Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Defining NAV:

Net Asset Value (NAV) represents the value of a fund's assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the net worth of the fund per share. For an ETF like the Amundi DJIA UCITS ETF, the NAV reflects the total market value of its holdings in the 30 companies that make up the DJIA, less any expenses or liabilities the fund incurs. This is a key indicator of the fund's intrinsic value.

NAV Calculation for Amundi DJIA UCITS ETF:

The Amundi DJIA UCITS ETF's NAV is calculated daily by taking the market value of all the underlying DJIA stocks held by the fund. This market value is determined by multiplying the number of shares of each stock owned by the fund by its closing price on the relevant exchange. The fund's liabilities, which might include management fees and other operational expenses, are then subtracted from this total asset value. Finally, this net asset value is divided by the total number of outstanding ETF shares to arrive at the NAV per share. This process ensures that the NAV accurately reflects the fund's current worth.

- NAV reflects the true value of the ETF's assets.

- Changes in NAV indicate fund performance. A rising NAV suggests positive performance, while a falling NAV suggests negative performance.

- NAV is used to determine the price at which you can buy or sell ETF shares. While the market price might fluctuate slightly around the NAV, it generally tracks the NAV closely.

- Understanding NAV helps in comparing investment performance with other ETFs tracking similar indices.

Factors Affecting the Amundi DJIA UCITS ETF NAV

Market Fluctuations:

The primary driver of the Amundi DJIA UCITS ETF's NAV is the performance of the Dow Jones Industrial Average itself. If the DJIA rises, the NAV of the ETF will generally rise as well, and vice-versa. Individual stock performance within the DJIA significantly impacts the overall NAV. A strong performance by a major component of the index can positively influence the ETF's NAV, while poor performance from several key stocks can negatively affect it.

Currency Exchange Rates:

While the Amundi DJIA UCITS ETF primarily invests in US dollar-denominated assets, currency fluctuations between the USD and the investor's base currency can still subtly influence the reported NAV in that investor's local currency. This is because the NAV is usually converted into the investor's local currency for reporting purposes.

Expenses and Fees:

The Amundi DJIA UCITS ETF, like any other fund, incurs expenses such as management fees and operational costs. These expenses are deducted from the fund's assets and, therefore, indirectly affect the NAV. While these fees are usually small relative to the overall value of the fund, they are nonetheless a factor that slightly reduces the NAV over time.

- Market volatility is a major driver of NAV fluctuations.

- Individual stock performance within the DJIA affects the overall NAV.

- Dividend distributions from the underlying DJIA companies can slightly decrease the NAV in the short term, as the fund distributes the dividends to its shareholders.

- Knowing these factors allows for better prediction of NAV trends, although precise prediction is impossible due to inherent market uncertainty.

How to Access and Interpret Amundi DJIA UCITS ETF NAV Data

Sources of NAV Information:

You can find the daily NAV of the Amundi DJIA UCITS ETF from several reliable sources:

- The Amundi Website: Amundi, the fund manager, typically publishes the NAV on its official website.

- Financial News Websites: Many reputable financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) will list the NAV for the Amundi DJIA UCITS ETF.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the current NAV will usually be displayed on your brokerage platform.

Interpreting NAV Changes:

Interpreting NAV changes requires considering the time horizon. Short-term fluctuations are normal due to market volatility. However, consistent upward trends over the long term generally suggest positive performance. Compare the NAV changes to the performance of the DJIA itself to gauge how well the ETF is tracking its benchmark index.

- Regularly check the NAV to monitor your investment performance.

- Compare NAV changes to benchmark indices (e.g., the DJIA itself). A good ETF will closely mirror the index’s performance.

- Use historical NAV data to analyze long-term trends and assess the overall success of your investment.

- Understand that short-term fluctuations are normal and don't necessarily indicate a problem.

Conclusion:

Understanding the Net Asset Value of the Amundi DJIA UCITS ETF is crucial for informed investing. By understanding how the NAV is calculated, the factors that influence it, and where to find reliable data, you can effectively track your investment performance and make strategic decisions. Regularly monitor your Amundi DJIA UCITS ETF NAV to stay abreast of your investment's progress and make well-informed choices for your portfolio. Learn more about Amundi DJIA UCITS ETF NAV and track your Amundi DJIA UCITS ETF NAV performance today!

