XRP's Legal Battle: SEC Vs. Ripple And The Commodity Question

Table of Contents

The SEC's Case Against Ripple

The SEC's case against Ripple rests heavily on the application of the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security.

The Howey Test and its Application to XRP

The Howey Test establishes four criteria for an investment contract: an investment of money, a common enterprise, an expectation of profits, and the efforts of others. The SEC argues that XRP satisfies all four prongs.

- Investment of Money: The SEC claims that purchasers of XRP invested money with the expectation of profit.

- Common Enterprise: They contend that Ripple and its affiliates operated as a common enterprise, managing and promoting XRP sales.

- Expectation of Profits: The SEC alleges that purchasers of XRP anticipated profits based on Ripple's efforts.

- Efforts of Others: A crucial point in the SEC’s argument is that the success of XRP depended heavily on the efforts of Ripple, not solely on market forces.

The SEC cites specific instances of XRP sales, including those directly to institutional investors and through secondary market sales, to support their claim of an unregistered securities offering.

Allegations of Unregistered Securities Offering

The SEC alleges that Ripple conducted unregistered sales of XRP, violating federal securities laws. They point to various sales methods:

- Direct Sales to Institutional Investors: Large-scale sales of XRP directly to institutional investors are highlighted as evidence of a securities offering.

- Programmatic Sales: The SEC also scrutinizes Ripple's sales of XRP through programmatic means, arguing these also constitute unregistered securities offerings.

- Secondary Market Sales: The SEC's argument extends to the secondary market sales of XRP, alleging that Ripple's actions indirectly influenced the market and benefitted from them.

The volume of XRP sold, estimated to be billions of dollars, significantly amplifies the SEC's case.

Ripple's Defense

Ripple vehemently denies the SEC's allegations, arguing that XRP is a decentralized digital asset functioning as a currency, not a security.

Arguments for XRP as a Commodity or Decentralized Currency

Ripple's defense hinges on the decentralized nature of XRP and its functionality as a payment currency. They argue:

- Decentralized Nature: Ripple emphasizes XRP's operational independence from Ripple Labs, highlighting its usage on various decentralized exchanges.

- Functional Use Cases: They showcase real-world applications of XRP as a fast and low-cost payment solution for cross-border transactions.

- Market Dynamics: Ripple points to the fact that XRP's price is largely determined by market forces, unlike securities typically tied to the success of a specific company.

Expert witnesses have been called upon by Ripple to bolster their arguments regarding XRP's decentralized nature and its lack of resemblance to a security.

Impact on the Crypto Industry's Regulatory Landscape

Ripple argues that the SEC's broad interpretation of securities law could stifle innovation and investment in the cryptocurrency market. They claim:

- Chilling Effect on Innovation: A ruling against Ripple could create a chilling effect, discouraging other companies from developing and launching new crypto projects.

- Uncertainty for Investors: The lack of regulatory clarity creates significant uncertainty for investors, potentially leading to reduced participation in the crypto market.

- Impact on Other Cryptocurrencies: The implications extend far beyond XRP, as the precedent set by this case could impact the classification of other cryptocurrencies.

This uncertainty negatively affects market stability and long-term growth.

The Judge's Ruling and its Implications

(This section will be updated to reflect the final court decision and its impact. Currently, the case is concluded with a partial win for Ripple. The judge ruled that programmatic sales and institutional sales constituted unregistered securities offerings, but not the secondary market sales.)

Key Aspects of the Judge's Decision

The judge's decision delivered a mixed outcome, ruling that certain sales of XRP constituted unregistered securities offerings, but other sales did not. This highlights the complexities involved in applying the Howey Test to cryptocurrencies.

- Programmatic and Institutional Sales: The judge determined that these sales met the criteria of the Howey Test.

- Secondary Market Sales: The court found that these sales did not constitute unregistered securities offerings.

This nuanced ruling underscores the difficulty of applying established securities law to the novel landscape of cryptocurrencies.

Impact on XRP Price and Market Sentiment

The judge’s decision caused significant volatility in XRP’s price and impacted investor sentiment. While a complete victory for Ripple was not achieved, the partial win was received positively, causing a temporary surge in XRP's price. However, long-term implications are still being assessed and depend greatly on any future appeals.

Future of the Case and its Broader Significance

Potential Appeals and Future Legal Battles

Both the SEC and Ripple have the option to appeal the ruling. The legal battle could continue for years, potentially impacting the regulatory clarity within the crypto industry. Further legal action could set a crucial precedent for future SEC enforcement actions.

Regulatory Clarity for the Crypto Industry

The SEC vs. Ripple case highlights the urgent need for clearer regulatory frameworks for cryptocurrencies. This case, irrespective of appeals, will significantly impact future regulatory decisions and discussions. Various regulatory approaches are being debated, each with potential benefits and drawbacks, and legislative efforts are continuing to address the issues of classification and oversight of digital assets.

Conclusion: The Ongoing XRP Legal Battle and its Impact

The SEC vs. Ripple lawsuit has presented a complex challenge, forcing a critical examination of existing securities law and its applicability to the decentralized world of cryptocurrencies. The judge's decision, while delivering a partial win for Ripple, still leaves significant room for ongoing legal battles and further regulatory uncertainty. The key takeaways from this case include the critical need for clearer regulatory definitions and the ongoing debate about the classification of digital assets. Stay informed about the ongoing SEC vs. Ripple case, XRP classification, and the evolving cryptocurrency regulation landscape. Understanding this lawsuit’s developments and their implications is crucial for navigating the future of cryptocurrencies and their potential impact on global finance.

