Analyzing Corporate Governance Through Proxy Statements (Form DEF 14A)

Table of Contents

Corporate governance refers to the system of rules, practices, and processes by which a company is directed and controlled. It involves balancing the interests of a company's many stakeholders, including shareholders, management, employees, customers, suppliers, and the community. Strong corporate governance mitigates risks, enhances transparency, and ultimately contributes to long-term value creation for investors.

Form DEF 14A, also known as the proxy statement, is a crucial document filed with the Securities and Exchange Commission (SEC) by publicly traded companies. It provides shareholders with information necessary to vote on matters such as electing directors, approving executive compensation, and considering shareholder proposals. Analyzing this document offers invaluable insights into a company's governance practices and its commitment to transparency and accountability.

This article will guide you through the key elements of analyzing proxy statements (Form DEF 14A) to effectively assess corporate governance, empowering you to make more informed investment decisions and contribute to better corporate governance practices.

Understanding the Structure and Content of a Proxy Statement (Form DEF 14A)

A DEF 14A proxy statement is a comprehensive document, but its structure is generally consistent across filings. Knowing where to look for specific information is key to efficient analysis.

Key Sections:

- Executive Compensation: This section details the compensation packages of top executives, including salaries, bonuses, stock options, and other benefits. Scrutinizing this section helps assess whether executive pay is aligned with company performance and shareholder interests.

- Board of Directors Composition and Qualifications: This section provides details about the members of the board of directors, including their background, experience, and independence. Understanding board composition is vital for assessing the quality of corporate oversight.

- Shareholder Proposals: This section outlines any proposals submitted by shareholders, providing insights into their concerns and priorities. Examining these proposals illuminates key governance issues and shareholder activism.

- Auditor Information: This section discloses information about the company's independent auditor, including their fees and any significant relationships with the company. This information is crucial for evaluating the independence and integrity of the audit process.

- Risk Factors: This section details significant risks facing the company, including those related to governance and compliance. Understanding these risks is essential for assessing the overall corporate governance landscape.

Identifying Key Information: Use the table of contents and index to quickly locate specific data points. Pay close attention to numerical data, such as compensation figures and director tenure.

Navigating Complex Language: Don't hesitate to use online resources, financial dictionaries, and legal glossaries to clarify unfamiliar terms.

Evaluating Executive Compensation and its Alignment with Corporate Performance

Executive compensation is a focal point of corporate governance scrutiny. Analyzing it effectively requires a nuanced approach.

- Compensation Structure: Examine the breakdown of executive pay—salary, bonuses, stock options, and other perks—and compare it to company performance metrics (e.g., revenue growth, profitability, shareholder return).

- Pay Ratios: The CEO-to-employee pay ratio reveals the disparity between executive compensation and that of average employees. A significantly high ratio can raise concerns about fairness and potential conflicts of interest.

- Performance-Based Incentives: Look for compensation structures that tie executive pay directly to company performance. This alignment incentivizes executives to prioritize shareholder value.

- Identifying Potential Conflicts of Interest: Red flags include excessive compensation regardless of performance, golden parachutes, and lack of transparency in compensation decisions.

Assessing Board Composition, Independence, and Oversight

The board of directors plays a vital role in overseeing management and ensuring accountability. A strong board is characterized by diversity, independence, and expertise.

- Board Diversity: A diverse board brings a wider range of perspectives and experiences, leading to better decision-making and improved corporate governance.

- Board Independence: Independent directors—those without significant ties to management—are crucial for objective oversight. Examine the percentage of independent directors and their involvement in key committees.

- Board Committees: Analyze the composition and functions of the audit, compensation, and nominating committees. These committees play crucial roles in financial reporting, executive compensation, and director selection.

- Director Qualifications and Experience: Assess the relevant expertise and experience of board members. A board with diverse skills and relevant industry knowledge is better equipped to provide effective oversight.

- Board Size and Structure: The ideal board size varies depending on the company, but excessively large or small boards can hinder effectiveness.

Analyzing Shareholder Proposals and Their Outcomes

Shareholder proposals provide a valuable window into stakeholder concerns and their impact on corporate governance.

- Understanding Shareholder Activism: Shareholder proposals allow investors to voice their opinions on corporate governance matters and push for changes.

