Market Dislocation Fuels Brookfield's Investment Strategy

Table of Contents

Brookfield's Contrarian Investment Philosophy

Brookfield's success is built on a contrarian investment philosophy. While many investors panic and sell during periods of market turmoil, Brookfield sees opportunity. Their long-term investment horizon and unwavering patience allow them to identify and acquire undervalued assets that others overlook. This approach is grounded in:

- Fundamental Analysis: Brookfield focuses on the underlying fundamentals of an asset, rather than reacting to short-term market fluctuations. They delve deep into the financial health, operational efficiency, and long-term potential of a company or property, regardless of current market sentiment.

- Seeking Mispriced Assets: Market panic often leads to irrational selling, creating opportunities to acquire assets significantly below their intrinsic value. Brookfield excels at identifying these mispriced assets, leveraging their deep market knowledge and extensive due diligence.

- Disciplined Due Diligence: A rigorous and thorough due diligence process is crucial to mitigating risk. Brookfield employs a team of experienced professionals across various sectors to meticulously assess potential investments, ensuring they make informed decisions even in uncertain market conditions.

Keywords: Contrarian investing, long-term value investing, fundamental analysis, risk mitigation.

Capitalizing on Distressed Assets

Brookfield is a master at identifying and acquiring distressed assets across diverse sectors, including real estate, infrastructure, renewable power, and private equity. Their expertise lies not just in acquisition, but also in restructuring and operational improvements. They possess the skills and resources to:

- Restructure and Improve: Brookfield's teams work to restructure the debt, streamline operations, and improve the overall performance of distressed assets, unlocking their inherent value.

- Successful Turnarounds: Numerous examples illustrate Brookfield's ability to turn around struggling businesses and properties. For example, their investments in underperforming real estate portfolios often involve significant renovations and repositioning to increase rental income and property values. Similarly, their expertise in infrastructure allows them to identify under-maintained assets with significant potential for improvement.

- Generating High Returns: By acquiring distressed assets at significantly discounted prices and implementing effective turnaround strategies, Brookfield consistently generates substantial returns for its investors, even during periods of market dislocation.

Keywords: Distressed assets, asset restructuring, operational improvements, turnaround strategies, real estate investment, infrastructure investment, renewable energy investment.

Strategic Acquisitions and Portfolio Diversification

Market dislocation creates opportunities for Brookfield to make strategic acquisitions of entire companies or portfolios at highly attractive valuations. Their diversified portfolio acts as a hedge against market risk, mitigating the impact of any single sector downturn. This strategy involves:

- Strategic Acquisitions: Brookfield actively seeks out companies or assets that align with their long-term investment strategy and offer significant growth potential, even during periods of market uncertainty. These acquisitions often involve significant value creation through operational improvements and strategic repositioning.

- Diversification Across Asset Classes and Geographies: Brookfield's investments span a wide range of asset classes and geographic locations. This diversification strategy limits the impact of market downturns in any single sector or region, ensuring portfolio resilience.

- Mitigating Risk: This multi-faceted approach, combining strategic acquisitions with diversified asset allocation, significantly mitigates the risk associated with market dislocation, allowing them to generate consistent returns even in turbulent markets.

Keywords: Strategic acquisitions, portfolio diversification, risk management, asset allocation, geographic diversification.

The Role of Private Equity in Brookfield's Strategy

Private equity plays a pivotal role in Brookfield's ability to navigate market dislocation. The nature of private equity investments—illiquid assets with a longer-term investment horizon—makes them less sensitive to short-term market volatility. This allows Brookfield to:

- Benefit from Long-Term Investments: Private equity investments offer the opportunity to focus on long-term value creation, rather than short-term market fluctuations. This aligns perfectly with Brookfield's contrarian investment philosophy.

- Capitalize on Distressed Opportunities: Market downturns often present unique opportunities to acquire private equity stakes in undervalued companies facing temporary challenges. Brookfield can then leverage their expertise to restructure, improve operations, and generate significant returns.

- Enhance Portfolio Performance: Private equity investments, with their potential for high returns, contribute significantly to the overall performance of Brookfield's diversified portfolio, adding resilience to their investment strategy.

Keywords: Private equity investment, illiquid assets, long-term capital, private equity returns.

