Ace The Private Credit Job Hunt: 5 Dos And Don'ts For Success

Table of Contents

DO: Tailor Your Resume and Cover Letter to Each Private Credit Role

Your resume and cover letter are your first impression – make it count! Generic applications rarely succeed in the competitive private credit job market.

Highlight Relevant Skills and Experience:

- Focus on transferable skills: Private credit roles demand specific expertise. Highlight skills like financial modeling, due diligence, credit analysis, leveraged finance, portfolio management, and loan structuring. Quantify your achievements whenever possible. For example, instead of saying "Managed a portfolio," say "Managed a $50 million portfolio, resulting in a 12% increase in annual returns."

- Keyword optimization: Carefully review job descriptions for keywords and incorporate them naturally into your resume and cover letter. Tools like Applicant Tracking Systems (ATS) scan for these keywords, so using them strategically is crucial.

- Software proficiency: Showcase your experience with industry-standard software such as Bloomberg Terminal, Argus, and Capital IQ. Mention specific functionalities you're proficient in.

Craft a Compelling Cover Letter:

- Personalize your approach: Generic cover letters are easily spotted. Each letter should demonstrate a deep understanding of the specific company's investment strategy, recent deals, and overall culture. Mention specific projects or team members that resonate with you.

- Show, don't tell: Instead of simply stating your skills, provide concrete examples of how you've applied them successfully in past roles. This allows you to directly connect your experience with the requirements of the specific private credit job.

- Demonstrate market knowledge: Show your awareness of current trends and challenges within the private credit market. Mention recent industry news or regulatory changes to demonstrate your engagement with the field.

DO: Network Strategically Within the Private Credit Industry

Networking is paramount in the private credit space. Building relationships can lead to unadvertised opportunities and valuable insights.

Attend Industry Events:

- Targeted networking: Conferences, seminars, and workshops focused on private credit, alternative investments, or leveraged finance are excellent avenues for meeting professionals. Prepare insightful questions to initiate engaging conversations.

- Information gathering: Actively listen to learn about different roles, company cultures, and current market trends. This information is invaluable in tailoring your job search strategy.

Leverage LinkedIn:

- Strategic connections: Connect with professionals working in private credit roles at firms you admire. Engage with their posts and share relevant industry articles to build relationships.

- Group participation: Join relevant LinkedIn groups and participate in discussions. Sharing your expertise and engaging with others showcases your knowledge and builds your professional network.

- Informational interviews: Don't hesitate to reach out to individuals for informational interviews. These conversations can provide invaluable insights and potentially lead to job opportunities.

DO: Prepare Thoroughly for Private Credit Interviews

Thorough preparation significantly increases your chances of success. Private credit interviews often involve both behavioral and technical questions.

Research the Firm and Interviewers:

- Deep dive: Go beyond the company website. Research the firm's investment strategy, recent deals, key personnel, and culture. Understand their competitive landscape and market positioning.

- Interviewer research: Look up the interviewers on LinkedIn to understand their background and experience. This allows you to tailor your responses and ask more relevant questions.

Practice Behavioral and Technical Questions:

- Behavioral preparedness: Prepare answers to common behavioral questions using the STAR method (Situation, Task, Action, Result). Practice articulating your experiences concisely and powerfully.

- Technical expertise: Expect technical questions related to financial modeling, valuation (DCF, LBO), credit analysis (covenant analysis, credit metrics), and industry knowledge. Practice your responses with case studies and examples.

Prepare Questions to Ask:

- Show your engagement: Asking insightful questions about the firm's investment strategy, team dynamics, or future plans demonstrates your genuine interest and initiative. Avoid questions easily answered on the company website.

DON'T: Neglect Your Online Presence

Your online presence reflects your professionalism and brand. Potential employers often research candidates online.

Update Your LinkedIn Profile:

- Professional profile: Ensure your LinkedIn profile is complete, professional, and up-to-date. Use relevant keywords from private credit job descriptions to improve searchability.

