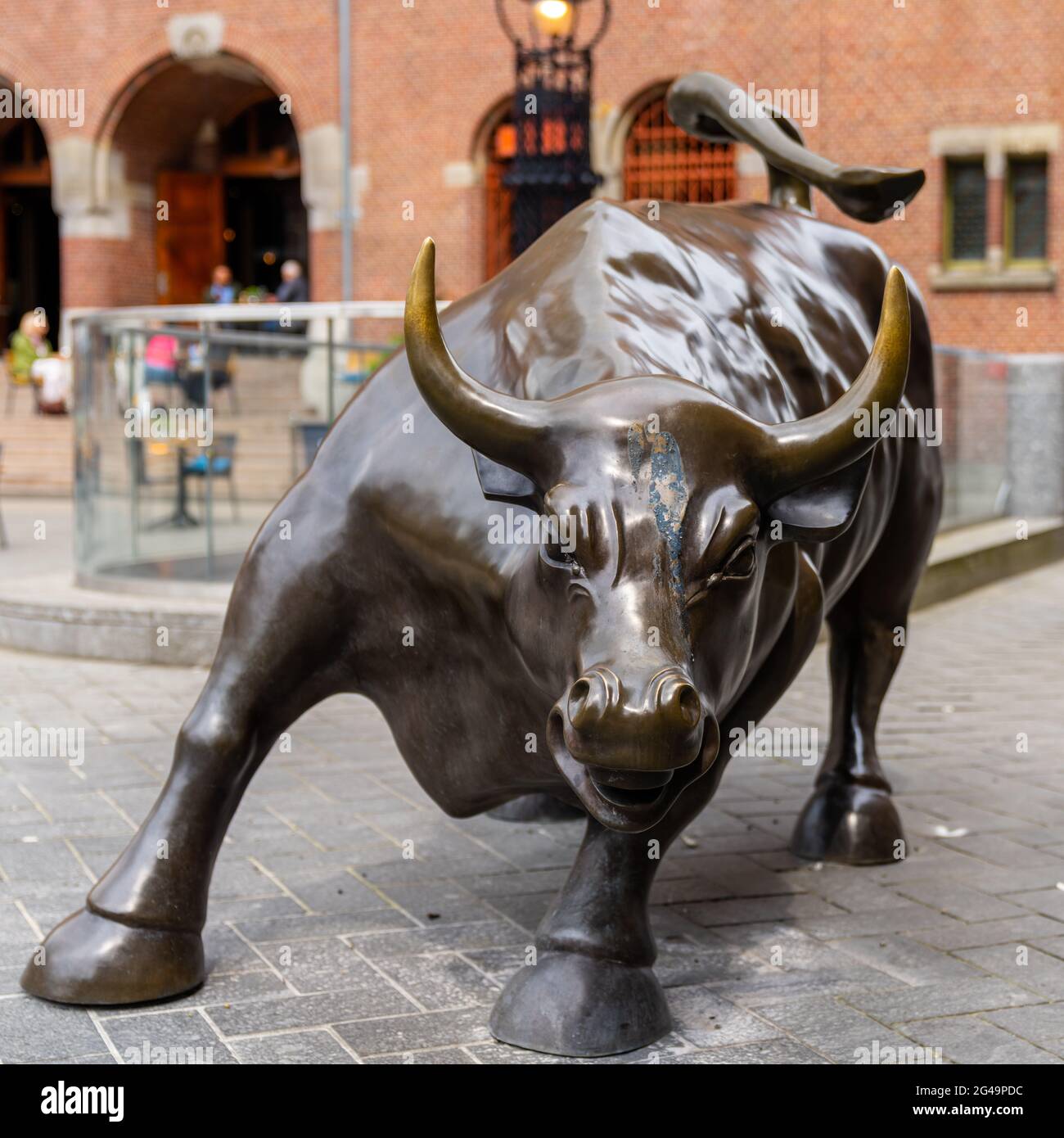

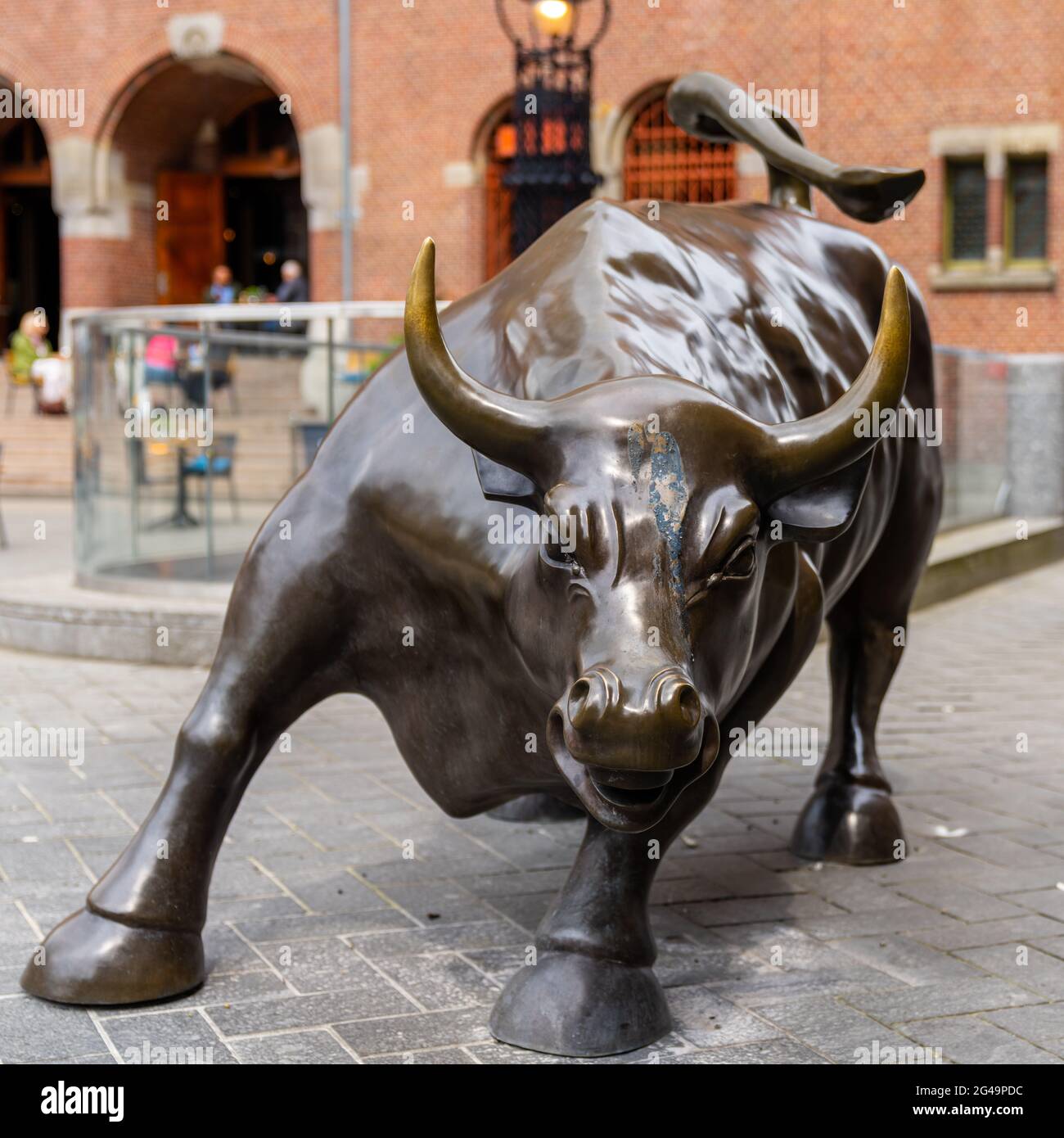

11% Drop In Three Days: Amsterdam Stock Exchange Faces Major Losses

Table of Contents

Causes of the Sharp Decline in the AEX Index

The precipitous drop in the AEX index is attributable to a confluence of factors, both global and domestic.

Global Economic Uncertainty

Global economic headwinds played a significant role in the AEX's decline. Several interconnected issues eroded investor confidence:

- Inflation and Rising Interest Rates: Persistent high inflation globally forced central banks, including the European Central Bank, to aggressively raise interest rates. This increases borrowing costs for businesses, dampening investment and economic growth, impacting stock market performance.

- Geopolitical Instability: The ongoing war in Ukraine continues to disrupt global supply chains, fuel energy price volatility, and create uncertainty in the global economic outlook. This uncertainty significantly impacts investor sentiment.

- Energy Crisis: The European energy crisis, exacerbated by the war in Ukraine, has pushed energy prices to record highs, impacting businesses across various sectors and adding to the overall economic uncertainty.

- Correlation with Global Indices: The AEX's decline mirrored similar drops in other major global indices, such as the Dow Jones and FTSE 100, indicating a global trend of declining investor confidence rather than a solely Dutch phenomenon.

Sector-Specific Challenges

Beyond global factors, specific challenges within the Dutch economy likely contributed to the AEX's downturn:

- Technology Sector Slowdown: A potential slowdown in the global technology sector, reflected in lower earnings reports from some key Dutch tech companies, negatively impacted investor sentiment towards the AEX.

- Supply Chain Disruptions: Lingering supply chain bottlenecks and increased transportation costs continue to affect businesses across multiple sectors in the Netherlands, contributing to lower-than-expected profits.

- Regulatory Changes: Potential new regulations or changes in existing policies impacting specific Dutch industries may have increased investor uncertainty and contributed to the market sell-off. For example, stricter environmental regulations might have impacted energy companies' stock prices.

Investor Sentiment and Market Volatility

Panic selling and a dramatic shift in investor sentiment amplified the initial downturn.

- Decreased Investor Confidence: Negative news and concerns about global and national economic prospects led to a significant decrease in investor confidence, triggering widespread selling.

