Analyzing The Net Asset Value (NAV) For The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

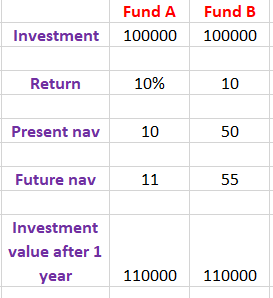

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. It's calculated by subtracting the ETF's liabilities from its total assets, then dividing by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF, this means:

- Assets: This includes the market value of the holdings that mirror the Dow Jones Industrial Average. This encompasses a basket of 30 large, publicly-owned companies. Fluctuations in the prices of these component stocks directly impact the ETF's assets.

- Liabilities: These are the ETF's expenses, such as management fees and any outstanding obligations.

NAV Calculation: (Total Asset Value - Total Liabilities) / Number of Outstanding Shares = NAV per Share

The Amundi Dow Jones Industrial Average UCITS ETF's NAV is typically calculated daily, reflecting the closing prices of its underlying assets. Understanding this daily NAV calculation allows for precise tracking of the ETF's performance. This daily NAV update provides investors with a clear picture of the ETF's value.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

- Underlying Asset Performance: The primary driver of the ETF's NAV is the performance of the Dow Jones Industrial Average. Positive market movements in the index's component stocks will generally lead to a higher NAV, while negative movements result in a lower NAV.

- Currency Fluctuations: Since the ETF might hold assets denominated in different currencies, fluctuations in exchange rates can affect the NAV, especially if the underlying assets are not all in the same currency as the ETF. This is particularly relevant for international investors.

- Expense Ratio: The ETF's expense ratio, which covers management fees and operational costs, gradually reduces the NAV over time. A higher expense ratio will result in slower NAV growth, compared to an ETF with a lower expense ratio.

- Other Factors: Corporate actions like dividends paid by the underlying companies, stock splits, and mergers and acquisitions within the Dow Jones Industrial Average can also slightly impact the ETF's NAV.

How to Interpret and Use NAV Data for Investment Decisions

Analyzing NAV data is key to making informed investment decisions. Here's how to use it:

- NAV vs. Market Price: Compare the ETF's NAV to its market price. A significant difference indicates a premium or discount. A premium suggests the market price exceeds the NAV, while a discount means the opposite. Understanding this premium/discount is vital for timing your entry and exit points.

- Historical NAV Analysis: Examine the historical NAV data to assess the ETF's long-term performance and volatility. This long-term perspective helps you gauge its historical growth and consistency.

- Integrated Investment Analysis: Use NAV in conjunction with other financial metrics such as the P/E ratio of the underlying companies (though this is less directly applicable to an index ETF) to gain a more holistic view of the investment's potential.

Accessing and Monitoring the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Several resources provide access to real-time and historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF:

- Amundi Website: The ETF provider's website is a primary source for the most accurate and up-to-date NAV information.

- Financial News Websites: Major financial news websites often publish real-time ETF data, including NAV.

- Brokerage Platforms: Most brokerage platforms display real-time NAV alongside other ETF details.

Regularly monitoring the NAV is crucial for effective investment management. Tools like portfolio tracking software can simplify this process, providing automated updates and alerts.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV Analysis

Analyzing the Net Asset Value of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for understanding its performance and making informed investment decisions. By understanding how NAV is calculated, the factors influencing it, and how to interpret NAV data, investors can optimize their investment strategy. Regularly monitor the Net Asset Value and consider supplementing your analysis with other relevant metrics for a comprehensive understanding. Continue your research by exploring similar ETFs tracking the Dow Jones Industrial Average or other market indices to diversify your portfolio effectively. Start analyzing the Net Asset Value of this ETF today!

Featured Posts

-

Free Transfer Target Crystal Palace Interested In Kyle Walker Peters

May 24, 2025

Free Transfer Target Crystal Palace Interested In Kyle Walker Peters

May 24, 2025 -

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Sharp Decline In Amsterdam Stock Market Down 7 As Trade War Escalates

May 24, 2025

Sharp Decline In Amsterdam Stock Market Down 7 As Trade War Escalates

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025

Latest Posts

-

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 24, 2025

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 24, 2025 -

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025 -

Amsterdam Stock Market Opens 7 Lower Trade War Anxiety

May 24, 2025

Amsterdam Stock Market Opens 7 Lower Trade War Anxiety

May 24, 2025 -

Euronext Amsterdam Sees 8 Stock Increase Impact Of Trumps Tariff Decision

May 24, 2025

Euronext Amsterdam Sees 8 Stock Increase Impact Of Trumps Tariff Decision

May 24, 2025 -

7 Drop For Amsterdam Stocks As Trade War Fears Rise

May 24, 2025

7 Drop For Amsterdam Stocks As Trade War Fears Rise

May 24, 2025