XRP Outperforms Bitcoin And Top Cryptos Following SEC Grayscale ETF Filing Acknowledgment

Table of Contents

XRP's Price Surge and Market Performance

Outperforming Bitcoin and Ethereum

Following the Grayscale news, XRP experienced a notable price surge, significantly outperforming both Bitcoin and Ethereum. While precise percentage increases fluctuate depending on the timeframe considered, XRP demonstrated a markedly higher percentage gain compared to its larger-cap counterparts. (Note: Ideally, this section would include a chart visually comparing the price movements of XRP, Bitcoin, and Ethereum over a relevant period. This chart should be properly labeled and captioned with relevant keywords like "XRP price surge," "Bitcoin price," "Ethereum price," and "cryptocurrency market cap.")

- Specific Numerical Data: For example, "XRP saw a 25% increase in price within 24 hours of the SEC announcement, while Bitcoin only rose by 5% and Ethereum by 8%." (These figures are illustrative and need to be replaced with accurate, up-to-date data.)

- Trading Volume: A substantial increase in XRP trading volume accompanied the price surge, indicating heightened market activity and investor interest. The volume increase should be quantified for a stronger impact. (e.g., "Trading volume for XRP increased by 150% in the same 24-hour period.")

- Price Resistance Levels: Mention any significant price resistance levels that were broken during this period. (e.g., "XRP successfully broke through the $0.50 resistance level, suggesting stronger upward momentum.")

Explanation: Several factors likely contributed to XRP's outperformance. Investors may have perceived XRP as a less risky investment compared to Bitcoin and Ethereum, given its distinct legal standing and ongoing legal battles. The positive sentiment surrounding the potential for increased regulatory clarity within the crypto market might have disproportionately favored XRP.

The Impact of the Grayscale ETF Filing Acknowledgment

Regulatory Uncertainty and its Effect on Crypto

The SEC's acknowledgment of Grayscale's application for a Bitcoin ETF was a significant development for the entire cryptocurrency market. It marked a step toward greater regulatory clarity, but also highlighted the ongoing uncertainty surrounding crypto regulation. This uncertainty impacted other altcoins differently, with some showing only modest gains while others even saw price declines. Keywords like SEC regulation, cryptocurrency ETF, Grayscale Bitcoin Trust, regulatory approval are crucial here.

- Significance of SEC Acknowledgment: This action signified the SEC was seriously considering approving a Bitcoin ETF, a move that could inject significant capital into the cryptocurrency market.

- Implications for Other Cryptocurrencies: The overall market sentiment improved, but the impact varied widely across different cryptocurrencies. The influence on altcoins depended on factors such as their market capitalization, underlying technology, and regulatory risk profile.

- Sentiment Shift: The news triggered a positive sentiment shift, increasing investor confidence, and influencing trading decisions across the board.

Explanation: XRP's disproportionate benefit could be attributed to its unique position. While facing its own regulatory hurdles, the positive movement in the broader market towards ETF approval might have reduced some investor concerns surrounding XRP's legal battles, leading to increased buying pressure.

