Trade War Intensifies: Amsterdam Stock Market Opens Down 7%

Table of Contents

Impact of Escalating Trade Tensions on the Amsterdam Exchange (AEX)

The 7% drop in the Amsterdam Exchange Index (AEX) is a direct consequence of recently escalated trade war events. The imposition of new tariffs on key Dutch exports, coupled with retaliatory measures from other nations, created a perfect storm that severely impacted investor confidence. This situation resulted in a significant sell-off, affecting various sectors within the AEX. Export-oriented industries, particularly technology companies reliant on global supply chains, have been hit the hardest.

- Specific examples of companies experiencing significant losses: Several major Dutch technology firms saw their share prices plummet by double digits, reflecting the immediate impact of disrupted supply chains and reduced export demand. Similarly, companies heavily involved in international trade saw a significant decrease in their value.

- Analysis of trading volume and its relation to the decline: The trading volume surged significantly, indicating a frantic rush by investors to offload their holdings, further exacerbating the decline. High trading volume during a market downturn usually indicates panic selling.

- Mention any government reactions or proposed solutions: The Dutch government has acknowledged the severity of the situation and is reportedly exploring various options to mitigate the impact on the Dutch economy, including exploring trade diversification strategies and potentially offering financial support to affected businesses.

Global Market Reactions and Contagion Effects

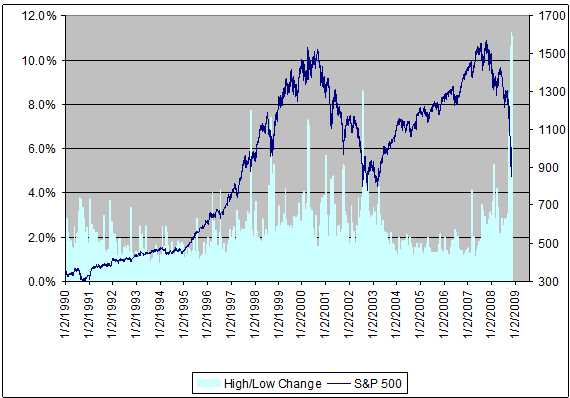

The negative impact of the Amsterdam market's sharp decline wasn't confined to the Netherlands. A ripple effect was immediately felt across European and global markets, demonstrating the interconnected nature of modern finance. The correlation between the AEX's fall and other major indices, such as the DAX (Germany), FTSE (UK), and even the Dow Jones (US), was evident, suggesting a global contagion effect.

- Specific examples of other markets experiencing declines: Following the Amsterdam drop, other European stock markets experienced significant declines, reflecting a broader loss of investor confidence. While the percentage drops varied, the general trend across major markets showed a negative correlation with the AEX.

- Expert opinions on the potential for further global market instability: Financial experts warn that if the trade war continues to escalate, further market instability is highly likely. The interconnected nature of global supply chains means that any significant disruption in one market quickly spreads to others.

- Analysis of investor behavior and flight to safety: Investors reacted to the uncertainty by exhibiting a "flight to safety," shifting their investments towards safer haven assets like government bonds and gold. This further fueled the decline in riskier assets like stocks.

Analysis of Investor Behavior and Future Predictions

The market crash has significantly impacted investor sentiment, forcing a reassessment of investment strategies. Short-term implications include continued volatility and potential further declines, depending on the evolution of the trade war. Long-term implications could include a reshaping of global supply chains and a potential slowdown in economic growth. Speculation and market psychology have undoubtedly played a significant role in amplifying the initial decline.

- Predictions from financial analysts regarding the Amsterdam stock market's recovery: Analysts offer varied predictions, with some suggesting a slow recovery contingent on de-escalation of the trade war, while others anticipate a more prolonged period of uncertainty.

- Discussion of potential investment strategies in the current climate: In this climate of uncertainty, diversification and risk management become paramount. Investors should consider hedging strategies and reassess their risk tolerance.

- Mention the role of uncertainty in shaping investor decisions: Uncertainty surrounding the future trajectory of the trade war is the primary driver of investor behavior, leading to cautious decision-making and a preference for safer assets.

Safe Haven Assets and Alternative Investments

The current market volatility has driven investors toward safe-haven assets, providing a degree of protection against further declines. This includes a surge in demand for government bonds and gold, which are traditionally considered less risky during periods of economic uncertainty. Exploring alternative investments is also gaining traction as a risk mitigation strategy.

- Specific examples of safe-haven assets gaining value: Gold prices typically rise during periods of uncertainty, and this trend has been observed in the wake of the Amsterdam Stock Market decline. Government bonds, perceived as less volatile than stocks, have also seen increased demand.

- Discussion of diversification strategies for investors: Diversification across asset classes, including stocks, bonds, and alternative investments, can help minimize overall portfolio risk.

- Mention of alternative investment classes (e.g., real estate, commodities): Real estate and commodities represent alternative asset classes that can offer some degree of insulation against market volatility.

Conclusion: Navigating the Intensifying Trade War and the Amsterdam Stock Market

The intensifying trade war has dealt a significant blow to the Amsterdam Stock Market, resulting in a dramatic 7% drop and highlighting the global impact of escalating trade tensions. This event underscores the interconnectedness of global markets and the vulnerability of export-oriented economies. While the future remains uncertain, understanding the dynamics of this situation is crucial. To navigate this volatile market effectively, stay informed about the evolving trade war situation and its impact on the Amsterdam Stock Market. Regularly check reputable financial news sources and always seek professional financial advice before making any investment decisions. Consider diversifying your portfolio to mitigate risk in this period of market volatility.

