Why Is The Indian Stock Market Up? Sensex 1400, Nifty 23800+ Explained

Table of Contents

Strong Domestic Economic Fundamentals

India's robust economic fundamentals play a significant role in boosting investor confidence and fueling the stock market rally.

Robust GDP Growth

India's consistent GDP growth is a major catalyst for the current market surge. Recent GDP figures showcase a healthy expansion, signaling a strong and growing economy.

- Q1 2024 GDP Growth: [Insert actual Q1 2024 GDP growth figure here]. This demonstrates continued resilience despite global headwinds.

- Contributing Sectors: The services sector, a major contributor to India's GDP, continues to show strong performance. Manufacturing also exhibits positive growth, indicating a diversified and robust economic engine.

- Future Growth Forecasts: Experts predict continued GDP growth in the coming quarters, further bolstering investor optimism and driving stock market performance. This positive outlook reinforces the belief in India's long-term growth potential.

Increased Consumption and Spending

Rising consumer spending is another key driver of the Indian stock market's upward trajectory. Increased disposable income and positive consumer sentiment are translating into higher demand for goods and services.

- Consumer Confidence Index: Recent data shows a rise in the consumer confidence index, suggesting a positive outlook among consumers and increased willingness to spend.

- Retail Sales Growth: Strong growth in retail sales across various sectors points towards a healthy consumer demand environment.

- Impact on Market Performance: This increased consumption directly translates into higher corporate profits, ultimately boosting stock prices and driving the market's upward momentum.

Government Initiatives and Reforms

Government policies and reforms are significantly contributing to the positive investor sentiment and overall market strength. Initiatives aimed at improving the ease of doing business and boosting infrastructure development are attracting significant investment.

- Infrastructure Development: Massive investments in infrastructure projects like roads, railways, and renewable energy are creating jobs and stimulating economic activity.

- Ease of Doing Business Reforms: Government initiatives to simplify regulations and improve the business environment are encouraging both domestic and foreign investment.

- Positive Impact on Investor Confidence: These reforms signal a stable and business-friendly environment, attracting both domestic and foreign investors, further fueling the market's growth.

Global Positive Sentiment and Foreign Institutional Investor (FII) Inflows

The Indian stock market's performance is also influenced by positive global sentiment and significant inflows from Foreign Institutional Investors (FIIs).

Global Economic Recovery

A recovering global economy, although still facing challenges, is positively impacting the Indian stock market. Improved global economic indicators are boosting investor confidence, leading to increased capital flows towards emerging markets like India.

- Positive Global Economic Indicators: [Mention specific positive global economic indicators, such as improving manufacturing PMIs or rising global trade]. These indicators suggest a more stable global economic environment, encouraging investments in emerging markets.

- Influence on FII Investments: This positive global outlook encourages FIIs to allocate more capital to India, considering its strong growth potential.

FII Investments and Portfolio Flows

FIIs have played a crucial role in the recent market rally, with substantial investments pouring into the Indian stock market.

- Recent FII Investment Trends: [Insert data on recent FII investments in the Indian market]. This significant inflow of foreign capital is a major driver of the market's upward movement.

- Reasons for Increased Investment in India: FIIs are attracted to India's strong growth story, relatively stable political environment, and the potential for high returns.

- Impact on Market Capitalization: The influx of FII capital has significantly increased the market capitalization of Indian companies, further boosting market indices.

Sector-Specific Performance and Key Market Drivers

The recent market surge is not just a broad-based rally but also reflects strong performance in specific sectors.

IT Sector Boom

The IT sector has been a major contributor to the overall market growth, fueled by robust export numbers and strong order books.

- Strong Export Numbers: The IT sector's strong export performance indicates a healthy demand for Indian IT services globally.

- Robust Order Books: High order books for IT companies signify a positive outlook for future growth and revenue generation.

- Positive Industry Forecasts: Analysts predict continued growth in the IT sector, further fueling the market's upward trajectory.

Positive Performance in Other Key Sectors

Other key sectors have also contributed significantly to the market rally.

- Banking Sector: Improved asset quality and increased lending activity have boosted the performance of banking stocks.

- Pharmaceutical Sector: Strong domestic and international demand for pharmaceutical products has driven growth in this sector.

- Consumer Goods Sector: Increased consumer spending has translated into higher sales and profits for companies in the consumer goods sector.

Impact of Specific Events/Announcements

Certain events and announcements have further influenced investor sentiment and market indices.

- Positive Earnings Reports: Strong earnings reports from major companies have boosted investor confidence and driven stock prices higher.

- Mergers and Acquisitions: Significant mergers and acquisitions have created positive market buzz and contributed to the overall market sentiment.

Understanding the Indian Stock Market's Rise - Sensex 1400, Nifty 23800+ and What it Means for Investors

The recent surge in the Indian stock market is a result of a confluence of factors: strong domestic economic fundamentals, positive global sentiment, significant FII inflows, and robust sector-specific performance. While the outlook appears positive, it’s important to acknowledge potential risks and uncertainties. Geopolitical events, global economic slowdown, and inflation remain potential headwinds.

