased Competition in the Quantum Computing Market

The quantum computing landscape is far from a monolith. The rapid advancement and commercialization of quantum technologies have led to a fiercely competitive environment, significantly impacting D-Wave's market position and investor sentiment regarding QBTS stock.

Emergence of New Players and Technologies

The quantum computing arena is becoming increasingly crowded. Established tech giants and innovative startups alike are pouring resources into research and development, creating a dynamic and rapidly evolving market. This intense competition poses a direct challenge to D-Wave's market share and its ability to maintain a competitive edge.

- Increased R&D investment from companies like Google, IBM, and Microsoft: These tech behemoths are investing billions in quantum computing research, developing their own proprietary technologies and potentially eclipsing D-Wave's advancements.

- Development of alternative quantum computing approaches (e.g., gate-based models) that potentially offer advantages over D-Wave's adiabatic quantum computation: D-Wave's adiabatic quantum computation approach, while pioneering, faces competition from other models which may offer superior scalability and versatility for certain applications. This technological competition directly impacts investor confidence in QBTS.

- The entrance of new players with disruptive technologies: The quantum computing field is attracting a constant influx of new players with potentially disruptive technologies. These emerging companies could quickly challenge the established players, further intensifying the competitive pressure on D-Wave.

Slow Pace of Commercial Adoption

Despite remarkable progress in quantum computing research, widespread commercial adoption lags behind expectations. This slow uptake significantly influences the overall market valuation of quantum computing companies, directly affecting the QBTS stock price.

- High costs associated with quantum computing hardware and software: The high initial investment required for quantum computing systems limits their accessibility to a select group of organizations, hindering widespread adoption.

- Limited availability of skilled quantum computing professionals: The specialized expertise needed to develop and implement quantum computing solutions is scarce, creating a bottleneck in the commercialization process.

- Challenges in developing practical quantum algorithms for real-world applications: Translating theoretical quantum advantages into practical, real-world applications remains a significant hurdle, slowing down the pace of commercial adoption.

Market-Wide Economic Factors and Investor Sentiment

Beyond the specific challenges within the quantum computing sector, broader economic factors and overall investor sentiment also play a crucial role in influencing the QBTS stock price.

Broader Tech Stock Market Corrections

The performance of individual tech stocks is intrinsically linked to the overall health of the technology sector. Market-wide corrections, driven by various macroeconomic factors, inevitably affect even promising companies like D-Wave.

- Influence of macroeconomic factors (e.g., inflation, interest rates): Economic uncertainty, driven by factors such as inflation and interest rate hikes, can trigger sell-offs in the technology sector, impacting the QBTS stock price.

- Investor risk aversion in uncertain economic times: During periods of economic uncertainty, investors tend to shift their portfolios towards safer, more conservative investments, leading to decreased demand for growth stocks like QBTS.

- Rotation out of growth stocks into more defensive investments: Investors often move away from high-growth, high-risk stocks during economic downturns, impacting the valuation of companies like D-Wave.

Investor Concerns Regarding Profitability and Long-Term Viability

Quantum computing companies are still primarily focused on research and development, with profitability remaining elusive. This lack of immediate financial returns fuels investor uncertainty and negatively impacts stock valuations.

- High capital expenditures and operational costs: Developing and maintaining advanced quantum computing infrastructure necessitates substantial capital expenditure and ongoing operational costs, impacting profitability.

- Uncertain timeline for achieving widespread commercial success: The path to widespread commercial adoption of quantum computing is still uncertain, increasing investor risk aversion.

- Concerns regarding the long-term viability of the quantum computing business model: The long-term viability and market dominance of various quantum computing approaches remain unclear, adding to the uncertainty surrounding QBTS stock.

Specific Challenges Facing D-Wave Quantum (QBTS)

Beyond the broader market trends, D-Wave faces specific technological and communication challenges impacting its stock performance.

Technological Limitations of Adiabatic Quantum Computation

While D-Wave’s adiabatic quantum computation is a significant achievement, it has inherent limitations compared to other quantum computing architectures.

- Potential scalability challenges: Scaling up the size and complexity of adiabatic quantum computers to compete with other approaches presents a significant technological hurdle.

- Difficulties in implementing certain types of quantum algorithms: The adiabatic approach may not be optimally suited for all types of quantum algorithms, limiting its applicability in certain areas.

- Ongoing research and development to enhance performance and overcome limitations: D-Wave is continually working to improve its technology, but overcoming these limitations takes time and resources.

Challenges in Communicating Value Proposition to Investors

Effectively communicating D-Wave's value proposition and technological advancements to a broad investor audience is crucial for maintaining stock price stability.

- Need for clear communication of technological advancements and future plans: D-Wave needs to clearly articulate its technological progress and its future roadmap to build investor confidence.

- Demonstrating tangible applications and real-world impact: Showcase real-world applications and success stories to demonstrate the practical value of D-Wave's technology.

- Building investor trust and confidence in the company's long-term vision: Establishing a strong track record of execution and a compelling long-term vision is vital for attracting and retaining investor confidence.

Conclusion

The decline in D-Wave Quantum (QBTS) stock price in 2025 is multifaceted, resulting from increased competition, macroeconomic pressures, and inherent challenges within D-Wave's technology and communication strategies. While the potential of quantum computing remains immense, investing in this sector requires a thorough understanding of the risks and uncertainties involved. Understanding these challenges is critical for navigating the complexities of D-Wave Quantum (QBTS) stock and the broader quantum computing market. Continue your research and stay informed about the D-Wave Quantum (QBTS) stock price and its future trajectory before making any investment decisions.

