DAX Stable After Record Run: Frankfurt Stock Market Opens

Table of Contents

DAX Performance Analysis: A Detailed Look at Today's Trading

Today's trading on the Frankfurt Stock Exchange revealed a relatively flat opening for the DAX index. While the precise numbers will fluctuate throughout the day, a comparison of the opening price to yesterday's closing price reveals a [Insert Actual Data Here – e.g., slight increase/decrease of X%]. This level of stability is noteworthy given the DAX's recent impressive gains. The trading volume is currently [Insert Actual Data Here – e.g., moderate/high/low], suggesting [Insert Interpretation – e.g., continued investor interest/hesitation/profit-taking]. Volatility, as measured by [Insert Volatility Metric – e.g., the VIX], remains [Insert Actual Data Here – e.g., relatively low/moderate/high], indicating [Insert Interpretation – e.g., a relatively calm market/potential for increased fluctuations].

- Opening Price vs. Closing Price: [Insert Actual Data – e.g., Opened at 16,000, closed yesterday at 15,980]

- Percentage Change from the Previous Day's Close: [Insert Actual Data – e.g., +0.12%]

- Top Performing Sectors: [Insert Actual Data – e.g., Energy, Technology]

- Underperforming Sectors: [Insert Actual Data – e.g., Automotive, Financials]

- Notable Company Performance: Volkswagen showed [Insert Actual Data – e.g., slight gains], while Allianz experienced [Insert Actual Data – e.g., minor losses]. SAP's performance was relatively flat.

Factors Contributing to DAX Stability

Several factors contribute to the DAX's current stability. Macroeconomic indicators play a significant role. Recent inflation data [Insert Actual Data and Interpretation – e.g., showed a slight decrease, potentially easing pressure on the European Central Bank], and the European Central Bank's recent interest rate decision [Insert Actual Data and Interpretation – e.g., to hold rates steady, signaling confidence in the economy] are influencing investor sentiment. Geopolitical events, particularly [Insert Specific Event and its Impact – e.g., the ongoing situation in Ukraine], continue to create uncertainty, but their immediate impact on the DAX appears to be muted for now.

- Influence of Economic Indicators: Inflation figures and interest rate decisions are key drivers.

- Investor Confidence and Risk Appetite: Investors seem to be adopting a wait-and-see approach.

- Impact of Global Market Trends: The performance of other major global indices, such as the Dow Jones and Nasdaq, is also influencing the DAX.

- Role of Specific Company News: Positive or negative news from individual DAX-listed companies can affect the overall index performance.

Outlook for the DAX: Predictions and Future Trends

Predicting the future performance of the DAX is inherently challenging. However, based on current market conditions, a cautious optimism prevails. Short-term fluctuations are expected, given the inherent volatility of the stock market. Long-term prospects remain largely positive, provided the macroeconomic environment remains relatively stable. Potential catalysts for further growth include continued strong corporate earnings and sustained consumer spending. Risks include escalating geopolitical tensions, unexpected economic shocks, and shifts in investor sentiment.

- Short-term Predictions: Expect some volatility, but overall stability.

- Long-term Predictions: Positive outlook, contingent on macroeconomic stability.

- Potential Catalysts for Growth: Strong corporate earnings, robust consumer spending.

- Potential Risks: Geopolitical instability, economic downturns, shifting investor confidence.

- Recommendations for Investors: Maintain a diversified portfolio and monitor key economic indicators closely.

DAX Stability: A Summary and Call to Action

The DAX index has demonstrated remarkable stability after its recent record highs. This stability reflects a complex interplay of macroeconomic factors, investor sentiment, and specific company performances. While short-term fluctuations are anticipated, the long-term outlook remains relatively positive, contingent upon the maintenance of a stable global and European economic climate. To stay informed about the DAX's performance and make sound investment decisions, it's crucial to monitor key economic indicators, follow relevant news, and stay updated on market trends. Stay updated on the DAX index and monitor the Frankfurt Stock Market for the latest developments. [Link to a relevant financial news source or market analysis website].

