Apple Stock (AAPL): Predicting The Next Key Price Levels

Table of Contents

Analyzing Current Market Conditions and their Impact on AAPL

Predicting the future price of AAPL requires understanding the broader economic context and competitive landscape.

Macroeconomic Factors

Broader economic trends significantly impact Apple's stock price prediction. Factors like inflation, interest rates, and recessionary risks all play a role.

-

Impact of Inflation on Consumer Spending: High inflation reduces consumer purchasing power, potentially impacting demand for Apple products, especially higher-priced items like iPhones and Macs. Data from the Consumer Price Index (CPI) can provide insights into this trend. A sustained high inflation rate could negatively affect the Apple stock forecast.

-

Potential Fed Rate Hikes and their Influence on Tech Stocks: The Federal Reserve's monetary policy directly influences interest rates. Rate hikes typically lead to decreased investment in growth stocks like AAPL, as investors seek safer, higher-yielding investments. This can affect the AAPL price target.

-

Recessionary Scenarios and their Effect on Apple's Sales: A recession significantly impacts consumer spending, potentially leading to lower sales for Apple products across all categories. The severity of a recession would directly influence the Apple stock price prediction. Historical data correlating economic recessions with tech stock performance can inform this analysis.

Competitive Landscape

Apple faces intense competition in various markets. Analyzing the competitive landscape is vital for accurate AAPL price target predictions.

-

Competition from Samsung, Google, and other tech companies: Samsung and Google are key competitors, constantly innovating and releasing new products that directly challenge Apple's market share in smartphones and wearables. Analysis of market share data from reputable research firms provides valuable insights.

-

Analysis of Market Share Trends: Monitoring Apple's market share across different product categories (smartphones, tablets, wearables, services) helps understand its competitive strength. Declining market share could put downward pressure on the Apple stock price.

-

Discussion of new product launches and their potential impact on AAPL: Competitors' new product launches and technological advancements directly impact Apple's stock. A competitor's groundbreaking innovation can affect investor sentiment and, subsequently, the Apple stock price prediction.

Assessing Apple's Fundamental Strength

Understanding Apple's financial health and innovation capabilities is critical for predicting AAPL stock's future performance.

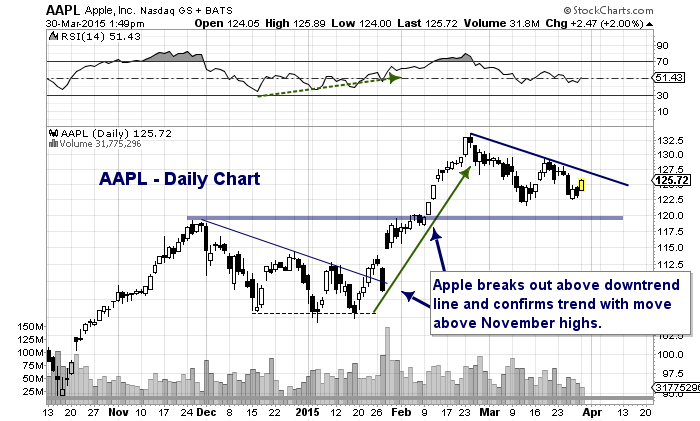

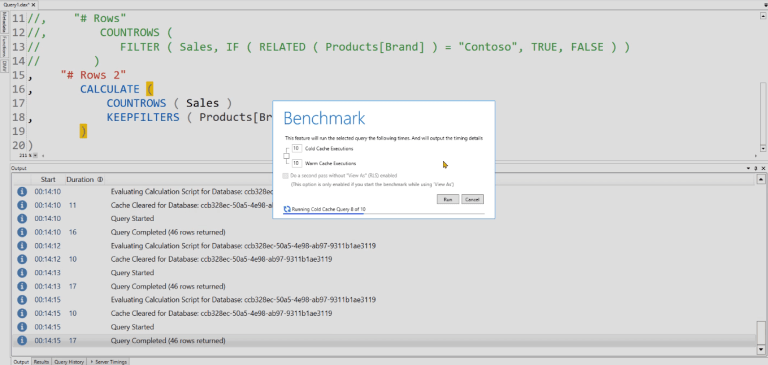

Financial Performance

Apple's consistent financial performance is a key factor influencing investor confidence and the Apple stock forecast.

