Amundi Dow Jones Industrial Average UCITS ETF Dist: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) in the context of the Amundi Dow Jones Industrial Average UCITS ETF Dist?

The Net Asset Value (NAV) represents the underlying value of each share in the Amundi Dow Jones Industrial Average UCITS ETF Dist. Simply put, it's the total value of all the ETF's assets (primarily holdings in the 30 companies comprising the DJIA) minus its liabilities, divided by the number of outstanding shares. This figure reflects the performance of the underlying DJIA. If the DJIA performs well, the NAV of the Amundi DJIA ETF generally increases, and vice-versa.

The NAV is calculated daily, usually at the close of the market. This calculation considers the closing prices of all the constituent stocks within the DJIA. Any dividends received by the ETF and any corporate actions affecting the underlying companies are also factored into the calculation.

- NAV is a key indicator of ETF price.

- Fluctuations in NAV mirror the market performance of the DJIA.

- Understanding NAV helps in making informed investment decisions.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Dist calculated?

The Amundi fund management team meticulously calculates the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Dist. The process involves several steps:

- Determining the market value of each holding: The closing prices of the 30 DJIA components are obtained from reliable sources.

- Adjusting for corporate actions: Events like stock splits, dividends, and mergers impact the value of the holdings and are accounted for in the NAV calculation.

- Accounting for expenses: The ETF’s operating expenses are deducted from the total asset value.

- Currency conversion (if applicable): If the ETF holds assets in multiple currencies, conversion to the base currency is necessary.

- Calculating the total net asset value: The total value of all assets, after adjustments and deductions, is divided by the total number of outstanding shares to determine the NAV per share.

It's important to remember the difference between NAV and the market price of the ETF. The market price fluctuates throughout the trading day and can differ slightly from the NAV due to the bid-ask spread. The fund manager, Amundi, plays a crucial role in ensuring the accuracy and transparency of the NAV calculation.

- Daily closing prices of the DJIA components.

- Adjustments for dividends and corporate actions.

- Currency conversions if applicable.

- Expenses deducted from the total asset value.

Why is understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Dist crucial for investors?

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Dist is paramount for several reasons:

-

Performance Evaluation: Monitoring the NAV allows investors to track the growth or decline of their investment over time. Comparing the NAV over different periods provides a clear picture of the ETF's performance.

-

Benchmark Comparison: The NAV facilitates comparison of the ETF's performance against the DJIA itself and other similar ETFs tracking the same index.

-

Investment Decisions: Knowing the NAV helps investors make well-informed buy and sell decisions, capitalizing on market fluctuations and optimizing returns.

-

Profit/Loss Determination: The difference between the purchase price and the current NAV (adjusted for any distributions) indicates the profit or loss on the investment.

-

Track investment growth over time.

-

Assess the ETF's performance relative to benchmarks.

-

Make informed buy/sell decisions.

-

Compare to other similar ETFs tracking the DJIA.

Where can you find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Dist?

Reliable sources for accessing real-time and historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF Dist include:

- Amundi's official website: The fund manager's website is a primary source for official NAV information.

- Major financial data providers: Reputable financial news websites and data providers (like Bloomberg, Yahoo Finance, etc.) typically publish ETF NAV data.

- Your brokerage account: Most brokerage platforms display the current NAV of your holdings directly within your account.

Understanding how to interpret the data presented—whether in tables or charts—is also key to effectively utilizing this information.

- Amundi's official website.

- Major financial data providers.

- Your brokerage account.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF Dist NAV

Mastering the concept of Amundi Dow Jones Industrial Average UCITS ETF Dist NAV is essential for effectively managing your investment in this popular ETF. Understanding the NAV allows you to track performance, compare it to benchmarks, and make informed decisions. Regularly monitoring the Amundi DJIA ETF NAV, Amundi Dow Jones ETF NAV, and understanding ETF NAV in general is crucial for maximizing your investment returns. Consult with a financial advisor for personalized guidance tailored to your investment goals and risk tolerance before making any significant investment decisions.

Featured Posts

-

Intervyu S Fedorom Lavrovym O Pavle I Trillerakh I Psikhologii Ostrykh Oschuscheniy

May 24, 2025

Intervyu S Fedorom Lavrovym O Pavle I Trillerakh I Psikhologii Ostrykh Oschuscheniy

May 24, 2025 -

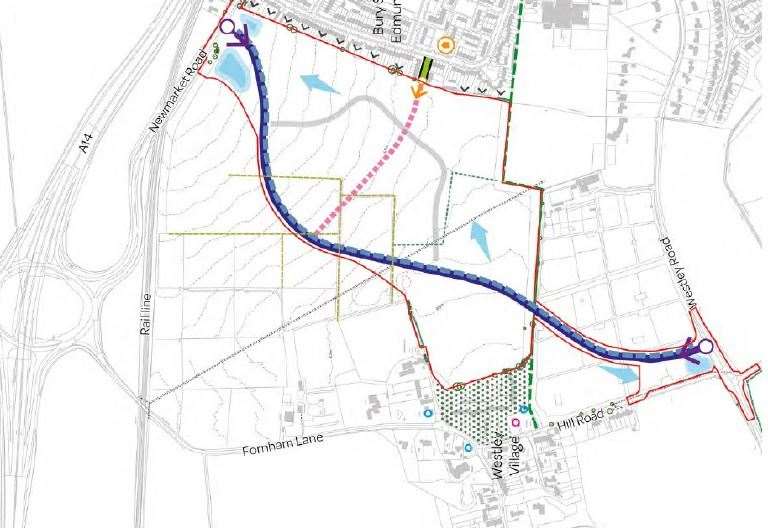

The Proposed M62 Relief Road Through Bury History And Impact

May 24, 2025

The Proposed M62 Relief Road Through Bury History And Impact

May 24, 2025 -

Test Po Filmam S Olegom Basilashvili Ugadayte Rol

May 24, 2025

Test Po Filmam S Olegom Basilashvili Ugadayte Rol

May 24, 2025 -

Cac 40 Index Finishes Week Lower But Shows Overall Resilience March 7 2025

May 24, 2025

Cac 40 Index Finishes Week Lower But Shows Overall Resilience March 7 2025

May 24, 2025 -

Joy Crookes Drops Emotional New Single I Know You D Kill

May 24, 2025

Joy Crookes Drops Emotional New Single I Know You D Kill

May 24, 2025

Latest Posts

-

Euronext Amsterdam Sees 8 Stock Increase Impact Of Trumps Tariff Decision

May 24, 2025

Euronext Amsterdam Sees 8 Stock Increase Impact Of Trumps Tariff Decision

May 24, 2025 -

7 Drop For Amsterdam Stocks As Trade War Fears Rise

May 24, 2025

7 Drop For Amsterdam Stocks As Trade War Fears Rise

May 24, 2025 -

8 Stock Market Gain On Euronext Amsterdam After Trumps Tariff Action

May 24, 2025

8 Stock Market Gain On Euronext Amsterdam After Trumps Tariff Action

May 24, 2025 -

Amsterdam Exchange Plunges 7 On Opening Trade War Concerns

May 24, 2025

Amsterdam Exchange Plunges 7 On Opening Trade War Concerns

May 24, 2025 -

Trumps Tariff Relief 8 Stock Market Surge On Euronext Amsterdam

May 24, 2025

Trumps Tariff Relief 8 Stock Market Surge On Euronext Amsterdam

May 24, 2025