Check Your Payslip: Are You Due An HMRC Refund?

Table of Contents

Common Reasons for Underpayment of Tax

Several factors can lead to an underpayment of tax, leaving you entitled to an HMRC refund. Understanding these common scenarios is the first step in reclaiming your money.

-

Incorrect Tax Code: Your tax code dictates how much income tax is deducted from your salary. An incorrect tax code, often assigned due to administrative errors or changes in circumstances, can result in either overpayment or, more relevantly here, underpayment of tax. For example, an incorrect code might deduct too little tax, leaving you potentially owed an HMRC refund. There are various types of tax codes; understanding yours is crucial. Check the HMRC website for a comprehensive guide to tax codes.

-

Changes in Circumstances: Life events frequently impact your tax liability. Failing to inform HMRC about these changes can lead to an incorrect tax code and subsequent underpayment. These changes include:

- Marriage or civil partnership

- Birth of a child

- Starting a new job

- Significant changes to your income

- Moving house (in some specific circumstances)

- Changes in your pension contributions.

-

Pension Contributions: Contributions to a pension scheme reduce your taxable income. If your employer hasn't accurately reported your pension contributions, it could lead to an overestimation of your taxable income and an underpayment of tax. This is another area where a payslip check for potential HMRC refunds is vital.

-

Self-Assessment Errors: If you're self-employed or have additional income sources requiring a self-assessment tax return, errors in your submission can easily result in underpayment. Carefully review your self-assessment forms to ensure accuracy.