-

Analysis of key financial ratios (e.g., P/E ratio, ROE): Analyzing key financial ratios provides insights into Apple's profitability and valuation. Comparing these ratios to industry benchmarks provides a comparative perspective.

-

Discussion of Apple's strong cash reserves: Apple's substantial cash reserves offer financial flexibility, enabling it to weather economic downturns and invest in future growth. This financial strength positively impacts the Apple stock price prediction.

-

Examination of revenue streams from various product categories (iPhone, Mac, Services): Analyzing revenue contributions from different product categories highlights the diversification of Apple's revenue streams. A diversified revenue base generally leads to greater stability in the Apple stock price.

Innovation and Future Product Pipeline

Apple's innovation capacity is crucial for long-term growth and the Apple stock price prediction.

-

Analysis of rumored new products (e.g., AR/VR headsets, new iPhones): Speculation about upcoming products, based on credible sources, influences investor expectations and the Apple stock forecast. Positive expectations for new product launches generally support higher Apple stock price predictions.

-

Assessment of Apple's R&D spending: Apple's substantial investment in research and development signals its commitment to innovation, positively influencing long-term growth prospects and the Apple stock price.

-

Discussion of potential breakthroughs in technology (e.g., advancements in AI, 5G): Advancements in AI and 5G technology create opportunities for Apple to develop new products and services, impacting the Apple stock price prediction.