- Increased Market Volatility: The rapid decline created a self-fulfilling prophecy; as the market fell, investors panicked and sold, further accelerating the downward spiral. Trading volume during this period likely surged, reflecting the heightened market volatility.

Impact of the Stock Market Drop on the Dutch Economy

The 11% drop in the AEX has significant implications for the Dutch economy, rippling through businesses and impacting consumer confidence.

Impact on Businesses and Consumers

- Reduced Investment: The stock market decline reduces the availability of capital for Dutch companies, potentially leading to decreased investment in expansion and innovation.

- Potential Job Losses: Companies facing reduced investment might be forced to cut costs, potentially leading to job losses across various sectors.

- Decreased Consumer Spending: Negative news about the stock market and a weakening economy can lead to decreased consumer confidence and reduced spending, further slowing economic growth. This creates a dangerous feedback loop.

Government Response and Mitigation Strategies

The Dutch government will likely respond with various measures aimed at stabilizing the market and supporting affected businesses. Potential actions include:

- Fiscal Stimulus: The government might consider measures such as tax cuts or increased public spending to boost economic activity and consumer confidence.

- Monetary Policy Adjustments: Coordination with the European Central Bank on monetary policy adjustments could provide additional support.

- Financial Sector Support: Measures to support struggling businesses within the financial sector might be considered to prevent further systemic risk.

Analysis and Predictions for the Future of the AEX

Predicting the future of the AEX is inherently complex, but analyzing short-term and long-term outlooks is crucial.

Short-Term Outlook

The immediate outlook for the AEX depends on various factors, including:

- Global Economic Developments: Any positive developments in global economic conditions, such as easing inflation or a resolution to geopolitical tensions, could boost investor confidence.

- Government Interventions: The effectiveness of government measures to support the economy will significantly influence the AEX's short-term trajectory.

- Earnings Reports: Forthcoming earnings reports from key Dutch companies will provide valuable insights into the health of various sectors and inform investor decisions.

Long-Term Implications

The long-term impact of this stock market drop will depend on several factors:

- Global Economic Recovery: A robust global economic recovery would positively influence the AEX's long-term prospects.

- Structural Reforms: The implementation of structural reforms within the Dutch economy to enhance competitiveness and productivity could also play a crucial role.

- Technological Advancements: Adaptability to technological advancements and innovation will be vital for Dutch companies to navigate the evolving global landscape.

Conclusion

The 11% drop in the Amsterdam Stock Exchange over three days represents a significant event with far-reaching consequences for the Dutch economy. The decline stems from a combination of global economic uncertainties, sector-specific challenges, and amplified investor anxieties. The impact on businesses, consumers, and the government necessitates a robust and coordinated response to mitigate the negative consequences. It highlights the interconnectedness of global markets and the importance of understanding market volatility. Keep a close eye on the Amsterdam Stock Exchange and its performance to make informed decisions regarding investments and economic trends. Stay informed through reputable financial news sources and consult with financial advisors for personalized guidance on navigating this volatile period.

Featured Posts

-

Avrupa Borsalari Ecb Faiz Karari Sonrasi Piyasa Hareketleri

May 25, 2025

Avrupa Borsalari Ecb Faiz Karari Sonrasi Piyasa Hareketleri

May 25, 2025 -

Piazza Affari Oggi Fed Banche E Prospettive

May 25, 2025

Piazza Affari Oggi Fed Banche E Prospettive

May 25, 2025 -

Lauryn Goodman Explains Shocking Italy Move Following Kyle Walker Transfer

May 25, 2025

Lauryn Goodman Explains Shocking Italy Move Following Kyle Walker Transfer

May 25, 2025 -

Porsche Classic Art Week Indonesia 2025 Seni And Otomotif Bersatu

May 25, 2025

Porsche Classic Art Week Indonesia 2025 Seni And Otomotif Bersatu

May 25, 2025 -

Buffetts Apple Stake Impact Of Trump Era Tariffs

May 25, 2025

Buffetts Apple Stake Impact Of Trump Era Tariffs

May 25, 2025

Latest Posts

-

Elon Musks Outbursts A Boon Or Bane For Tesla

May 25, 2025

Elon Musks Outbursts A Boon Or Bane For Tesla

May 25, 2025 -

Microsoft Activision Deal Ftcs Appeal Throws Future Into Doubt

May 25, 2025

Microsoft Activision Deal Ftcs Appeal Throws Future Into Doubt

May 25, 2025 -

Rio Tinto Responds To Andrew Forrests Pilbara Concerns

May 25, 2025

Rio Tinto Responds To Andrew Forrests Pilbara Concerns

May 25, 2025 -

The China Conundrum Automotive Brands Facing Headwinds

May 25, 2025

The China Conundrum Automotive Brands Facing Headwinds

May 25, 2025 -

Uk Inflation Slowdown Impact On Pound And Boe Rate Cut Expectations

May 25, 2025

Uk Inflation Slowdown Impact On Pound And Boe Rate Cut Expectations

May 25, 2025