Amsterdam Stock Market Freefall: 7% Opening Plunge Due To Trade War Fears

Table of Contents

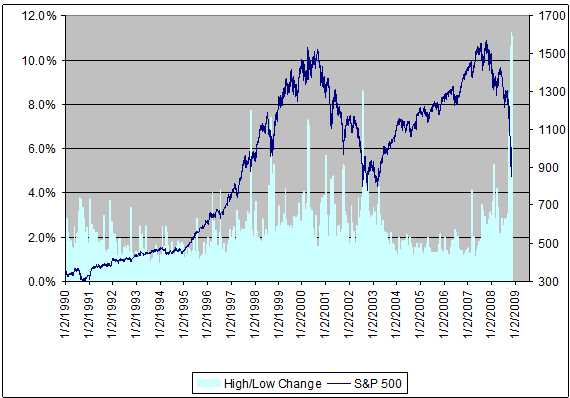

The 7% Plunge: A Detailed Analysis of the Amsterdam Stock Exchange Crash

Magnitude and Impact

The sheer scale of the 7% drop in the AEX index represents a significant event, far exceeding typical daily fluctuations. This Amsterdam Stock Market crash marks one of the most substantial single-day declines in recent history. The impact was widespread, affecting various sectors and individual stocks.

- Affected Sectors: The technology, finance, and export-oriented sectors were particularly hard hit, experiencing disproportionately large declines.

- Notable Stock Declines: Several blue-chip companies within the AEX saw double-digit percentage drops in their share prices, reflecting widespread panic selling.

- Trading Volume Changes: Trading volume surged dramatically, indicating heightened investor activity and a rush to liquidate positions.

Compared to historical market crashes, such as the 1987 Black Monday or the 2008 global financial crisis, while not reaching those levels of severity, the speed and magnitude of this decline are noteworthy and warrant serious consideration of the underlying issues within the Amsterdam Stock Market.

Timing and Correlation with Global Events

The timing of the crash is highly correlated with recent escalations in the global trade war. Several key events likely contributed to the downturn:

- New Tariffs: The imposition of new tariffs on key Dutch exports by major trading partners created significant uncertainty and negatively impacted investor sentiment.

- Retaliatory Measures: Retaliatory measures from the Netherlands and other affected countries further exacerbated the situation, creating a sense of escalating conflict and potential economic damage.

- Statements from Global Economic Organizations: Warnings from the IMF and other international organizations regarding the negative global economic impacts of the trade war likely fueled investor fears.

This clear causal link between escalating trade war uncertainty and the subsequent investor panic selling drove the sharp decline in the Amsterdam Stock Market.

Underlying Causes Beyond Trade War Fears

Investor Sentiment and Confidence

Trade war fears significantly impacted investor sentiment and confidence, leading to a dramatic sell-off.

- Negative News and Uncertainty: The constant barrage of negative news regarding the trade war fostered uncertainty, prompting risk-averse investors to liquidate their holdings.

- Analyst Predictions: Negative predictions from financial analysts and economic forecasters further contributed to the overall pessimistic outlook and amplified the sell-off.

This situation illustrates the concept of market contagion, where fear and uncertainty spread rapidly through the market, triggering widespread panic selling.

Other Contributing Factors

While trade war fears were the primary driver, other factors may have exacerbated the situation:

- Geopolitical Instability: Broader geopolitical instability in other regions of the world may have added to overall investor anxiety.

- Internal Dutch Economic Issues: Concerns about specific aspects of the Dutch economy might have contributed to the negative sentiment, although these issues likely played a secondary role compared to trade war fears.

The combined effect of these factors created a perfect storm that led to the significant decline in the Amsterdam Stock Market.

Consequences and Future Outlook for the Amsterdam Stock Market

Immediate Economic Impacts

The short-term consequences for the Dutch economy are significant:

- Job Losses: Companies in affected sectors may face pressure to reduce costs, potentially leading to job losses.

- Reduced Consumer Spending: The market downturn could lead to reduced consumer confidence and spending, slowing overall economic growth.