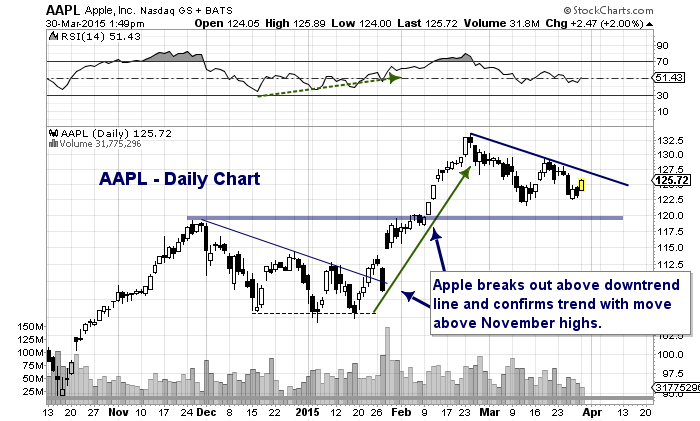

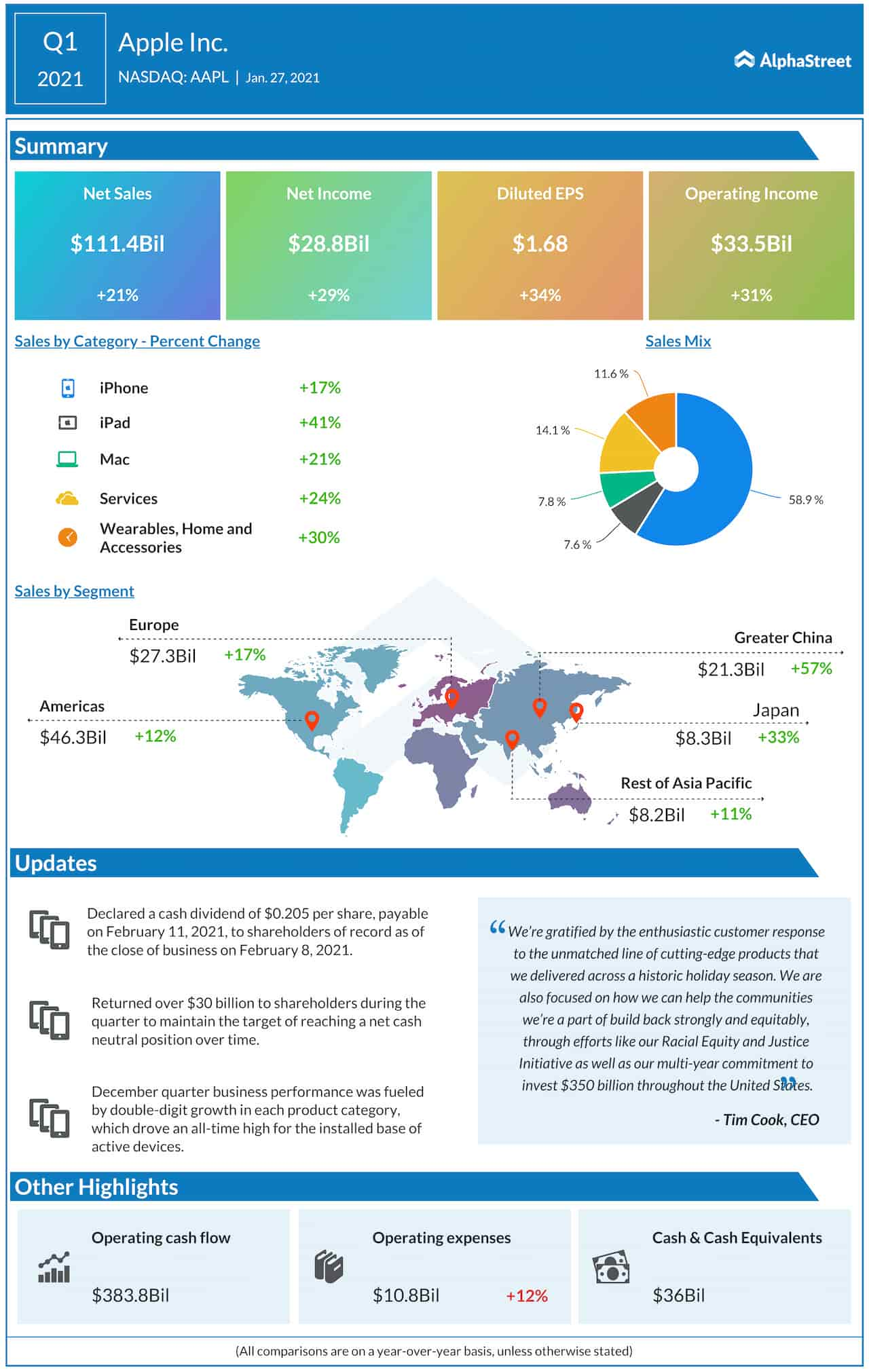

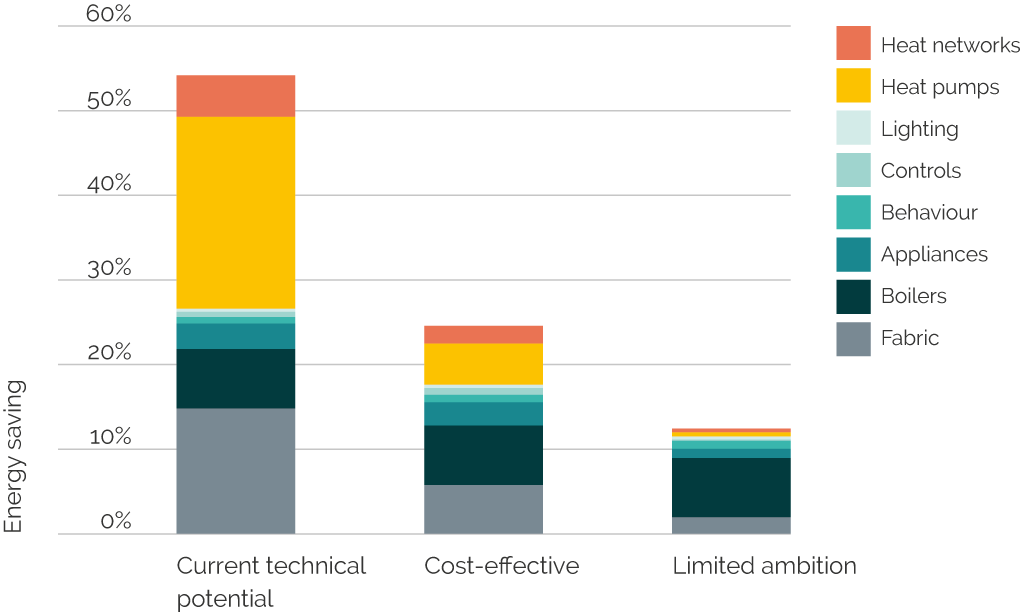

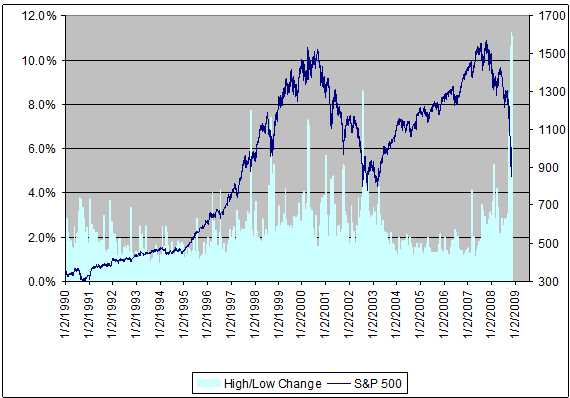

Technical Analysis of AAPL Stock Charts

Technical analysis helps identify potential support and resistance levels, providing insights into future price movements.

Identifying Key Support and Resistance Levels

Analyzing historical stock price movements helps identify key support and resistance levels for AAPL.

-

Explanation of support and resistance levels: Support levels represent price points where buying pressure is expected to outweigh selling pressure, while resistance levels are the opposite.

-

Identification of key price points on charts: Using charts, we can identify significant past support and resistance levels that could serve as potential price targets in the future.

-

Discussion of moving averages and other technical indicators: Moving averages and other technical indicators offer additional insights into potential price trends and momentum.

Predicting Potential Price Targets

Combining technical and fundamental analysis helps predict potential AAPL price targets.

-

Presentation of potential price targets with justifications: Based on the analysis, we can present potential short-term and long-term price targets, outlining the rationale for each.

-

Outlining various scenarios (bullish, bearish, neutral): We consider different scenarios, acknowledging the inherent uncertainty in stock market predictions. A bearish scenario would account for negative factors, while a bullish scenario focuses on positive indicators.