Featured Posts

-

Nyt Mini Crossword Solution March 18

May 20, 2025

Nyt Mini Crossword Solution March 18

May 20, 2025 -

Efimeries Giatron Patra 12 13 Aprilioy 2024 Plirofories And Epikoinonia

May 20, 2025

Efimeries Giatron Patra 12 13 Aprilioy 2024 Plirofories And Epikoinonia

May 20, 2025 -

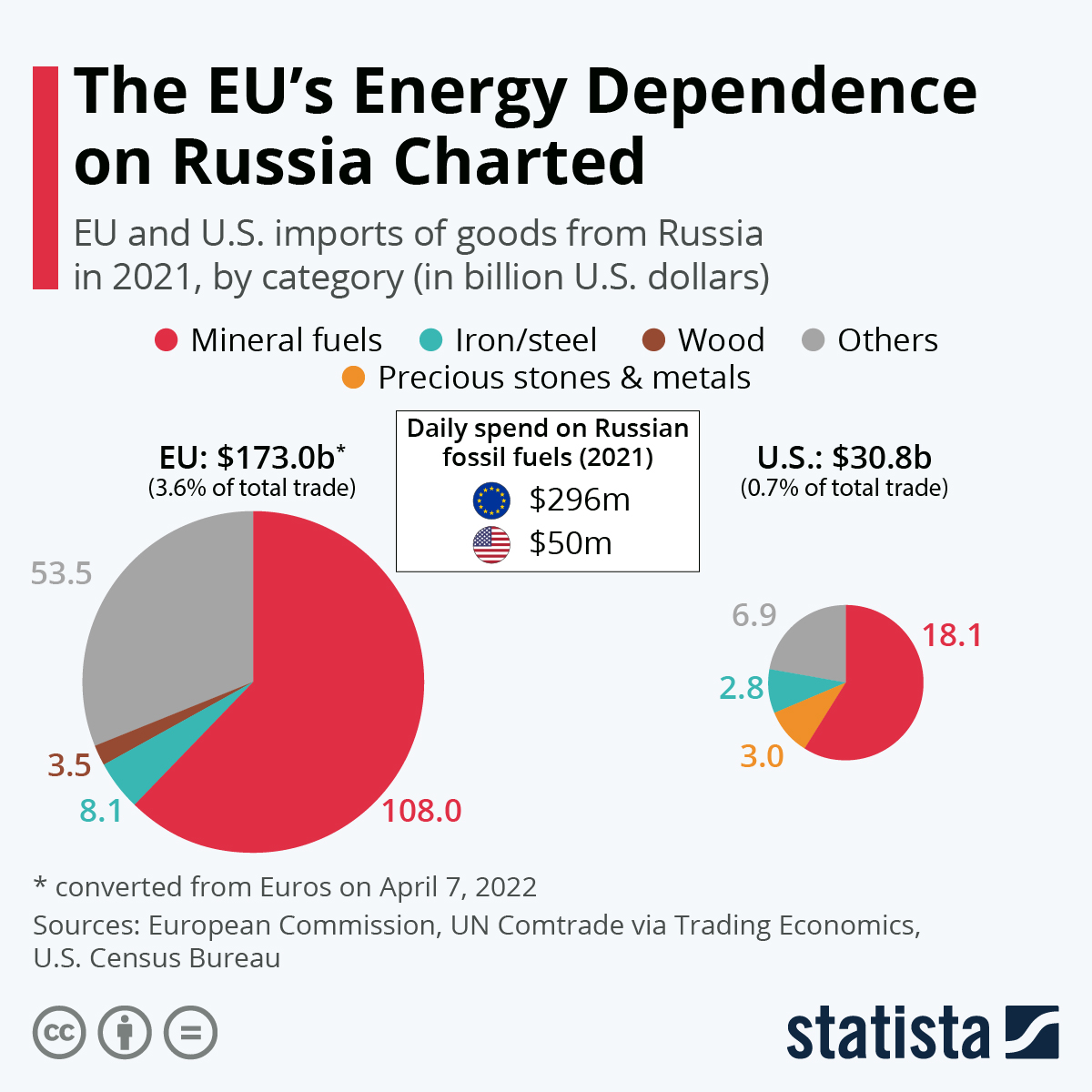

Taiwans Energy Transition Increased Reliance On Lng Imports Following Nuclear Closure

May 20, 2025

Taiwans Energy Transition Increased Reliance On Lng Imports Following Nuclear Closure

May 20, 2025 -

Robert Pattinsons Accent A Key To His Mickey 17 Performance

May 20, 2025

Robert Pattinsons Accent A Key To His Mickey 17 Performance

May 20, 2025 -

62 5m Transfer Battle Man Utd Joins Arsenal And Chelsea In Pursuit

May 20, 2025

62 5m Transfer Battle Man Utd Joins Arsenal And Chelsea In Pursuit

May 20, 2025

Latest Posts

-

Epistrofi Giakoymaki Sto Mls To Oneiro Ton Amerikanon

May 20, 2025

Epistrofi Giakoymaki Sto Mls To Oneiro Ton Amerikanon

May 20, 2025 -

Efimereyontes Iatroi Patras Savvatokyriako Imerominia

May 20, 2025

Efimereyontes Iatroi Patras Savvatokyriako Imerominia

May 20, 2025 -

Iatroi Se Efimeria Patra Savvatokyriako Imerominia

May 20, 2025

Iatroi Se Efimeria Patra Savvatokyriako Imerominia

May 20, 2025 -

Factors Affecting Giorgos Giakoumakis Potential Mls Transfer

May 20, 2025

Factors Affecting Giorgos Giakoumakis Potential Mls Transfer

May 20, 2025 -

Efimeries Iatron Patras Savvatokyriako Imerominia

May 20, 2025

Efimeries Iatron Patras Savvatokyriako Imerominia

May 20, 2025