Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Defining NAV:

The Net Asset Value (NAV) of an ETF, like the Amundi DJIA UCITS ETF, is essentially the value of its underlying assets per share. Think of it as the net worth of the ETF, calculated on a per-share basis.

- NAV reflects the true market value of the ETF's holdings. It represents the total value of all the stocks within the ETF, minus any liabilities.

- Daily NAV calculations provide transparency to investors. This daily update allows investors to track the performance of their investment accurately.

- NAV fluctuations show the ETF’s performance relative to the DJIA. By comparing the NAV changes to the DJIA's movement, you can assess how effectively the ETF is tracking the index.

- Understanding NAV helps in comparing ETF performance with other investments. NAV provides a standardized metric for comparing the performance of different ETFs or other investment vehicles.

Explanation: The NAV is calculated by taking the total market value of all the assets held by the ETF, subtracting any liabilities (such as expenses), and then dividing the result by the total number of outstanding shares. This gives you the NAV per share. It's important to note the difference between NAV and market price. While the market price fluctuates throughout the trading day, the NAV is usually calculated at the end of the trading day, providing a more accurate reflection of the underlying asset values.

How is the Amundi DJIA UCITS ETF NAV Calculated?

The Role of the DJIA:

The Amundi DJIA UCITS ETF is designed to track the Dow Jones Industrial Average (DJIA). This means its portfolio aims to mirror the composition and weighting of the DJIA. This direct link to the DJIA significantly influences the ETF's NAV.

- Daily rebalancing to maintain alignment with the DJIA. The ETF's managers regularly adjust the portfolio to keep it closely aligned with the DJIA's composition, ensuring accurate index tracking.

- Impact of changes in DJIA component weights on the ETF NAV. If the weighting of a particular stock in the DJIA changes, the ETF's NAV will reflect this adjustment.

- Dividend distributions and their effect on NAV. When companies within the DJIA pay dividends, these dividends are passed on to the ETF's investors, which subsequently affects the NAV.

- Expense ratio and its effect on the NAV. The ETF's expense ratio (the annual fee charged to manage the fund) slightly reduces the NAV over time.

Explanation: The daily NAV calculation involves valuing each asset in the ETF's portfolio at its closing market price. These values are summed, liabilities are deducted, and the result is divided by the number of outstanding shares. This process considers dividends received, any capital gains or losses, and the expense ratio, ultimately providing a daily updated NAV that reflects the ETF's performance.

Accessing and Interpreting Amundi DJIA UCITS ETF NAV Data

Sources of NAV Information:

Investors can find the daily NAV for the Amundi DJIA UCITS ETF from several reputable sources:

- Regular updates on the ETF provider's website (Amundi). This is the most reliable source for official NAV data.

- Availability through brokerage accounts and financial platforms. Most brokerage accounts and online financial platforms provide real-time or delayed NAV information for ETFs.

- Financial news websites and dedicated financial data providers. Many financial news sources and data providers publish ETF NAV information.

Explanation: Accessing and interpreting NAV data is straightforward. Look for daily updates, usually available at the close of the market. Pay attention to the time zone specified for the NAV update. Many platforms offer charts and graphs that visually represent the NAV's movement over time, making it easy to track the ETF's performance.

Factors Affecting Amundi DJIA UCITS ETF NAV

Market Fluctuations:

The Amundi DJIA UCITS ETF's NAV is directly influenced by the performance of the DJIA. Any changes in the index's value directly impact the NAV.

- Impact of economic news and events. Positive or negative economic news significantly impacts the DJIA and, consequently, the ETF's NAV.

- Influence of individual company performance within the DJIA. The performance of individual companies within the DJIA contributes to the overall index performance and the ETF's NAV. A strong performance by one component can positively influence the NAV, while poor performance can have the opposite effect.

- Geopolitical factors affecting the market. Global events, geopolitical tensions, and international market dynamics all influence the DJIA and the Amundi DJIA UCITS ETF's NAV.

Explanation: The NAV of this index-tracking ETF is inherently linked to market volatility. Understanding the factors that influence the DJIA is crucial for predicting potential NAV fluctuations and managing investment risk.

Conclusion

Understanding the Amundi DJIA UCITS ETF's Net Asset Value (NAV) is critical for making informed investment decisions. The NAV, calculated daily, reflects the true market value of the ETF's underlying assets and provides transparency into its performance relative to the DJIA. Several factors, including market fluctuations, economic news, individual company performance, and geopolitical events, all influence the ETF's NAV. Regularly monitoring the NAV and understanding its determinants helps investors gauge the ETF's performance and manage risk effectively.

Stay informed about the Amundi DJIA UCITS ETF's NAV and make confident investment choices. Visit [link to Amundi website] for more details on this and other Amundi ETFs.

