Amsterdam Exchange Plunges: 11% Drop Since Wednesday Marks Third Straight Loss

Table of Contents

Factors Contributing to the Amsterdam Exchange Plunge

The severity of the Amsterdam Exchange plunge is a result of a confluence of factors, both global and domestic. Understanding these contributing elements is crucial for comprehending the current market volatility.

Global Market Volatility

The current instability in the Amsterdam stock market is inextricably linked to broader global economic anxieties. Rising inflation rates in many countries, coupled with aggressive interest rate hikes by central banks attempting to curb inflation, have created a climate of uncertainty. This uncertainty, combined with lingering geopolitical instability stemming from the ongoing war in Ukraine and other international tensions, is significantly impacting investor confidence worldwide, leading to a sell-off in various markets including Amsterdam.

- Specific Global Events: The recent downgrade of several national credit ratings and escalating energy prices have further fueled market volatility.

- Data Points: The S&P 500 experienced a similar, albeit less severe, decline in the same period, falling by 5%. The FTSE 100 also saw a noticeable drop of 7%. These correlated declines suggest a global trend rather than an isolated Amsterdam problem.

Sector-Specific Weakness

The Amsterdam Exchange plunge isn't affecting all sectors equally. Certain industries within the Dutch economy are experiencing disproportionately negative impacts.

- Underperforming Sectors: The technology and energy sectors have been particularly hard hit, reflecting global trends. The technology sector is facing challenges related to slowing growth and increased regulation, while energy companies are grappling with fluctuating prices and supply chain disruptions.

- Data Points: The technology sector within the Amsterdam exchange has seen a 15% drop, while the energy sector has fallen by 12%. This sector-specific weakness contributes significantly to the overall Amsterdam Exchange plunge.

Investor Sentiment and Confidence

Declining investor confidence is a key driver of the current market downturn. Negative news reports, concerning analyst predictions, and the general uncertainty surrounding the global economic outlook are prompting investors to reduce their risk exposure by selling off assets.

- Factors Influencing Investor Sentiment: The ongoing inflation crisis, fears of a recession, and geopolitical tensions are all major factors eroding investor confidence.

- Data Points: Trading volume on the Amsterdam exchange has increased significantly, suggesting a large-scale sell-off driven by nervous investors rushing to liquidate their positions.

Consequences of the Amsterdam Exchange Plunge

The ramifications of the Amsterdam Exchange plunge extend beyond the immediate market decline. The ripple effects have the potential to significantly impact the Dutch economy and influence international market dynamics.

Impact on the Dutch Economy

The substantial decline in the Amsterdam exchange directly impacts the Dutch economy. A prolonged downturn could lead to several negative consequences.

- Potential Negative Impacts: Reduced investment in Dutch businesses, potential job losses, and decreased consumer spending are all plausible outcomes of the current market situation.

- Data Points: Preliminary economic forecasts suggest a potential reduction in GDP growth for the Netherlands in the coming quarters.

International Market Reactions

The Amsterdam exchange’s plunge isn't isolated; it's influencing other European and global markets. The interconnected nature of global finance means that declines in one major market often have cascading effects on others.

