10% Tariff Baseline: Trump's Trade Policy And The Search For Exceptions

Table of Contents

The Genesis of the 10% Tariff Baseline

The announcement of the 10% tariff baseline, initially targeting specific goods from various countries, was justified by the administration as a necessary measure to protect American industries from unfair trade practices and to bolster domestic production. The stated goals included leveling the playing field for American businesses and reducing the trade deficit. However, the decision was met with immediate criticism from economists and international trade experts who predicted negative economic consequences.

- Impacted Industries: Steel and aluminum were among the initial sectors heavily impacted by the 10% tariff, leading to increased prices and reduced competitiveness for some manufacturers. Other industries felt ripple effects as supply chains were disrupted.

- Affected Countries: China, the European Union, and several other nations were subject to these tariffs, triggering retaliatory measures and escalating the trade conflict.

- Justification Analysis: While the administration emphasized unfair trade practices as the justification, critics pointed to the potential for protectionism and the disruption of established global trade relationships.

The Application Process for Tariff Exemptions

Businesses seeking relief from the 10% tariff faced a challenging and often opaque application process. They had to demonstrate that the imposed tariffs would cause them significant economic harm and that there were no readily available domestic substitutes for the imported goods. The process involved substantial documentation and bureaucratic hurdles, creating significant delays and uncertainty for affected companies.

- Application Steps: The process typically involved detailed applications, extensive evidence submission, and rigorous review by government agencies.

- Exemption Criteria: The criteria for exemption were strictly defined, and the success rate was relatively low, leaving many businesses facing increased costs and reduced competitiveness.

- Successful/Unsuccessful Cases: While some businesses successfully secured exemptions, many others faced considerable financial losses due to the lengthy and demanding process. The lack of transparency surrounding the decision-making process further exacerbated the situation.

- Bureaucratic Hurdles: Navigating the complexities of the application process, including meeting strict deadlines and providing extensive documentation, proved to be a major obstacle for many companies.

Economic Impacts of the 10% Tariff Baseline and Exemptions

The 10% tariff baseline had a significant and multifaceted impact on the global economy. While the intended goal was to protect domestic industries, the results were often complex and sometimes counterintuitive. The imposition of tariffs led to increased prices for consumers, reduced competitiveness for American businesses relying on imported inputs, and retaliatory tariffs from other countries, further disrupting global trade flows.

- Statistical Data: Studies revealed a noticeable increase in consumer prices for certain goods, reflecting the added tariff costs. Economic growth forecasts were also revised downwards in several countries.

- Case Studies: Analyses of specific companies highlighted the varied impacts, with some experiencing severe financial hardship and others adapting through diversification or relocation of production.

- Inflation and Consumer Spending: The added costs associated with tariffs contributed to inflation and decreased consumer purchasing power in several sectors.

- Long-Term Consequences: The long-term effects included shifts in global supply chains, reduced trade volumes, and increased uncertainty in international business relationships.

Political Ramifications and International Relations

The 10% tariff baseline had profound implications for international trade relations. The imposition of tariffs triggered retaliatory measures from affected countries, escalating trade tensions and disrupting diplomatic ties. The actions challenged existing international trade agreements and institutions, raising concerns about the stability of the global trading system.

- Retaliatory Tariffs: Several countries, including China and the European Union, imposed retaliatory tariffs on American goods, leading to a tit-for-tat trade war.

- Impact on Trade Negotiations: The trade war significantly complicated international trade negotiations and undermined efforts to resolve existing trade disputes.

- Role of the WTO: The World Trade Organization (WTO) played a key role in mediating disputes, but its effectiveness was challenged by the escalating trade conflict and the lack of consensus among member states.

Long-Term Consequences and Lessons Learned

The 10% tariff baseline left a lasting impact on global trade and business strategies. Businesses learned to diversify their supply chains, explore alternative sourcing options, and develop more resilient business models in response to the increased uncertainty. The experience highlighted the significant risks associated with unilateral trade policies and the need for greater cooperation and predictability in international trade.

- Shifts in Trade Patterns: The tariffs spurred shifts in global trade patterns, with some countries seeking alternative trading partners and others investing in domestic production to reduce reliance on imports.

- Evolution of Business Strategies: Businesses adopted strategies to mitigate the impact of tariffs, including diversifying their supply chains, investing in domestic production, and seeking exemptions.

- Implications for Future Trade Policy: The experience served as a cautionary tale, emphasizing the importance of considering the broader economic and political consequences before implementing significant trade policy changes.

Conclusion:

The 10% tariff baseline represents a significant chapter in recent trade history. Its implementation, the subsequent scramble for exemptions, and the resulting economic and political ramifications underscore the complexities of trade policy and its far-reaching effects. Understanding the lessons learned from this period is crucial for navigating future trade negotiations and building a more stable and predictable global trading system. To further your understanding of the 10% tariff baseline and its ongoing impacts, we encourage you to explore relevant government reports, academic research, and news articles. Engage in informed discussions about the implications of such trade policies to contribute to a more nuanced understanding of international trade dynamics.