Featured Posts

-

Vervolg Snelle Markt Draai Europese Aandelen Tegenover Wall Street

May 24, 2025

Vervolg Snelle Markt Draai Europese Aandelen Tegenover Wall Street

May 24, 2025 -

Maryland Softball Defeats Delaware 5 4 In Thrilling Contest

May 24, 2025

Maryland Softball Defeats Delaware 5 4 In Thrilling Contest

May 24, 2025 -

Amsterdam City Faces Lawsuit From Residents Due To Tik Tok Influx At Local Snack Bar

May 24, 2025

Amsterdam City Faces Lawsuit From Residents Due To Tik Tok Influx At Local Snack Bar

May 24, 2025 -

One Womans Pandemic Journey The Importance Of Green Spaces In Seattle

May 24, 2025

One Womans Pandemic Journey The Importance Of Green Spaces In Seattle

May 24, 2025 -

The Kyle Walker Annie Kilner And Mystery Women Situation

May 24, 2025

The Kyle Walker Annie Kilner And Mystery Women Situation

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

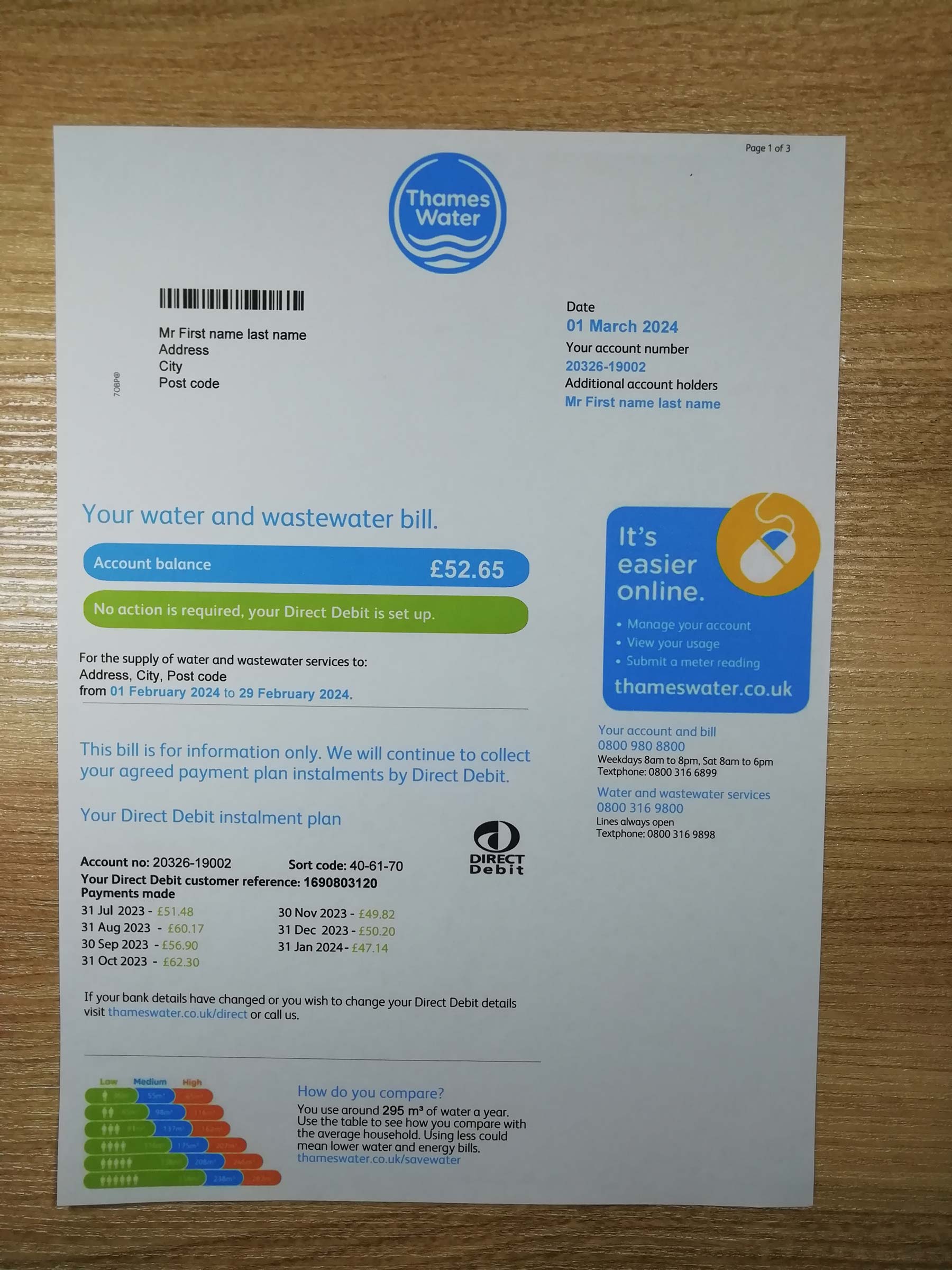

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025