Apple Stock Slumps: $900 Million Tariff Impact

Table of Contents

The $900 Million Tariff Impact on Apple's Bottom Line

The $900 million figure represents a direct and indirect impact on Apple's financial health. This isn't just a minor setback; it's a substantial hit that demands close examination.

Direct Impact on Product Costs

Tariffs directly increase the cost of manufacturing Apple products, primarily due to the reliance on Chinese manufacturing for many components.

- Increased manufacturing costs in China: Tariffs on imported parts used in iPhones, iPads, MacBooks, and other Apple devices increase manufacturing costs in China, where a significant portion of Apple's production takes place.

- Higher prices passed onto consumers: To maintain profit margins, Apple may be forced to pass these increased costs onto consumers, potentially leading to reduced demand for its products. This price sensitivity is particularly relevant in the competitive smartphone market.

- Impact on specific product lines: The impact isn't uniform across all product lines. The iPhone, being Apple's flagship product and a significant revenue driver, is likely to be disproportionately affected. Similarly, iPads and MacBooks, also reliant on imported components, will feel the pinch.

- Percentage increase in cost for key components: While precise figures remain confidential, estimates suggest a 5-10% increase in the cost of certain key components like display panels and processors, significantly impacting overall product costs.

Indirect Impact on Supply Chain

Beyond direct costs, tariffs create wider disruptions within Apple's intricate global supply chain.

- Disruptions to the global supply chain: Trade uncertainty stemming from escalating tariffs leads to unpredictability, making it harder for Apple to accurately forecast demand and manage its inventory.

- Increased logistical costs and delays in product delivery: Navigating the complexities of tariffs and trade regulations adds logistical hurdles, increasing shipping costs and potentially delaying product deliveries.

- Potential for future tariff increases: The current tariffs may only be the beginning. Further tariff increases could significantly exacerbate the problem, putting immense pressure on Apple's profitability.

- Alternative manufacturing locations: Apple is actively exploring alternative manufacturing locations to reduce its reliance on China. This diversification strategy, however, comes with its own set of challenges, including establishing new supply chains and infrastructure.

Investor Reaction and Stock Market Volatility

The tariff news sent shockwaves through the market, triggering a significant decline in Apple's stock price.

Immediate Stock Price Drop

The announcement of the tariffs immediately impacted Apple's stock price, resulting in a notable percentage drop.

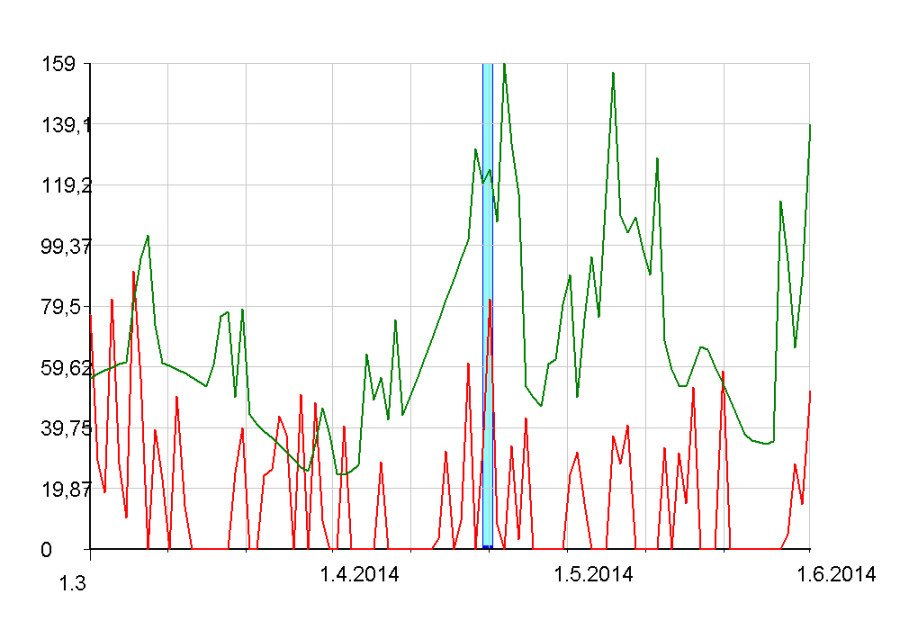

- Percentage drop in Apple's stock price: Following the tariff announcement, Apple's stock experienced a significant drop, illustrating the immediate market reaction to this negative news. The precise percentage will fluctuate depending on the specific timing and market conditions.

- Comparison to historical stock performance: Analyzing Apple's stock performance during previous economic downturns or periods of trade uncertainty provides a valuable historical context for understanding the current situation.