Harnessing Market Dislocation for Investment Success

Brookfield Asset Management's success is a testament to their ability to leverage market dislocations for profit. Their strategy hinges on a potent combination of contrarian investing, distressed asset acquisition, strategic acquisitions, portfolio diversification, and the strategic use of private equity. By understanding and capitalizing on market volatility, Brookfield consistently delivers strong returns for its investors. Understanding how Brookfield Asset Management capitalizes on market dislocation can offer valuable insights for your own investment strategy. Explore the opportunities presented by market volatility and develop a resilient portfolio capable of thriving even in turbulent times. Learn more about alternative investment strategies and how to build a portfolio that withstands market uncertainty.

Featured Posts

-

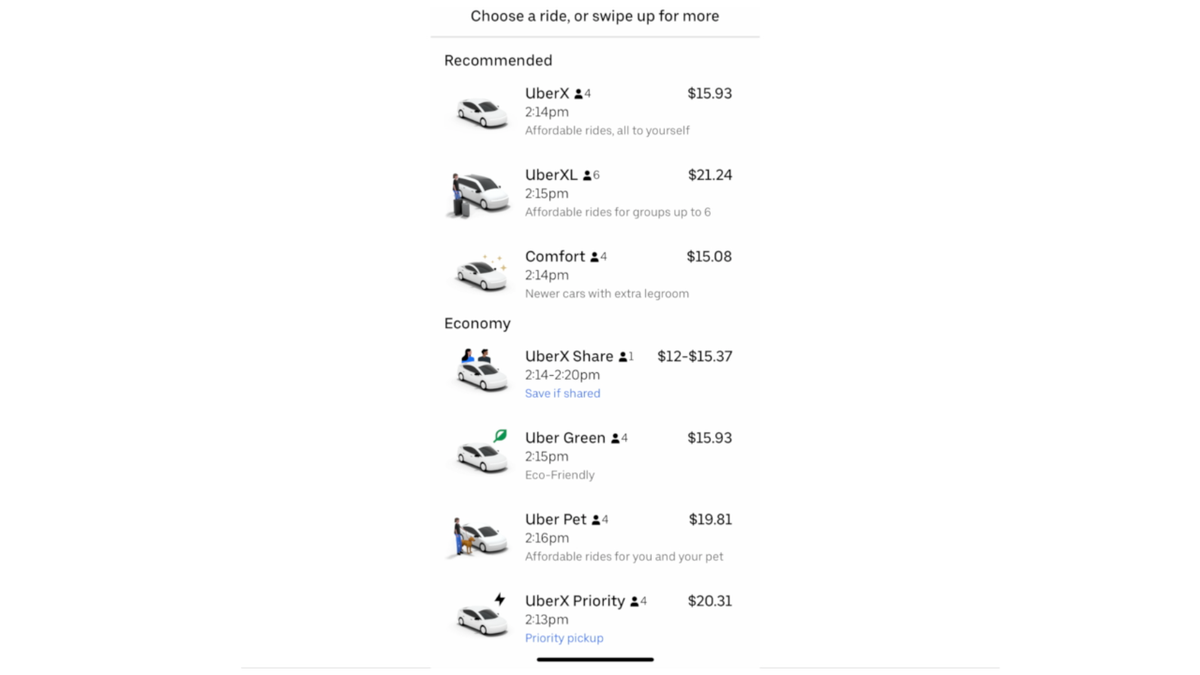

Understanding Ubers New Cash Only Auto Service Option

May 08, 2025

Understanding Ubers New Cash Only Auto Service Option

May 08, 2025 -

Arsenal Psg Macin Yayinci Kanali Ve Canli Izleme Secenekleri

May 08, 2025

Arsenal Psg Macin Yayinci Kanali Ve Canli Izleme Secenekleri

May 08, 2025 -

Psg Nantes Heyecan Dolu Berabere Mac

May 08, 2025

Psg Nantes Heyecan Dolu Berabere Mac

May 08, 2025 -

The Long Walk Trailer Simple Yet Terrifying

May 08, 2025

The Long Walk Trailer Simple Yet Terrifying

May 08, 2025 -

Cantina Canalla La Experiencia Gastronomica Mexicana En Malaga

May 08, 2025

Cantina Canalla La Experiencia Gastronomica Mexicana En Malaga

May 08, 2025