Amsterdam Stock Market Opens 7% Lower: Trade War Anxiety

Table of Contents

Impact of the US-China Trade War on the Amsterdam Stock Market

The US-China trade war's impact on the Amsterdam Stock Market is multifaceted, affecting both directly and indirectly exposed sectors and businesses.

Direct Exposure:

Dutch companies with direct trade links to either China or the US are experiencing the brunt of the trade war's consequences. This includes:

- Technology sector: Companies involved in exporting semiconductor equipment or software to China are facing significant challenges due to imposed tariffs and trade restrictions. Reduced demand from the Chinese market directly impacts their bottom line, leading to stock price decreases.

- Agricultural sector: Dutch agricultural exports to China, including dairy products and flowers, are facing increased tariffs, leading to reduced competitiveness and impacting the profitability of involved companies.

- Manufacturing sector: Companies reliant on importing raw materials from China or exporting finished goods to the US are experiencing supply chain disruptions and increased costs, negatively influencing their stock performance. For example, [mention a specific company and its stock performance, if available].

Keywords: direct investment, export dependence, import tariffs, supply chain disruptions

Indirect Impact:

Beyond the direct impact, the broader Dutch economy is feeling the ripple effects of global trade uncertainty.

- Investor sentiment: The ongoing trade war creates significant uncertainty, negatively impacting investor confidence and leading to a flight to safety. This results in decreased investment in the Amsterdam Stock Market, driving down stock prices.

- Market confidence: The overall feeling of instability and unpredictability surrounding global trade decreases market confidence, making investors more hesitant to invest, further contributing to the market decline.

- Decreased consumption: Uncertainty about future economic prospects can lead to decreased consumer spending and business investment, creating a negative feedback loop affecting overall economic growth and impacting the stock market.

Keywords: investor sentiment, market confidence, global economic slowdown, decreased consumption

Analyzing the 7% Drop: Reasons Beyond Trade War Concerns

While the trade war is a significant factor, the 7% drop in the Amsterdam Stock Market likely stems from a combination of contributing elements.

Other Contributing Factors:

- Geopolitical risks: Global political instability in other regions can influence investor sentiment and lead to capital flight from emerging markets, indirectly affecting the Amsterdam Stock Market.

- Interest rate changes: Monetary policy decisions by central banks, both domestically and internationally, can significantly influence market conditions and investor behavior.

- Market speculation: Speculative trading and herd behavior can amplify market reactions to existing negative news, leading to more significant drops than might otherwise be expected.

Keywords: market sentiment, speculation, macroeconomic factors, geopolitical risks

Technical Analysis:

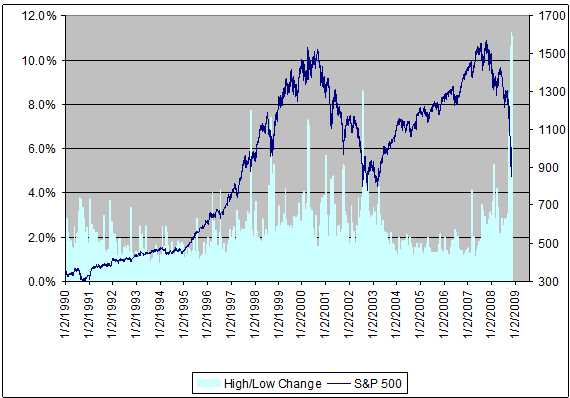

While a detailed technical analysis requires expert knowledge, certain indicators may have contributed to the decline. [If applicable, mention specific chart patterns, trading volume, or other technical indicators observed. Include links to reputable financial charts if possible].

Keywords: technical indicators, chart patterns, trading volume, market trends

Potential Future Implications for the Amsterdam Stock Market

The future implications of this market downturn are complex and depend on various factors.

Short-Term Outlook:

- Market recovery: The speed of market recovery will depend on several elements, including the resolution (or escalation) of the trade war, investor confidence, and any government interventions.

- Volatility prediction: High volatility is expected in the short term, as investors react to ongoing news and developments. A further decline is possible, depending on the unfolding situation.

- Government intervention: The Dutch government may implement measures to support the economy and boost investor confidence, potentially influencing the short-term market trajectory.

Keywords: market recovery, volatility prediction, government intervention, short-term forecast

Long-Term Consequences:

- Structural changes in global trade: The trade war could lead to structural shifts in global trade patterns, potentially creating new opportunities and challenges for Dutch businesses.

- Economic adaptation: The Dutch economy's ability to adapt to these changes will significantly impact its long-term growth trajectory.

- Business resilience: The success of Dutch businesses in navigating these challenges will depend on their adaptability, innovation, and diversification strategies.

Keywords: long-term economic impact, structural changes, economic adaptation, business resilience

Conclusion: Navigating the Amsterdam Stock Market's Volatility

The 7% drop in the Amsterdam Stock Market highlights the significant impact of the US-China trade war and other contributing factors on investor sentiment and market stability. Both short-term volatility and potential long-term structural changes in the global economy pose challenges for investors and the Dutch economy. It's crucial to stay informed about Amsterdam Stock Market developments and to seek professional financial advice before making any investment decisions during this period of high trade war uncertainty. For further updates and analysis, consult reputable financial news sources such as [list reputable financial news sources]. Understanding the intricacies of the Amsterdam Stock Exchange and its relationship with global trade is critical for navigating the current volatility and making informed investment choices.

Featured Posts

-

September Gucci Reveal Kering Reports Lower Sales Figures

May 24, 2025

September Gucci Reveal Kering Reports Lower Sales Figures

May 24, 2025 -

Ferrari 296 Speciale Novo Hibrido De 880 Cv Chega Ao Mercado

May 24, 2025

Ferrari 296 Speciale Novo Hibrido De 880 Cv Chega Ao Mercado

May 24, 2025 -

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Demnas Gucci Designs Kering Announces Sales Decrease And September Launch Date

May 24, 2025

Demnas Gucci Designs Kering Announces Sales Decrease And September Launch Date

May 24, 2025 -

Rekordnoe Kolichestvo Svadeb Na Kharkovschine Krasivaya Data Sobrala 89 Par

May 24, 2025

Rekordnoe Kolichestvo Svadeb Na Kharkovschine Krasivaya Data Sobrala 89 Par

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025