Analyzing The Canadian Tire-Hudson's Bay Merger: A Cautious Approach

Table of Contents

H2: Synergies and Potential Benefits of the Canadian Tire-Hudson's Bay Merger

The merger could unlock several key synergies, potentially transforming the Canadian retail scene.

H3: Enhanced Retail Reach and Market Share

- Increased store footprint across Canada: Combining Canadian Tire's extensive network with Hudson's Bay's prime locations would create a significantly larger retail footprint, reaching a broader customer base.

- Access to new customer demographics: The merger could expose each brand to new customer segments. Canadian Tire, traditionally strong in hardware and automotive, could gain access to Hudson's Bay's more fashion-conscious clientele, while Hudson's Bay could tap into Canadian Tire's loyal base of DIY enthusiasts.

- Potential for cross-selling opportunities: Imagine seamlessly integrating Canadian Tire's automotive services with Hudson's Bay's home improvement offerings or leveraging the existing loyalty programs to drive sales across both brands. This synergy could create powerful new revenue streams.

- Geographic overlap and optimization: However, careful consideration must be given to geographic overlap. Some store closures or rebranding might be necessary to maximize efficiency and avoid redundant locations, a crucial aspect of successful retail mergers.

H3: Supply Chain Optimization and Cost Savings

- Consolidation of distribution networks: Combining logistics and distribution networks could lead to significant cost savings through increased efficiency and reduced warehousing needs.

- Reduced operational costs: Shared resources, such as IT infrastructure and administrative staff, could further streamline operations and lower overhead costs.

- Improved procurement power: A larger entity can negotiate better prices from suppliers, positively impacting profit margins.

- Streamlined integration: Despite these potential savings, the successful integration of two vastly different supply chains presents a significant challenge, requiring careful planning and execution to prevent disruptions.

H3: Brand Synergy and Customer Loyalty Programs

- Unified loyalty program: A combined loyalty program could dramatically improve customer engagement and data collection, providing valuable insights for targeted marketing campaigns.

- Integrated brand messaging: Synergistic marketing strategies could enhance brand awareness and customer loyalty, but maintaining the distinct identities of both brands is crucial to avoid alienating existing customer bases.

- Navigating brand differences: While integrating loyalty programs presents opportunities, the difference in brand identities and target markets will require careful management to avoid dilution of brand equity.

H2: Challenges and Risks Associated with the Canadian Tire-Hudson's Bay Merger

Despite the potential advantages, several significant challenges threaten the success of this merger.

H3: Integration Challenges and Operational Difficulties

- IT system integration: Merging disparate IT systems, inventory management software, and point-of-sale systems can be complex and time-consuming, potentially causing operational disruptions.

- Employee redundancies: Overlapping roles and functions will inevitably lead to job losses, potentially impacting employee morale and productivity.

- Cultural clashes: Integrating two distinct corporate cultures can be difficult, requiring sensitive management to prevent conflicts and maintain a positive work environment.

- Managing a large and diverse operation: Effectively managing a significantly larger and more diverse retail operation presents its own set of logistical and managerial hurdles.

H3: Regulatory Scrutiny and Antitrust Concerns

- Competition Bureau of Canada review: The Competition Bureau will scrutinize the merger for potential anti-competitive practices, which could lead to delays or even block the deal.

- Regulatory approvals and delays: Securing all necessary regulatory approvals can be a lengthy and uncertain process, potentially impacting the merger timeline.

- Impact on the merger's success: Regulatory hurdles could significantly affect the ultimate success and profitability of the merged entity.

H3: Financial Implications and Investor Sentiment

- Financial feasibility: A thorough financial analysis is crucial to ensure the long-term viability and profitability of the merged company.