Featured Posts

-

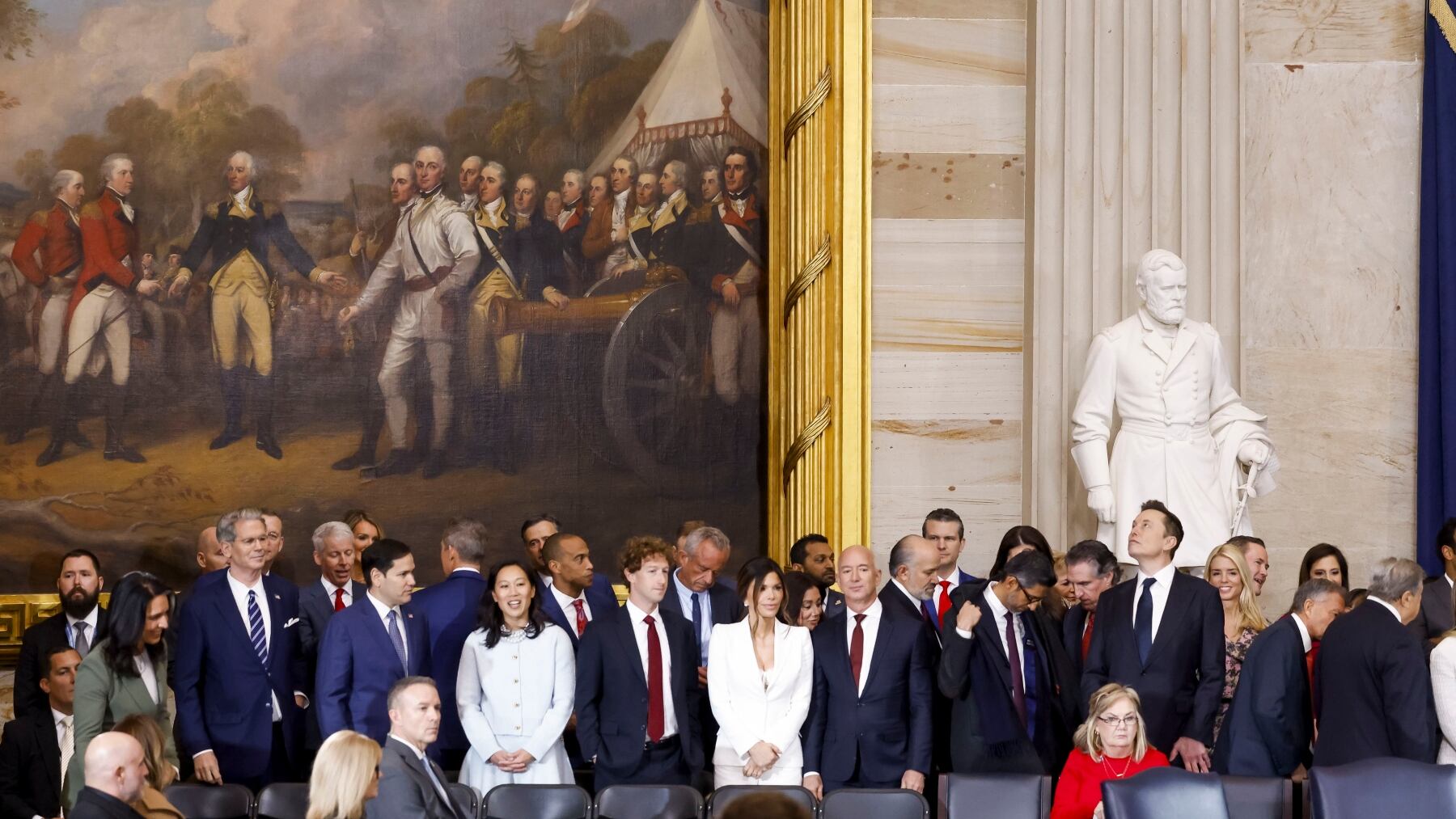

Analyzing The Net Worth Losses Of Elon Musk Jeff Bezos And Mark Zuckerberg After Trumps Inauguration

May 10, 2025

Analyzing The Net Worth Losses Of Elon Musk Jeff Bezos And Mark Zuckerberg After Trumps Inauguration

May 10, 2025 -

Disaster Betting The Los Angeles Wildfire Example

May 10, 2025

Disaster Betting The Los Angeles Wildfire Example

May 10, 2025 -

3e Ligne De Tram A Dijon La Concertation Citoyenne Demarre

May 10, 2025

3e Ligne De Tram A Dijon La Concertation Citoyenne Demarre

May 10, 2025 -

Ftc To Challenge Courts Approval Of Microsoft Activision Deal

May 10, 2025

Ftc To Challenge Courts Approval Of Microsoft Activision Deal

May 10, 2025 -

Overcoming Rejection The Journey From Wolves To Europes Best Team

May 10, 2025

Overcoming Rejection The Journey From Wolves To Europes Best Team

May 10, 2025