Analyzing The Potential For A Bank Of England Half-Point Interest Rate Cut

Table of Contents

Current Economic Climate and Inflationary Pressures

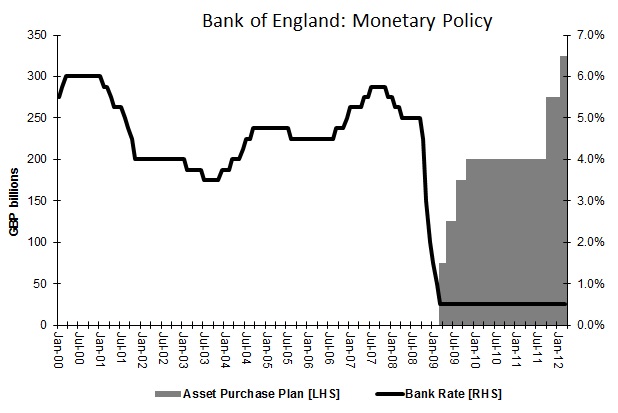

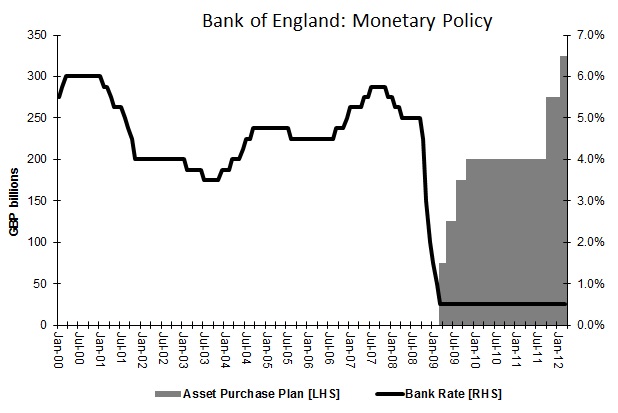

The UK's current economic climate is characterized by persistent inflationary pressures, a slowing global economy, and ongoing uncertainty. Understanding these factors is crucial to assessing the likelihood of a Bank of England interest rate cut. Inflation, measured by the Consumer Price Index (CPI), remains stubbornly high, exceeding the Bank of England's target of 2%.

- Latest CPI figures and their interpretation: Recent CPI data shows inflation [insert latest CPI figures and source]. This indicates [interpretation of the data – e.g., a slowing but still significant inflationary pressure].

- Analysis of core inflation: Core inflation, which excludes volatile energy and food prices, [insert data and interpretation – e.g., remains elevated, suggesting underlying inflationary pressures].

- Assessment of wage growth and its inflationary impact: Strong wage growth [insert data and source] can fuel further price increases, creating a wage-price spiral. This adds to the complexity of the Bank of England’s decision on interest rates.

- Impact of geopolitical factors on inflation: The ongoing war in Ukraine and its impact on energy prices, coupled with global supply chain disruptions, continue to exert significant upward pressure on inflation. These geopolitical factors make predicting future inflation particularly challenging.

Arguments for a Bank of England Half-Point Interest Rate Cut

Proponents of a half-point Bank of England interest rate cut argue that such a move is necessary to stimulate economic growth and avert a potential recession. Lower interest rates would make borrowing cheaper for businesses and consumers, potentially boosting investment and spending.

- Evidence suggesting a recession is imminent: Several economic indicators, such as [mention specific indicators e.g., falling consumer confidence, weakening manufacturing output], point towards a potential recession. A rate cut could help mitigate the severity of any downturn.

- Analysis of consumer confidence and spending: Falling consumer confidence [cite data source] suggests reduced spending, potentially leading to further economic slowdown. A significant interest rate cut could help revive consumer spending.

- Impact on business investment and job creation: Lower borrowing costs could encourage businesses to invest more, leading to job creation and overall economic growth. This is a key argument for those advocating a substantial interest rate reduction.

- Comparison with other central banks' actions: Some other central banks have already implemented significant rate cuts [mention examples and their context], suggesting that a similar approach by the Bank of England could be warranted.

Arguments Against a Bank of England Half-Point Interest Rate Cut

Conversely, opponents argue that a half-point Bank of England interest rate cut risks fueling further inflation and weakening the pound sterling. A reduction in interest rates could increase the money supply, potentially leading to higher prices.

- Risks of exacerbating inflationary pressures: A rate cut could further stimulate demand, potentially worsening already high inflation. This risk is a significant concern for those advocating a more cautious approach.

- Potential for currency devaluation: Lower interest rates could make the pound less attractive to foreign investors, potentially leading to a devaluation and increased import prices. This would further complicate the inflation picture.

- Impact on government borrowing costs: Lower interest rates might increase government borrowing costs, potentially adding to the national debt. This is a key fiscal consideration for the government.

- Concerns about losing control of inflation: Some argue that a rate cut could signal a loss of control over inflation, potentially eroding the Bank of England's credibility. This risk highlights the importance of careful consideration before any significant rate change.

Potential Impact of a Bank of England Half-Point Interest Rate Cut

A half-point Bank of England interest rate cut would have significant repercussions across the UK economy. The effects would be felt across various sectors, including housing, consumer spending, and business investment.

- Forecasts for mortgage rate changes: A reduction in the Bank Rate would likely lead to lower mortgage rates [provide forecast range and source], making homeownership more affordable.

- Impact on consumer debt levels: Lower borrowing costs could lead to increased consumer debt, potentially creating future financial vulnerabilities.

- Potential effects on property prices: Lower mortgage rates could boost demand for housing, potentially driving up property prices further.

- Analysis of the ripple effect across various sectors: The impact would extend beyond the housing market, influencing business investment, consumer spending, and overall economic growth. The ripple effect across different sectors requires careful assessment.

Conclusion

This analysis has explored the complex factors surrounding the potential for a Bank of England half-point interest rate cut. While a reduction could stimulate economic activity and alleviate recessionary pressures, it also carries the risk of exacerbating inflation and weakening the pound. The decision hinges on a delicate balancing act between supporting growth and maintaining price stability.

Call to Action: Stay informed about future Bank of England announcements and continue to monitor the evolving economic landscape to understand the implications of any interest rate changes. Further analysis of the Bank of England interest rate cut possibilities is crucial for informed financial planning and decision-making. For up-to-date information and analysis on the Bank of England’s interest rate policy, regularly check reputable financial news sources.

Featured Posts

-

Celtics Game 1 Loss Prompts Sharp Criticism From Colin Cowherd On Tatum

May 08, 2025

Celtics Game 1 Loss Prompts Sharp Criticism From Colin Cowherd On Tatum

May 08, 2025 -

Canadian Dollars Strength A Cause For Concern

May 08, 2025

Canadian Dollars Strength A Cause For Concern

May 08, 2025 -

Technology And Trade Ahsans Vision For Made In Pakistan On The World Stage

May 08, 2025

Technology And Trade Ahsans Vision For Made In Pakistan On The World Stage

May 08, 2025 -

Unveiling The Past A Rogue One Heros Journey In The New Star Wars Series

May 08, 2025

Unveiling The Past A Rogue One Heros Journey In The New Star Wars Series

May 08, 2025 -

The Trump Media And Crypto Com Etf Partnership What Investors Need To Know

May 08, 2025

The Trump Media And Crypto Com Etf Partnership What Investors Need To Know

May 08, 2025