To make informed investment decisions, conduct thorough research, consult with a qualified financial advisor, and stay updated on market trends using reliable sources. Understanding "Indian stock market analysis," following "Sensex and Nifty predictions," and exploring different "investment strategies in India" are crucial steps for navigating this dynamic market. Don't hesitate to seek professional advice before making any investment decisions related to the Indian stock market.

Featured Posts

-

Greenlands Evolving Relationship With Denmark The Impact Of Trumps Actions

May 10, 2025

Greenlands Evolving Relationship With Denmark The Impact Of Trumps Actions

May 10, 2025 -

Mariah The Scientists Burning Blue Tracklist Release Date And More

May 10, 2025

Mariah The Scientists Burning Blue Tracklist Release Date And More

May 10, 2025 -

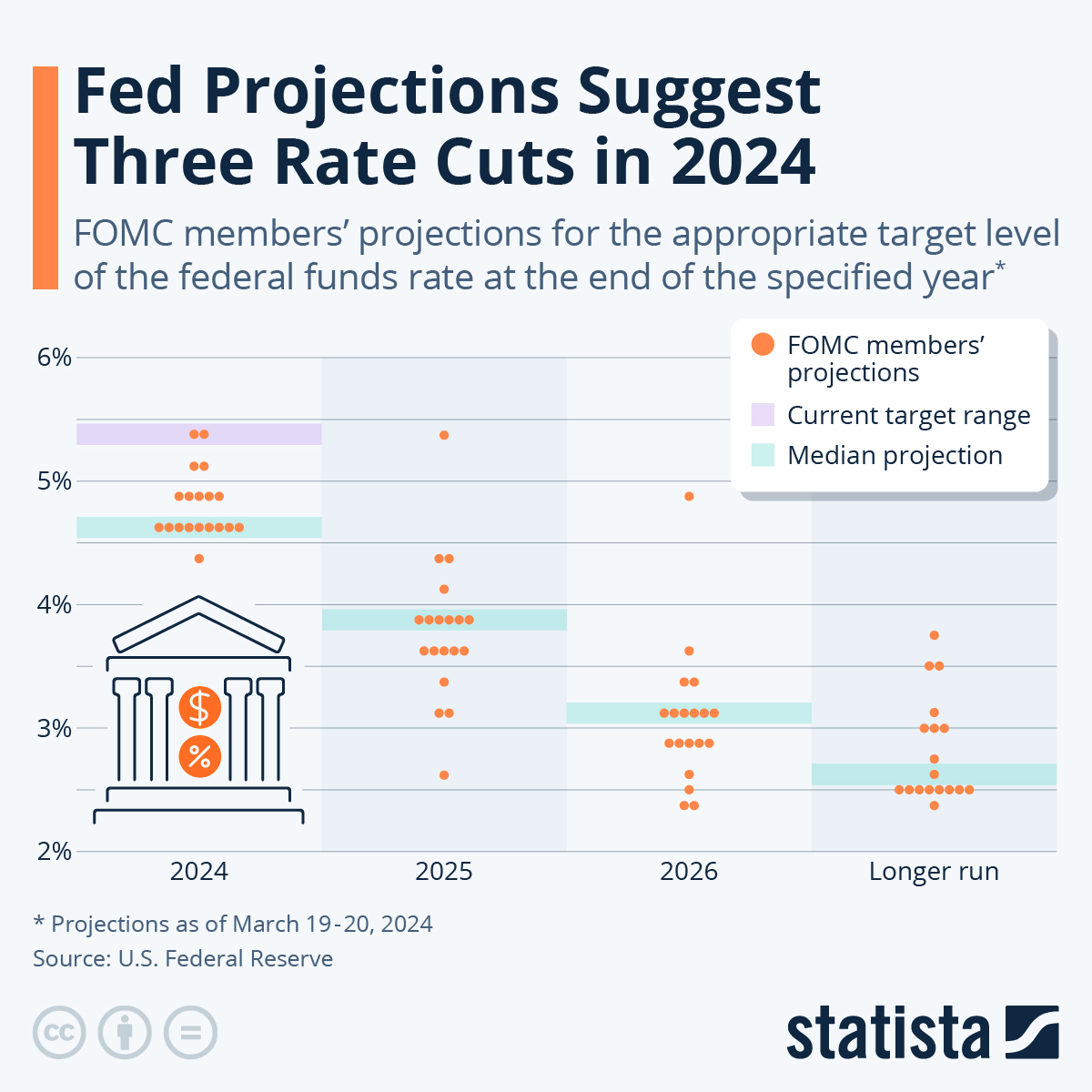

Feds Cautious Approach Why No Rate Cuts Yet

May 10, 2025

Feds Cautious Approach Why No Rate Cuts Yet

May 10, 2025 -

Hurun Global Rich List 2025 Elon Musks Net Worth Drops Over 100 Billion But Still Worlds Richest

May 10, 2025

Hurun Global Rich List 2025 Elon Musks Net Worth Drops Over 100 Billion But Still Worlds Richest

May 10, 2025 -

Burning Blue Mariah The Scientists Comeback Album Explored

May 10, 2025

Burning Blue Mariah The Scientists Comeback Album Explored

May 10, 2025