Wyckoff Accumulation Signals Imminent Ethereum Price Rally To $2,700?

Table of Contents

Is the Wyckoff method hinting at a significant Ethereum price surge? Recent market behavior suggests a potential accumulation phase, leading many analysts to predict a rally towards $2,700. This article will delve into the key Wyckoff accumulation signals observed in the Ethereum market and analyze their implications for the price of ETH. We will explore the supporting evidence and discuss the potential risks involved in this bullish prediction, focusing on keywords like Wyckoff Accumulation, Ethereum Price Prediction, Ethereum Price Rally, and $2700 Ethereum.

Understanding Wyckoff Accumulation:

What is Wyckoff Accumulation?

The Wyckoff method is a technical analysis approach that identifies market phases, focusing on the accumulation and distribution of assets. Unlike other methods that rely heavily on individual indicators, Wyckoff emphasizes the relationship between price, volume, and time to determine market sentiment and potential price movements. It's a holistic approach, considering the broader market context.

- Wyckoff Method: A technical analysis technique focused on identifying market phases of accumulation and distribution.

- Stages of Accumulation: The accumulation phase, typically before a significant price increase, involves several stages including: the "Spring" (a test of support), the "Sign of Weakness" (a minor decline), the "Secondary Test" (another test of support), and finally, the "Automatic Markup" (the beginning of the price increase).

- Importance of Volume and Price Action: Wyckoff analysis emphasizes the interplay between volume and price. High volume during periods of price consolidation often signals significant accumulation by large players.

Identifying Key Wyckoff Signals in Ethereum:

Several chart patterns and indicators suggest a potential Wyckoff accumulation phase is underway for Ethereum. Analyzing these signals provides a basis for the $2700 Ethereum price prediction.

- Support and Resistance Levels: Observe how ETH price repeatedly finds support at a specific level, indicating buying pressure. (Insert chart image showing support levels). Similarly, resistance levels are tested but eventually broken. (Insert chart image showing resistance levels).

- Volume Spikes and Price Movement: High volume during price consolidation confirms the accumulation thesis. (Insert chart image showing volume spikes during consolidation). Low volume during price increases suggests less selling pressure.

- Candlestick Patterns: The presence of bullish candlestick patterns like hammers or engulfing patterns near support levels strengthens the accumulation signal. (Insert chart image showing example candlestick patterns).

Factors Supporting the $2,700 Ethereum Price Target:

On-Chain Metrics and Fundamentals:

Positive on-chain metrics bolster the bullish outlook for Ethereum. These indicators suggest growing network activity and increased adoption.

- Correlation between On-Chain Activity and Price Movement: A rise in active addresses, indicating increased user engagement, often precedes price increases.

- Relevant News and Developments: Positive news, such as major partnerships or technological advancements, can fuel investor confidence and drive price appreciation. (Mention specific news if applicable).

Macroeconomic Factors:

Broader market trends also influence Ethereum's price trajectory.

- Impact of Regulatory Changes: Clearer regulatory frameworks could reduce uncertainty and potentially attract institutional investment.

- Overall Market Sentiment: Positive sentiment in the broader cryptocurrency market typically supports Ethereum's price. A strong Bitcoin price often correlates with Ethereum's performance.

Potential Risks and Challenges:

Limitations of Technical Analysis:

It's crucial to acknowledge the inherent limitations of technical analysis.

- Bear Trap: The pattern observed could be a "bear trap," where a temporary price increase lures in buyers before a further price decline.

- Importance of Risk Management: Always use stop-loss orders and diversify your portfolio to mitigate potential losses.

Unforeseen Events:

Unpredictable events can significantly impact cryptocurrency prices.

- Market Volatility: The cryptocurrency market is inherently volatile, and unexpected price swings are common.

- Need for Diversification: Diversification is key to managing risk in the volatile crypto market.

Conclusion:

The evidence suggests a potential Wyckoff accumulation phase for Ethereum, with some analysts predicting a price surge to $2,700. While the combination of Wyckoff signals, positive on-chain data, and broader market factors paints a bullish picture, it's crucial to acknowledge the inherent risks in the cryptocurrency market. Before investing, thoroughly research the market and implement appropriate risk management strategies. Careful analysis of Wyckoff accumulation signals, coupled with a solid understanding of the market, can significantly improve your chances of capitalizing on potential Ethereum price rallies. Don't miss out on the opportunity to learn more about identifying Wyckoff Accumulation signals and potentially profiting from the next Ethereum price movement. Learn more about Wyckoff Accumulation strategies today!

