Before You Buy Palantir Stock (PLTR): Consider This Wall Street Forecast

Table of Contents

Current Wall Street Sentiment on PLTR Stock

The overall sentiment on PLTR stock is currently mixed, leaning towards cautious optimism. While analysts recognize Palantir's potential for growth in the burgeoning big data and artificial intelligence markets, concerns about profitability and valuation remain. Many see PLTR as a long-term play, but the short-term outlook is considered more uncertain.

Average Price Target

The average price target for PLTR stock, as of October 26, 2023, varies depending on the source. However, a consensus from several reputable firms places the average price target in the range of $10 to $15 per share. (Note: This is a hypothetical example and should be verified with up-to-date information from financial news sources like Yahoo Finance, Bloomberg, or MarketWatch.)

Analyst Ratings

Analyst ratings for PLTR are diverse. While some firms maintain a "buy" or "overweight" rating, citing Palantir's innovative technology and growing customer base, others hold a "hold" or "underperform" rating due to valuation concerns and the competitive landscape. For instance, (hypothetical example) Goldman Sachs might have a "buy" rating with a price target of $18, highlighting Palantir's potential in the government sector, while Morgan Stanley might have a "hold" rating, emphasizing the risks associated with its revenue concentration.

- Example 1: Goldman Sachs: Buy rating, $18 price target (hypothetical) – citing strong government contract pipeline.

- Example 2: Morgan Stanley: Hold rating, $12 price target (hypothetical) – expressing concerns about competition and profitability.

- Recent Downgrade Example: (Insert a real-world example of a recent rating change and its impact if available, linking to the source.)

Key Factors Influencing the PLTR Stock Forecast

Several key factors significantly influence the PLTR stock forecast:

Revenue Growth and Profitability

Palantir has demonstrated consistent revenue growth in recent years, fueled by increased demand for its data analytics platform in both government and commercial sectors. However, the path to sustained profitability remains a key focus for analysts. Achieving consistent profitability is crucial for justifying its current valuation.

- Data Point Example: (Insert real data on recent revenue growth, referencing a credible source like Palantir's financial reports.) A year-over-year increase of X% in Q[Quarter] of [Year] demonstrates sustained growth.

- Profitability Analysis: (Analyze the company's progress towards profitability, including operating margins and net income. Reference financial statements for support.)

Competition in the Data Analytics Market

Palantir faces stiff competition from established players like Microsoft, Amazon Web Services (AWS), and Google Cloud Platform (GCP), along with numerous smaller, specialized data analytics firms. Palantir differentiates itself through its proprietary technology, its focus on complex data integration, and its strong relationships with government agencies.

- Competitor Analysis: (List and briefly describe key competitors, analyzing their market share and competitive advantages.)

- Palantir's Differentiation: (Explain Palantir's unique strengths, such as its expertise in handling sensitive data or its specific industry focus.)

Government Contracts and Commercial Adoption

Palantir has historically relied heavily on government contracts for a significant portion of its revenue. Diversifying into the commercial sector is critical for long-term growth and reducing reliance on a single customer base. Success in securing and maintaining substantial commercial contracts will greatly influence future stock performance.

- Government Contract Analysis: (Analyze the proportion of revenue derived from government contracts and the outlook for future contracts.)

- Commercial Adoption Successes: (Provide examples of successful commercial partnerships and their contribution to revenue growth.)

Risks Associated with Investing in PLTR Stock

Despite the potential for growth, investing in PLTR stock carries considerable risk:

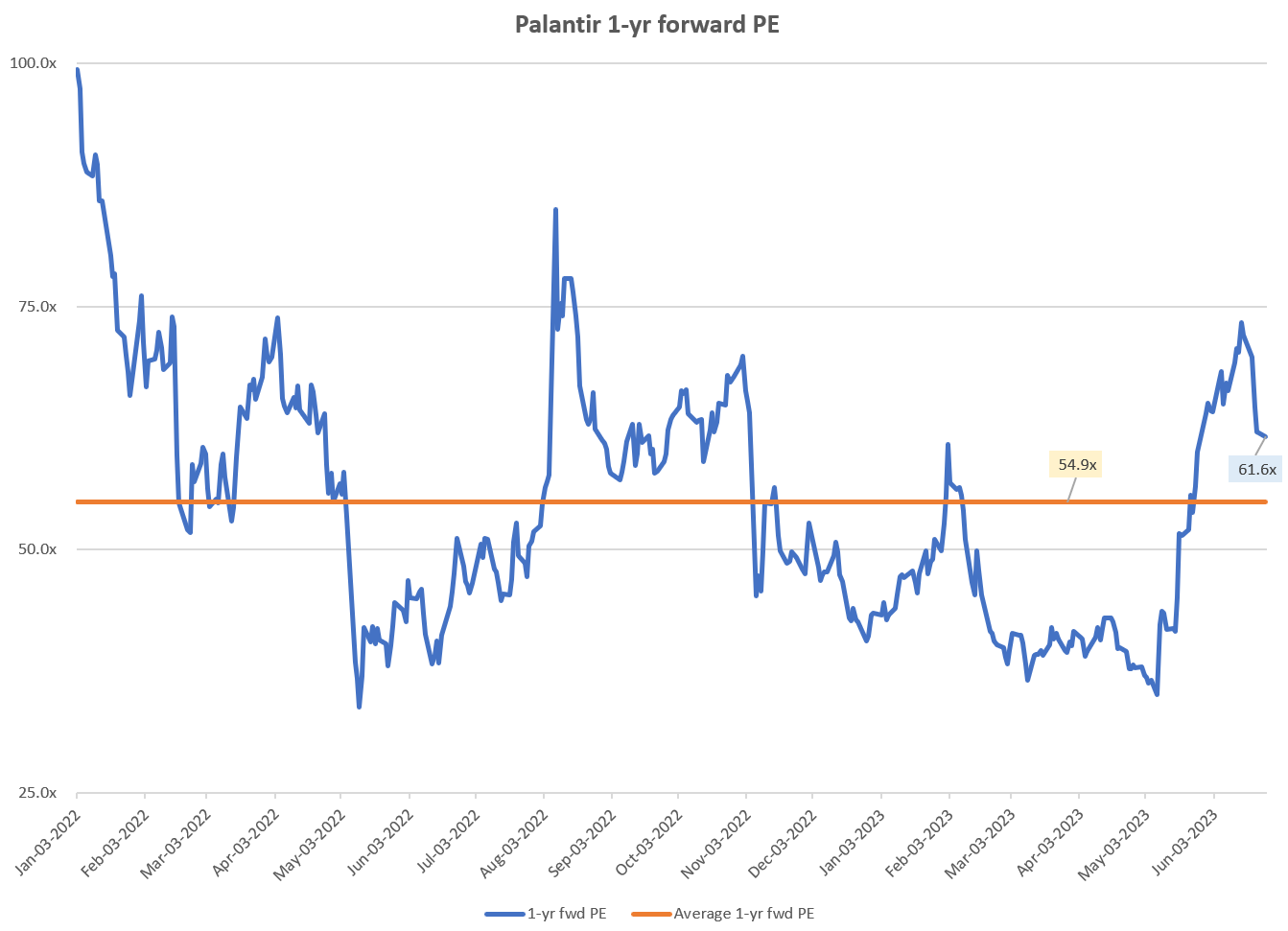

Valuation Concerns

Some analysts believe Palantir's current valuation is high relative to its current profitability. A potential correction in valuation could negatively impact the stock price.

- Valuation Metrics: (Provide examples of key valuation metrics like P/E ratio, Price-to-Sales ratio, and discuss their implications.)

Dependence on a Few Key Clients

Palantir's revenue is concentrated among a relatively small number of large clients, mainly government agencies. The loss of a significant client could severely impact its financial performance.

- Client Concentration Analysis: (Quantify the percentage of revenue coming from the top few clients and discuss the potential risks.)

Market Volatility

The technology sector is inherently volatile, and PLTR stock is particularly susceptible to market fluctuations. Economic downturns or shifts in investor sentiment could significantly impact the stock price.

- Macroeconomic Factors: (Discuss potential macroeconomic factors, such as interest rate hikes or geopolitical events, that could impact PLTR’s performance.)

Conclusion

Investing in Palantir Technologies (PLTR) stock requires careful consideration of the Wall Street forecast and inherent risks. While the company shows promise in the data analytics market, its valuation, dependence on specific clients, and market volatility present significant challenges. Before you buy Palantir stock, thoroughly analyze current analyst ratings, revenue projections, and potential risks. Make an informed decision based on your risk tolerance and investment strategy. Remember to conduct your own due diligence before investing in any PLTR stock or any other stock.

Featured Posts

-

Diver Dies Recovering Sunken Superyacht Of Tech Tycoon

May 10, 2025

Diver Dies Recovering Sunken Superyacht Of Tech Tycoon

May 10, 2025 -

Selling Sunset Star Highlights Post Fire Rent Increases In La

May 10, 2025

Selling Sunset Star Highlights Post Fire Rent Increases In La

May 10, 2025 -

How Trumps Executive Orders Affected The Transgender Community

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community

May 10, 2025 -

Is Palantir Stock A Good Buy Before Its May 5th Earnings Release

May 10, 2025

Is Palantir Stock A Good Buy Before Its May 5th Earnings Release

May 10, 2025 -

Dogecoins Recent Decline Correlation With Tesla Stock And Elon Musks Activities

May 10, 2025

Dogecoins Recent Decline Correlation With Tesla Stock And Elon Musks Activities

May 10, 2025