- Identifying Key Issues: Proposals often address issues such as executive compensation, environmental sustainability, and social responsibility.

- Assessing Management's Response: Evaluate how management responds to shareholder proposals—whether they engage in constructive dialogue or resist change.

- Implications for Corporate Governance: The outcome of shareholder proposals (approved or rejected) reflects the company's responsiveness to stakeholder concerns and its commitment to good governance.

Utilizing Proxy Statement Analysis for Informed Investment Decisions

Analyzing proxy statements goes beyond compliance; it's a powerful tool for informed investment decisions.

- ESG Investing: Proxy statement analysis is crucial for ESG investing, as it reveals a company's commitment to environmental, social, and governance factors.

- Risk Assessment: By identifying potential governance weaknesses, proxy statement analysis helps investors assess corporate risks.

- Long-Term Value Creation: Companies with strong corporate governance tend to outperform those with weaker governance, contributing to long-term shareholder value.

- Comparative Analysis: Compare proxy statements of companies within the same industry to benchmark governance practices and identify best-in-class performers.

Conclusion: Mastering Corporate Governance Analysis Through Proxy Statements (Form DEF 14A)

Analyzing proxy statements (Form DEF 14A) is paramount for understanding a company's corporate governance practices. By carefully reviewing executive compensation, board composition, shareholder proposals, and other key sections, investors can assess a company's commitment to transparency, accountability, and long-term value creation. This analysis supports informed investment decisions and promotes better corporate governance practices. Start analyzing proxy statements today to improve your understanding of corporate governance and make more informed decisions. Don't underestimate the power of a thorough DEF 14A analysis in your investment strategy.

Featured Posts

-

Reddit Down Page Not Found Errors Affecting Us Users

May 17, 2025

Reddit Down Page Not Found Errors Affecting Us Users

May 17, 2025 -

Creatine Your Questions Answered

May 17, 2025

Creatine Your Questions Answered

May 17, 2025 -

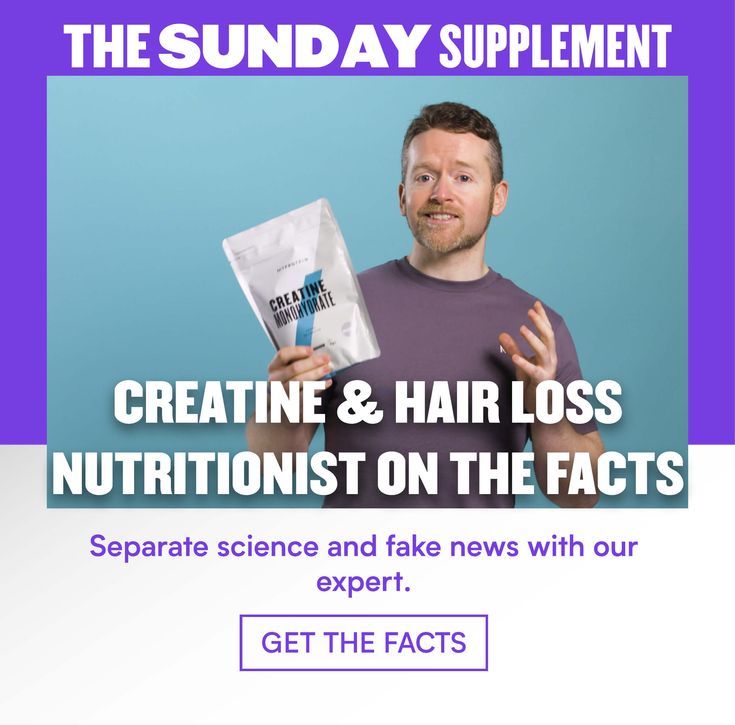

Canada Significantly Reduces Tariffs On Us Imports Exemptions Explained

May 17, 2025

Canada Significantly Reduces Tariffs On Us Imports Exemptions Explained

May 17, 2025 -

Weekly Review Identifying And Addressing Failures

May 17, 2025

Weekly Review Identifying And Addressing Failures

May 17, 2025 -

Analysis Of Ontarios 14 6 Billion Deficit Causes And Consequences

May 17, 2025

Analysis Of Ontarios 14 6 Billion Deficit Causes And Consequences

May 17, 2025