Featured Posts

-

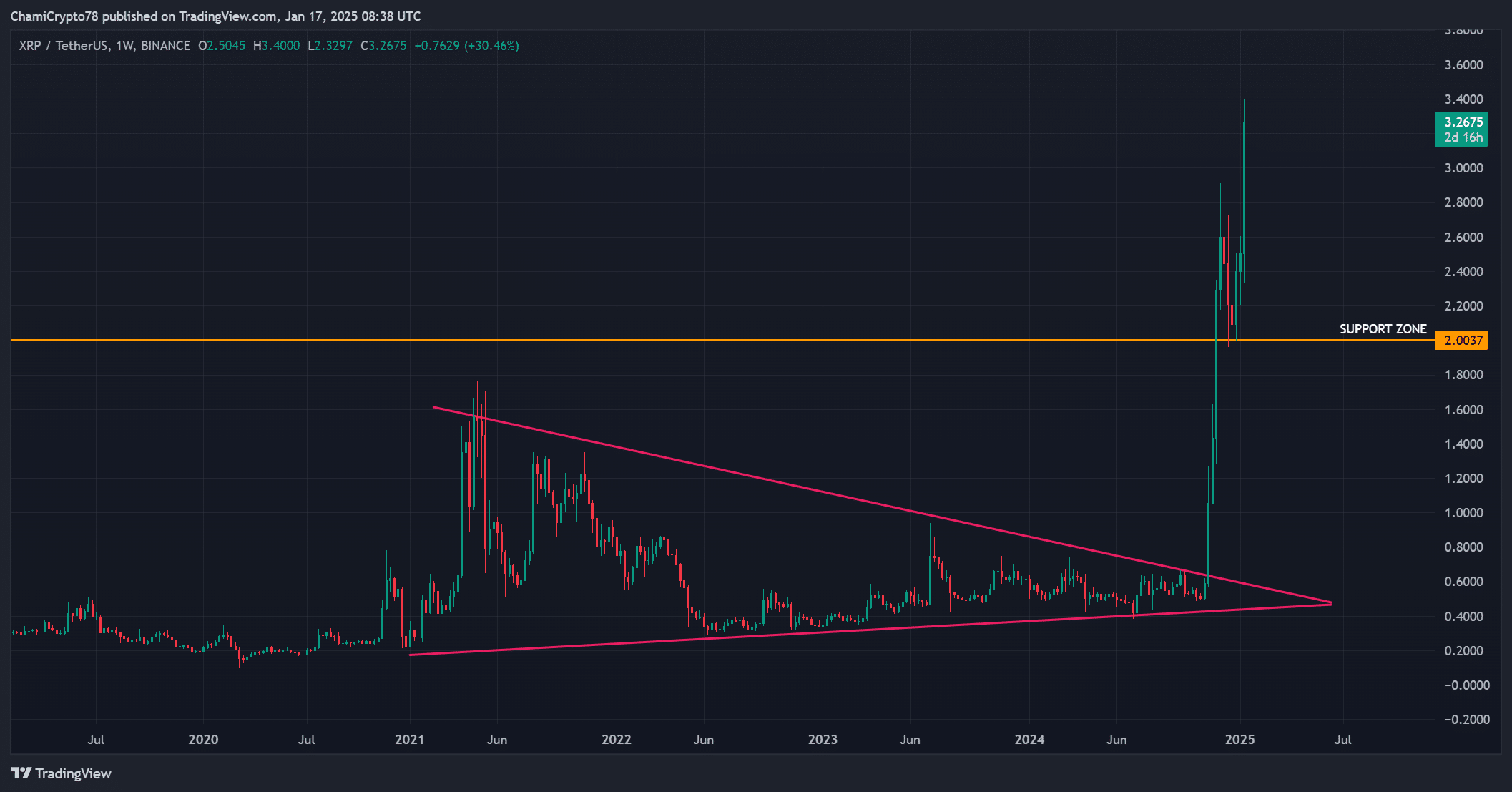

Ripples Xrp Jumps After Presidential Mention Of Trumps Influence

May 08, 2025

Ripples Xrp Jumps After Presidential Mention Of Trumps Influence

May 08, 2025 -

The Inter Barcelona Champions League Final A Defining Match

May 08, 2025

The Inter Barcelona Champions League Final A Defining Match

May 08, 2025 -

Xrp Etf Approval Analyzing The Potential For 800 Million In Week 1

May 08, 2025

Xrp Etf Approval Analyzing The Potential For 800 Million In Week 1

May 08, 2025 -

Black Rock Etf A Billionaire Investment Poised For Massive Growth

May 08, 2025

Black Rock Etf A Billionaire Investment Poised For Massive Growth

May 08, 2025 -

Easing Trade War Tensions Key Meeting Between U S And Chinese Officials Scheduled

May 08, 2025

Easing Trade War Tensions Key Meeting Between U S And Chinese Officials Scheduled

May 08, 2025