Bond Market Instability: A Critical Analysis For Investors

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The inverse relationship between interest rates and bond prices is a fundamental concept in fixed-income investing. When interest rates rise, the yields on newly issued bonds become more attractive, causing the prices of existing bonds with lower yields to fall. This is because investors can obtain higher returns from newer bonds. The Federal Reserve's monetary policy plays a significant role in influencing interest rates. For example, the Fed's decision to raise interest rates to combat inflation directly impacts bond yields, causing ripple effects throughout the bond market. Inflation itself further erodes the purchasing power of fixed-income investments, adding another layer of complexity.

- Higher interest rates lead to lower bond prices.

- Unexpected rate hikes cause significant market fluctuations, increasing bond market volatility.

- Inflation erodes the purchasing power of fixed-income investments, reducing the real return for bondholders.

- Investors need to reassess their bond portfolios based on prevailing interest rate environments and adjust their investment strategies accordingly.

Keywords: Interest rate risk, bond yields, inflation, Federal Reserve, monetary policy, bond market volatility

Geopolitical Risks and Their Influence on Bond Markets

Global events significantly impact investor sentiment and bond prices. Geopolitical uncertainty, such as wars, trade disputes, or political instability in key regions, can create volatility in the bond market. Investors often seek safe haven assets during times of uncertainty, which can drive demand for government bonds, potentially pushing their prices up. However, this effect is not consistent across all bond types. The impact of geopolitical risk on bond yields is often unpredictable, making it crucial for investors to carefully monitor global developments.

- Geopolitical instability increases investor demand for safe haven assets (potentially impacting bond prices).

- Uncertainty creates volatility, making bond market prediction challenging and increasing bond market instability.

- Diversification across different bond markets and asset classes is crucial to mitigate risk.

- Examples of events causing bond market instability include the 2014 Russian annexation of Crimea and the 2022 war in Ukraine.

Keywords: Geopolitical risk, bond market volatility, global uncertainty, safe haven assets, diversification, bond market instability

Credit Risk and Default Concerns in the Bond Market

Credit risk, the risk that a bond issuer will default on its obligations, is a major concern for bond investors. Credit ratings, assigned by agencies like Moody's, Standard & Poor's, and Fitch, provide an assessment of a bond's creditworthiness. Higher credit risk bonds (e.g., high-yield bonds) offer higher yields to compensate for the increased default risk. However, during economic downturns, the likelihood of corporate defaults increases, impacting the stability of the bond market. Thorough due diligence, including evaluating the financial health of the issuer, is crucial before investing in corporate bonds.

- Higher credit risk bonds offer higher yields but carry greater default risk.

- Economic downturns increase the likelihood of corporate defaults, leading to bond market instability.

- Thorough due diligence is crucial before investing in corporate bonds to mitigate credit risk.

- Consider diversifying across different credit ratings to manage risk effectively.

Keywords: Credit risk, bond defaults, credit ratings, corporate bonds, high-yield bonds, bond market instability

Strategies for Navigating Bond Market Instability

Effective risk management is critical when navigating bond market instability. Diversification is a key strategy, involving spreading investments across different bond maturities, sectors, and geographies. Hedging techniques, such as interest rate swaps or options, can help protect against potential losses. The appropriate investment strategy will depend on an investor's risk tolerance and financial goals. Consulting with a qualified financial advisor is strongly recommended.

- Diversify across different bond maturities, sectors, and geographies to reduce overall portfolio risk.

- Consider using hedging instruments like interest rate swaps or options to mitigate potential losses from interest rate changes or other market events.

- Consult with a financial advisor to determine the right investment strategy based on your risk tolerance and financial goals.

- Regularly review and rebalance your bond portfolio to adapt to changing market conditions.

Keywords: Risk management, diversification, hedging, investment strategies, financial advisor, bond market instability

Conclusion

The bond market's recent instability highlights the need for a cautious and strategic approach to fixed-income investments. Understanding the factors driving this volatility—rising interest rates, geopolitical risks, and credit concerns—is paramount for success. By diversifying portfolios, employing hedging techniques, and carefully evaluating credit risks, investors can mitigate potential losses and navigate the complexities of the bond market. Remember, proactive risk management is crucial when dealing with bond market instability. Consult with a financial professional to develop a comprehensive investment strategy tailored to your risk tolerance and financial goals. Don't underestimate the importance of understanding bond market volatility and its implications for your investments.