Featured Posts

-

Choosing The Right Surface Pro 12 Inch Vs Larger Models

May 08, 2025

Choosing The Right Surface Pro 12 Inch Vs Larger Models

May 08, 2025 -

Universal Credit Unclaimed Hardship Payment Refunds Are You Eligible

May 08, 2025

Universal Credit Unclaimed Hardship Payment Refunds Are You Eligible

May 08, 2025 -

Fortalezas Y Debilidades De Central Cordoba En El Contexto Del Gigante De Arroyito

May 08, 2025

Fortalezas Y Debilidades De Central Cordoba En El Contexto Del Gigante De Arroyito

May 08, 2025 -

Update On Jayson Tatums Wrist What The Celtics Coach Said

May 08, 2025

Update On Jayson Tatums Wrist What The Celtics Coach Said

May 08, 2025 -

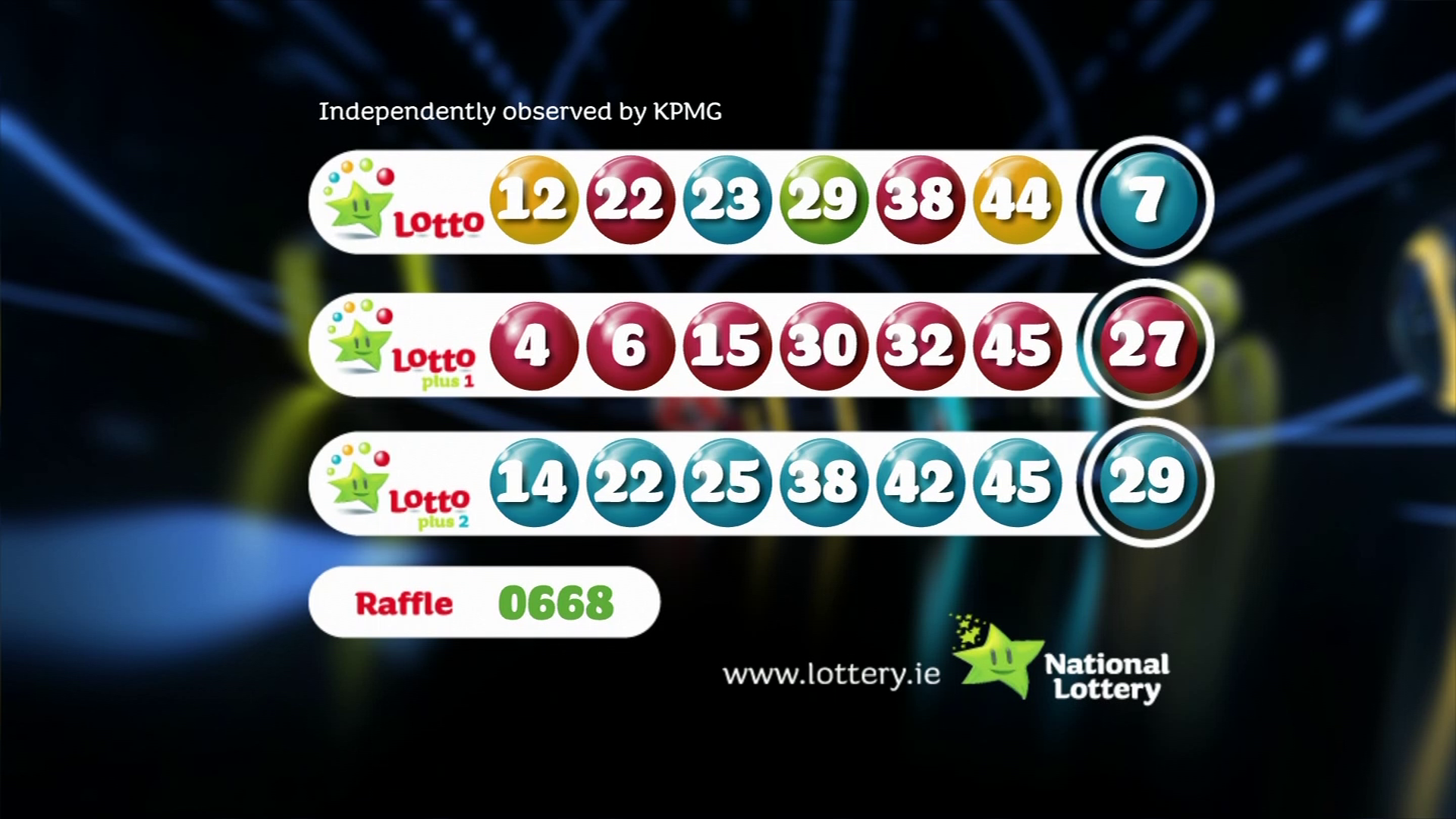

Check The April 12th Lotto Results Saturday Jackpot Numbers

May 08, 2025

Check The April 12th Lotto Results Saturday Jackpot Numbers

May 08, 2025