XRP ETF Launch: ProShares Enters The Crypto Market (No Spot ETFs)

Table of Contents

Understanding ProShares' XRP Futures ETF

ProShares' foray into the crypto market utilizes a futures-based Exchange Traded Fund (ETF), a crucial distinction from a spot ETF. A spot ETF directly invests in the underlying asset (in this case, XRP), while a futures-based ETF tracks the price of XRP futures contracts. This approach offers several advantages and disadvantages:

Advantages:

- Lower regulatory hurdles for initial launch: Futures-based ETFs face a less stringent regulatory approval process compared to spot ETFs, facilitating a quicker market entry.

- Exposure to XRP price movements without direct ownership: Investors gain exposure to XRP's price fluctuations without needing to directly hold the cryptocurrency.

Disadvantages:

- Potential for tracking discrepancies compared to the spot price: The price of futures contracts may not perfectly mirror the spot price of XRP, leading to potential tracking errors.

- Higher management fees potentially: Futures-based ETFs may incur higher management fees compared to their spot counterparts.

(Note: The exact ticker symbol will be added once officially released by ProShares.) Understanding these nuances is vital for investors weighing the potential gains and losses associated with this innovative XRP investment vehicle.

The Regulatory Landscape and Its Impact on XRP ETFs

The regulatory environment surrounding cryptocurrencies in the US, particularly regarding ETFs, is complex and evolving. The Securities and Exchange Commission (SEC) has shown a cautious approach to approving spot crypto ETFs, citing concerns about market manipulation and investor protection. This conservative stance has driven the adoption of the futures-based approach for this XRP ETF launch.

Key regulatory considerations influencing XRP ETFs include:

- SEC approval process: The rigorous SEC approval process demands extensive due diligence and compliance with stringent regulations.

- Anti-money laundering (AML) compliance: Robust AML measures are essential to mitigate the risk of illicit activities within the crypto market.

- Investor protection regulations: Regulations aimed at safeguarding investors from fraud and manipulation are paramount.

Any ongoing legal battles or regulatory uncertainty directly impacting XRP will significantly influence the future trajectory of XRP ETFs.

Investing in the ProShares XRP Futures ETF: A Practical Guide

Investing in the ProShares XRP Futures ETF is relatively straightforward for those with existing brokerage accounts. Investors can typically purchase shares through their preferred brokerage platforms, similar to buying traditional ETFs.

Practical investment considerations include:

- Brokerage account requirements: Ensure your brokerage account supports ETF trading and that you understand the platform's fees and trading policies.

- Trading commission fees: Consider the commission fees charged by your brokerage for each trade.

- Tax implications of ETF investments: Understand the tax implications of investing in ETFs, as capital gains taxes may apply upon sale.

Remember to always diversify your investments and avoid putting all your eggs in one basket. Investing in crypto ETFs carries inherent risk, and understanding these risks is crucial before investing.

The Future of XRP ETFs: Spot ETFs on the Horizon?

The question on many investors' minds is: when will we see a spot XRP ETF? While the ProShares XRP futures-based ETF represents a significant step, the possibility of a spot ETF remains a key driver of market sentiment. A spot ETF offers a more direct and potentially less volatile exposure to XRP's price movements.

Future prospects include:

- Timeline for potential spot ETF approvals: The timeline for SEC approval of spot XRP ETFs remains uncertain, depending largely on regulatory developments and market stability.

- Impact on XRP price volatility: The launch of a spot ETF could potentially reduce XRP's price volatility, attracting more institutional investors.

- Increased institutional adoption of XRP: Wider ETF availability could accelerate the institutional adoption of XRP.

Several competing firms are likely exploring the possibility of launching their own spot XRP ETFs, further intensifying competition in this burgeoning market segment.

Conclusion: The ProShares XRP ETF Launch: A Step Towards Wider Crypto Adoption

ProShares' launch of a futures-based XRP ETF marks a significant milestone in the evolution of cryptocurrency investing. While not a spot ETF, it offers investors a regulated and accessible pathway to gain exposure to XRP's price movements. The regulatory landscape remains dynamic, and the potential approval of future spot XRP ETFs will undoubtedly shape the market's trajectory. Learn more about the ProShares XRP ETF and diversify your portfolio today. Stay informed on the latest developments in the XRP ETF market and consider responsible XRP investment strategies.