Featured Posts

-

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025 -

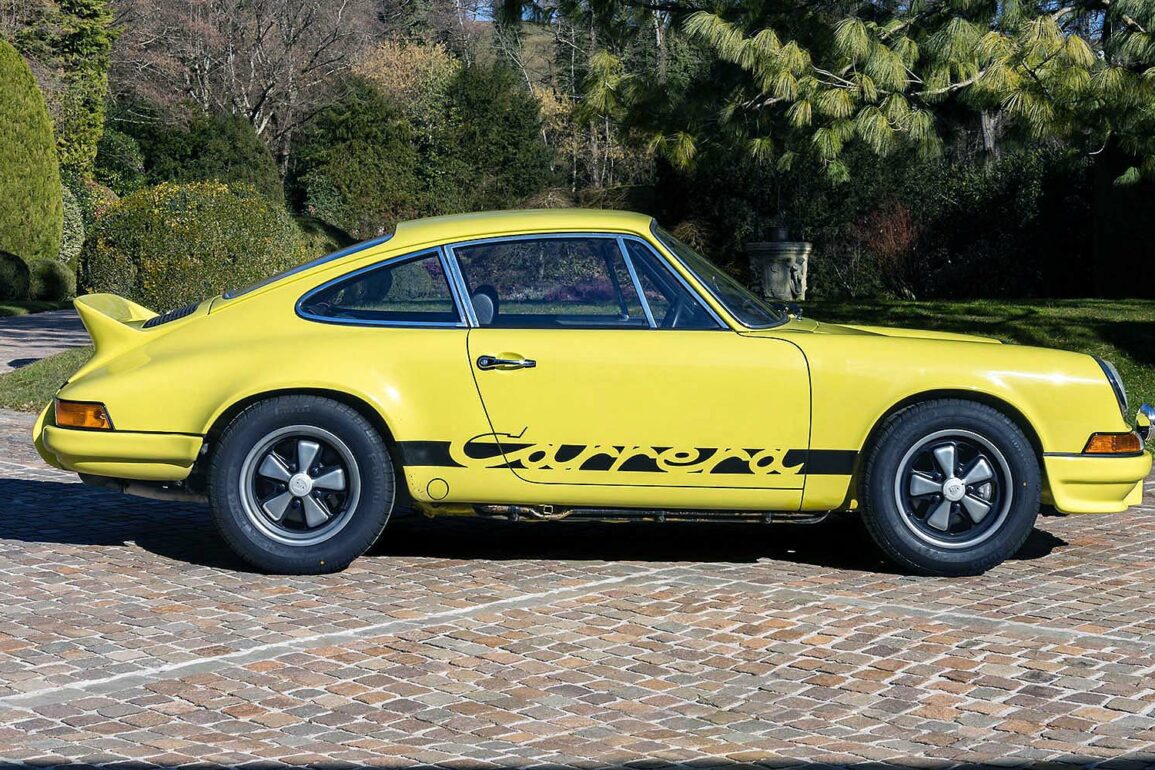

Neden Porsche 956 Arabalari Havada Sergileniyor

May 24, 2025

Neden Porsche 956 Arabalari Havada Sergileniyor

May 24, 2025 -

Daks Alalmany Ytjawz Dhrwt Mars Mwshr Awrwby Rayd

May 24, 2025

Daks Alalmany Ytjawz Dhrwt Mars Mwshr Awrwby Rayd

May 24, 2025 -

Escape To The Country Nicki Chapmans 700 000 Property Investment Strategy

May 24, 2025

Escape To The Country Nicki Chapmans 700 000 Property Investment Strategy

May 24, 2025 -

Understanding Massimo Vians Departure From Guccis Supply Chain Leadership

May 24, 2025

Understanding Massimo Vians Departure From Guccis Supply Chain Leadership

May 24, 2025

Latest Posts

-

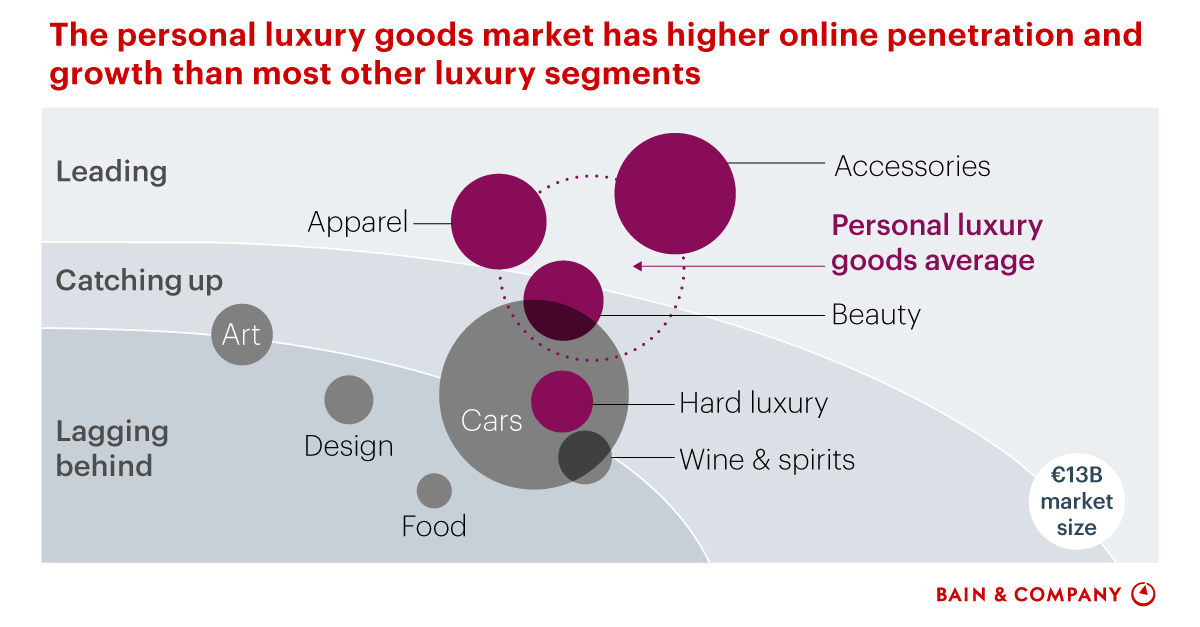

Analysis How The Luxury Goods Recession Affects Paris

May 24, 2025

Analysis How The Luxury Goods Recession Affects Paris

May 24, 2025 -

Pariss Economy Suffers As Luxury Sector Contracts

May 24, 2025

Pariss Economy Suffers As Luxury Sector Contracts

May 24, 2025 -

The Impact Of The Luxury Goods Crisis On Pariss Economy

May 24, 2025

The Impact Of The Luxury Goods Crisis On Pariss Economy

May 24, 2025 -

Market Report Cac 40 Weekly Performance March 7 2025

May 24, 2025

Market Report Cac 40 Weekly Performance March 7 2025

May 24, 2025 -

Luxury Sector Slump The Economic Repercussions For Paris

May 24, 2025

Luxury Sector Slump The Economic Repercussions For Paris

May 24, 2025