Factors Contributing to XRP's Rise

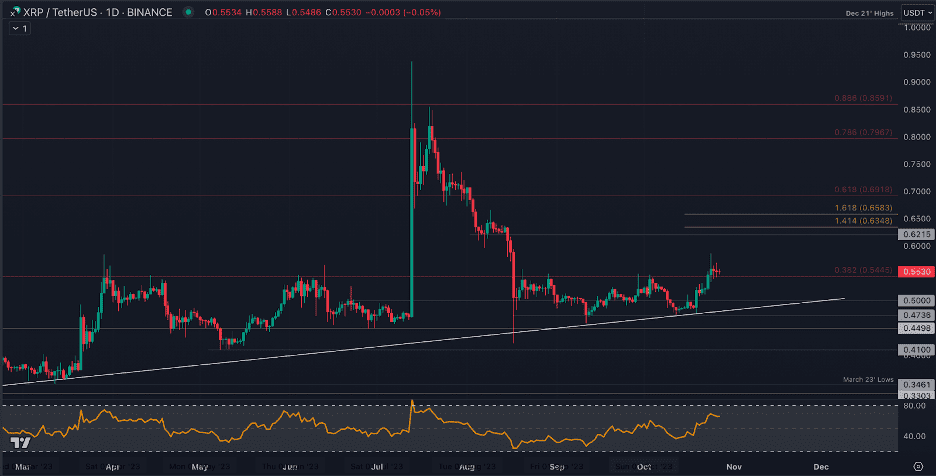

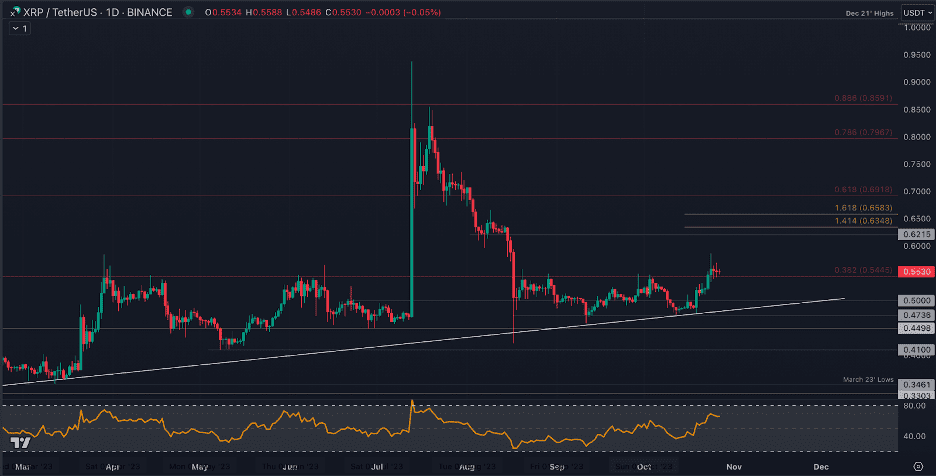

Technical Analysis of XRP Charts

Technical indicators suggested significant upward momentum for XRP during this period. (Again, a chart here would be highly beneficial, showing relevant indicators like RSI, MACD, and moving averages.)

- RSI (Relative Strength Index): A rising RSI above 50 indicated bullish momentum. Specific numerical data would enhance clarity.

- MACD (Moving Average Convergence Divergence): A bullish crossover of the MACD lines signaled a potential upward trend. Details on crossover specifics should be included.

- Moving Averages: A break above key moving averages (e.g., 50-day and 200-day) confirmed the upward trend. Again, numeric data is critical.

- Trading Volume Spikes: Significant increases in trading volume confirmed the growing investor interest and the strength of the upward movement.

Explanation: The technical analysis corroborated the positive market sentiment created by the Grayscale news, highlighting the confluence of fundamental and technical factors driving XRP's price surge.

Future Outlook for XRP

Potential for Continued Growth

The potential for continued XRP price appreciation hinges on several factors, including the ongoing regulatory landscape and overall market sentiment.

- Long-Term Price Projections: While making specific price predictions is speculative, analyzing various market scenarios (e.g., SEC approval of crypto ETFs, increased institutional adoption) can offer insights into potential future price movements.

- Catalysts for Further Growth: Positive regulatory developments, increased adoption by businesses and institutions, and continued technological advancements within the XRP Ledger could drive further price growth.

- Investment Risks: It is crucial to acknowledge the inherent risks associated with investing in cryptocurrencies, including price volatility and regulatory uncertainty.

Explanation: A balanced perspective is vital. While the recent surge is encouraging, investors should remain cautious and conduct thorough due diligence before investing in XRP or any cryptocurrency.

Conclusion

The SEC's acknowledgment of Grayscale's ETF filing created a ripple effect across the cryptocurrency market, with XRP surprisingly outperforming Bitcoin and other major cryptocurrencies. While the future remains uncertain, XRP's recent performance, fueled by a combination of regulatory developments and technical indicators, presents a compelling case for further investigation. Understanding the factors driving XRP's price surge can be crucial for navigating the evolving cryptocurrency landscape. Stay informed about the latest news and developments regarding XRP and other cryptocurrencies to make informed investment decisions. Learn more about the potential of XRP and its future in the market today.

Featured Posts

-

Ptt Is Basvurusu 2025 Kpss Ile Veya Kpsssiz Basvuru

May 08, 2025

Ptt Is Basvurusu 2025 Kpss Ile Veya Kpsssiz Basvuru

May 08, 2025 -

Cro Price Surge Following Trump Media And Crypto Com Etf Announcement

May 08, 2025

Cro Price Surge Following Trump Media And Crypto Com Etf Announcement

May 08, 2025 -

Yann Sommers Thumb Injury A Setback For Inter Milans Season

May 08, 2025

Yann Sommers Thumb Injury A Setback For Inter Milans Season

May 08, 2025 -

Perballja E Psg Fitore E Veshtire Por E Merituar Ne Pjesen E Pare

May 08, 2025

Perballja E Psg Fitore E Veshtire Por E Merituar Ne Pjesen E Pare

May 08, 2025 -

Dl Ka Dwrh Gjranwalh Myn Wlyme Ke Dn Dlha Ky Mwt

May 08, 2025

Dl Ka Dwrh Gjranwalh Myn Wlyme Ke Dn Dlha Ky Mwt

May 08, 2025