Featured Posts

-

Strategies For Expediting Crime Control A Directive Approach

May 08, 2025

Strategies For Expediting Crime Control A Directive Approach

May 08, 2025 -

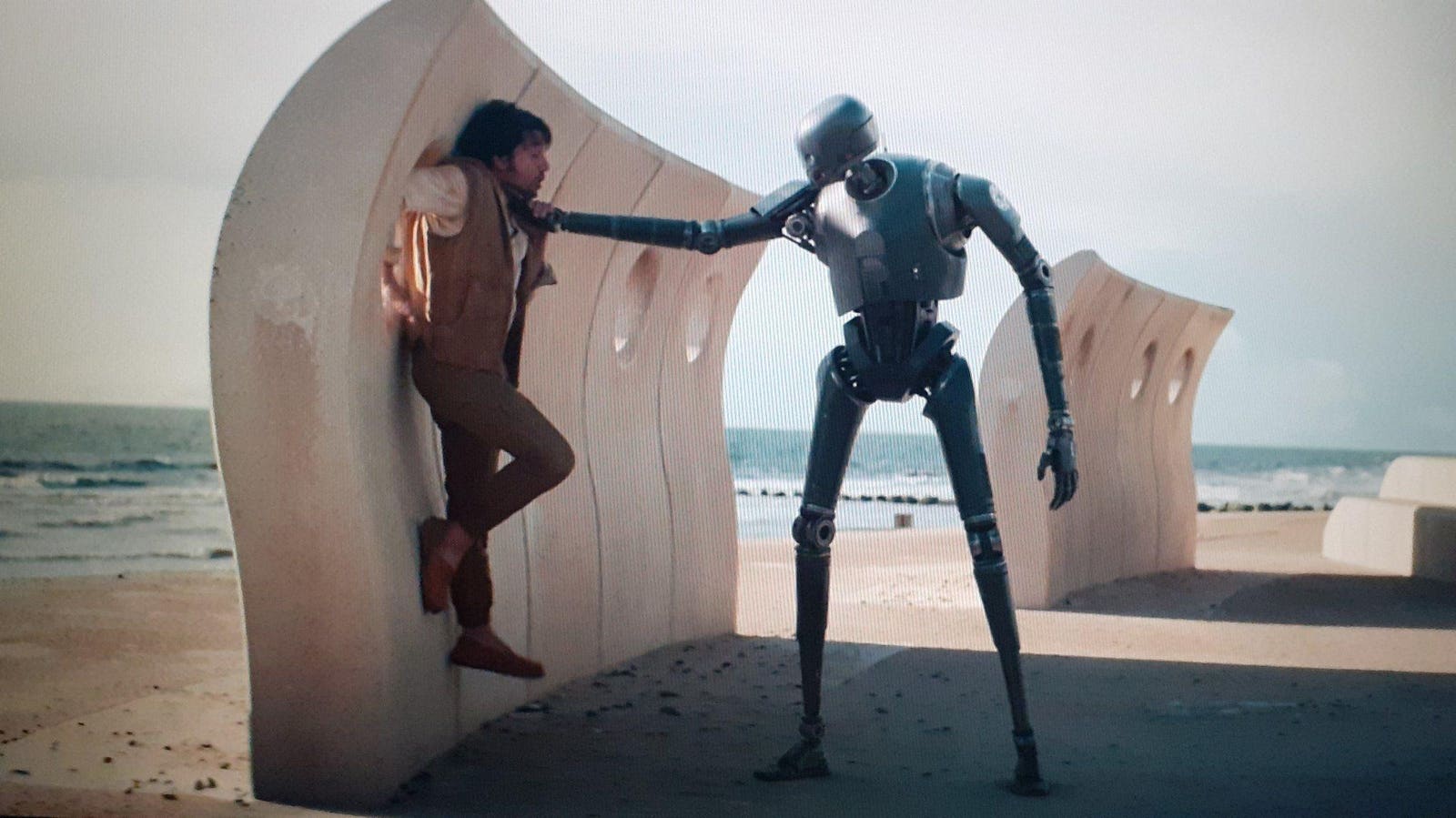

Andor Season 2 What We Know About The Release Date And Trailer

May 08, 2025

Andor Season 2 What We Know About The Release Date And Trailer

May 08, 2025 -

Steven Spielbergs War Films Ranked 7 Powerful Stories Beyond Saving Private Ryan

May 08, 2025

Steven Spielbergs War Films Ranked 7 Powerful Stories Beyond Saving Private Ryan

May 08, 2025 -

Bitcoins Potential A Growth Investor Forecasts A 1 500 Increase

May 08, 2025

Bitcoins Potential A Growth Investor Forecasts A 1 500 Increase

May 08, 2025 -

Inter Milan Upsets Bayern Munich In Champions League Quarterfinal

May 08, 2025

Inter Milan Upsets Bayern Munich In Champions League Quarterfinal

May 08, 2025