Featured Posts

-

Porsche Now Labubu Porsche

May 24, 2025

Porsche Now Labubu Porsche

May 24, 2025 -

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025 -

The Impact Of Urban Nature On Mental Health A Seattle Perspective

May 24, 2025

The Impact Of Urban Nature On Mental Health A Seattle Perspective

May 24, 2025 -

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025 -

Your Guide To Getting Tickets For The Bbc Radio 1 Big Weekend

May 24, 2025

Your Guide To Getting Tickets For The Bbc Radio 1 Big Weekend

May 24, 2025

Latest Posts

-

Sharp Decline On Amsterdam Stock Exchange 11 Down In Three Days

May 24, 2025

Sharp Decline On Amsterdam Stock Exchange 11 Down In Three Days

May 24, 2025 -

Amsterdam Exchange Suffers 11 Drop Since Wednesday Three Days Of Losses

May 24, 2025

Amsterdam Exchange Suffers 11 Drop Since Wednesday Three Days Of Losses

May 24, 2025 -

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 24, 2025 -

Legal Battle Amsterdam Residents Sue City Council For Tik Tok Driven Overcrowding At Snack Bar

May 24, 2025

Legal Battle Amsterdam Residents Sue City Council For Tik Tok Driven Overcrowding At Snack Bar

May 24, 2025 -

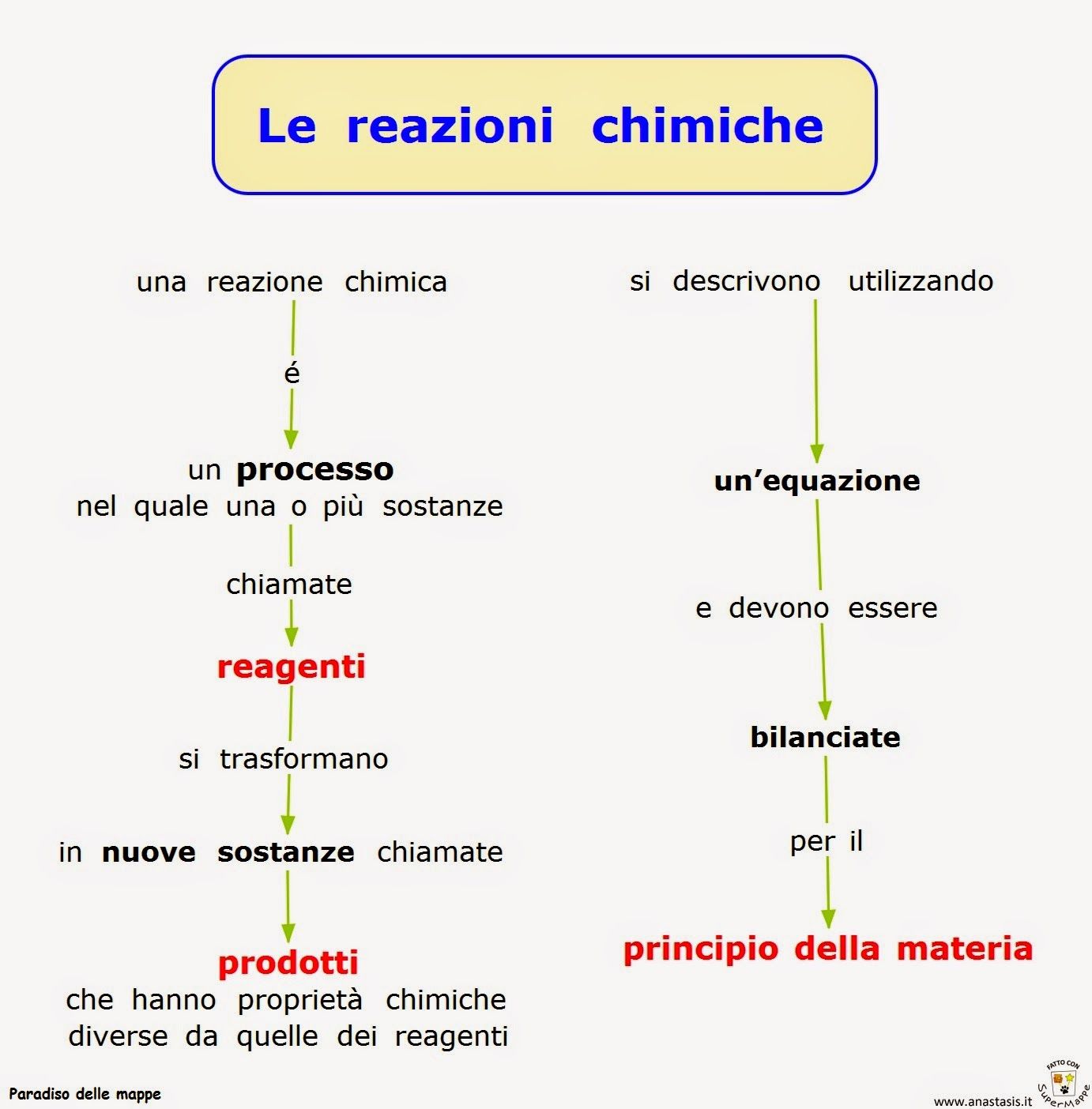

Dazi E Mercati L Impatto Sulle Borse E Le Reazioni Della Ue

May 24, 2025

Dazi E Mercati L Impatto Sulle Borse E Le Reazioni Della Ue

May 24, 2025