Broadcom's VMware Deal: An Extreme Price Hike Of 1050% According To AT&T

Table of Contents

AT&T's Allegation: A 1050% Price Surge

AT&T's claim of a 1050% increase in VMware licensing costs post-acquisition is the focal point of considerable debate. While specific details haven't been publicly released by AT&T, the sheer magnitude of the alleged increase has sent shockwaves through the industry. Such a drastic price hike could significantly impact AT&T's operational budgets and financial planning. The potential ripple effect across other large enterprises is also a major concern.

- Products Affected: The alleged price increase reportedly affects a range of VMware products, including vSphere, vSAN, and NSX, core components for many enterprise IT infrastructures.

- Illustrative Calculation: A hypothetical 1050% increase on a $100,000 annual license would translate to a staggering $1,050,000, illustrating the potential financial burden on businesses.

- Broadcom's Response: At the time of writing, Broadcom has not yet publicly addressed AT&T's specific claim of a 1050% price increase, making independent verification difficult. This lack of transparency fuels uncertainty and speculation.

Broadcom's Rationale and Market Reactions

Broadcom has justified the VMware acquisition as a strategic move to expand its enterprise software portfolio and strengthen its position in the cloud computing market. The company envisions significant synergies and cost-saving opportunities through integration. However, the market reaction has been mixed, with some analysts expressing concerns about potential monopolistic practices and price increases. Stock prices have fluctuated following the announcement, reflecting the uncertainty surrounding the deal's long-term impact.

- Broadcom's Goals: Broadcom aims to integrate VMware's technologies with its existing offerings, potentially creating a more comprehensive and competitive suite of enterprise solutions.

- Cost-Saving Measures: Broadcom's plans likely involve streamlining operations and eliminating redundancies within VMware's infrastructure, but whether these will offset potential price increases remains to be seen.

- Competitive Landscape: The acquisition significantly alters the competitive landscape, raising concerns about reduced choice and potentially higher prices for customers with limited alternatives.

Implications for Businesses and the Future of VMware

The Broadcom-VMware deal carries significant implications for businesses of all sizes. The alleged price increases could force companies to re-evaluate their IT budgets and explore alternative virtualization solutions. Smaller businesses, with already constrained budgets, could be particularly vulnerable to these price hikes.

- Impact on Small Businesses: The dramatic increase could make VMware products unaffordable for many smaller companies, forcing them to seek less expensive, potentially less robust alternatives.

- Increased Competition: The acquisition may paradoxically spur increased competition from other virtualization providers, encouraging innovation and potentially offering customers more choice.

- Likelihood of Further Increases: The possibility of similar price increases for other VMware customers remains a significant concern, leading many to carefully assess their reliance on VMware technology.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware deal has attracted significant regulatory scrutiny, particularly concerning potential antitrust issues. Competition authorities in various jurisdictions are likely to review the acquisition to ensure it doesn't stifle competition and harm consumers. The outcome of these reviews will significantly impact the deal's future and the availability of VMware products.

- Ongoing Investigations: Several regulatory bodies are likely to be investigating the deal, analyzing the competitive landscape and potential impacts on pricing.

- Potential Remedies: If antitrust concerns are validated, regulatory bodies may impose conditions on the deal, potentially including divestitures or behavioral remedies to mitigate risks.

- Industry Precedent: The outcome of this deal will set an important precedent for future large-scale acquisitions in the tech sector, influencing how future mergers are scrutinized.

Conclusion: Understanding the Future of Broadcom's VMware Deal and its Pricing

AT&T's claim of a 1050% price increase underscores the significant uncertainty surrounding Broadcom's VMware deal. The potential impact on businesses, especially smaller companies, is considerable. Regulatory scrutiny and ongoing investigations will play a crucial role in determining the ultimate outcome. Staying informed about the developments in Broadcom's VMware deal is paramount. Businesses should carefully analyze their VMware dependencies, explore alternative virtualization solutions, and factor potential price increases into their future budgeting and strategic planning. Understanding the evolving landscape of the Broadcom's VMware deal is crucial for navigating the future of enterprise virtualization.