Featured Posts

-

Arcanes New Episode A Vi And Caitlyn Spinoff On The Horizon

May 29, 2025

Arcanes New Episode A Vi And Caitlyn Spinoff On The Horizon

May 29, 2025 -

Winning On Two Wheels The Honda Rider Advantage

May 29, 2025

Winning On Two Wheels The Honda Rider Advantage

May 29, 2025 -

League Of Legends Lore Changes How Arcane Affects 2 Xko

May 29, 2025

League Of Legends Lore Changes How Arcane Affects 2 Xko

May 29, 2025 -

Bukszak Atvizsgalasa Tippek Es Truekkoek Ertekes Holmik Felfedezesehez

May 29, 2025

Bukszak Atvizsgalasa Tippek Es Truekkoek Ertekes Holmik Felfedezesehez

May 29, 2025 -

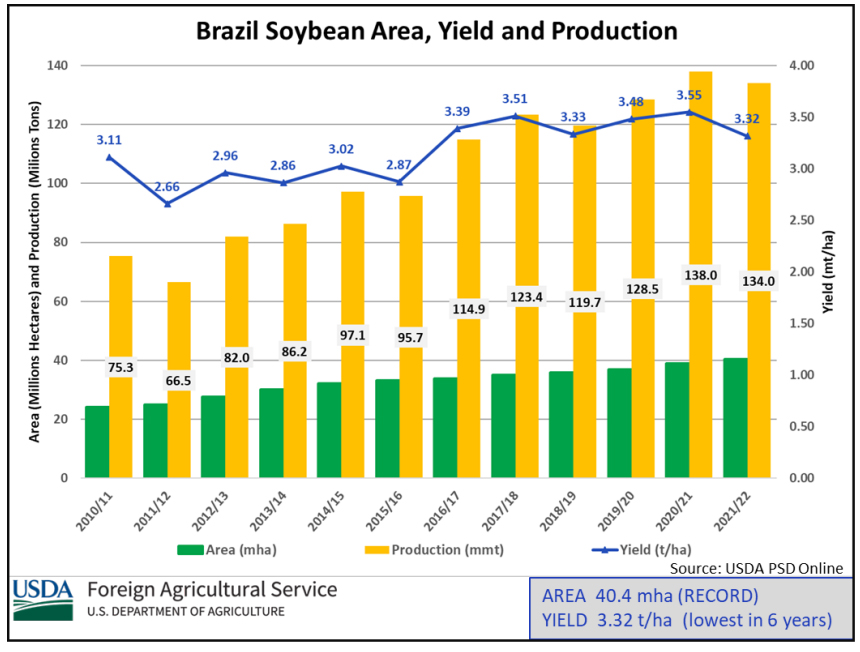

Chinas Soybean Supply Crunch Sinograins Auction Response

May 29, 2025

Chinas Soybean Supply Crunch Sinograins Auction Response

May 29, 2025

Latest Posts

-

The Reality Of Ai Learning Guiding Principles For Responsible Use

May 31, 2025

The Reality Of Ai Learning Guiding Principles For Responsible Use

May 31, 2025 -

Responsible Ai Acknowledging And Addressing The Limits Of Ai Learning

May 31, 2025

Responsible Ai Acknowledging And Addressing The Limits Of Ai Learning

May 31, 2025 -

Responsible Ai Acknowledging The Limitations Of Ai Learning

May 31, 2025

Responsible Ai Acknowledging The Limitations Of Ai Learning

May 31, 2025 -

The Reality Of Ai Learning Building A Future With Responsible Ai

May 31, 2025

The Reality Of Ai Learning Building A Future With Responsible Ai

May 31, 2025 -

Limited Time Offer 30 Off Lavish Spring Hotel Bookings

May 31, 2025

Limited Time Offer 30 Off Lavish Spring Hotel Bookings

May 31, 2025