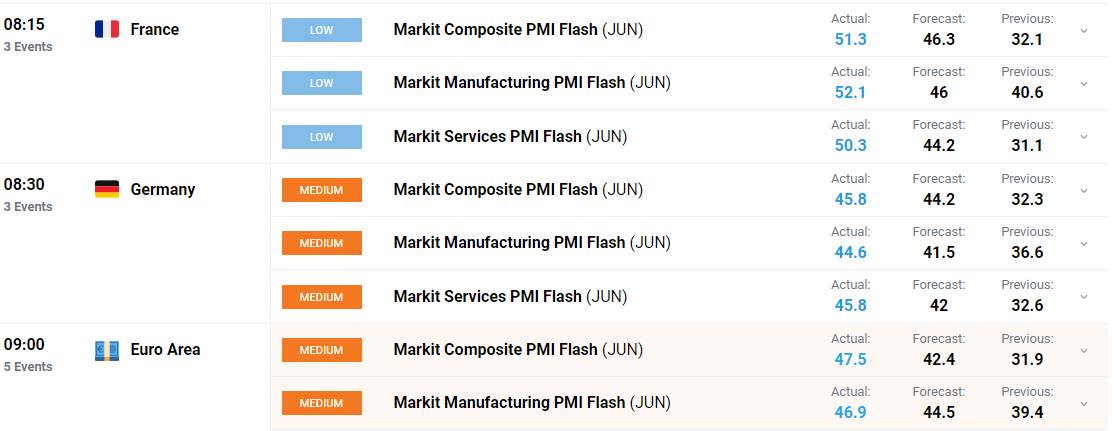

- Correlations with Other Indices: The Amsterdam exchange's decline shows a correlation with other major European indices, indicating a broader trend of market uncertainty across the continent.

- Comparative Performance Data: A comparison of the Amsterdam exchange's performance with other indices like the DAX (Germany) and CAC 40 (France) reveals a similar downward trend, underscoring the wider market concerns.

Government Response and Potential Intervention

The Dutch government is likely to monitor the situation closely and may consider intervention to mitigate the negative consequences. The nature and extent of this intervention remain to be seen.

- Possible Policy Interventions: The government might implement fiscal stimulus measures or provide financial support to affected industries.

- Data Points: The Dutch government has yet to announce any specific policy interventions, but statements from officials suggest a close watch on the situation.

Conclusion

The 11% drop in the Amsterdam exchange over three consecutive days represents a significant event with far-reaching consequences. The Amsterdam Exchange plunge is driven by a complex interplay of global market volatility, sector-specific weakness, and declining investor sentiment. The potential impacts on the Dutch economy and international markets are substantial, necessitating close monitoring and potentially proactive government intervention.

Call to Action: Stay informed on the evolving situation surrounding the Amsterdam Exchange plunge. Continue to monitor market trends and consult financial experts for advice before making any investment decisions related to the Amsterdam Exchange or similar markets. Understanding the Amsterdam Exchange plunge and its implications is crucial for navigating the current market uncertainty.

Featured Posts

-

7 Drop In Amsterdam Stock Market Trade War Fears Fuel Market Volatility

May 25, 2025

7 Drop In Amsterdam Stock Market Trade War Fears Fuel Market Volatility

May 25, 2025 -

Dow Joness Measured Rise Pmi Data Provides Support

May 25, 2025

Dow Joness Measured Rise Pmi Data Provides Support

May 25, 2025 -

17 Celebrities Who Destroyed Their Careers Overnight

May 25, 2025

17 Celebrities Who Destroyed Their Careers Overnight

May 25, 2025 -

Mia Farrows Career Revival Is Ronan Farrow The Key

May 25, 2025

Mia Farrows Career Revival Is Ronan Farrow The Key

May 25, 2025 -

Faiz Indirimi Sonrasi Avrupa Borsalari Analizi

May 25, 2025

Faiz Indirimi Sonrasi Avrupa Borsalari Analizi

May 25, 2025

Latest Posts

-

Analyzing Thames Waters Executive Bonus Scheme

May 25, 2025

Analyzing Thames Waters Executive Bonus Scheme

May 25, 2025 -

The Problem With Thames Waters Executive Bonuses

May 25, 2025

The Problem With Thames Waters Executive Bonuses

May 25, 2025 -

Thames Waters Executive Pay Performance Vs Reward

May 25, 2025

Thames Waters Executive Pay Performance Vs Reward

May 25, 2025 -

Thames Water Executive Compensation A Public Outcry

May 25, 2025

Thames Water Executive Compensation A Public Outcry

May 25, 2025 -

The Thames Water Executive Bonus Scandal An Examination Of The Facts

May 25, 2025

The Thames Water Executive Bonus Scandal An Examination Of The Facts

May 25, 2025