Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV Analysis And Performance

Table of Contents

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist

The Amundi MSCI World II UCITS ETF USD Hedged Dist is an exchange-traded fund that tracks the MSCI World Index, providing broad exposure to global equities. It's designed to replicate the performance of this widely recognized benchmark, which includes large and mid-cap companies across developed markets worldwide. A key feature is its USD hedging strategy. Let's define some key terms:

- UCITS (Undertakings for Collective Investment in Transferable Securities): A regulatory framework in Europe ensuring investor protection and standardization for investment funds. This ETF's UCITS compliance makes it accessible to investors across many European countries.

- ETF (Exchange Traded Fund): A type of investment fund traded on stock exchanges like individual stocks. ETFs offer diversification and typically have lower expense ratios than actively managed funds.

- NAV (Net Asset Value): The value of an ETF's underlying assets per share. It's calculated daily and reflects the market value of the holdings.

- USD Hedged: This means the ETF employs strategies to mitigate the impact of currency fluctuations between the base currency of the underlying assets (likely a mix of currencies) and the US dollar. This is beneficial for investors whose primary currency is the US dollar, reducing their exposure to currency risk.

Key Features:

- Tracks the MSCI World Index, offering broad global market exposure.

- USD-hedged, mitigating currency risk for US dollar-based investors.

- UCITS compliant, suitable for investors across Europe.

- Distributing ETF, paying out dividends regularly.

NAV Analysis: A Deep Dive into the Amundi MSCI World II UCITS ETF's Value

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is calculated daily by taking the total market value of the ETF's holdings and dividing it by the number of outstanding shares. This provides a snapshot of the ETF's value per share. Monitoring NAV changes helps investors track the ETF's performance and value over time.

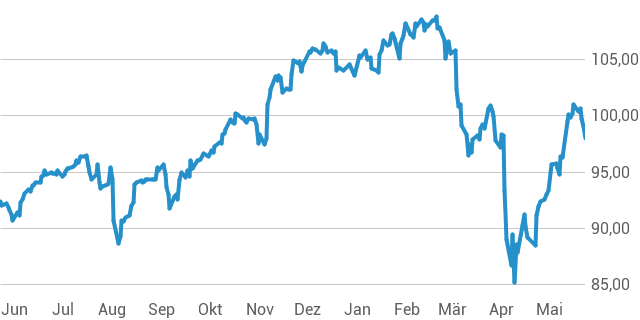

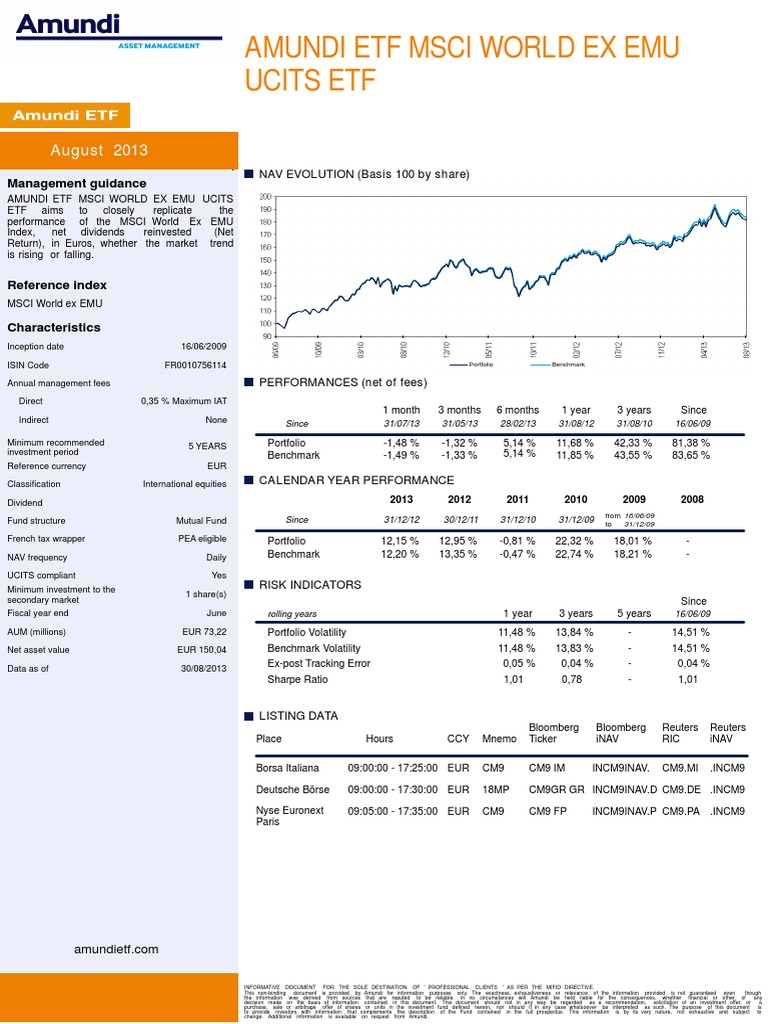

(Insert Chart/Graph here showing historical NAV performance. Ideally, this would show a line graph with dates on the x-axis and NAV on the y-axis. Label key periods of growth and decline. Consider adding comparison lines against relevant benchmark indices like the S&P 500)

Factors influencing NAV fluctuations include:

- Market Conditions: Overall market trends (bull or bear markets) significantly impact the value of the underlying assets. Positive market sentiment generally leads to NAV increases, while negative sentiment leads to decreases.