Featured Posts

-

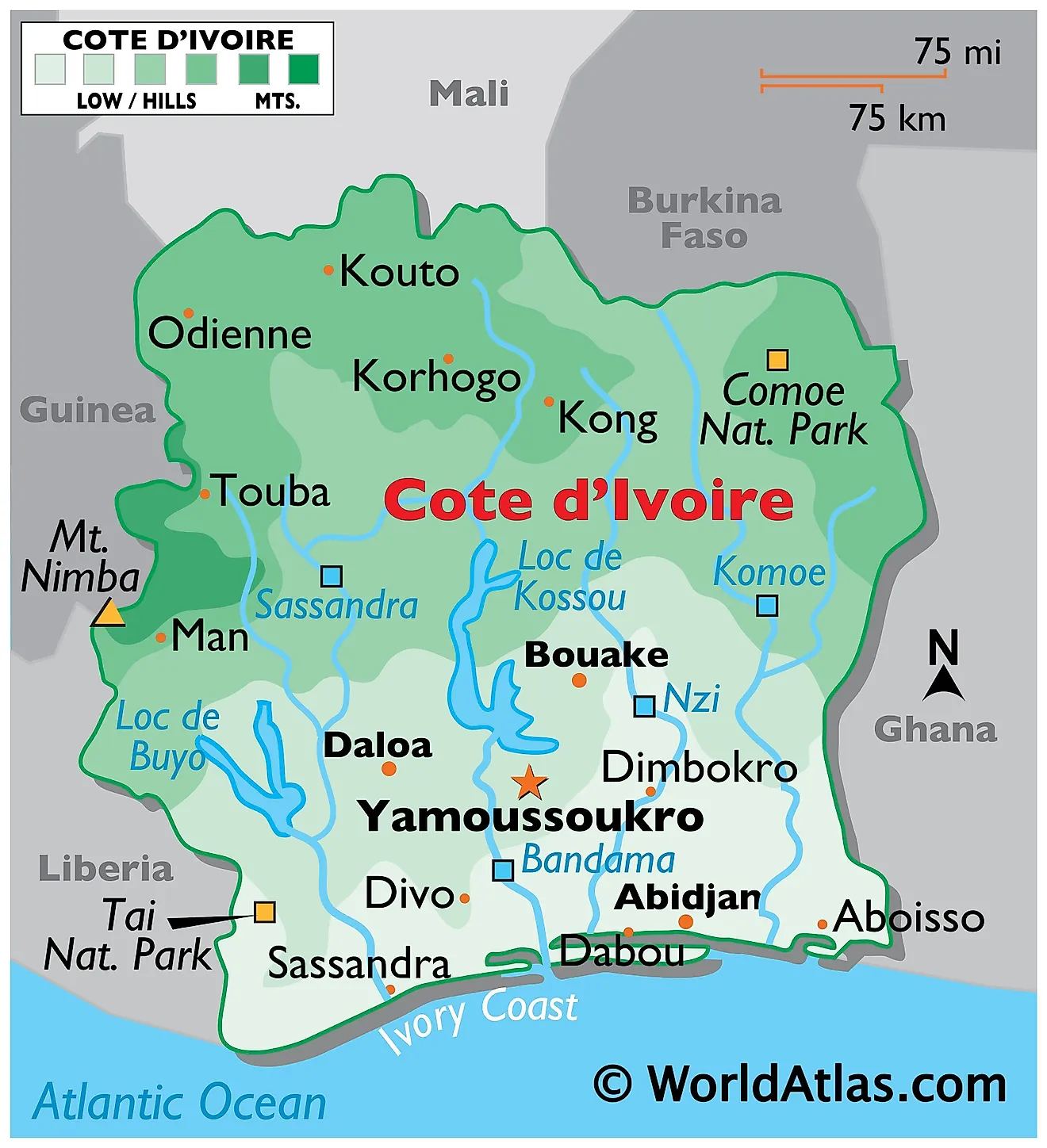

Le Ghana Et La Cote D Ivoire Diplomatie Et Cooperation Au C Ur De La Visite Du President Mahama

May 20, 2025

Le Ghana Et La Cote D Ivoire Diplomatie Et Cooperation Au C Ur De La Visite Du President Mahama

May 20, 2025 -

Dont Ignore This Important Hmrc Child Benefit Update

May 20, 2025

Dont Ignore This Important Hmrc Child Benefit Update

May 20, 2025 -

Fenerbahce De Yeni Bir Doenem Dusan Tadic In Tarihi Transferi

May 20, 2025

Fenerbahce De Yeni Bir Doenem Dusan Tadic In Tarihi Transferi

May 20, 2025 -

Wireless Headphones Significant Enhancements You Need To Know

May 20, 2025

Wireless Headphones Significant Enhancements You Need To Know

May 20, 2025 -

Exploring The Meaning Behind Suki Waterhouses On This Love Lyrics

May 20, 2025

Exploring The Meaning Behind Suki Waterhouses On This Love Lyrics

May 20, 2025

Latest Posts

-

Bbai Stock A Deep Dive Into The Q1 Earnings Report And Market Reaction

May 20, 2025

Bbai Stock A Deep Dive Into The Q1 Earnings Report And Market Reaction

May 20, 2025 -

Big Bear Ais Q1 Earnings Miss Expectations Impacting Stock Price

May 20, 2025

Big Bear Ais Q1 Earnings Miss Expectations Impacting Stock Price

May 20, 2025 -

Big Bear Ai Stock Plunges Following Disappointing Q1 Earnings Report

May 20, 2025

Big Bear Ai Stock Plunges Following Disappointing Q1 Earnings Report

May 20, 2025 -

The Top Reason To Invest In Ai Quantum Computing Right Now

May 20, 2025

The Top Reason To Invest In Ai Quantum Computing Right Now

May 20, 2025 -

One Key Reason To Consider Ai Quantum Computing Stocks

May 20, 2025

One Key Reason To Consider Ai Quantum Computing Stocks

May 20, 2025