Featured Posts

-

A Seattle Womans Pandemic Refuge Finding Solace In Urban Green Space

May 24, 2025

A Seattle Womans Pandemic Refuge Finding Solace In Urban Green Space

May 24, 2025 -

Ferrari Challenge A High Octane Weekend In South Florida

May 24, 2025

Ferrari Challenge A High Octane Weekend In South Florida

May 24, 2025 -

The Case For News Corp Why Its More Valuable Than The Market Suggests

May 24, 2025

The Case For News Corp Why Its More Valuable Than The Market Suggests

May 24, 2025 -

Picture This Prime Video Every Song Featured In The New Rom Com

May 24, 2025

Picture This Prime Video Every Song Featured In The New Rom Com

May 24, 2025 -

Allt Um Nyju Porsche Macan Rafmagnsutgafuna Upplysingar Og Eiginleikar

May 24, 2025

Allt Um Nyju Porsche Macan Rafmagnsutgafuna Upplysingar Og Eiginleikar

May 24, 2025

Latest Posts

-

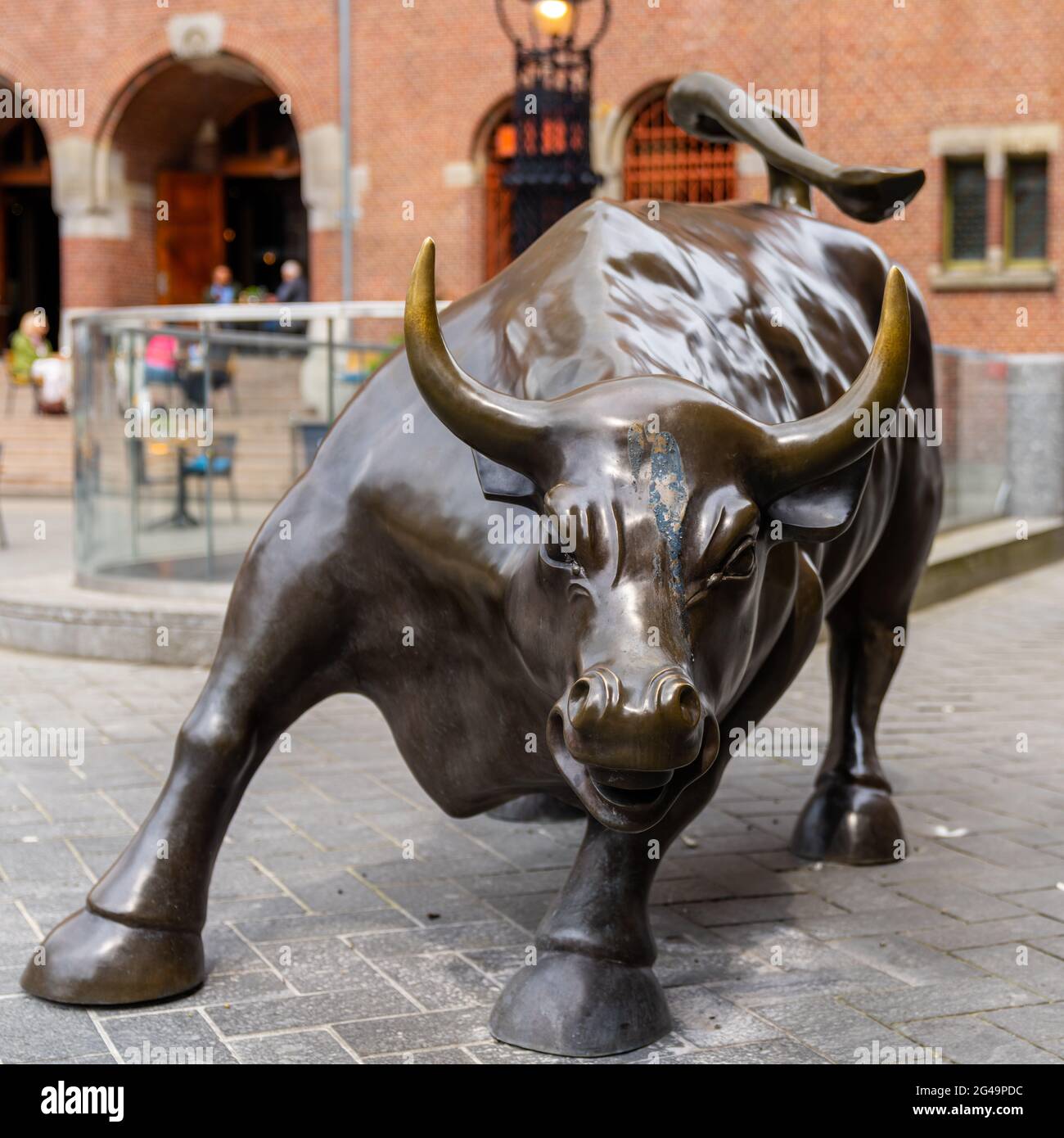

Sharp Decline On Amsterdam Stock Exchange 11 Down In Three Days

May 24, 2025

Sharp Decline On Amsterdam Stock Exchange 11 Down In Three Days

May 24, 2025 -

Amsterdam Exchange Suffers 11 Drop Since Wednesday Three Days Of Losses

May 24, 2025

Amsterdam Exchange Suffers 11 Drop Since Wednesday Three Days Of Losses

May 24, 2025 -

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Plunges Third Consecutive Day Of Heavy Losses

May 24, 2025 -

Legal Battle Amsterdam Residents Sue City Council For Tik Tok Driven Overcrowding At Snack Bar

May 24, 2025

Legal Battle Amsterdam Residents Sue City Council For Tik Tok Driven Overcrowding At Snack Bar

May 24, 2025 -

Dazi E Mercati L Impatto Sulle Borse E Le Reazioni Della Ue

May 24, 2025

Dazi E Mercati L Impatto Sulle Borse E Le Reazioni Della Ue

May 24, 2025