- Currency Movements: Despite the USD hedging, residual currency fluctuations can still slightly affect the NAV. Changes in exchange rates between the USD and other currencies represented in the index can cause minor variations.

- Underlying Asset Performance: The performance of the individual companies within the MSCI World Index directly influences the NAV. Strong performance by constituent companies will generally drive the NAV upward.

Key Points from NAV Analysis:

- Historical NAV data and visualization (refer to chart/graph).

- Comparison of NAV performance against benchmark indices (refer to chart/graph).

- Explanation of factors affecting NAV (e.g., market volatility, currency fluctuations).

Performance Evaluation: Assessing Returns and Risk

Assessing the performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist requires considering both returns and risk. Historical performance data can provide insights, but past results do not guarantee future returns.

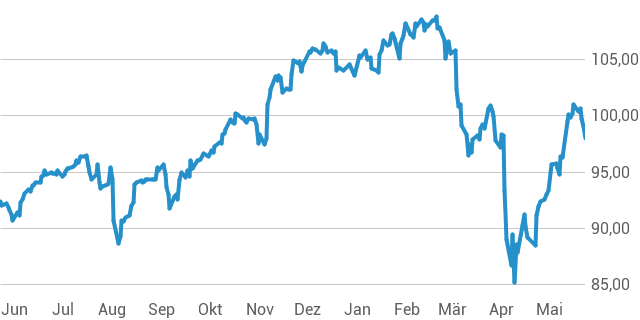

(Insert Chart/Graph here showing historical performance data, potentially including annualized returns and volatility measures like standard deviation or Sharpe ratio. Compare its performance to similar ETFs and benchmark indices like the MSCI World Index or a relevant S&P 500 equivalent)

Key Risk Factors:

- Market Risk: The inherent risk associated with fluctuations in global equity markets. This is a systemic risk that affects all equity investments.

- Currency Risk: Although USD hedged, residual currency risk remains, particularly if the hedging strategy is not perfectly effective.

- Expense Ratio: The annual fee charged to manage the ETF. Higher expense ratios reduce overall returns.

Key Points from Performance Evaluation:

- Historical performance data (e.g., annualized returns, Sharpe ratio) (refer to chart/graph).

- Comparison with similar ETFs and benchmark indices (refer to chart/graph).

- Discussion of risk factors, including market risk, currency risk, and expense ratio.

Expense Ratio and Fees

The expense ratio of the Amundi MSCI World II UCITS ETF USD Hedged Dist is a crucial factor to consider. This annual fee covers the costs of managing the ETF, including administrative expenses, marketing, and trading fees. A lower expense ratio translates to higher returns for investors. (Insert the actual expense ratio here if available). It's important to compare this expense ratio to similar ETFs to assess its competitiveness.

Tax Implications

Tax implications for investing in this ETF vary depending on your jurisdiction and individual circumstances. Capital gains taxes may apply when selling shares, and dividend distributions may also be subject to tax. Consult a qualified tax advisor for personalized advice regarding the tax implications in your specific situation.

Conclusion

This article provided a detailed analysis of the Amundi MSCI World II UCITS ETF USD Hedged Dist, examining its NAV and performance. Understanding its historical performance, associated risks, and potential benefits is crucial for making informed investment decisions. While past performance does not guarantee future results, a thorough analysis of the Amundi MSCI World II UCITS ETF USD Hedged Dist can help investors assess its suitability within a diversified portfolio. Remember to conduct thorough research and consider your individual risk tolerance before investing in any ETF. For more in-depth information, consult a financial advisor. Consider the Amundi MSCI World II UCITS ETF USD Hedged Dist for your global equity investment strategy.

Featured Posts

-

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Reporting

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Reporting

May 24, 2025 -

West Hams Transfer Pursuit A Bid For Kyle Walker Peters

May 24, 2025

West Hams Transfer Pursuit A Bid For Kyle Walker Peters

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Implications

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Implications

May 24, 2025 -

Dax Stable After Record Run Frankfurt Stock Market Opens

May 24, 2025

Dax Stable After Record Run Frankfurt Stock Market Opens

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

Latest Posts

-

Pariss Economy Suffers As Luxury Sector Contracts

May 24, 2025

Pariss Economy Suffers As Luxury Sector Contracts

May 24, 2025 -

The Impact Of The Luxury Goods Crisis On Pariss Economy

May 24, 2025

The Impact Of The Luxury Goods Crisis On Pariss Economy

May 24, 2025 -

Market Report Cac 40 Weekly Performance March 7 2025

May 24, 2025

Market Report Cac 40 Weekly Performance March 7 2025

May 24, 2025 -

Luxury Sector Slump The Economic Repercussions For Paris

May 24, 2025

Luxury Sector Slump The Economic Repercussions For Paris

May 24, 2025 -

Understanding Massimo Vians Departure From Guccis Supply Chain Leadership

May 24, 2025

Understanding Massimo Vians Departure From Guccis Supply Chain Leadership

May 24, 2025