Bitcoin Price Soars: Trump's Crypto Expert Offers Unexpected Forecast

Table of Contents

The Recent Bitcoin Price Surge: Factors at Play

Bitcoin's price has recently seen a significant increase, fueled by a confluence of factors. Several key elements contribute to this upward trend.

-

Increased Institutional Investment: Large financial institutions are increasingly allocating assets to Bitcoin, viewing it as a potential hedge against inflation and a diversification tool. This institutional adoption signals a growing level of legitimacy and acceptance within the traditional finance world. Companies like MicroStrategy and Tesla's significant Bitcoin investments have been pivotal in driving this trend. This increased institutional Bitcoin investment contributes significantly to the price increase.

-

Growing Adoption by Mainstream Businesses: More and more businesses are accepting Bitcoin as a form of payment, broadening its utility and increasing demand. This expanding cryptocurrency adoption reflects a growing confidence in Bitcoin's long-term viability and its potential to become a mainstream payment method. The acceptance of Bitcoin as payment enhances its liquidity and price stability over the longer term.

-

Regulatory Clarity in Certain Jurisdictions: Some countries are developing clearer regulatory frameworks for cryptocurrencies, reducing uncertainty and encouraging further investment. This increasing regulatory clarity regarding Bitcoin and other cryptocurrencies improves investor confidence and reduces risk, thereby promoting investment. Clearer regulations facilitate institutional investment and contribute to price stability.

-

Macroeconomic Factors Influencing Safe-Haven Asset Demand: Amidst global economic uncertainty, investors are seeking safe-haven assets, and Bitcoin is increasingly seen as one such option. This is evidenced by a strong correlation between periods of economic turmoil and increased Bitcoin price. The perception of Bitcoin as a safe-haven asset is a direct consequence of the deflationary properties and limited supply.

-

Scarcity of Bitcoin and its Deflationary Nature: Bitcoin's limited supply of 21 million coins makes it a deflationary asset, potentially increasing its value over time as demand grows. This inherent scarcity of Bitcoin is a primary factor contributing to its long-term value appreciation. This limited supply is a fundamental driver of the increasing Bitcoin price.

Trump's Crypto Expert's Unexpected Forecast

Anthony Scaramucci, a prominent figure known for his ties to the Trump administration and his involvement in the financial industry, recently offered a bullish prediction for Bitcoin's future price.

-

Scaramucci's Forecast: While the specifics vary depending on the source and the context, Scaramucci has generally expressed a positive outlook for Bitcoin's long-term price trajectory, predicting significant price appreciation over the coming years. He highlights the technology's transformative potential and the increasing mainstream adoption as key drivers of this price increase.

-

Reasoning Behind the Forecast: Scaramucci's positive outlook stems from his belief in the underlying technology and the growing acceptance of Bitcoin as a store of value and a medium of exchange. His forecast considers technological advancements, the increasing institutional and retail investment, and the evolving global financial landscape.

-

Potential Caveats and Risks: Scaramucci acknowledges the inherent volatility of the cryptocurrency market and cautions against excessive risk-taking. He stresses the importance of diversification and prudent investment strategies in the cryptocurrency market. He also points out the unpredictable nature of governmental regulation as a potential source of risk.

Market Reaction and Expert Opinions

The market reacted to Scaramucci’s forecast with a mix of enthusiasm and caution.

-

Trading Volume and Price Volatility: Following the announcement, Bitcoin trading volume experienced a surge, and the price showed increased volatility. However, the overall trend remained positive, reflecting a generally optimistic outlook for the cryptocurrency. The price volatility emphasizes the risk associated with investing in Bitcoin, even in the context of bullish forecasts.

-

Opinions from Other Prominent Figures: Other crypto experts and analysts offered a range of opinions, with some sharing Scaramucci's optimism, while others remained more cautious, citing potential market corrections and regulatory risks. The diverse opinions highlight the inherent uncertainty within the cryptocurrency market. A careful analysis of various opinions is necessary to get a balanced perspective of the Bitcoin market.

-

Impact on Other Cryptocurrencies: The positive sentiment surrounding Bitcoin also had a positive spillover effect on other cryptocurrencies, leading to increased trading activity across the broader cryptocurrency market. The impact varied depending on the specific cryptocurrency, with some experiencing greater price increases than others. This interconnectivity within the market emphasizes the importance of understanding the broader market dynamics.

Potential Risks and Considerations

Despite the positive forecast, investors should be aware of the potential downsides.

-

Market Volatility and Price Fluctuations: Bitcoin is known for its volatility, and price swings can be dramatic. Investors need to be prepared for significant price fluctuations, both positive and negative. The price volatility of Bitcoin underscores the necessity of proper risk management.

-

Regulatory Uncertainty and Potential Government Intervention: Government regulations regarding cryptocurrencies remain unclear in many jurisdictions, which poses a significant risk to investors. Changes in government policy could significantly impact Bitcoin's price. The potential for regulatory changes emphasizes the necessity of staying informed about relevant regulations.

-

Security Risks Associated with Cryptocurrency Exchanges: Cryptocurrency exchanges can be vulnerable to hacking and theft, posing a risk to investors' funds. It's critical to select reputable and secure exchanges. Security considerations are paramount, especially when dealing with significant amounts of funds.

-

The Speculative Nature of Bitcoin Investment: Bitcoin remains a highly speculative investment, and its price is driven by a combination of factors that are difficult to predict accurately. Investors need to carefully consider their risk tolerance before investing. The speculative nature of Bitcoin investment underscores the importance of thorough research and diversification.