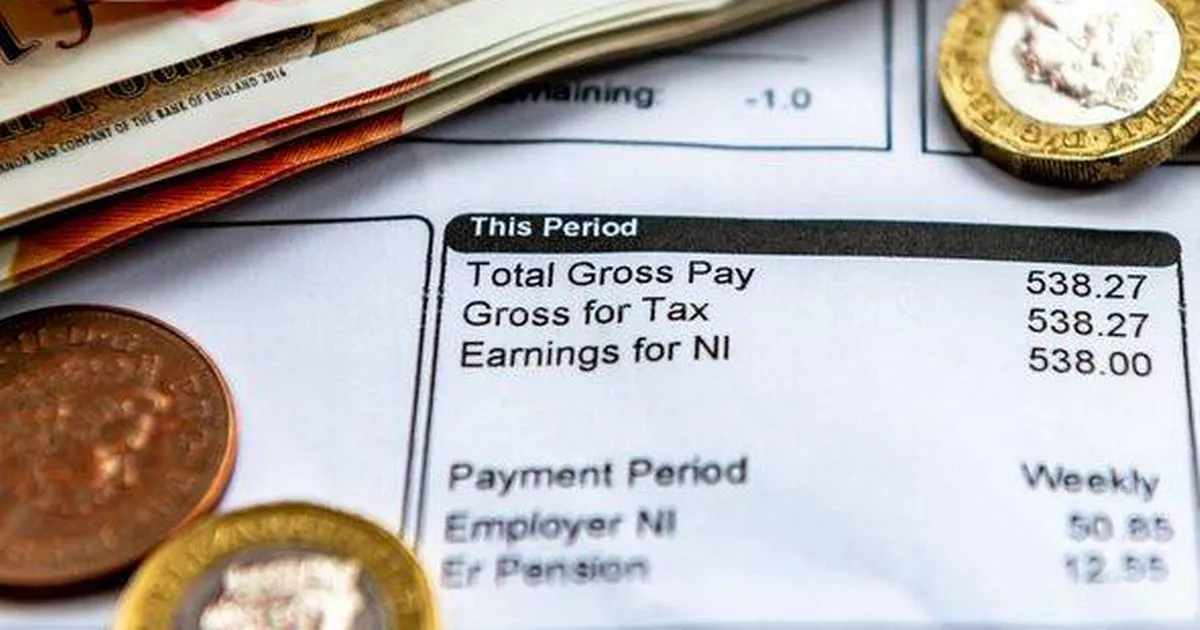

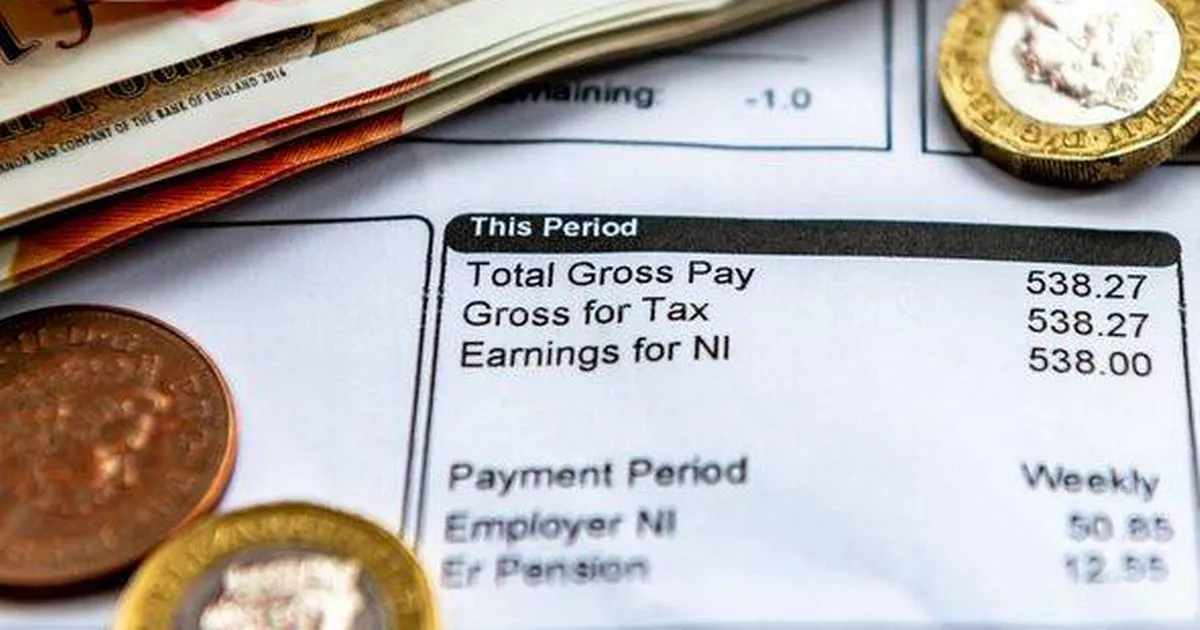

How to Check Your Payslip for Potential HMRC Refunds

Your payslip contains vital information about your tax deductions. Knowing what to look for is crucial in identifying a potential HMRC tax refund.

Here's what to focus on:

- Tax Code: Verify your tax code's accuracy against the code HMRC issued. A mismatch could indicate an issue.

- Tax Deducted (Tax Paid): Compare the amount of tax deducted from your salary to what you expect based on your income and tax code. A significant difference could mean you're owed a refund.

- National Insurance Contributions (NICs): While less common, errors can also occur here. Cross-reference with expected NIC payments.

Example Payslip Scenarios: (Include visual aids here – images of sample payslips with annotations highlighting key fields, showing examples of correct and incorrect tax deductions).

If you spot discrepancies between your expected tax deduction and the amount shown on your payslip, it warrants further investigation and may indicate an HMRC refund is due.

What to Do if You Think You're Due an HMRC Refund

If you suspect an underpayment, follow these steps:

- Gather Documentation: Collect your payslips, P60 (end-of-year tax statement), and any other relevant documents.

- Contact HMRC: Contact HMRC through their online services, telephone helpline, or by post. Use the official HMRC website for the most up-to-date contact details.

- Use HMRC Online Services: Use the HMRC online portal to check your tax records and submit a claim for a refund. This is often the fastest and most efficient method.

- Timeframe: The time it takes to receive your HMRC tax refund will vary, but HMRC provides estimated processing times on their website.

Avoiding Future HMRC Underpayments

Proactive measures can prevent future underpayment issues:

- Regular Payslip Checks: Regularly review your payslip for accuracy. This is your first line of defense against tax issues.

- Notify HMRC of Changes: Immediately inform HMRC of any changes in your circumstances that may affect your tax code.

- Accurate Record Keeping: Maintain accurate records of your income and expenses, especially if self-employed.

- Professional Advice: Consider seeking professional advice from an accountant, particularly if your tax affairs are complex.

Conclusion: Claim Your HMRC Refund Today!

Checking your payslip for potential tax underpayments could lead to a significant financial gain. Don't leave money on the table! If you suspect you're owed an HMRC refund, take action today. Review your payslips, gather necessary documentation, and contact HMRC to claim back what's rightfully yours. Claim your HMRC tax refund and ensure you receive the correct amount of tax each year. Don't delay – check your payslip for a refund now and get your HMRC refund!

Featured Posts

-

Missing Hmrc Refunds Check Your Savings Account Now

May 20, 2025

Missing Hmrc Refunds Check Your Savings Account Now

May 20, 2025 -

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025 -

Red Bulls Warning Why Michael Schumachers Comeback Failed

May 20, 2025

Red Bulls Warning Why Michael Schumachers Comeback Failed

May 20, 2025 -

Uk Taxpayers Facing Hmrc Scrutiny Income Over 23 000

May 20, 2025

Uk Taxpayers Facing Hmrc Scrutiny Income Over 23 000

May 20, 2025 -

Analiz Gonki Pochemu Lekler I Khemilton Byli Diskvalifitsirovany Komandoy Ferrari

May 20, 2025

Analiz Gonki Pochemu Lekler I Khemilton Byli Diskvalifitsirovany Komandoy Ferrari

May 20, 2025

Latest Posts

-

Novo Dijete Jennifer Lawrence Objavljeni Detalji

May 20, 2025

Novo Dijete Jennifer Lawrence Objavljeni Detalji

May 20, 2025 -

Jennifer Lawrence Majka Dva Djeteta

May 20, 2025

Jennifer Lawrence Majka Dva Djeteta

May 20, 2025 -

Iznenadenje Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Iznenadenje Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Vijesti Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Vijesti Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025