- Government Responses: The Dutch government may implement measures to mitigate the economic impact, such as tax cuts or investment incentives.

The potential economic damage from this Amsterdam Stock Market crash needs careful assessment and monitoring.

Long-Term Implications and Recovery Prospects

The long-term outlook depends on several factors:

- Resolution of Trade Disputes: A resolution of the trade war would significantly boost investor confidence and facilitate market recovery.

- Government Policies: Effective government policies and international cooperation could mitigate the negative impacts and accelerate recovery.

- Global Economic Conditions: The overall global economic climate will also influence the speed and extent of recovery.

Expert forecasts vary, but a cautious optimism prevails, provided that trade tensions ease and supportive government policies are implemented.

Conclusion

The dramatic 7% plunge in the Amsterdam Stock Market underscores the significant impact of escalating trade war fears on global financial markets. This Amsterdam Stock Market crash highlights the inherent risks associated with investment in times of economic uncertainty. Understanding the complexities of global trade and its influence on market volatility is crucial for investors. Stay informed about developments in the Amsterdam Stock Market and global trade to manage your investment portfolio effectively. Learn more about mitigating risks in volatile markets and continue to follow the latest updates on the Amsterdam Stock Market.

Featured Posts

-

Escape To The Country Choosing The Right Rural Property For You

May 24, 2025

Escape To The Country Choosing The Right Rural Property For You

May 24, 2025 -

Memorial Day 2025 Flight Bookings When To Fly For Lower Prices And Fewer Crowds

May 24, 2025

Memorial Day 2025 Flight Bookings When To Fly For Lower Prices And Fewer Crowds

May 24, 2025 -

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025

Ai In Healthcare Key Findings From The Philips Future Health Index 2025

May 24, 2025 -

Kyle Walker Peters Transfer Leeds Make Contact

May 24, 2025

Kyle Walker Peters Transfer Leeds Make Contact

May 24, 2025 -

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025

Latest Posts

-

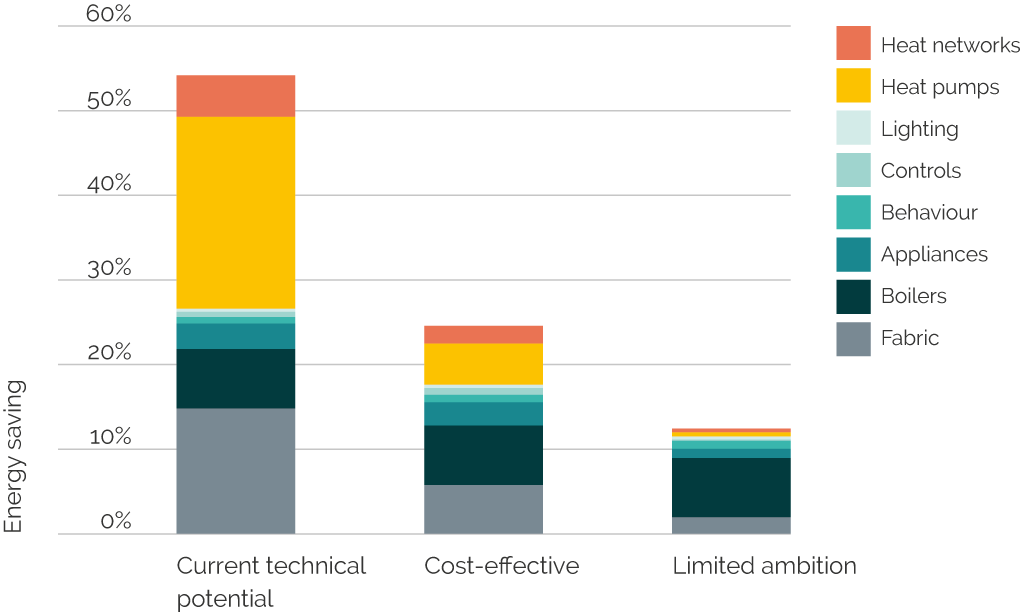

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025