- Showcase your experience: Highlight your relevant skills and accomplishments, using quantifiable results whenever possible.

Be Mindful of Your Social Media:

- Professional image: Review your social media profiles (Facebook, Twitter, Instagram) to ensure they present a professional image. Remove anything that could be considered unprofessional or controversial.

DON'T: Underestimate the Importance of Due Diligence

Researching potential employers is just as important as them researching you.

Research Potential Employers Thoroughly:

- Go beyond the surface: Thoroughly investigate the firm's investment strategy, portfolio composition, and reputation within the private credit industry. Look for news articles, industry rankings, and any potential red flags.

- Assess their culture: Research employee reviews on sites like Glassdoor to understand the company culture and employee satisfaction.

Prepare Questions about the Role and Company Culture:

- Demonstrate genuine interest: Prepare thoughtful questions about the role's responsibilities, team dynamics, and the company's long-term goals. This shows you're serious and engaged.

Conclusion

Securing a position in private credit requires diligent preparation and strategic networking. By following these dos and don'ts, you'll significantly improve your chances of acing your private credit job hunt. Remember to tailor your application materials, network effectively, and thoroughly prepare for interviews. Don't underestimate the power of a strong online presence and due diligence in researching potential employers. Start your successful private credit job hunt today!

Featured Posts

-

Reddit Goes Dark Global Service Interruption Affecting Users

May 17, 2025

Reddit Goes Dark Global Service Interruption Affecting Users

May 17, 2025 -

How Late Student Loan Payments Impact Your Credit

May 17, 2025

How Late Student Loan Payments Impact Your Credit

May 17, 2025 -

Ukraina Pod Massirovannoy Atakoy Rossiya Vypustila Bolee 200 Raket I Bespilotnikov

May 17, 2025

Ukraina Pod Massirovannoy Atakoy Rossiya Vypustila Bolee 200 Raket I Bespilotnikov

May 17, 2025 -

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025 -

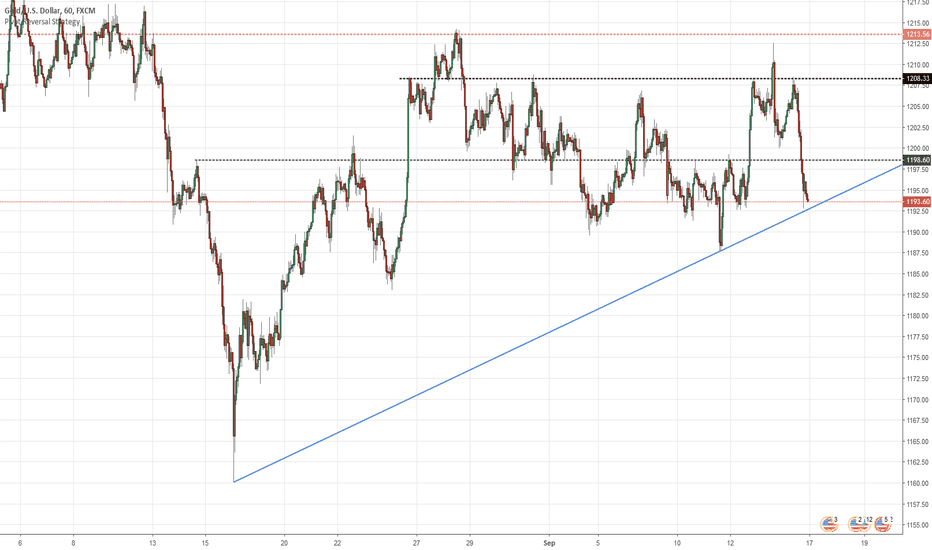

Xauusd Gold Price Recovery Us Economic Data And Rate Cut Speculation

May 17, 2025

Xauusd Gold Price Recovery Us Economic Data And Rate Cut Speculation

May 17, 2025