Amsterdam Exchange Plunges 7% On Opening: Trade War Concerns

Table of Contents

The Immediate Impact of the 7% Drop on the Amsterdam Exchange

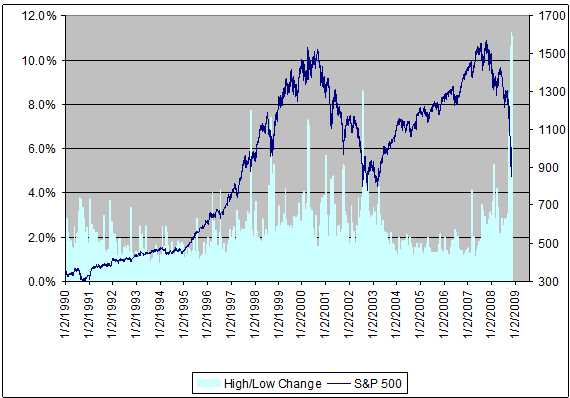

The market's reaction to the opening plunge was swift and severe. Panic selling ensued, leading to a significant decrease in trading volume as investors grappled with uncertainty. The initial drop triggered a ripple effect, impacting various sectors and leading to widespread concern among market participants.

- Specific examples of stocks heavily affected: Shares in major Dutch companies heavily reliant on international trade, such as those in the agricultural and technology sectors, experienced particularly sharp declines. For example, [Insert example of a Dutch company and its stock performance].

- Impact on investor confidence and trading volume: Investor confidence plummeted, resulting in a significant decrease in trading volume as investors adopted a wait-and-see approach. Many opted to withdraw from the market, exacerbating the downward trend.

- Short-term predictions based on the initial drop: Analysts predict continued volatility in the short term, with further downward pressure possible depending on the evolution of trade negotiations and global market sentiment.

- Mention any immediate government or regulatory responses: The Dutch government issued a statement acknowledging the market's concerns and emphasizing its commitment to supporting the national economy through this period of uncertainty. Regulatory bodies are monitoring the situation closely to prevent any market manipulation.

Trade War Concerns as the Primary Catalyst

The link between rising trade tensions and the Amsterdam Exchange's fall is undeniable. Escalating trade disputes, particularly those involving major global economies, create uncertainty and negatively impact investor confidence. This uncertainty directly translates to decreased investment and market volatility.

- Specific trade policies or events triggering the concern: The recent [mention specific trade policy or event, e.g., imposition of tariffs on Dutch agricultural products by a major trading partner] significantly contributed to the downturn. The threat of further trade restrictions fueled investor anxiety.

- How these policies directly affect Dutch businesses and the exchange: Dutch businesses reliant on exports are particularly vulnerable to trade wars. Increased tariffs and trade barriers reduce their competitiveness in international markets, directly impacting profitability and stock prices.

- Analysis of the vulnerability of the Dutch economy to global trade disputes: The Dutch economy, with its strong reliance on international trade, is highly susceptible to global trade disputes. The current situation underscores the need for diversification and resilience-building strategies.

- Mention specific sectors in the Netherlands most affected by the trade war: The agricultural sector, known for its significant exports, is among the most directly affected, along with the technology and manufacturing sectors which rely heavily on global supply chains.

Impact of Global Market Volatility on the Amsterdam Exchange

The Amsterdam Exchange's drop is not an isolated incident. Global market volatility, fueled by broader economic concerns and trade war anxieties, played a significant role in the decline. The interconnectedness of global financial markets means that events in one region can rapidly impact others.

- Mention the performance of other major global stock exchanges: Major stock exchanges worldwide experienced similar, although perhaps less severe, declines, highlighting the widespread impact of trade war concerns.

- Explain the interconnectedness of global markets and the ripple effect: The global nature of financial markets means that events in one region quickly spread to others. Negative news from one market can trigger a sell-off in others, creating a ripple effect.

- Discuss the role of investor sentiment and speculation in the decline: Investor sentiment plays a crucial role in market movements. Negative news and uncertainty tend to fuel speculative selling, exacerbating market declines.

Potential Long-Term Consequences for the Amsterdam Exchange and the Dutch Economy

The 7% plunge on the Amsterdam Exchange and the underlying trade war concerns could have significant long-term consequences for both the exchange and the Dutch economy. The full impact will depend on the resolution of trade disputes and the effectiveness of government responses.

- Long-term economic forecasts for the Netherlands: Economists predict slower economic growth for the Netherlands in the short to medium term, with the potential for a more significant impact if trade tensions persist.

- Possible government interventions to mitigate the impact: The Dutch government may implement fiscal and monetary policies to stimulate the economy and mitigate the negative impact of the trade war.

- The potential for shifts in investment strategies and foreign direct investment: Uncertainty created by the trade war could lead to shifts in investment strategies, potentially deterring foreign direct investment.

- The implications for job security and economic growth: Prolonged trade disputes could threaten job security and hinder economic growth, particularly in export-oriented sectors.

Conclusion

The 7% plunge in the Amsterdam Exchange is a stark reminder of the significant impact trade wars can have on global markets. The interplay between trade war anxieties, global market volatility, and investor sentiment led to this dramatic decline. Understanding these interconnected factors is crucial for navigating the current economic climate. Staying informed about the evolving situation on the Amsterdam Exchange and the impact of escalating trade wars is paramount. Continue to monitor the Amsterdam Exchange and global market trends for further updates on this developing story. Understanding the implications of trade wars on the Amsterdam Exchange is crucial for informed investment decisions.

Featured Posts

-

40 Svadeb Na Kharkovschine Kakaya Data Stala Rekordnoy Foto

May 24, 2025

40 Svadeb Na Kharkovschine Kakaya Data Stala Rekordnoy Foto

May 24, 2025 -

Escape To The Country A Step By Step Relocation Guide

May 24, 2025

Escape To The Country A Step By Step Relocation Guide

May 24, 2025 -

Steady Start For Frankfurt Dax Following Record Breaking Performance

May 24, 2025

Steady Start For Frankfurt Dax Following Record Breaking Performance

May 24, 2025 -

Kak Khorosho Vy Znaete Olega Basilashvili Test Na Znanie Ego Roley

May 24, 2025

Kak Khorosho Vy Znaete Olega Basilashvili Test Na Znanie Ego Roley

May 24, 2025 -

Annual General Meeting Of Philips Shareholders Key Announcements And Updates

May 24, 2025

Annual General Meeting Of Philips Shareholders Key Announcements And Updates

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025