Analyzing The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is the Amundi Dow Jones Industrial Average UCITS ETF?

The Amundi Dow Jones Industrial Average UCITS ETF is designed to track the performance of the iconic Dow Jones Industrial Average (DJIA). This index comprises 30 of the largest and most influential publicly traded companies in the United States, offering investors exposure to a diversified basket of blue-chip stocks.

- Investment Strategy & Objective: The ETF aims to replicate the DJIA's performance as closely as possible, providing investors with a simple and cost-effective way to gain exposure to this benchmark index.

- Underlying Index: The Dow Jones Industrial Average is the benchmark, representing a significant slice of the US economy. Changes in the DJIA directly influence the ETF's value.

- UCITS Structure: The "UCITS" designation (Undertakings for Collective Investment in Transferable Securities) signifies that the ETF complies with EU regulations, enhancing investor protection and ensuring a standardized structure.

- Expense Ratio and Management Fees: Like all ETFs, this one has an expense ratio, which represents the annual cost of managing the fund. This fee is crucial to consider when evaluating the ETF's overall performance. Check the fund's prospectus for the most up-to-date information on fees.

- Key benefits: Diversification, low cost, ease of trading, and transparency.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

The Net Asset Value (NAV) of an ETF like the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily, reflecting the fund's current value. The calculation is straightforward:

NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares

Let's break down the components:

- Total Assets: This includes the market value of all the securities held within the ETF's portfolio (the 30 DJIA components), plus any cash reserves.

- Total Liabilities: These encompass expenses such as management fees, accrued expenses, and any other outstanding obligations.

- Number of Outstanding Shares: This refers to the total number of ETF shares currently held by investors.

The custodian bank plays a vital role in this process, verifying the holdings and ensuring the accurate calculation of the NAV.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors can influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

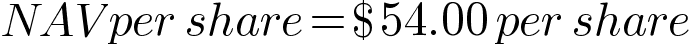

- Dow Jones Industrial Average Performance: The primary driver is the performance of the underlying DJIA. Positive movements in the index generally lead to an increase in the ETF's NAV, and vice versa.

- Currency Fluctuations: If the ETF holds assets denominated in currencies other than the base currency of the ETF, fluctuations in exchange rates can impact the NAV.

- Dividends: Dividends received from the underlying DJIA companies are typically reinvested or distributed to shareholders, affecting the NAV accordingly. Reinvestment increases the NAV, while distributions reduce it.

- ETF Fees and Expenses: Management fees and other operational expenses will gradually reduce the NAV over time.

Where to Find and Interpret the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Reliable sources for accessing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF include:

- Amundi's Website: The fund manager's website will typically provide real-time and historical NAV data.

- Financial News Sources: Many reputable financial news websites and platforms publish ETF NAV information.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will display the current NAV and historical data.

Interpreting the NAV: The NAV should be considered alongside the ETF's overall performance and investment strategy. It's crucial to understand that the NAV represents the intrinsic value of the ETF's holdings. The market price at which the ETF trades might differ slightly from the NAV due to supply and demand dynamics. Comparing the NAV to historical NAV data allows you to track the ETF's growth and assess its performance against its benchmark (DJIA). This is essential for calculating returns and evaluating your investment performance.

Conclusion: Mastering Net Asset Value (NAV) Analysis for the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is fundamental for making informed investment decisions. We've explored how NAV is calculated, the factors influencing it, and where to find reliable data. Remember that regularly monitoring the NAV, in conjunction with understanding the ETF's investment strategy and the performance of the Dow Jones Industrial Average, is key to effective portfolio management. Regularly analyzing the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for effective portfolio management. Learn more about ETF NAV analysis and make informed investment decisions today!

Featured Posts

-

Amundi Msci World Ex Us Ucits Etf Acc A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc A Deep Dive Into Net Asset Value

May 24, 2025 -

Test Po Filmam S Olegom Basilashvili Ugadayte Rol

May 24, 2025

Test Po Filmam S Olegom Basilashvili Ugadayte Rol

May 24, 2025 -

Gucci Supply Chain Shake Up Massimo Vians Departure And Its Implications

May 24, 2025

Gucci Supply Chain Shake Up Massimo Vians Departure And Its Implications

May 24, 2025 -

Borsa Italiana Banche Deboli Italgas In Rialzo Dopo I Conti

May 24, 2025

Borsa Italiana Banche Deboli Italgas In Rialzo Dopo I Conti

May 24, 2025 -

Dax Falls Below 24 000 Frankfurt Stock Market Losses

May 24, 2025

Dax Falls Below 24 000 Frankfurt Stock Market Losses

May 24, 2025

Latest Posts

-

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 24, 2025

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 24, 2025 -

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025 -

Amsterdam Stock Market Opens 7 Lower Trade War Anxiety

May 24, 2025

Amsterdam Stock Market Opens 7 Lower Trade War Anxiety

May 24, 2025 -

Euronext Amsterdam Sees 8 Stock Increase Impact Of Trumps Tariff Decision

May 24, 2025

Euronext Amsterdam Sees 8 Stock Increase Impact Of Trumps Tariff Decision

May 24, 2025 -

7 Drop For Amsterdam Stocks As Trade War Fears Rise

May 24, 2025

7 Drop For Amsterdam Stocks As Trade War Fears Rise

May 24, 2025