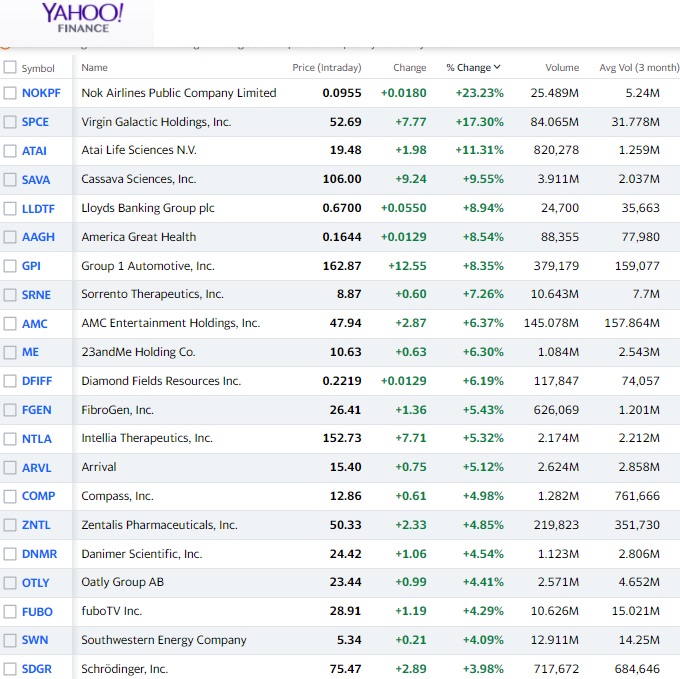

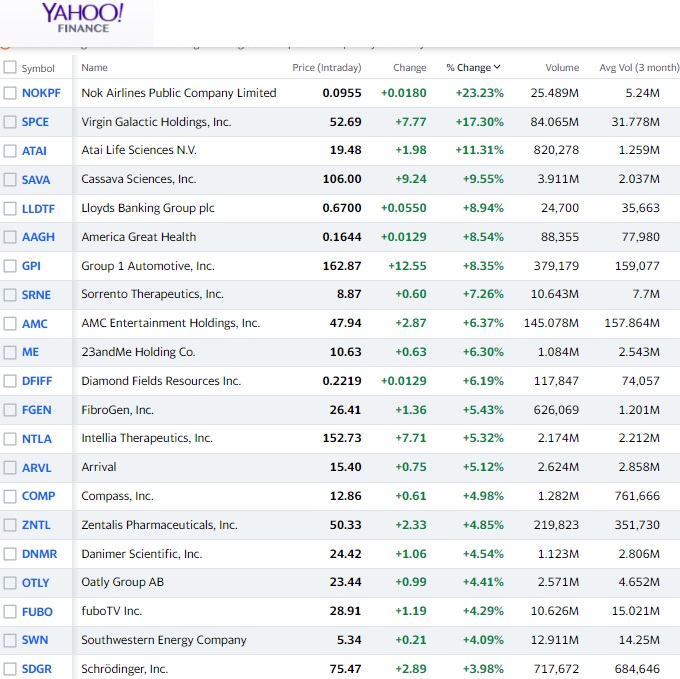

- Impact on stock prices: The market's reaction to the merger announcement and subsequent developments will be a key indicator of investor confidence.

- Debt levels and financing: The merger's financial success will depend heavily on effective debt management and securing appropriate financing.

- Shareholder value: Ultimately, the success of the merger will be measured by its impact on shareholder value and dividend payouts.

H2: Impact on Consumers and the Canadian Retail Landscape

The merger's implications for Canadian consumers and the retail landscape are far-reaching.

H3: Changes in Pricing and Product Availability

- Potential price changes: The merger could lead to both price increases and decreases depending on the efficiencies achieved and competitive pressures.

- Product range changes: Consumers may see changes in the range and availability of products offered by both brands as the companies consolidate their offerings.

- Reduced competition: The merger could lessen competition in certain segments, potentially impacting prices and consumer choice.

H3: Shift in Competitive Dynamics

- Impact on other retailers: The combined strength of Canadian Tire and Hudson's Bay will inevitably alter the competitive landscape, putting pressure on other major retailers like Walmart and Loblaws.

- Changing retail industry: This merger is a significant development in the ongoing evolution of the Canadian retail sector, driving further consolidation and transformation.

- Long-term implications: The long-term effects on consumers and the market remain uncertain, necessitating ongoing analysis and observation.

3. Conclusion:

The proposed Canadian Tire-Hudson's Bay merger presents a complex picture of potential benefits and significant risks. While synergies in supply chain, retail reach, and brand loyalty programs are enticing, the challenges of integration, regulatory scrutiny, and potential negative impacts on consumers and competition cannot be ignored. A cautious and thorough assessment is essential before concluding whether this merger will ultimately benefit Canadian consumers and the overall retail landscape. Continue the discussion on the Canadian Tire-Hudson's Bay merger; what are your thoughts on this potentially transformative Canadian retail merger? Keep an eye on the unfolding Canadian Tire and Hudson's Bay merger story.

Featured Posts

-

Nyt Mini Crossword Answers For March 20 2025

May 20, 2025

Nyt Mini Crossword Answers For March 20 2025

May 20, 2025 -

Eurovision Song Contest 2025 Artist Lineup Revealed

May 20, 2025

Eurovision Song Contest 2025 Artist Lineup Revealed

May 20, 2025 -

Qbts Stock Predicting The Earnings Reaction

May 20, 2025

Qbts Stock Predicting The Earnings Reaction

May 20, 2025 -

How Michael Strahan Secured A Key Interview During A Ratings War

May 20, 2025

How Michael Strahan Secured A Key Interview During A Ratings War

May 20, 2025 -

Solve The Nyt Mini Crossword March 24 2025 Answers And Hints

May 20, 2025

Solve The Nyt Mini Crossword March 24 2025 Answers And Hints

May 20, 2025

Latest Posts

-

Reddits Top 12 Ai Stocks A Deep Dive For Smart Investors

May 20, 2025

Reddits Top 12 Ai Stocks A Deep Dive For Smart Investors

May 20, 2025 -

Is Big Bear Ai Stock A Buy Right Now A Motley Fool Analysis

May 20, 2025

Is Big Bear Ai Stock A Buy Right Now A Motley Fool Analysis

May 20, 2025 -

12 Best Ai Stocks On Reddit Investor Insights For 2024

May 20, 2025

12 Best Ai Stocks On Reddit Investor Insights For 2024

May 20, 2025 -

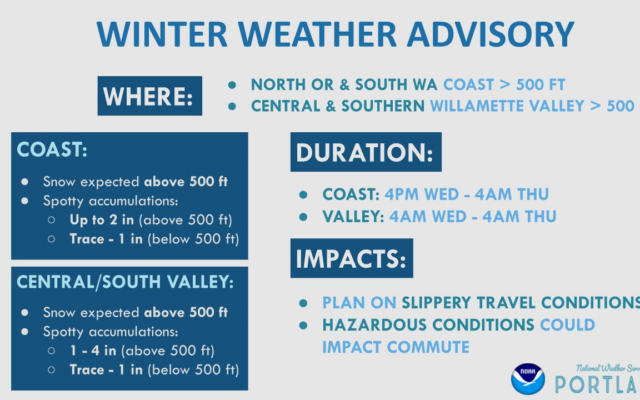

How To Prepare For School Delays During A Winter Weather Advisory

May 20, 2025

How To Prepare For School Delays During A Winter Weather Advisory

May 20, 2025 -

Collins Aerospace Layoffs Impact On Cedar Rapids Workforce

May 20, 2025

Collins Aerospace Layoffs Impact On Cedar Rapids Workforce

May 20, 2025