XRP (Ripple) Investment: Balancing Potential Gains With Financial Risks

Table of Contents

Understanding XRP and its Potential

XRP is a digital asset designed to facilitate fast and low-cost international money transfers within the Ripple ecosystem. Unlike Bitcoin, which operates on a decentralized, proof-of-work blockchain, XRP leverages a unique consensus mechanism. Its potential for growth stems from increasing market adoption and ongoing technological advancements within the Ripple network.

XRP's Technological Advantages

- Fast Transaction Speeds: XRP transactions are significantly faster than many other cryptocurrencies, often settling in a matter of seconds. This speed is crucial for real-time payments.

- Low Transaction Fees: The cost of sending XRP is typically very low, making it a cost-effective solution for international payments.

- Scalability Potential: The Ripple network is designed for high transaction throughput, allowing it to handle a large volume of payments simultaneously.

- Integration with Existing Financial Infrastructure: Ripple actively collaborates with banks and financial institutions, aiming to integrate XRP into their existing systems for smoother cross-border payments.

Market Adoption and Partnerships

Several factors contribute to XRP's potential for future growth.

- Key Partnerships: Ripple has established partnerships with numerous banks and financial institutions globally, expanding the reach and utility of XRP. These partnerships are key drivers of adoption.

- Expanding Use Cases Beyond RippleNet: While RippleNet is the primary platform for XRP's use, its potential applications extend beyond this, including decentralized exchange (DEX) integration and other financial applications.

- Growing Institutional Interest: Increasing interest from institutional investors suggests a potential shift toward wider acceptance and integration of XRP into mainstream finance.

Future Price Predictions (with Disclaimer)

Various analysts offer price predictions for XRP, ranging from conservative to extremely bullish. It is crucial to understand that these are speculative opinions and should not be considered financial advice. The cryptocurrency market is highly volatile, and past performance is not indicative of future results. Any investment decision should be based on your own thorough research and risk tolerance, not solely on price predictions.

Assessing the Risks of XRP Investment

While the potential rewards are alluring, investing in XRP carries inherent risks that must be carefully considered.