- Graphs illustrating stock price fluctuations: Visual representations of the stock price changes will enhance understanding and highlight the volatility experienced by Apple's investors.

Investor Sentiment and Future Predictions

Investor sentiment shifted dramatically following the tariff announcement, leading to uncertainty about Apple's future prospects.

- Expert opinions and analyses: Financial analysts and market experts are offering various projections for the long-term impact on Apple's stock price, ranging from cautious optimism to more pessimistic outlooks.

- Assessment of investor confidence: Investor confidence in Apple's ability to navigate these challenges is crucial for the stock's long-term performance. Factors such as Apple's diversification strategies and its response to the tariffs will heavily influence this confidence.

- Potential hedging strategies: Investors concerned about further declines in Apple stock might explore various hedging strategies to mitigate potential losses.

- Predictions from various financial analysts: Summarizing predictions from leading financial analysts provides a diverse range of perspectives on the potential future trajectory of Apple's stock price.

Apple's Response and Mitigation Strategies

Apple has responded to the tariff situation with a combination of public statements and strategic adjustments.

Public Statements and Corporate Actions

Apple has issued public statements acknowledging the impact of the tariffs and outlining its plans to mitigate the negative consequences.

- Analysis of Apple's official response: A detailed examination of Apple's public statements reveals its strategy for addressing the situation, including any attempts to negotiate with the government or explore alternative solutions.

- Cost-cutting measures and price adjustments: Apple is likely to implement various cost-cutting measures and may adjust pricing strategies to offset some of the tariff-related impacts.

Long-Term Strategic Adjustments

Apple is likely to explore long-term strategic adjustments to reduce its dependency on Chinese manufacturing.

- Diversification strategies: This includes exploring alternative manufacturing locations, potentially diversifying production across several countries to mitigate risks associated with relying heavily on a single manufacturing hub.

- Geographical locations for production: The advantages and disadvantages of potential alternative locations (e.g., Vietnam, India, Mexico) will need to be carefully evaluated based on factors like labor costs, infrastructure, and political stability.

- Potential long-term solutions: A summary of possible long-term solutions, including diversification of manufacturing, supply chain optimization, and potential investment in automation, will give investors a clearer picture of Apple's resilience.

Conclusion

The $900 million tariff impact on Apple's revenue presents a significant challenge, causing a noticeable slump in its stock price and impacting investor confidence. While Apple is actively mitigating these effects, ongoing trade tensions pose considerable risks to its future profitability. Investors should carefully monitor the situation and consider diversifying their portfolio to manage risks associated with Apple stock and other companies exposed to similar trade disputes. Staying informed about the latest developments regarding Apple stock and tariff impacts is crucial for making informed investment decisions. Understanding the complexities of Apple’s stock price fluctuations in relation to global trade policies is vital for successful long-term investing.

Featured Posts

-

The Pilbaras Future Examining The Rio Tinto And Andrew Forrest Dispute

May 24, 2025

The Pilbaras Future Examining The Rio Tinto And Andrew Forrest Dispute

May 24, 2025 -

Yevrobachennya Peremozhtsi Ostannikh 10 Rokiv Ta Yikhni Dosyagnennya

May 24, 2025

Yevrobachennya Peremozhtsi Ostannikh 10 Rokiv Ta Yikhni Dosyagnennya

May 24, 2025 -

Israeli Embassy Staffers Killed In Washington Museum Shooting

May 24, 2025

Israeli Embassy Staffers Killed In Washington Museum Shooting

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Implications

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Implications

May 24, 2025 -

Analyzing The Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Latest Posts

-

3 Burc Icin Mayys Ayynda Athk Fyrtynasy

May 24, 2025

3 Burc Icin Mayys Ayynda Athk Fyrtynasy

May 24, 2025 -

Luchshie Goroskopy I Predskazaniya Onlayn

May 24, 2025

Luchshie Goroskopy I Predskazaniya Onlayn

May 24, 2025 -

Athk Ve Mayys Bu 3 Burc Icin Romantik Bir Ay

May 24, 2025

Athk Ve Mayys Bu 3 Burc Icin Romantik Bir Ay

May 24, 2025 -

Goroskopy I Predskazaniya Dlya Vsekh Znakov Zodiaka

May 24, 2025

Goroskopy I Predskazaniya Dlya Vsekh Znakov Zodiaka

May 24, 2025 -

Astrologicheskie Prognozy Goroskopy I Predskazaniya Na Mesyats

May 24, 2025

Astrologicheskie Prognozy Goroskopy I Predskazaniya Na Mesyats

May 24, 2025