-

Including caveats and risk assessments: It's crucial to acknowledge the risks associated with stock market predictions, emphasizing that these are estimates, not guarantees.

Conclusion

Predicting the precise future price of Apple stock (AAPL) is challenging, but understanding the interplay between macroeconomic conditions, Apple's fundamental strength, and technical analysis allows for more informed investment decisions. While we've explored potential price targets, remember that numerous factors can impact the AAPL price target, including unforeseen events. Conduct thorough research and consult with a financial advisor before making any investment decisions related to Apple stock or any other security. Continue to monitor Apple stock (AAPL) and its key performance indicators for a better understanding of future price movements.

Featured Posts

-

Apple Stock Strong I Phone Sales Drive Q2 Results

May 24, 2025

Apple Stock Strong I Phone Sales Drive Q2 Results

May 24, 2025 -

Frances Next Election Can Bardella Overcome The Odds

May 24, 2025

Frances Next Election Can Bardella Overcome The Odds

May 24, 2025 -

This Weeks Hottest R And B Leon Thomas And Flo Dominate

May 24, 2025

This Weeks Hottest R And B Leon Thomas And Flo Dominate

May 24, 2025 -

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 24, 2025

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 24, 2025 -

Steady Start For Frankfurt Dax Following Record Breaking Performance

May 24, 2025

Steady Start For Frankfurt Dax Following Record Breaking Performance

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025