Volatility and Market Fluctuations

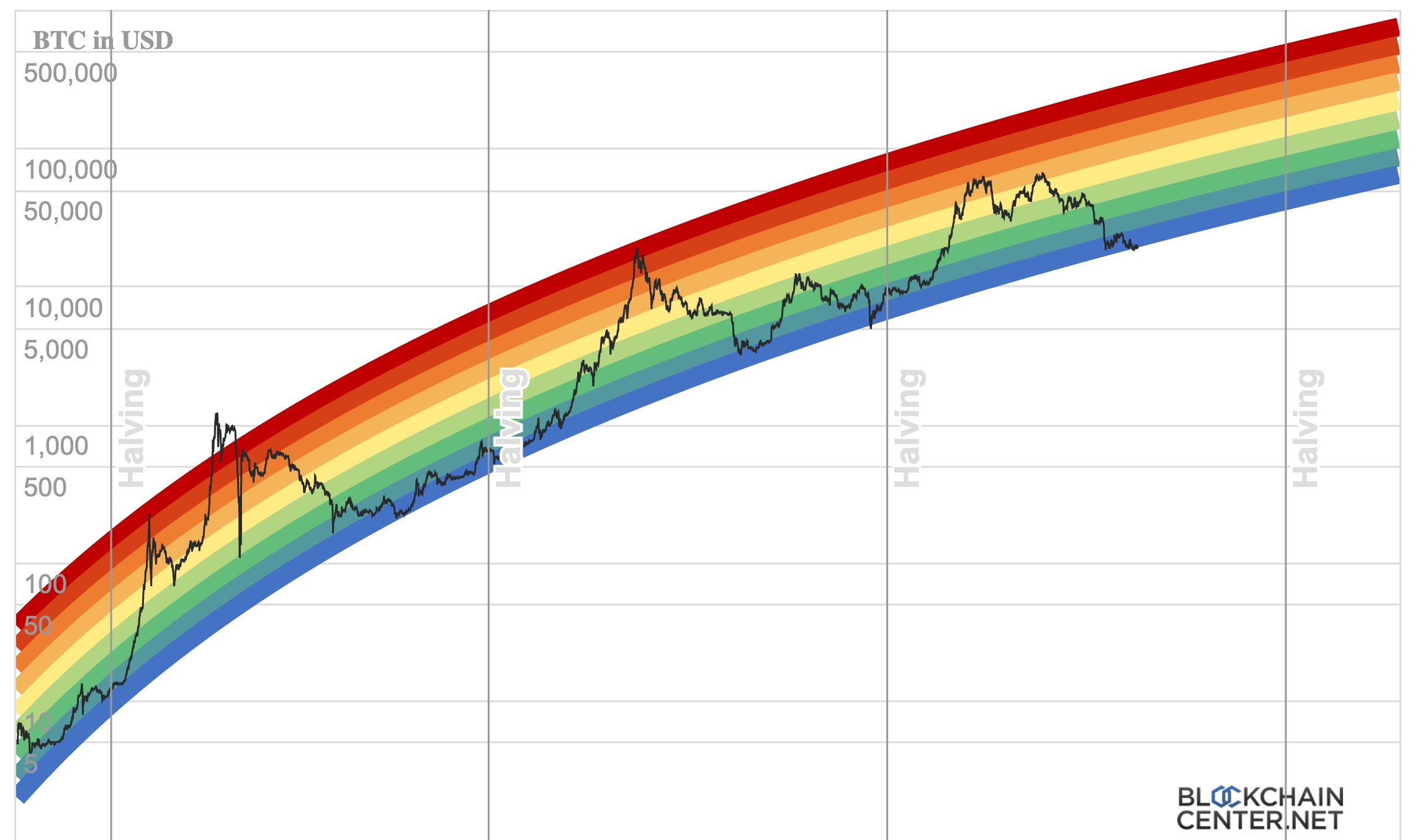

- High Volatility: The cryptocurrency market, including XRP, is notorious for its volatility. Prices can fluctuate dramatically in short periods, leading to significant gains or losses.

- Past Price Swings: XRP's history demonstrates substantial price swings, highlighting the inherent risk of investment in this asset class.

- Risk Management Strategies: Employing strategies like diversification (spreading your investments across various asset classes) and dollar-cost averaging (investing a fixed amount at regular intervals) can help mitigate some of the risks associated with XRP's volatility.

Regulatory Uncertainty

- Ongoing Legal Battles: Ripple faces ongoing legal challenges from the Securities and Exchange Commission (SEC) in the United States, which could significantly impact XRP's price and future.

- Regulatory Changes: The regulatory landscape for cryptocurrencies is constantly evolving, and changes can have unpredictable consequences for XRP's value and legality.

- Jurisdictional Differences: Regulations vary significantly across different jurisdictions, adding another layer of complexity and risk for XRP investors.

Security Risks

- Exchange Hacks: Storing XRP on cryptocurrency exchanges exposes your assets to the risk of hacks and theft.

- Private Key Loss: Losing your private keys, which are essential for accessing your XRP, could result in the permanent loss of your funds.

- Secure Wallet Usage: Using secure hardware wallets or reputable software wallets is crucial to mitigate these security risks.

Developing a Sound XRP Investment Strategy

Making informed decisions about XRP requires a well-defined investment strategy.

Due Diligence and Research

- Thorough Research: Before investing, conduct extensive research on XRP, the Ripple network, its technology, and the competitive landscape.

- Reliable Information Sources: Stay updated on XRP news and analysis through reputable sources, avoiding misleading or biased information.

- Understand the Whitepaper: Familiarize yourself with Ripple's whitepaper to grasp the underlying technology and the project's goals.

Risk Tolerance and Diversification

- Assess Your Risk Tolerance: Understand your own risk tolerance before investing in any cryptocurrency, including XRP. Investing in volatile assets requires a higher risk tolerance.

- Portfolio Diversification: Don't put all your eggs in one basket. Diversify your investments across different asset classes to mitigate potential losses.

- Consider your Financial Goals: Align your XRP investments with your overall financial goals and investment timeline.

Investment Timeline and Goals

- Long-Term vs. Short-Term: Determine whether you're aiming for a long-term or short-term investment strategy with XRP. Long-term strategies generally offer better chances of weathering market fluctuations.

- Realistic Goals: Set realistic goals for your XRP investment, avoiding unrealistic expectations driven by hype or speculation.

- Regular Portfolio Review: Regularly review and adjust your investment strategy as needed, considering market conditions and your own financial goals.

Conclusion

Investing in XRP offers the potential for significant gains, but also presents substantial risks. By understanding the technology behind XRP, assessing the market volatility and regulatory landscape, and developing a sound investment strategy, you can make more informed decisions regarding your XRP investment. Remember to conduct thorough research, diversify your portfolio, and only invest what you can afford to lose. Careful consideration of the potential gains and risks is crucial before making any XRP investment. Start your research today and make informed decisions about your XRP investment.

Featured Posts

-

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Detaylar Ve Etkileri

May 08, 2025

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Detaylar Ve Etkileri

May 08, 2025 -

India Vs Pakistan Kashmir As The Core Of The Conflict And The Possibility Of Renewed Warfare

May 08, 2025

India Vs Pakistan Kashmir As The Core Of The Conflict And The Possibility Of Renewed Warfare

May 08, 2025 -

Bitcoin Price Forecast Evaluating The Impact Of Trumps 100 Day Speech

May 08, 2025

Bitcoin Price Forecast Evaluating The Impact Of Trumps 100 Day Speech

May 08, 2025 -

Investing In Uber Uber Pros Cons And Future Outlook

May 08, 2025

Investing In Uber Uber Pros Cons And Future Outlook

May 08, 2025 -

Spk Nin Kripto Para Karari Yatirimcilar Icin Nelere Dikkat Edilmeli

May 08, 2025

Spk Nin Kripto Para Karari Yatirimcilar Icin Nelere Dikkat Edilmeli

May 08, 2025