Conclusion

The recent Bitcoin price surge, coupled with the unexpected forecast from Trump's crypto expert, has created significant buzz in the cryptocurrency market. While the prediction is bullish, it's crucial to acknowledge the inherent risks and volatility associated with Bitcoin investment. Increased institutional investment, growing mainstream adoption, and evolving regulatory landscapes contribute to the upward price trajectory, but market fluctuations and regulatory uncertainty remain significant factors. While the future of Bitcoin remains uncertain, staying informed about the latest developments and understanding the potential risks is crucial for any investor interested in navigating the volatile world of Bitcoin price fluctuations. Monitor the Bitcoin price, stay updated on Bitcoin news, and research Bitcoin investment strategies carefully before making any investment decisions.

Featured Posts

-

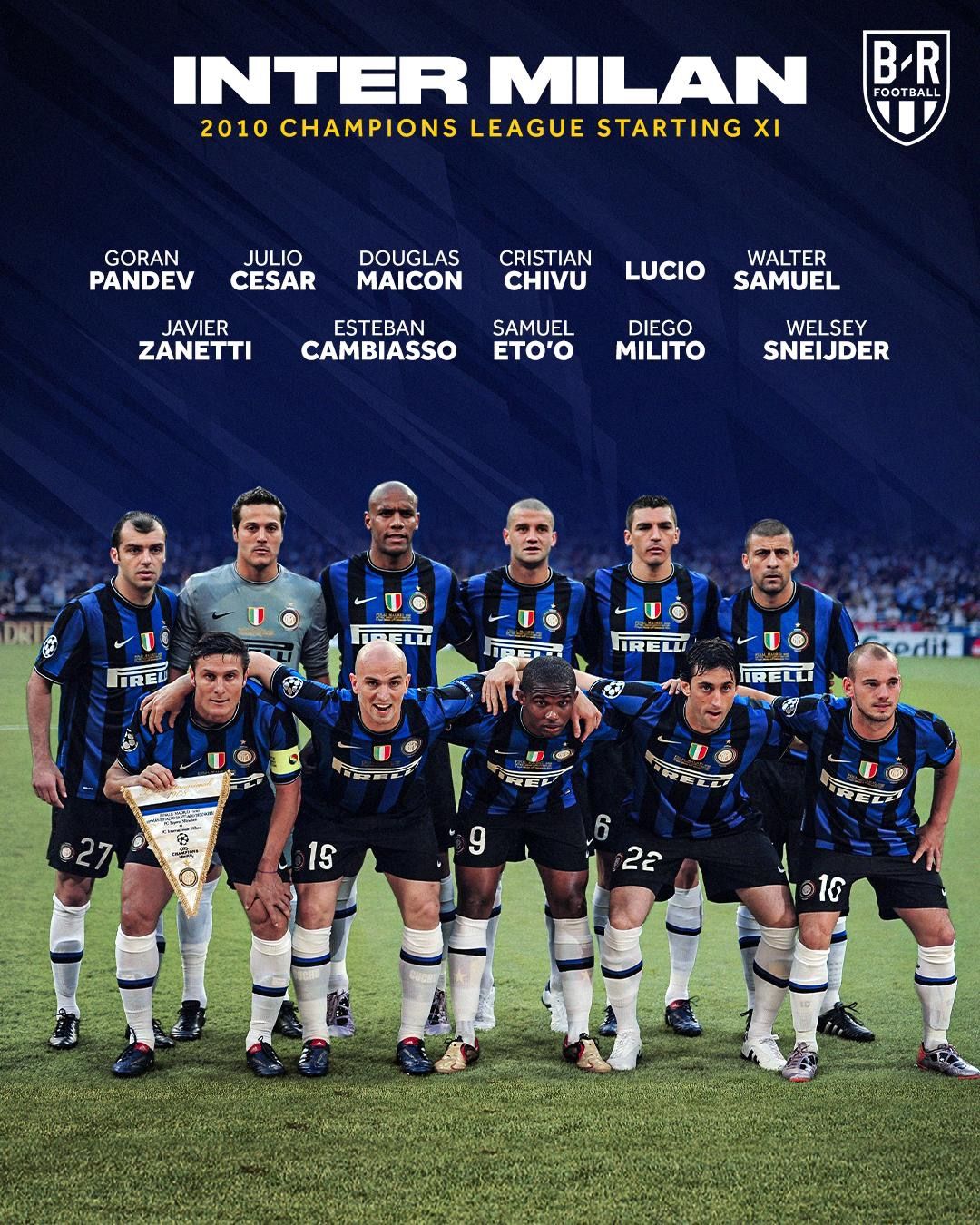

Champions League Inter Milans Shock Win Against Bayern Munich

May 08, 2025

Champions League Inter Milans Shock Win Against Bayern Munich

May 08, 2025 -

Dwp Issues Warning Letters Uk Benefits At Risk

May 08, 2025

Dwp Issues Warning Letters Uk Benefits At Risk

May 08, 2025 -

Arsenal Proti Ps Zh Ta Barselona Proti Intera Anons Matchiv 1 2 Finalu Ligi Chempioniv 2024 2025

May 08, 2025

Arsenal Proti Ps Zh Ta Barselona Proti Intera Anons Matchiv 1 2 Finalu Ligi Chempioniv 2024 2025

May 08, 2025 -

Understanding The Risks And Rewards Of Investing In Xrp Ripple

May 08, 2025

Understanding The Risks And Rewards Of Investing In Xrp Ripple

May 08, 2025 -

Prelista De Brasil Neymar Incluido Posible Enfrentamiento Con Argentina

May 08, 2025

Prelista De Brasil Neymar Incluido Posible Enfrentamiento Con Argentina

May 08, 2025